Please Also Attach All Applicable Schedules and 1099 NEC to Avoid Delays 2020

Understanding the Importance of Schedules and 1099 NEC Attachments

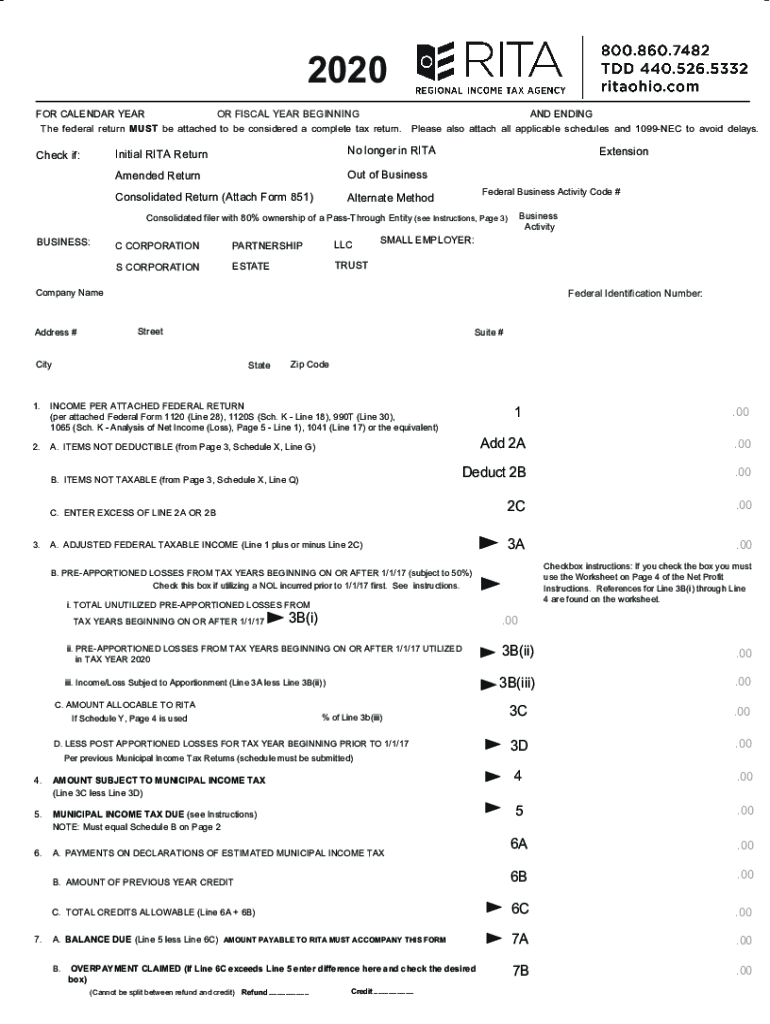

When filing the oh rita return, it is essential to include all applicable schedules and 1099 NEC forms. These documents provide critical information regarding income and deductions that the tax authorities require for accurate processing. Missing these attachments can lead to delays in your return being processed, which may result in penalties or interest on unpaid taxes.

Schedules such as the Schedule C for business income or Schedule E for rental income are particularly important. The 1099 NEC form reports non-employee compensation, which is crucial for self-employed individuals. Including these documents ensures that your return reflects all sources of income and complies with IRS regulations.

Steps to Ensure Proper Attachment of Schedules and 1099 NEC

To avoid delays when submitting your oh rita return, follow these steps:

- Review your income sources and determine which schedules apply to your situation.

- Gather all relevant 1099 NEC forms that report any non-employee compensation received during the tax year.

- Ensure that each schedule and 1099 NEC form is completed accurately and reflects the correct amounts.

- Attach the schedules and forms to your oh rita return before submission, ensuring they are in the correct order.

- Double-check for completeness to avoid any missing documents that could delay processing.

Legal Considerations for Attachments

Including all applicable schedules and 1099 NEC forms is not just a best practice; it is a legal requirement. The IRS mandates that taxpayers report all income accurately, and failure to do so can lead to audits or penalties. By ensuring that your oh rita return is complete with the necessary documentation, you are protecting yourself from potential legal issues.

Additionally, understanding the legal implications of each form can help you make informed decisions about your tax filing. For instance, the 1099 NEC must be issued by businesses that have paid you for services, and not reporting this income can lead to discrepancies in your tax filings.

Filing Deadlines for the Oh Rita Return

Timely filing of your oh rita return is crucial to avoid penalties. The typical deadline for filing is April 15, unless it falls on a weekend or holiday, in which case the deadline may be extended. If you are unable to file by this date, consider requesting an extension. However, it is important to note that an extension to file does not extend the time to pay any taxes owed.

Be aware of any specific deadlines related to the submission of schedules and 1099 NEC forms, as these may differ from the general filing deadline for the oh rita return.

Required Documents for the Oh Rita Return

To successfully complete your oh rita return, you will need several key documents:

- W-2 forms from employers

- 1099 NEC forms for any freelance or contract work

- Schedules applicable to your income sources, such as Schedule C or Schedule E

- Receipts for any deductible expenses

- Previous year’s tax return for reference

Having these documents organized and ready will streamline the process of completing your return and ensure that you meet all requirements.

Consequences of Non-Compliance

Failing to attach the necessary schedules and 1099 NEC forms can lead to significant consequences. The IRS may impose penalties for late filing or for inaccuracies in your tax return. In severe cases, this could result in an audit or additional scrutiny of your financial records.

Understanding the importance of compliance not only helps in avoiding penalties but also ensures that you maintain a good standing with tax authorities. By being diligent in your filing process, you can mitigate risks associated with non-compliance.

Quick guide on how to complete please also attach all applicable schedules and 1099 nec to avoid delays

Effortlessly Prepare Please Also Attach All Applicable Schedules And 1099 NEC To Avoid Delays on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle Please Also Attach All Applicable Schedules And 1099 NEC To Avoid Delays on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Edit and eSign Please Also Attach All Applicable Schedules And 1099 NEC To Avoid Delays with Ease

- Find Please Also Attach All Applicable Schedules And 1099 NEC To Avoid Delays and click Get Form to commence.

- Use the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal significance as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from your preferred device. Modify and eSign Please Also Attach All Applicable Schedules And 1099 NEC To Avoid Delays and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct please also attach all applicable schedules and 1099 nec to avoid delays

Create this form in 5 minutes!

How to create an eSignature for the please also attach all applicable schedules and 1099 nec to avoid delays

How to make an eSignature for a PDF in the online mode

How to make an eSignature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The best way to create an eSignature straight from your smart phone

The best way to make an eSignature for a PDF on iOS devices

The best way to create an eSignature for a PDF document on Android OS

People also ask

-

What is the 'oh rita return' feature in airSlate SignNow?

The 'oh rita return' feature in airSlate SignNow streamlines the document signing process by allowing users to easily track and manage their document returns. With this feature, you can ensure that all necessary signatures are obtained efficiently and that return documents are logged automatically for your convenience.

-

How does airSlate SignNow's 'oh rita return' help with document management?

Using the 'oh rita return' feature, airSlate SignNow enhances document management by providing users with clear visibility over their signed and returned documents. This functionality minimizes the risk of losing important files and allows for easy access, making it an essential tool for businesses.

-

Is there a pricing plan for using 'oh rita return' in airSlate SignNow?

Yes, airSlate SignNow offers flexible pricing plans that include access to the 'oh rita return' functionality. You can choose a plan that best suits your business needs, ensuring that you receive cost-effective solutions for eSigning and document management.

-

Can 'oh rita return' integrate with other platforms?

Absolutely! The 'oh rita return' feature in airSlate SignNow can seamlessly integrate with various platforms, enhancing your document workflow. This capability allows you to connect with tools and applications you already use, ensuring compatibility and increased efficiency.

-

What are the benefits of using airSlate SignNow's 'oh rita return' for eSigning?

Utilizing airSlate SignNow's 'oh rita return' feature offers benefits such as improved turnaround times for documents and increased accuracy in tracking returns. This functionality helps reduce paperwork-related burdens, allowing your team to focus on more critical tasks.

-

How user-friendly is the 'oh rita return' interface in airSlate SignNow?

The 'oh rita return' interface in airSlate SignNow is designed with user-friendliness in mind. Even those new to document signing can navigate the feature effortlessly, making it an accessible option for businesses of all sizes.

-

Does airSlate SignNow provide support for the 'oh rita return' feature?

Yes, airSlate SignNow offers comprehensive support for the 'oh rita return' feature. Customers can access tutorials, FAQs, and dedicated customer service assistance to ensure that they can fully leverage this powerful functionality.

Get more for Please Also Attach All Applicable Schedules And 1099 NEC To Avoid Delays

Find out other Please Also Attach All Applicable Schedules And 1099 NEC To Avoid Delays

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy