If You File a Consolidated Sales TaxReturn, List All Locations by Rhode Island Identification Number Including the 2 Digit Tax R 2018

What is the If You File A Consolidated Sales TaxReturn, List All Locations By Rhode Island Identification Number Including The 2 Digit Tax Ri

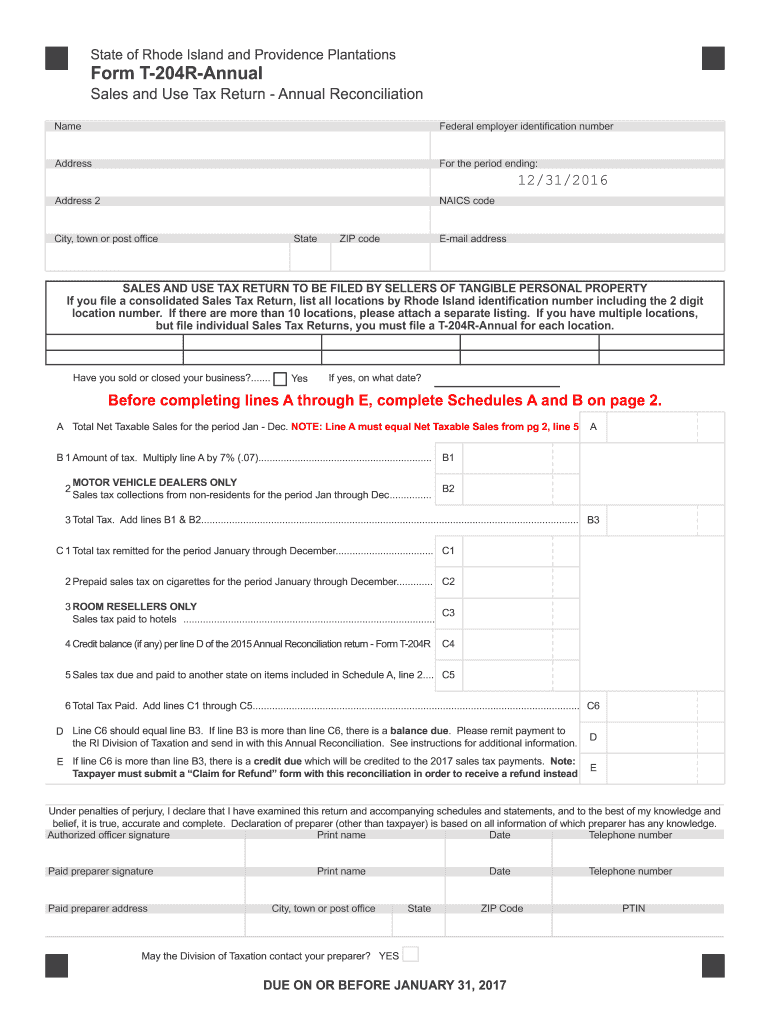

The form titled "If You File A Consolidated Sales TaxReturn, List All Locations By Rhode Island Identification Number Including The 2 Digit Tax Ri" is a crucial document for businesses operating in Rhode Island that need to report sales tax across multiple locations. This form allows businesses to consolidate their sales tax reporting, simplifying the process of compliance with state tax regulations. By listing all business locations along with their corresponding Rhode Island identification numbers, it ensures accurate tax calculations and reporting.

Steps to Complete the If You File A Consolidated Sales TaxReturn, List All Locations By Rhode Island Identification Number Including The 2 Digit Tax Ri

Completing the form requires careful attention to detail to ensure accuracy. Here are the key steps involved:

- Gather all necessary information about your business locations, including the Rhode Island identification numbers for each location.

- Fill out the form by entering the required details for each location, ensuring that the information is accurate and up to date.

- Review the completed form for any errors or omissions.

- Sign the form electronically using a secure eSignature tool to validate your submission.

- Submit the form according to the specified guidelines, either online or by mail.

Legal Use of the If You File A Consolidated Sales TaxReturn, List All Locations By Rhode Island Identification Number Including The 2 Digit Tax Ri

This form is legally recognized as a valid method for reporting sales tax in Rhode Island, provided it is completed correctly and submitted on time. The use of electronic signatures is permissible, as long as they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). This legal framework ensures that eDocuments hold the same weight as traditional paper documents when properly executed.

State-Specific Rules for the If You File A Consolidated Sales TaxReturn, List All Locations By Rhode Island Identification Number Including The 2 Digit Tax Ri

Rhode Island has specific regulations governing the filing of consolidated sales tax returns. Businesses must adhere to the state’s guidelines regarding the frequency of filing, the types of transactions that must be reported, and the deadlines for submission. Understanding these rules is essential for maintaining compliance and avoiding penalties. It is advisable to consult the Rhode Island Division of Taxation for the most current regulations and requirements.

Required Documents for the If You File A Consolidated Sales TaxReturn, List All Locations By Rhode Island Identification Number Including The 2 Digit Tax Ri

To complete the form accurately, businesses must have several documents on hand, including:

- Sales records from all locations for the reporting period.

- Rhode Island identification numbers for each business location.

- Any previous sales tax returns filed for reference.

- Documentation of any exemptions or special circumstances that may apply.

Penalties for Non-Compliance with the If You File A Consolidated Sales TaxReturn, List All Locations By Rhode Island Identification Number Including The 2 Digit Tax Ri

Failure to file the consolidated sales tax return on time or inaccuracies in the submission can lead to significant penalties. Rhode Island imposes fines for late filings, which can accumulate over time. Additionally, businesses may face audits or further scrutiny from tax authorities. It is crucial to ensure that all information is accurate and submitted by the deadline to avoid these consequences.

Quick guide on how to complete if you file a consolidated sales taxreturn list all locations by rhode island identification number including the 2 digit tax ri

Effortlessly Prepare If You File A Consolidated Sales TaxReturn, List All Locations By Rhode Island Identification Number Including The 2 Digit Tax R on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers a fantastic eco-friendly substitute for conventional printed and signed documents, as you can easily locate the required form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, alter, and electronically sign your documents quickly without delays. Manage If You File A Consolidated Sales TaxReturn, List All Locations By Rhode Island Identification Number Including The 2 Digit Tax R on any device using the airSlate SignNow apps for Android or iOS, and streamline any document-related process today.

How to Alter and Electronically Sign If You File A Consolidated Sales TaxReturn, List All Locations By Rhode Island Identification Number Including The 2 Digit Tax R with Ease

- Obtain If You File A Consolidated Sales TaxReturn, List All Locations By Rhode Island Identification Number Including The 2 Digit Tax R and then click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow caters to all your document management needs with just a few clicks from any device you prefer. Alter and electronically sign If You File A Consolidated Sales TaxReturn, List All Locations By Rhode Island Identification Number Including The 2 Digit Tax R and guarantee exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct if you file a consolidated sales taxreturn list all locations by rhode island identification number including the 2 digit tax ri

Create this form in 5 minutes!

How to create an eSignature for the if you file a consolidated sales taxreturn list all locations by rhode island identification number including the 2 digit tax ri

How to generate an eSignature for your PDF in the online mode

How to generate an eSignature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The best way to make an eSignature straight from your smart phone

The best way to create an electronic signature for a PDF on iOS devices

The best way to make an eSignature for a PDF document on Android OS

People also ask

-

What is the process for filing a consolidated sales tax return in Rhode Island?

When you file a consolidated sales tax return, it's essential to list all locations by Rhode Island Identification Number, including the 2-digit tax RI. This streamlined approach helps ensure compliance and simplifies your reporting responsibilities, making it easier for businesses to manage their sales tax obligations.

-

How does airSlate SignNow facilitate filing for consolidated sales tax returns?

airSlate SignNow provides an intuitive eSignature and document management platform that can help you prepare and file your consolidated sales tax return efficiently. By utilizing our software, you can easily list all locations by Rhode Island Identification Number, including the 2-digit tax RI, ensuring accuracy and compliance while saving you time.

-

What are the pricing options for airSlate SignNow?

We offer flexible pricing plans tailored to meet the needs of various businesses. Whether you need basic functionality or advanced features, our solutions empower you to eSign documents and fulfill requirements such as filing a consolidated sales tax return and listing all locations by Rhode Island Identification Number, including the 2-digit tax RI, at a reasonable cost.

-

What features make airSlate SignNow beneficial for businesses?

With airSlate SignNow, businesses can streamline their document workflows and enhance compliance across various processes, including sales tax returns. Our platform allows easy listing of locations by Rhode Island Identification Number, including the 2-digit tax RI, while providing features like customizable templates, real-time tracking, and robust security to protect your documents.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow offers integrations with a variety of popular business applications, allowing seamless data transfer and workflow automation. This means you can easily incorporate your sales tax reporting processes and ensure that when you file a consolidated sales tax return, you can efficiently list all locations by Rhode Island Identification Number, including the 2-digit tax RI.

-

What benefits can I gain from using airSlate SignNow for eSignature?

Using airSlate SignNow for eSignatures ensures legal compliance, improves turnaround times, and enhances your document management process. In particular, it helps when you file a consolidated sales tax return by allowing you to list all locations by Rhode Island Identification Number, including the 2-digit tax RI, ensuring every step is handled efficiently.

-

Is it secure to use airSlate SignNow for sensitive documents?

Absolutely. airSlate SignNow utilizes top-notch security measures to protect your sensitive documents and data. As you file a consolidated sales tax return and list all locations by Rhode Island Identification Number, including the 2-digit tax RI, rest assured that our platform keeps your information secure and confidential.

Get more for If You File A Consolidated Sales TaxReturn, List All Locations By Rhode Island Identification Number Including The 2 Digit Tax R

Find out other If You File A Consolidated Sales TaxReturn, List All Locations By Rhode Island Identification Number Including The 2 Digit Tax R

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy