Rita Form 27 Instructions 2022-2026

Understanding the Rita Form 27 Instructions

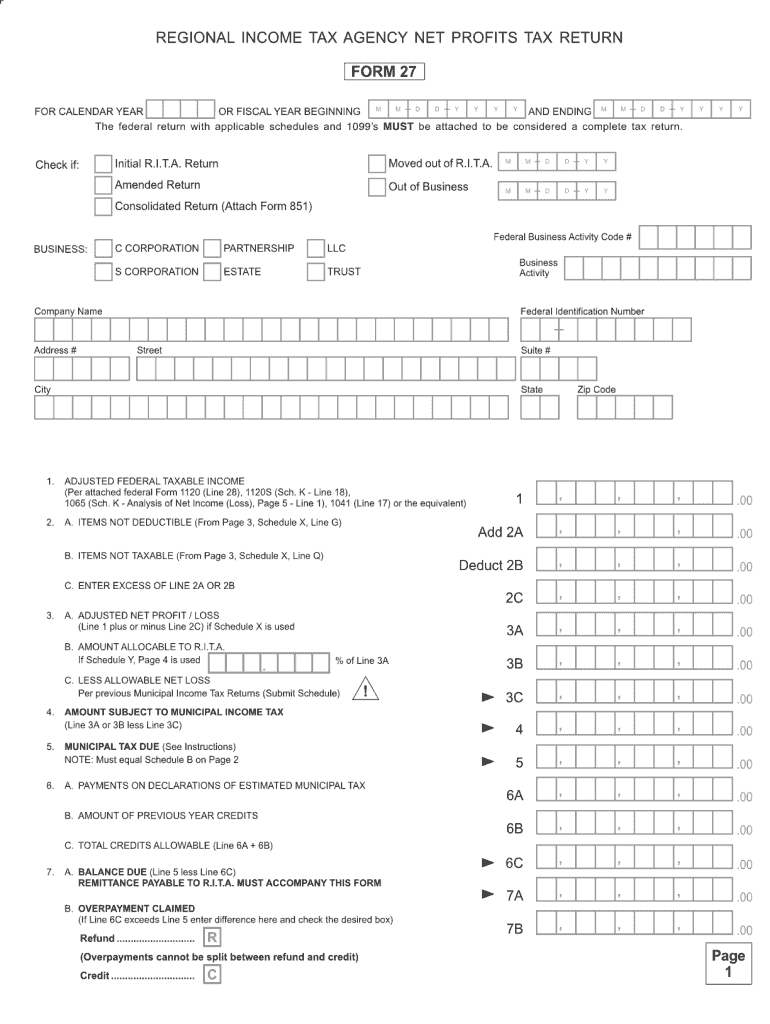

The Rita Form 27 is essential for individuals and businesses in Ohio to report their net profits for tax purposes. This form provides a structured way to calculate and declare income, ensuring compliance with local tax regulations. The instructions for the Rita Form 27 outline the necessary steps for accurate completion, including details on how to report various income sources and applicable deductions. Understanding these instructions is crucial for avoiding errors that could lead to penalties or delays in processing.

Steps to Complete the Rita Form 27 Instructions

Completing the Rita Form 27 involves several key steps. First, gather all required financial documents, including income statements and expense records. Next, follow the specific instructions provided on the form to accurately report your net profits. This includes filling out sections related to business income, allowable deductions, and any credits applicable to your situation. After completing the form, review it carefully to ensure all information is accurate and complete before submission.

Legal Use of the Rita Form 27 Instructions

The Rita Form 27 is legally binding when completed correctly. It is essential to adhere to the instructions to ensure that the form meets all legal requirements. This includes providing accurate financial information and signatures where necessary. Electronic submissions are accepted, but they must comply with the relevant eSignature laws to be considered valid. Utilizing a trusted platform for electronic signing can enhance the legal standing of your submitted documents.

Filing Deadlines and Important Dates

Filing deadlines for the Rita Form 27 vary based on the tax year and the specific circumstances of the taxpayer. Generally, the form must be submitted by the due date for the annual tax return. It is important to stay informed about any changes to deadlines, as late submissions may result in penalties. Marking your calendar with these important dates can help ensure timely compliance with tax obligations.

Required Documents for the Rita Form 27

To successfully complete the Rita Form 27, certain documents are required. These typically include financial statements, such as profit and loss statements, and any relevant tax documents that support your income and deductions. Keeping organized records will facilitate a smoother completion process and ensure that all necessary information is readily available when filling out the form.

Form Submission Methods

The Rita Form 27 can be submitted through several methods, including online, by mail, or in person. Online submission is often the most efficient option, allowing for quicker processing times. If submitting by mail, ensure that you send the form to the correct address and consider using a trackable mailing option. In-person submissions may be available at designated tax offices, providing an opportunity for immediate assistance if needed.

Examples of Using the Rita Form 27

Understanding practical scenarios can help clarify the use of the Rita Form 27. For instance, a self-employed individual would report their business income and expenses on this form to determine their net profits. Similarly, a partnership would use the form to report collective income and distribute profits among partners. Familiarizing yourself with these examples can enhance your understanding of how to accurately complete the form based on your specific situation.

Quick guide on how to complete rita form 27 instructions

Complete Rita Form 27 Instructions effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed papers, as you can locate the correct form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Rita Form 27 Instructions on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Rita Form 27 Instructions with ease

- Obtain Rita Form 27 Instructions and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes a few seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced documents, tiring form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any chosen device. Modify and eSign Rita Form 27 Instructions and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct rita form 27 instructions

Create this form in 5 minutes!

How to create an eSignature for the rita form 27 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of the airSlate SignNow platform for managing RITA Form 27 instructions?

The airSlate SignNow platform offers an array of features designed to streamline workflow, including document management, eSignature capabilities, and customizable templates specifically for RITA Form 27 instructions. Users can easily send, receive, and sign documents securely, ensuring compliance with necessary regulations.

-

How does airSlate SignNow simplify the process of completing RITA Form 27 instructions?

airSlate SignNow simplifies the RITA Form 27 instructions by providing users with templates that are easy to fill out and sign electronically. The platform's intuitive interface helps eliminate errors and ensures that all required information is collected efficiently, thus speeding up the submission process.

-

Are there any costs associated with using airSlate SignNow for RITA Form 27 instructions?

Yes, there are various pricing plans available for airSlate SignNow, which cater to different business sizes and needs. Each plan includes features that assist with RITA Form 27 instructions, ensuring that you get the best value for your investment in eSignature technology.

-

Can I integrate airSlate SignNow with other applications while managing RITA Form 27 instructions?

Absolutely! airSlate SignNow offers seamless integrations with various applications and platforms, allowing users to manage RITA Form 27 instructions within their existing workflows. Popular integrations include CRM systems, project management tools, and cloud storage services, enhancing your overall productivity.

-

What security measures does airSlate SignNow implement for RITA Form 27 instructions?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like RITA Form 27 instructions. The platform employs industry-standard encryption, secure access protocols, and compliance with regulations to protect your data and maintain confidentiality.

-

How can airSlate SignNow improve collaboration on RITA Form 27 instructions?

Collaboration is simplified with airSlate SignNow, as multiple users can access and work on RITA Form 27 instructions in real-time. The platform allows for comments, notifications, and task assignments, ensuring that all team members are on the same page and can contribute to the document effectively.

-

Is there customer support available for users of airSlate SignNow dealing with RITA Form 27 instructions?

Yes, airSlate SignNow provides comprehensive customer support to assist users with any questions about RITA Form 27 instructions. Their support team is readily available via chat, email, and phone, ensuring you have assistance whenever needed to optimize your experience.

Get more for Rita Form 27 Instructions

- Farmington mn building permits form

- Oral presentation rubric form

- Kindred hospital medical records request form

- Application for mri sri claim form

- Boiler startup checklist form

- Organisation profile information form

- My next pet adoption formsapplications petfinder

- Occupational fitness assessment form

Find out other Rita Form 27 Instructions

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast