Partnership Other Entities 2017-2026

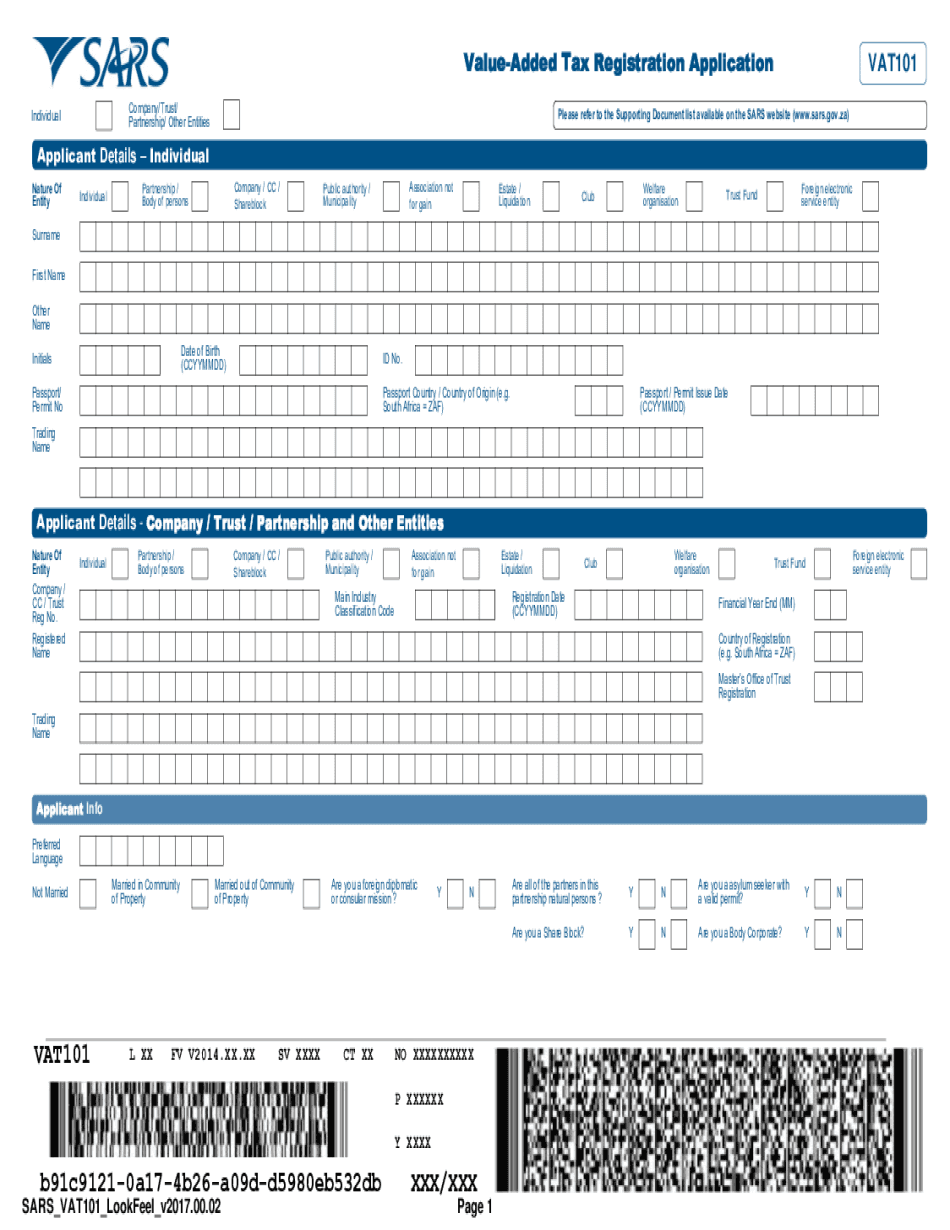

Understanding the VAT101 Form

The VAT101 form, also known as the Value Added Tax Registration Application, is essential for businesses operating in the United States that are required to register for value added tax. This form is particularly relevant for entities that engage in taxable activities and need to ensure compliance with tax regulations. By completing the VAT101, businesses can obtain their VAT registration number, which is crucial for invoicing and tax reporting purposes.

Steps to Complete the VAT101 Form

Filling out the VAT101 form involves several steps to ensure accurate and complete submission. Start by gathering necessary information, including business details, contact information, and tax identification numbers. Next, carefully fill out each section of the form, ensuring that all fields are completed accurately. Once the form is filled out, review it for any errors or omissions. After verification, the form can be submitted electronically or via mail, depending on the preferred submission method.

Required Documents for VAT101 Submission

When submitting the VAT101 form, certain documents are typically required to support your application. These may include:

- Proof of business registration

- Tax identification number (TIN)

- Financial statements or records

- Identification documents of the business owner(s)

Ensuring all required documents are included with your VAT101 form can expedite the processing time and help avoid delays.

Legal Use of the VAT101 Form

The VAT101 form must be used in compliance with local tax laws and regulations. It is crucial to ensure that the information provided is truthful and accurate, as any discrepancies can lead to legal penalties or issues with tax authorities. The form serves as a legal declaration of intent to register for VAT, making it essential for businesses to understand their obligations under the law.

Form Submission Methods

The VAT101 form can be submitted through various methods, allowing flexibility for businesses. Common submission methods include:

- Online submission through the relevant tax authority’s portal

- Mailing a physical copy of the form to the designated tax office

- In-person submission at local tax offices

Choosing the right submission method can depend on factors such as urgency, availability of resources, and personal preference.

IRS Guidelines for VAT101 Compliance

It is important to adhere to IRS guidelines when completing and submitting the VAT101 form. These guidelines outline the necessary requirements for VAT registration, including eligibility criteria and compliance standards. Familiarizing yourself with these guidelines can help ensure that your application is processed smoothly and in accordance with federal regulations.

Quick guide on how to complete partnership other entities

Effortlessly Prepare Partnership Other Entities on Any Device

Digital document management has gained immense traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents promptly without any holdups. Manage Partnership Other Entities on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The Easiest Way to Modify and eSign Partnership Other Entities Without Effort

- Find Partnership Other Entities and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or conceal sensitive data with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign function, which takes just seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form hunting, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and eSign Partnership Other Entities and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct partnership other entities

Create this form in 5 minutes!

How to create an eSignature for the partnership other entities

How to make an electronic signature for a PDF file online

How to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

How to make an electronic signature from your mobile device

The best way to generate an eSignature for a PDF file on iOS

How to make an electronic signature for a PDF file on Android devices

People also ask

-

What is the VAT101 form and why do I need it?

The VAT101 form is a critical document for businesses to report their taxable transactions in compliance with VAT regulations. Downloading the VAT101 form is essential for accurate tax filing, ensuring you avoid penalties and remain compliant with tax laws.

-

How can I download the VAT101 form using airSlate SignNow?

You can easily download the VAT101 form through airSlate SignNow by accessing our user-friendly platform. Simply navigate to the forms section, locate the VAT101, and click the download button to get your form instantly.

-

Is there a cost associated with the VAT101 form download?

Downloading the VAT101 form through airSlate SignNow is included in our subscription plans, making it a budget-friendly option. We offer transparent pricing with various tiers to accommodate businesses of all sizes, ensuring you get great value while managing your documents.

-

What features does airSlate SignNow offer for signing VAT101 forms?

airSlate SignNow provides a comprehensive eSignature solution that simplifies the signing process for VAT101 forms. Features include secure digital signatures, document tracking, and customizable templates, allowing you to streamline your workflow and enhance the signing experience.

-

Can I integrate airSlate SignNow with other tools for VAT101 form management?

Yes, airSlate SignNow supports integrations with several popular business tools and software, making VAT101 form management more efficient. You can connect it with platforms like Google Drive, Salesforce, and more to enhance your document workflows and data synchronization.

-

What benefits can I expect from using airSlate SignNow for my VAT101 form download?

By using airSlate SignNow for your VAT101 form download, you gain access to a streamlined process that saves you time and reduces errors. Additionally, the platform provides a secure environment for managing sensitive documents, ensuring your information remains protected throughout the signing process.

-

How does airSlate SignNow ensure the security of my VAT101 form information?

AirSlate SignNow prioritizes security with advanced features such as 256-bit encryption and secure cloud storage to protect your VAT101 form data. Our robust security protocols ensure that your documents and personal information are safeguarded against unauthorized access.

Get more for Partnership Other Entities

Find out other Partnership Other Entities

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple