Nat 13044 2014

What is the Nat 13044?

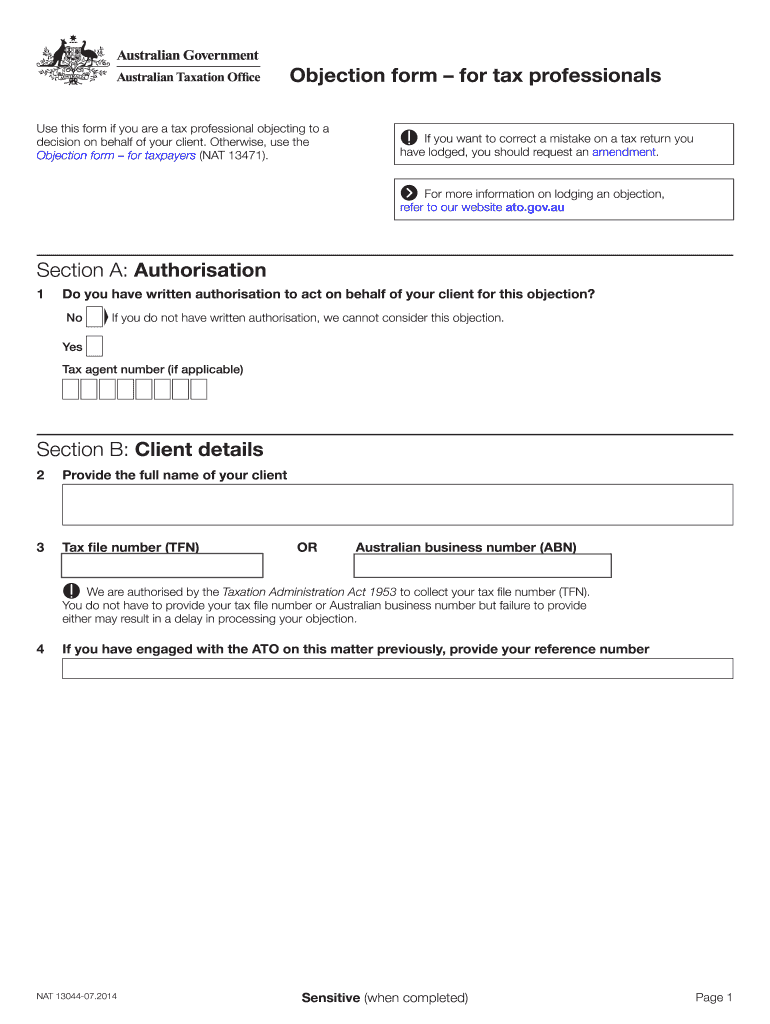

The Nat 13044 is a specific form used in the tax process, particularly relevant for tax professionals. It serves as an objection form that allows individuals or entities to contest certain tax decisions made by the Australian Taxation Office (ATO). Understanding the purpose and implications of this form is crucial for ensuring compliance and addressing any disputes effectively.

How to use the Nat 13044

Using the Nat 13044 involves several key steps. First, ensure that you have a clear understanding of the decision you are contesting. Gather all necessary documentation that supports your objection. Complete the form accurately, providing detailed information regarding your case. It is essential to submit the form within the specified time frame to ensure that your objection is considered valid.

Steps to complete the Nat 13044

Completing the Nat 13044 requires careful attention to detail. Follow these steps:

- Read the instructions thoroughly to understand the requirements.

- Fill out your personal information and the details of the decision you are contesting.

- Provide a clear explanation of your objection, supported by relevant documents.

- Review the completed form for accuracy before submission.

- Submit the form via the preferred method, ensuring you keep a copy for your records.

Legal use of the Nat 13044

The legal use of the Nat 13044 is governed by specific regulations set forth by the ATO. To ensure that your objection is legally valid, it is important to comply with all relevant laws regarding tax objections. This includes adhering to deadlines and providing accurate information. Utilizing electronic tools for submission can enhance the legal standing of your objection, as long as they meet the necessary compliance standards.

Key elements of the Nat 13044

Several key elements must be included in the Nat 13044 to ensure its effectiveness:

- Your personal identification details.

- The specific decision you are objecting to.

- A detailed explanation of your grounds for objection.

- Supporting documentation that substantiates your claim.

- Your signature and date of submission.

Filing Deadlines / Important Dates

Filing deadlines for the Nat 13044 are critical to the success of your objection. Typically, you must submit the form within a specified period following the notification of the decision you wish to contest. It is advisable to check the ATO guidelines for the most current deadlines to avoid any potential penalties or dismissals of your objection.

Who Issues the Form

The Nat 13044 is issued by the Australian Taxation Office (ATO). The ATO provides the necessary guidelines and resources for completing the form, ensuring that taxpayers have access to the information required to contest tax decisions effectively. Understanding the role of the ATO in this process can help in navigating any objections more smoothly.

Quick guide on how to complete nat 13044

Effortlessly Prepare Nat 13044 on Any Device

Managing documents online has gained immense popularity among both businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without interruptions. Handle Nat 13044 seamlessly on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest method to modify and eSign Nat 13044 with ease

- Obtain Nat 13044 and click Get Form to begin.

- Make use of the tools provided to complete your form.

- Emphasize essential sections of the documents or redact sensitive information with specialized tools offered by airSlate SignNow.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal significance as a traditional handwritten signature.

- Verify the details and click the Done button to save your modifications.

- Choose how you want to submit your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that necessitate reprinting documents. airSlate SignNow fulfills all your document management needs with just a few clicks from any device of your preference. Edit and eSign Nat 13044 to ensure outstanding communication throughout your form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nat 13044

Create this form in 5 minutes!

How to create an eSignature for the nat 13044

The best way to create an eSignature for a PDF in the online mode

The best way to create an eSignature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The best way to generate an electronic signature from your smart phone

The way to generate an eSignature for a PDF on iOS devices

The best way to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is nat 13044 ato?

The nat 13044 ato is a unique identifier for specific taxation categories in Australia. Understanding this code is crucial for businesses that need to comply with ATO regulations. Using airSlate SignNow can help streamline document management related to nat 13044 ato.

-

How can airSlate SignNow assist with nat 13044 ato compliance?

airSlate SignNow offers robust electronic signature capabilities that enable businesses to sign and send important documents related to nat 13044 ato efficiently. By using this platform, you can ensure your documents are compliant and securely stored. Its features simplify the completion of necessary paperwork.

-

Are there any fees associated with using airSlate SignNow for nat 13044 ato processes?

airSlate SignNow offers flexible pricing plans that can accommodate various business needs, including those related to nat 13044 ato documentation. Subscription costs are transparent, and you'll only pay for the features that best suit your requirements. This makes it a cost-effective solution for all users.

-

What features make airSlate SignNow effective for nat 13044 ato documentation?

AirSlate SignNow provides user-friendly features such as customizable templates, document tracking, and secure signing for nat 13044 ato documentation. These features allow you to manage your documents efficiently and reduce errors. The platform's automation tools also help save valuable time.

-

Can airSlate SignNow integrate with other tools for nat 13044 ato management?

Yes, airSlate SignNow seamlessly integrates with various applications that are beneficial for managing nat 13044 ato processes. This includes popular accounting and payroll software, ensuring a smooth workflow. Integration helps maintain data consistency across platforms essential for compliance.

-

What are the benefits of using airSlate SignNow for nat 13044 ato document signings?

Using airSlate SignNow for nat 13044 ato document signings enhances security, speed, and accessibility. Digital signatures are legally binding and increase efficiency by reducing paperwork. This platform makes it easy for teams to collaborate on documents from anywhere.

-

Is airSlate SignNow secure for handling nat 13044 ato documents?

Absolutely! airSlate SignNow employs advanced encryption and security measures to protect your nat 13044 ato documents. You can trust the platform to keep your sensitive information safe while complying with legal requirements. Enhanced security protocols are in place for all transactions.

Get more for Nat 13044

Find out other Nat 13044

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will