Form T 204R Annual Rhode Island Division of Taxation RI 2020-2026

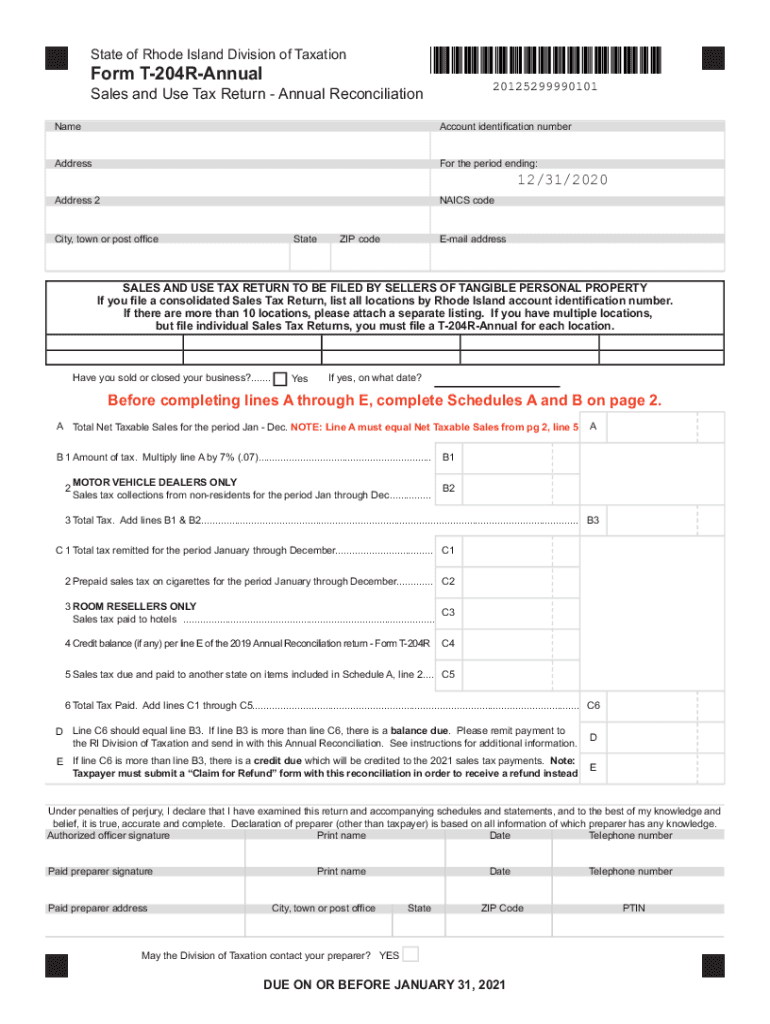

What is the Form T 204R Annual?

The Form T 204R Annual is a tax form used by businesses in Rhode Island to report annual sales and reconcile sales tax collected throughout the year. This form is essential for ensuring compliance with state tax regulations and is part of the Rhode Island Division of Taxation's efforts to maintain accurate tax records. Businesses must accurately complete this form to reflect their sales activities and the corresponding sales tax obligations.

How to Use the Form T 204R Annual

Using the Form T 204R Annual involves several key steps. First, businesses must gather all necessary financial records, including sales invoices and tax collected. Next, the form should be filled out with accurate figures, including total sales and the amount of sales tax collected. Once completed, the form can be submitted electronically or via mail, depending on the preferences of the business and the guidelines set by the Rhode Island Division of Taxation.

Steps to Complete the Form T 204R Annual

Completing the Form T 204R Annual requires careful attention to detail. Here are the steps to follow:

- Gather all relevant sales records for the reporting period.

- Calculate total sales and sales tax collected.

- Fill out the form with accurate figures, ensuring all sections are completed.

- Review the form for any errors or omissions.

- Submit the completed form by the specified deadline, either electronically or by mail.

Legal Use of the Form T 204R Annual

The legal use of the Form T 204R Annual is governed by Rhode Island tax laws. This form must be completed accurately to ensure that the reported sales and tax figures are valid. Failure to comply with the legal requirements can result in penalties or audits by the Rhode Island Division of Taxation. Therefore, it is crucial for businesses to understand the legal implications of the information provided on this form.

Filing Deadlines / Important Dates

Businesses must be aware of the filing deadlines associated with the Form T 204R Annual. Typically, the form is due on a specific date each year, which is set by the Rhode Island Division of Taxation. Missing this deadline can result in late fees or penalties. It is advisable for businesses to mark their calendars and prepare the form well in advance to avoid any last-minute issues.

Penalties for Non-Compliance

Non-compliance with the requirements of the Form T 204R Annual can lead to significant penalties. These may include fines, interest on unpaid taxes, or even legal action from the Rhode Island Division of Taxation. To avoid these consequences, businesses should ensure that they complete and submit the form accurately and on time, maintaining thorough records of their sales and tax collections.

Quick guide on how to complete form t 204r annual rhode island division of taxation ri

Prepare Form T 204R Annual Rhode Island Division Of Taxation RI effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly without any delays. Manage Form T 204R Annual Rhode Island Division Of Taxation RI on any platform with the airSlate SignNow Android or iOS applications and enhance any document-centered workflow today.

The simplest way to modify and eSign Form T 204R Annual Rhode Island Division Of Taxation RI with ease

- Locate Form T 204R Annual Rhode Island Division Of Taxation RI and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with the tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the information carefully and click on the Done button to save your changes.

- Choose how you’d like to share your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, the hassle of form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form T 204R Annual Rhode Island Division Of Taxation RI and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form t 204r annual rhode island division of taxation ri

Create this form in 5 minutes!

How to create an eSignature for the form t 204r annual rhode island division of taxation ri

The best way to generate an electronic signature for a PDF online

The best way to generate an electronic signature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The best way to make an eSignature straight from your smartphone

The way to make an eSignature for a PDF on iOS

The best way to make an eSignature for a PDF document on Android

People also ask

-

What is the 204r annual form and why is it important?

The 204r annual form is essential for businesses to report specific financial activities to the IRS. This form helps ensure compliance and provides a clear overview of a company's financial standing. Understanding how to fill out the 204r annual form accurately can prevent costly penalties and optimize tax filings.

-

How can airSlate SignNow assist with the 204r annual documentation process?

airSlate SignNow simplifies the workflow for preparing and submitting the 204r annual form by allowing users to eSign documents securely and efficiently. The platform’s intuitive interface enables quick preparation and management of necessary documents, ensuring that your submissions are both timely and compliant.

-

What are the pricing options for airSlate SignNow when using it for the 204r annual form?

airSlate SignNow offers flexible pricing plans designed to accommodate different business needs. Whether you require basic eSignature features or advanced functionalities for handling the 204r annual form, you'll find a plan that fits your budget. You can start with a free trial to explore the capabilities before committing.

-

Are there any integrations available to help with the 204r annual submissions?

Yes, airSlate SignNow integrates seamlessly with a variety of third-party applications, streamlining the process of completing the 204r annual form. These integrations enhance workflow efficiency, allowing you to work within platforms you already use, such as CRM and accounting software, to manage the eSigning process easily.

-

What features does airSlate SignNow offer for creating the 204r annual form?

airSlate SignNow provides robust features like customizable templates, in-document commenting, and automated notifications to ensure you never miss a deadline. These tools support an efficient process for completing the 204r annual form, making it easier to manage multiple documents at once while maintaining accuracy.

-

Can I securely store my 204r annual documents using airSlate SignNow?

Absolutely! airSlate SignNow offers secure cloud storage for all your important documents, including the 204r annual form. This means your documents are always accessible, securely backed up, and compliant with industry-standard security protocols to protect sensitive information.

-

How does eSigning with airSlate SignNow ensure compliance for the 204r annual form?

eSigning through airSlate SignNow ensures compliance by offering legally binding signatures recognized across jurisdictions. Each signed 204r annual form includes an audit trail that records the signing process, providing verifiable proof of actions taken, which is crucial for regulatory purposes.

Get more for Form T 204R Annual Rhode Island Division Of Taxation RI

Find out other Form T 204R Annual Rhode Island Division Of Taxation RI

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast