Form X 201 New York Sole Proprietorship 2018

What is the Form IT-201 X for New York Sole Proprietorship

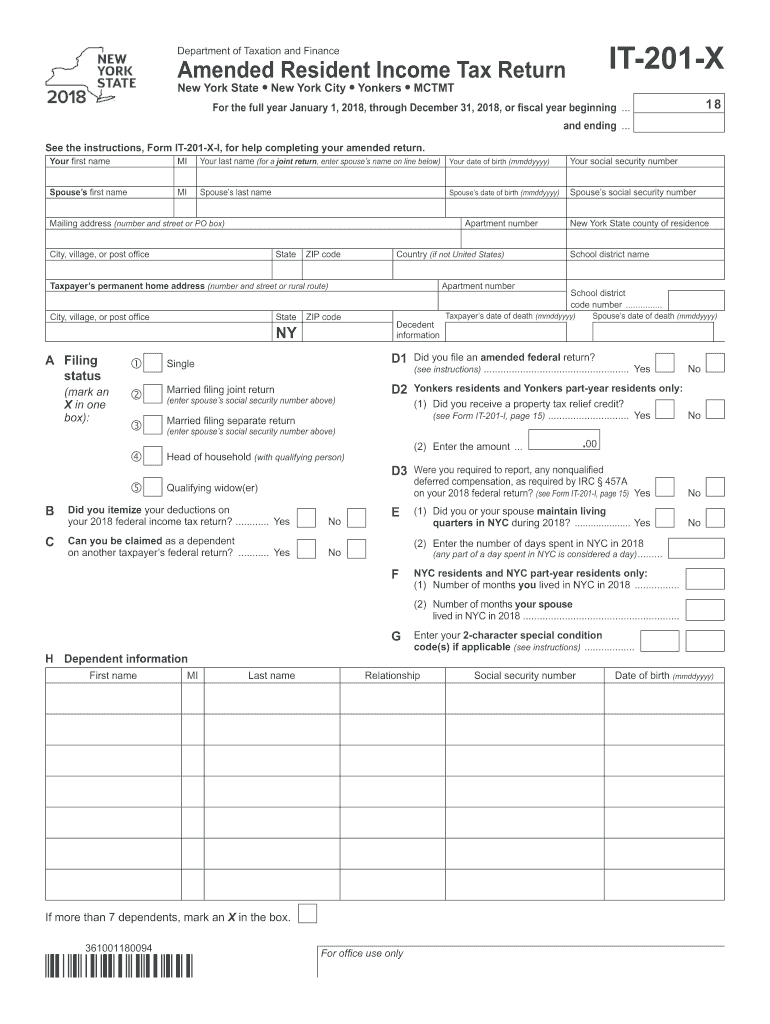

The Form IT-201 X is an amended personal income tax return used by sole proprietors in New York to correct errors or make changes to a previously filed IT-201 form. This form is essential for individuals who need to adjust their reported income, deductions, or credits for the state tax year. It allows taxpayers to ensure that their tax filings accurately reflect their financial situation, thereby avoiding potential penalties or issues with the New York State Department of Taxation and Finance.

Steps to Complete the Form IT-201 X

Completing the Form IT-201 X involves several key steps to ensure accuracy and compliance with state tax regulations:

- Gather necessary documents: Collect all relevant financial documents, including previous tax returns, W-2s, and any supporting documentation for changes.

- Fill out the form: Enter your personal information, including your name, address, and Social Security number. Indicate the tax year you are amending.

- Detail the changes: Clearly specify what changes you are making to your original return, including any adjustments to income, deductions, or credits.

- Calculate the new tax liability: Determine how the changes affect your overall tax liability and whether you owe additional taxes or are due a refund.

- Sign and date the form: Ensure that you sign and date the form before submission to validate the amendment.

Legal Use of the Form IT-201 X

The Form IT-201 X must be used in accordance with New York State tax laws. It is legally binding once submitted, and it is crucial to provide accurate information to avoid penalties. Taxpayers should ensure that any amendments comply with the guidelines set forth by the New York State Department of Taxation and Finance. Misuse of the form or providing false information can lead to legal repercussions, including fines or audits.

Filing Deadlines / Important Dates

When filing the Form IT-201 X, it is important to adhere to specific deadlines to avoid penalties. Generally, amendments must be filed within three years from the original due date of the tax return or within two years from the date the tax was paid, whichever is later. Keeping track of these deadlines ensures compliance and helps in managing any potential tax liabilities effectively.

Required Documents for Form IT-201 X

To complete the Form IT-201 X, you will need several documents:

- Original IT-201 form: The initial tax return you are amending.

- W-2 forms: Any wage statements that reflect income changes.

- Supporting documentation: Any receipts or records that justify the changes being made.

- Previous correspondence: Any letters or notices from the New York State Department of Taxation and Finance regarding your original return.

Form Submission Methods

The Form IT-201 X can be submitted through various methods, ensuring convenience for taxpayers. Options include:

- Online: Use the New York State Department of Taxation and Finance's online services for electronic submission.

- Mail: Send the completed form via postal service to the appropriate address listed on the form.

- In-Person: Visit a local office of the New York State Department of Taxation and Finance to submit the form directly.

Quick guide on how to complete form 201 x 2018 2019

Your comprehensive manual for preparing your Form X 201 New York Sole Proprietorship

If you're interested in learning how to fill out and submit your Form X 201 New York Sole Proprietorship, here are some straightforward guidelines to simplify your tax processing.

To begin, simply register for your airSlate SignNow account to change the way you manage documents online. airSlate SignNow is a highly user-friendly and robust document solution that enables you to edit, generate, and finalize your income tax papers effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures, as well as revisit to amend details as needed. Enhance your tax management with sophisticated PDF editing, eSigning, and seamless sharing.

Follow the instructions below to finalize your Form X 201 New York Sole Proprietorship in just a few minutes:

- Establish your account and start editing PDFs in a matter of minutes.

- Utilize our directory to obtain any IRS tax form; browse through different versions and schedules.

- Click Get form to access your Form X 201 New York Sole Proprietorship in our editor.

- Input the necessary data in the fillable fields (text, numbers, checkmarks).

- Employ the Sign Tool to insert your legally-binding eSignature (if necessary).

- Examine your document and correct any discrepancies.

- Save modifications, print your copy, send it to your intended recipient, and download it to your device.

Refer to this guide to electronically file your taxes with airSlate SignNow. Be aware that submitting on paper may lead to errors on returns and delays in refunds. Of course, before e-filing your taxes, consult the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct form 201 x 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

-

How do I fill out the NEET 2019 application form?

Expecting application form of NEET2019 will be same as that of NEET2018, follow the instructions-For Feb 2019 Exam:EventsDates (Announced)Release of application form-1st October 2018Application submission last date-31st October 2018Last date to pay the fee-Last week of October 2018Correction Window Open-1st week of November 2018Admit card available-1st week of January 2019Exam date-3rd February to 17th February 2019Answer key & OMR release-Within a week after examAnnouncement of result-1st week of March 2019Counselling begins-2nd week of June 2019For May 2019 Exam:EventsDates (Announced)Application form Release-2nd week of March 2019Application submission last date-2nd week of April 2019Last date to pay the fee-2nd week of April 2019Correction Window Open-3rd week of April 2019Admit card available-1st week of May 2019Exam date-12th May to 26th May 2019Answer key & OMR release-Within a week after examAnnouncement of result-1st week of June 2019Counselling begins-2nd week of June 2019NEET 2019 Application FormCandidates should fill the application form as per the instructions given in the information bulletin. Below we are providing NEET 2019 application form details:The application form will be issued through online mode only.No application will be entertained through offline mode.NEET UG registration 2019 will be commenced from the 1st October 2018 (Feb Exam) & second week of March 2018 (May Exam).Candidates should upload the scanned images of recent passport size photograph and signature.After filling the application form completely, a confirmation page will be generated. Download it.There will be no need to send the printed confirmation page to the board.Application Fee:General and OBC candidates will have to pay Rs. 1400/- as an application fee.The application fee for SC/ST and PH candidates will be Rs. 750/-.Fee payment can be done through credit/debit card, net banking, UPI and e-wallet.Service tax will also be applicable.CategoryApplication FeeGeneral/OBC-1400/-SC/ST/PH-750/-Step 1: Fill the Application FormGo the official portal of the conducting authority (Link will be given above).Click on “Apply Online” link.A candidate has to read all the instruction and then click on “Proceed to Apply Online NEET (UG) 2019”.Step 1.1: New RegistrationFill the registration form carefully.Candidates have to fill their name, Mother’s Name, Father’s Name, Category, Date of Birth, Gender, Nationality, State of Eligibility (for 15% All India Quota), Mobile Number, Email ID, Aadhaar card number, etc.After filling all the details, two links will be given “Preview &Next” and “Reset”.If candidate satisfied with the filled information, then they have to click on “Next”.After clicking on Next Button, the information submitted by the candidate will be displayed on the screen. If information correct, click on “Next” button, otherwise go for “Back” button.Candidates may note down the registration number for further procedure.Now choose the strong password and re enter the password.Choose security question and feed answer.Enter the OTP would be sent to your mobile number.Submit the button.Step 1.2: Login & Application Form FillingLogin with your Registration Number and password.Fill personal details.Enter place of birth.Choose the medium of question paper.Choose examination centres.Fill permanent address.Fill correspondence address.Fill Details (qualification, occupation, annual income) of parents and guardians.Choose the option for dress code.Enter security pin & click on save & draft.Now click on preview and submit.Now, review your entries.Then. click on Final Submit.Step 2: Upload Photo and SignatureStep 2 for images upload will be appeared on screen.Now, click on link for Upload photo & signature.Upload the scanned images.Candidate should have scanned images of his latest Photograph (size of 10 Kb to 100 Kb.Signature(size of 3 Kb to 20 Kb) in JPEG format only.Step 3: Fee PaymentAfter uploading the images, candidate will automatically go to the link for fee payment.A candidate has to follow the instruction & submit the application fee.Choose the Bank for making payment.Go for Payment.Candidate can pay the fee through Debit/Credit Card/Net Banking/e-wallet (CSC).Step 4: Take the Printout of Confirmation PageAfter the fee payment, a candidate may take the printout of the confirmation page.Candidates may keep at least three copies of the confirmation page.Note:Must retain copy of the system generated Self Declaration in respect of candidates from J&K who have opted for seats under 15% All India Quota.IF any queries, feel free to comment..best of luck

Create this form in 5 minutes!

How to create an eSignature for the form 201 x 2018 2019

How to generate an electronic signature for the Form 201 X 2018 2019 online

How to generate an electronic signature for the Form 201 X 2018 2019 in Google Chrome

How to create an eSignature for putting it on the Form 201 X 2018 2019 in Gmail

How to create an eSignature for the Form 201 X 2018 2019 right from your smart phone

How to create an electronic signature for the Form 201 X 2018 2019 on iOS devices

How to create an electronic signature for the Form 201 X 2018 2019 on Android

People also ask

-

What is the Form X 201 New York Sole Proprietorship?

The Form X 201 New York Sole Proprietorship is a crucial document for individuals looking to establish a sole proprietorship in New York. This form allows you to officially register your business and is essential for obtaining necessary licenses and permits. Using airSlate SignNow, you can easily eSign and submit your Form X 201 online, streamlining the registration process.

-

How can airSlate SignNow help with the Form X 201 New York Sole Proprietorship process?

airSlate SignNow simplifies the process of completing and submitting your Form X 201 New York Sole Proprietorship. Our platform provides an intuitive interface for filling out the form, along with eSigning capabilities that ensure your documents are legally binding. This not only saves time but also enhances accuracy, making the registration process hassle-free.

-

What are the pricing options for airSlate SignNow when filing the Form X 201 New York Sole Proprietorship?

airSlate SignNow offers flexible pricing plans to cater to businesses of all sizes, making it cost-effective to manage your Form X 201 New York Sole Proprietorship. Whether you need basic eSigning features or advanced document management tools, our plans are competitively priced. You can choose a plan that fits your budget while ensuring you have all the necessary features for your business.

-

What features does airSlate SignNow provide for managing the Form X 201 New York Sole Proprietorship?

With airSlate SignNow, you gain access to a range of features designed to facilitate the management of your Form X 201 New York Sole Proprietorship. Features include customizable templates, seamless eSigning, and secure cloud storage for your documents. These tools enhance efficiency, allowing you to focus more on growing your business rather than paperwork.

-

Can I integrate airSlate SignNow with other software for my Form X 201 New York Sole Proprietorship?

Yes, airSlate SignNow offers robust integration capabilities with various software solutions, making it easy to manage your Form X 201 New York Sole Proprietorship. You can connect with CRMs, cloud storage services, and other productivity tools to streamline your workflow. This integration ensures that all your documents are organized and accessible in one place.

-

Is airSlate SignNow secure for eSigning the Form X 201 New York Sole Proprietorship?

Absolutely! airSlate SignNow employs industry-standard security measures to protect your data when eSigning the Form X 201 New York Sole Proprietorship. Our platform uses encryption and secure servers to ensure that your documents remain confidential and secure throughout the signing process.

-

What are the benefits of using airSlate SignNow for my Form X 201 New York Sole Proprietorship?

Using airSlate SignNow for your Form X 201 New York Sole Proprietorship offers numerous benefits, including efficiency, cost-effectiveness, and ease of use. You can complete, eSign, and store your documents digitally, signNowly reducing processing time. Additionally, our user-friendly platform ensures that you can navigate the registration process without any technical challenges.

Get more for Form X 201 New York Sole Proprietorship

Find out other Form X 201 New York Sole Proprietorship

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online