PDF Form it 201 X Amended Resident Income Tax Return Tax Year 2021

What is the PDF Form IT 201 X Amended Resident Income Tax Return Tax Year

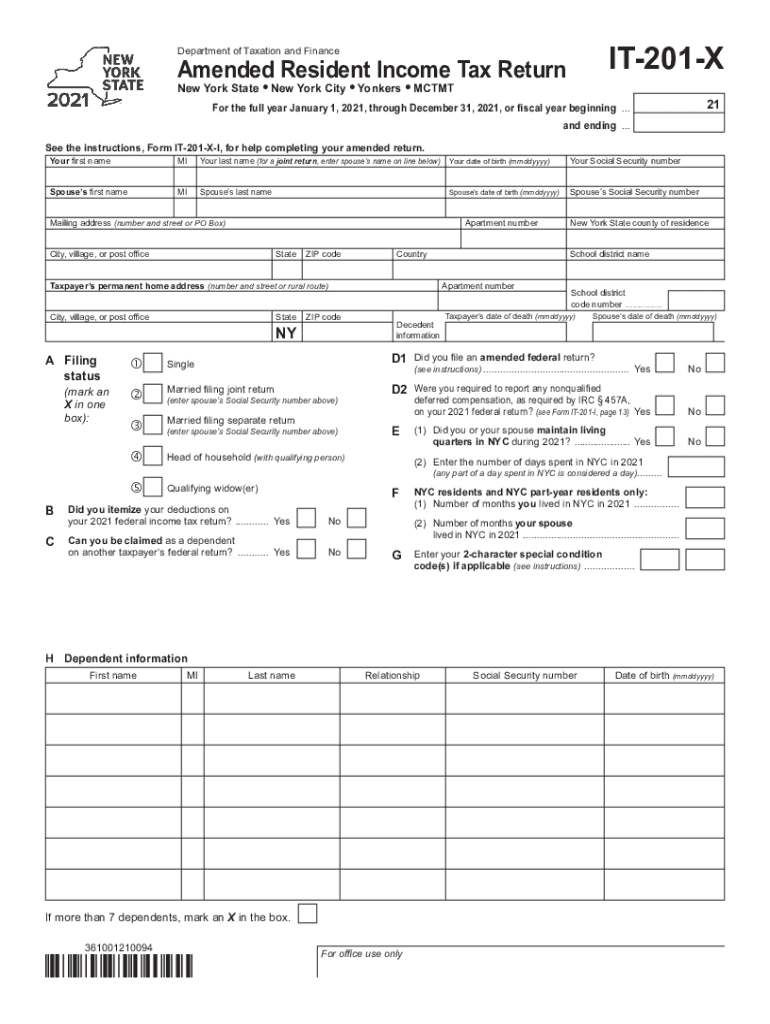

The PDF Form IT 201 X is designed for New York State residents who need to amend their previously filed income tax returns. This form allows taxpayers to correct errors or make adjustments to their original submissions for the tax year. The amended return can address various issues, such as changes in income, deductions, or credits that were not accurately reported in the initial filing. Understanding the purpose of this form is essential for ensuring compliance with New York State tax regulations.

Steps to complete the PDF Form IT 201 X Amended Resident Income Tax Return Tax Year

Completing the PDF Form IT 201 X involves several key steps:

- Begin by downloading the form from the New York State Department of Taxation and Finance website.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the tax year you are amending and provide details about your original return.

- Clearly outline the changes you are making, including any additional income, deductions, or credits.

- Calculate the new tax liability or refund amount based on the amended information.

- Sign and date the form to validate your submission.

Legal use of the PDF Form IT 201 X Amended Resident Income Tax Return Tax Year

The PDF Form IT 201 X is legally recognized for amending income tax returns in New York State. To ensure its validity, taxpayers must adhere to specific guidelines set forth by the New York State Department of Taxation and Finance. This includes timely submission within the designated period for amendments and providing accurate information. Failure to comply with these regulations may result in penalties or denial of the amended return.

Filing Deadlines / Important Dates

When amending a tax return using the PDF Form IT 201 X, it is crucial to be aware of the filing deadlines. Generally, taxpayers have three years from the original due date of the return to file an amendment. For example, if the original return was due on April fifteenth, the amended return must be submitted by April fifteenth of the third year following the tax year in question. Staying informed about these deadlines helps avoid potential issues with the New York State tax authorities.

Form Submission Methods (Online / Mail / In-Person)

The PDF Form IT 201 X can be submitted through various methods, depending on the taxpayer's preference. Options include:

- Mailing the completed form to the appropriate New York State tax office.

- Submitting the form electronically through the New York State Department of Taxation and Finance's online portal, if applicable.

- In-person submissions at designated tax offices for those who prefer direct interaction.

Required Documents

When filing the PDF Form IT 201 X, certain documents may be required to support the amendments being made. These may include:

- A copy of the original tax return.

- Documentation for any new income, deductions, or credits being claimed.

- Any correspondence received from the New York State tax authorities related to the original return.

Gathering these documents ensures a smooth amendment process and helps substantiate the changes made on the form.

Quick guide on how to complete pdf form it 201 x amended resident income tax return tax year 2021

Complete PDF Form IT 201 X Amended Resident Income Tax Return Tax Year effortlessly on any device

Virtual document administration has gained signNow traction among businesses and individuals. It offers an ideal environmentally-friendly substitute for traditional printed and signed paperwork, as you can easily locate the correct template and securely archive it online. airSlate SignNow provides all the resources required to create, modify, and eSign your documents swiftly and without issues. Handle PDF Form IT 201 X Amended Resident Income Tax Return Tax Year on any platform with airSlate SignNow Android or iOS applications and simplify any document-related workflow today.

The easiest method to alter and eSign PDF Form IT 201 X Amended Resident Income Tax Return Tax Year without difficulty

- Obtain PDF Form IT 201 X Amended Resident Income Tax Return Tax Year and then click Get Form to begin.

- Utilize the tools we provide to submit your document.

- Emphasize pertinent sections of your files or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your updates.

- Choose how you wish to send your document, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, laborious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign PDF Form IT 201 X Amended Resident Income Tax Return Tax Year and ensure effective communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pdf form it 201 x amended resident income tax return tax year 2021

Create this form in 5 minutes!

How to create an eSignature for the pdf form it 201 x amended resident income tax return tax year 2021

The best way to generate an e-signature for a PDF in the online mode

The best way to generate an e-signature for a PDF in Chrome

How to create an e-signature for putting it on PDFs in Gmail

The best way to create an e-signature right from your smart phone

How to create an e-signature for a PDF on iOS devices

The best way to create an e-signature for a PDF on Android OS

People also ask

-

What is the relationship between airSlate SignNow and ny state income tax?

airSlate SignNow allows businesses to streamline the document signing process, which can help in managing paperwork related to ny state income tax. By digitally signing tax-related documents, you can ensure timely submission and compliance with New York tax regulations.

-

How can airSlate SignNow help with document submissions for ny state income tax?

With airSlate SignNow, you can quickly send and eSign tax documents required for ny state income tax. This efficient process reduces the chances of errors and ensures that all deadlines are met, helping you stay compliant with state regulations.

-

What features does airSlate SignNow offer for managing ny state income tax documents?

AirSlate SignNow offers features like customizable templates, automated reminders, and secure document storage tailored for ny state income tax documents. These tools help businesses manage their tax documentation more effectively and reduce administrative tasks.

-

Is airSlate SignNow a cost-effective solution for handling ny state income tax documentation?

Yes, airSlate SignNow is a cost-effective solution designed to save businesses money on paperwork and administrative costs related to ny state income tax. Our competitive pricing plans allow companies of all sizes to easily adopt our eSigning solutions without breaking the bank.

-

Can airSlate SignNow integrate with other accounting software to manage ny state income tax?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, allowing for efficient management of ny state income tax documents. These integrations ensure all financial data is synchronized, simplifying the overall tax preparation and filing process.

-

How secure is airSlate SignNow for handling sensitive ny state income tax documents?

Security is a top priority at airSlate SignNow. Our platform uses advanced encryption and security protocols to protect sensitive ny state income tax documents, ensuring that your data remains confidential and secure throughout the signing process.

-

What benefits does airSlate SignNow offer for businesses managing ny state income tax?

The benefits of using airSlate SignNow for ny state income tax management include increased efficiency, reduced paperwork errors, and enhanced compliance with state regulations. Moreover, our easy-to-use platform allows for faster turnaround times on document processing.

Get more for PDF Form IT 201 X Amended Resident Income Tax Return Tax Year

- Bail bond form

- Louisiana bond form

- Bail 497308671 form

- Original brief on behalf of appellant louisiana form

- Writ review form

- Writ certiorari 497308674 form

- Brief in support of motion for rehearing on behalf of defendant appellant louisiana form

- Original brief on behalf of defendant appellant louisiana form

Find out other PDF Form IT 201 X Amended Resident Income Tax Return Tax Year

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT