2020-2026

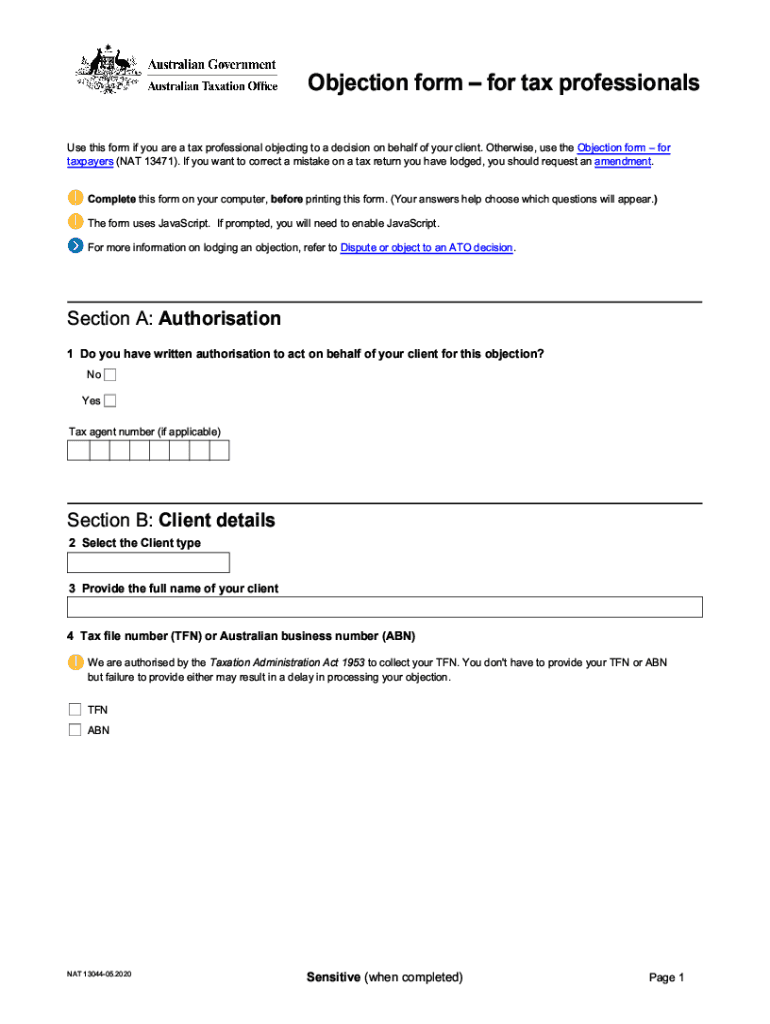

What is the nat 13044?

The nat 13044 is an official objection form for tax professionals, specifically designed for use in the United States. This form allows tax professionals to formally contest decisions made by tax authorities, ensuring that clients' rights are protected during tax disputes. The nat 13044 serves as a crucial tool for professionals navigating complex tax regulations and provides a structured approach to address grievances with tax assessments or rulings.

Steps to complete the nat 13044

Completing the nat 13044 involves several key steps to ensure accuracy and compliance with tax regulations. Begin by gathering all necessary information, including client details and specifics regarding the objection. The form typically requires the following:

- Client's name and contact information

- Details of the tax assessment being contested

- Clear explanation of the reasons for the objection

- Supporting documentation to substantiate the claim

Once the information is compiled, fill out the form carefully, ensuring all sections are completed. Review the form for accuracy before submission, as errors can lead to delays or rejections. Finally, submit the nat 13044 through the designated channels, which may include online submission or mailing it to the appropriate tax authority.

Legal use of the nat 13044

The nat 13044 is legally recognized as a valid document for contesting tax decisions, provided it adheres to the relevant regulations set forth by tax authorities. To ensure its legal standing, the form must be completed with accurate information, and all required signatures must be obtained. Additionally, compliance with eSignature laws is essential when submitting the form electronically. The use of a reliable eSigning platform can enhance the form's validity and provide a secure way to manage sensitive information.

Required Documents for the nat 13044

When submitting the nat 13044, it is important to include all required documents to support the objection. These documents may vary depending on the nature of the dispute but generally include:

- Copies of relevant tax returns

- Correspondence with tax authorities

- Financial statements or records that support the objection

- Any additional documentation requested by the tax authority

Providing comprehensive documentation not only strengthens the case but also helps expedite the review process by the tax authorities.

Form Submission Methods

The nat 13044 can be submitted through various methods, depending on the preferences of the tax professional and the requirements of the tax authority. Common submission methods include:

- Online submission through secure e-filing systems

- Mailing a physical copy to the designated tax office

- In-person submission at local tax offices, if applicable

Choosing the appropriate submission method is important for ensuring timely processing and compliance with any specific guidelines set by tax authorities.

IRS Guidelines for the nat 13044

Tax professionals must adhere to IRS guidelines when utilizing the nat 13044. These guidelines outline the proper procedures for filing objections and detail the information required for a successful submission. Key points include:

- Understanding the specific grounds for objection as defined by the IRS

- Filing within the designated time frames to avoid penalties

- Maintaining accurate records of all communications and submissions related to the objection

Familiarity with these guidelines is essential for tax professionals to effectively represent their clients and navigate the complexities of tax disputes.

Quick guide on how to complete 551353890

Complete seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the required form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without interruptions. Manage on any device through the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and electronically sign effortlessly

- Locate and then click Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you wish to deliver your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 551353890

Create this form in 5 minutes!

How to create an eSignature for the 551353890

How to make an electronic signature for a PDF online

How to make an electronic signature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

How to make an electronic signature from your smartphone

The best way to generate an eSignature for a PDF on iOS

How to make an electronic signature for a PDF file on Android

People also ask

-

What is nat 13044 and how does it relate to airSlate SignNow?

Nat 13044 is a key feature within airSlate SignNow that enhances document management and eSigning capabilities. It allows businesses to streamline their workflows, making it easier to send and sign documents securely. Understanding nat 13044 is essential for maximizing the benefits of our solution.

-

How much does airSlate SignNow cost with nat 13044 integration?

Pricing for airSlate SignNow varies based on features and integration levels, including nat 13044. We offer several plans tailored to different business needs, ensuring cost-effectiveness while providing all necessary functionalities. For the latest pricing details, please check our pricing page.

-

What features does airSlate SignNow provide with nat 13044?

With nat 13044, airSlate SignNow offers features such as automated workflows, customizable templates, and robust document tracking. These tools help businesses save time and enhance productivity while ensuring compliance. Learn more about how nat 13044 can transform your document management processes.

-

Are there any benefits to using nat 13044 in airSlate SignNow?

Yes, utilizing nat 13044 in airSlate SignNow brings numerous benefits, such as increased efficiency and improved security for document handling. It allows users to manage eSignatures better and reduces the time spent on paper-based processes. Embracing nat 13044 can signNowly enhance your business operations.

-

Can I integrate nat 13044 with other applications or software?

Absolutely! airSlate SignNow with nat 13044 can be easily integrated with a variety of applications, including CRM and project management tools. This integration allows for a seamless data flow and improved collaboration between different software platforms. Discover how nat 13044 can work with your existing systems.

-

Is it easy to set up airSlate SignNow with nat 13044?

Yes, setting up airSlate SignNow with nat 13044 is straightforward and user-friendly. Our platform provides step-by-step instructions and support to ensure a smooth onboarding process. You’ll be up and running in no time, empowering your team to eSign documents efficiently.

-

How secure is the eSigning process with nat 13044?

The eSigning process using nat 13044 in airSlate SignNow is highly secure, with industry-leading encryption protocols in place. We prioritize the security of your documents and data, ensuring they are protected at all times. Trust in our commitment to providing a safe environment for all your eSigning needs.

Get more for

- What does a form for a step 1 grievance look like

- Solicitud de registro de marca form

- Cm 100 form

- Daycare emergency contact form

- Electron configuration chem worksheet 5 6 form

- Scatter plot worksheets pdf form

- Notice of rent increase and modification of another 735467225 form

- Youth group registration form farringdon church

Find out other

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney