it 201 X 2019

What is the Form IT-201 X?

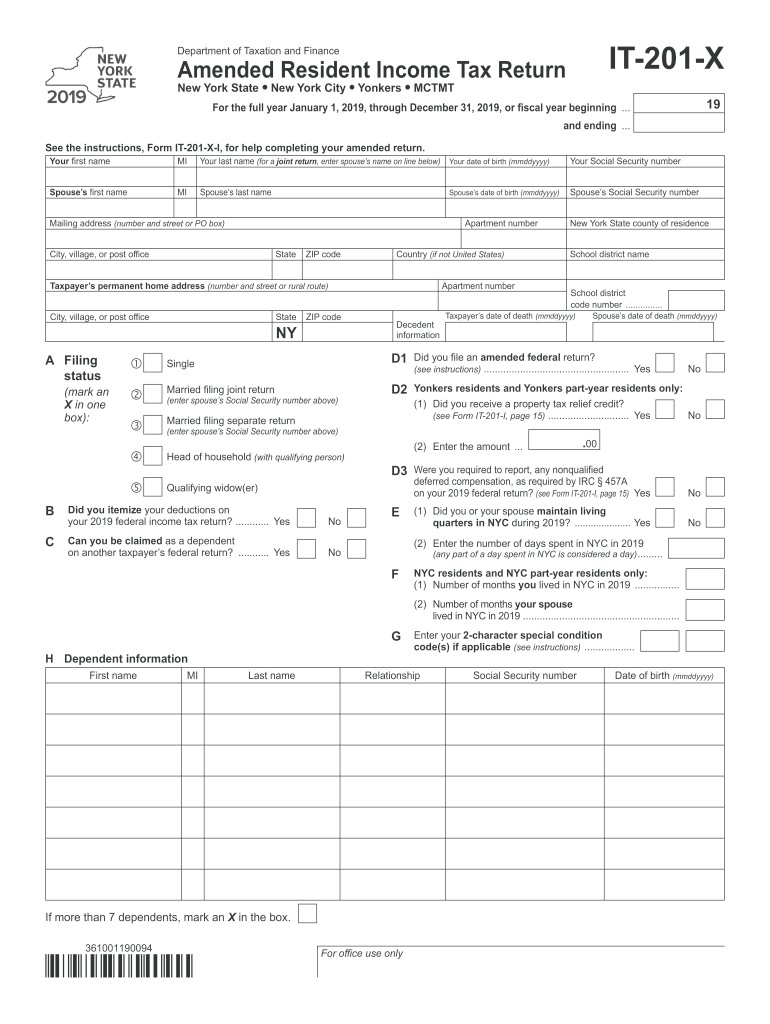

The Form IT-201 X is the New York State Amended Resident Income Tax Return. It is designed for individuals who need to amend their previously filed New York State tax returns. This form allows taxpayers to correct errors, claim additional deductions or credits, or make other necessary adjustments to their tax filings. It is essential for ensuring that your tax records are accurate and up to date.

Steps to Complete the Form IT-201 X

Completing the Form IT-201 X involves several key steps:

- Gather your original tax return and any supporting documents.

- Clearly indicate the tax year you are amending at the top of the form.

- Fill out the form by providing the correct information in the appropriate sections, ensuring to highlight the changes made.

- Attach any necessary documentation that supports your amendments, such as W-2 forms or 1099s.

- Review the completed form for accuracy before submission.

Legal Use of the Form IT-201 X

The Form IT-201 X is legally recognized for amending tax returns in New York State. To ensure compliance, it must be completed accurately and submitted within the designated time frame. The form adheres to the guidelines set forth by the New York State Department of Taxation and Finance, which governs the legal use of amended returns. Proper use of this form can help avoid penalties and ensure that taxpayers meet their obligations under state tax laws.

Filing Deadlines / Important Dates

When amending a tax return using Form IT-201 X, it is important to be aware of the filing deadlines. Generally, the form must be submitted within three years from the original tax return due date or within two years from the date the tax was paid, whichever is later. Adhering to these deadlines helps ensure that amendments are processed in a timely manner and that any potential refunds are received without delay.

Required Documents

To successfully complete and submit Form IT-201 X, you will need several supporting documents:

- Your original tax return for the year being amended.

- Any additional forms or schedules that are relevant to the changes being made.

- Documentation supporting the amendments, such as W-2s or 1099s.

- Any correspondence from the New York State Department of Taxation and Finance regarding your original return.

Form Submission Methods

Form IT-201 X can be submitted through various methods, ensuring convenience for taxpayers:

- Online submission through the New York State Department of Taxation and Finance website.

- Mailing the completed form to the appropriate address as specified in the form instructions.

- In-person submission at designated tax offices, if preferred.

Examples of Using the Form IT-201 X

There are several scenarios where using Form IT-201 X is appropriate:

- Correcting a mistake in reported income or deductions on the original return.

- Claiming a tax credit that was missed in the initial filing.

- Updating filing status due to changes in personal circumstances, such as marriage or divorce.

Quick guide on how to complete form it 2012019resident income tax return taxnygov

Effortlessly Manage It 201 X on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent environmentally-friendly alternative to conventional printed and signed documents, allowing you to access the necessary forms and securely save them online. airSlate SignNow equips you with all the tools required to create, modify, and digitally sign your documents swiftly and without hold-ups. Handle It 201 X on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Modify and Digitally Sign It 201 X with Ease

- Find It 201 X and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your digital signature with the Sign feature, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred delivery method for your form—via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks, from any device you choose. Edit and digitally sign It 201 X to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 2012019resident income tax return taxnygov

Create this form in 5 minutes!

How to create an eSignature for the form it 2012019resident income tax return taxnygov

How to make an electronic signature for the Form It 2012019resident Income Tax Return Taxnygov online

How to make an eSignature for the Form It 2012019resident Income Tax Return Taxnygov in Chrome

How to make an eSignature for signing the Form It 2012019resident Income Tax Return Taxnygov in Gmail

How to make an eSignature for the Form It 2012019resident Income Tax Return Taxnygov straight from your smart phone

How to generate an eSignature for the Form It 2012019resident Income Tax Return Taxnygov on iOS devices

How to generate an eSignature for the Form It 2012019resident Income Tax Return Taxnygov on Android

People also ask

-

What is form it 201 x and how does it benefit my business?

Form it 201 x is a powerful tool offered by airSlate SignNow that enables businesses to streamline document signing processes. By simplifying the eSigning experience, it enhances productivity and reduces turnaround times, making it an ideal solution for modern businesses.

-

How does form it 201 x integrate with other software?

form it 201 x seamlessly integrates with various third-party applications, allowing businesses to enhance their workflows. This includes popular tools like Google Drive, Dropbox, and CRM systems, ensuring that your document management process is efficient and centralized.

-

What are the key features of form it 201 x?

Key features of form it 201 x include customizable templates, advanced security options, and real-time tracking of document status. These features empower users to create, send, and manage their documents efficiently while ensuring compliance and security.

-

Is there a free trial available for form it 201 x?

Yes, airSlate SignNow offers a free trial of form it 201 x, allowing businesses to experience its capabilities without any financial commitment. This enables you to explore its features and determine how it can benefit your organization before making a purchase.

-

What are the pricing options for form it 201 x?

Pricing for form it 201 x is flexible, with various plans designed to accommodate different business needs. Whether you're a small business or a large enterprise, airSlate SignNow offers competitive pricing to ensure that businesses of all sizes can leverage its powerful features.

-

How secure is document signing with form it 201 x?

Document signing with form it 201 x is highly secure, employing encryption and compliance with various regulations such as eIDAS and GDPR. Rest assured that sensitive information is protected, providing peace of mind during the signing process.

-

Can I customize forms using form it 201 x?

Absolutely! Form it 201 x allows you to customize your documents and forms effortlessly. You can add fields, logos, and personalized messages, ensuring that your documents reflect your brand while meeting your specific requirements.

Get more for It 201 X

- Massmutual separation from service form

- Raskob application form

- Approved supplier list march 4 2014 circor aerospace form

- Certificate of assumed name nyc outward bound schools form

- Private american international banc court form

- Hemap recertification form pennsylvania housing finance agency phfa

- Pennsylvania public disclosure form bco 23

- Td2 form

Find out other It 201 X

- Sign West Virginia Standard residential lease agreement Safe

- Sign Wyoming Standard residential lease agreement Online

- Sign Vermont Apartment lease contract Online

- Sign Rhode Island Tenant lease agreement Myself

- Sign Wyoming Tenant lease agreement Now

- Sign Florida Contract Safe

- Sign Nebraska Contract Safe

- How To Sign North Carolina Contract

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe

- Can I Sign West Virginia Personal loan contract template

- How Do I Sign Hawaii Real estate sales contract template

- Sign Kentucky New hire forms Myself