Ri Form T 204r Annual 2017

What is the RI Form T 204R Annual

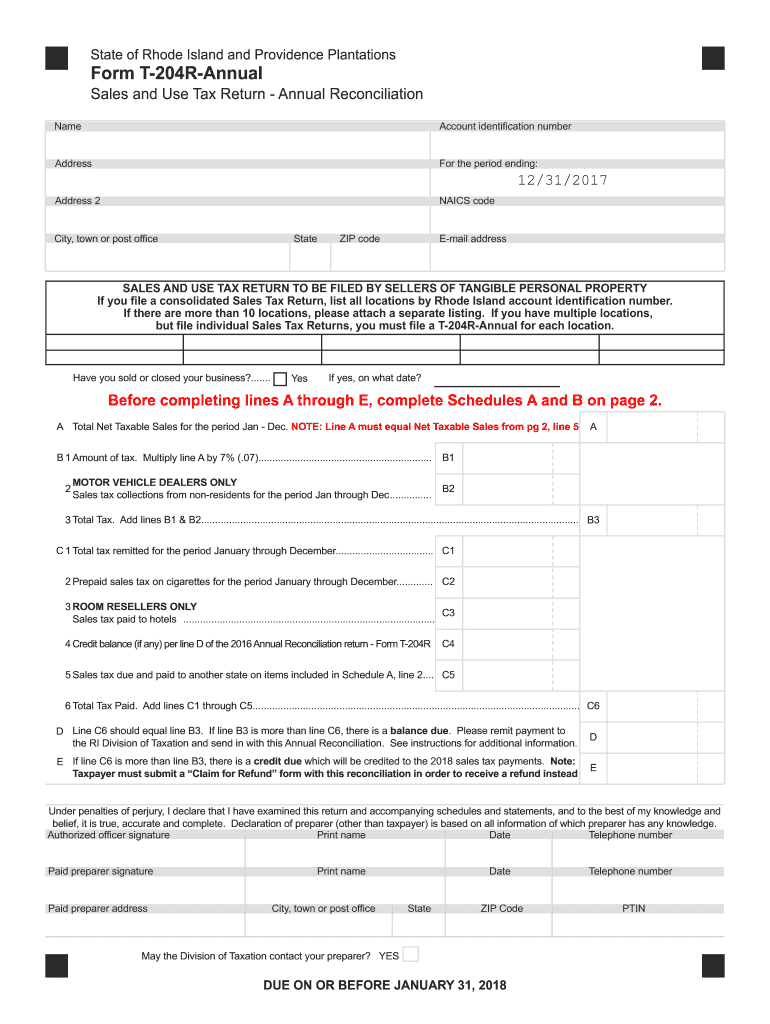

The RI Form T 204R Annual is a tax reconciliation form used by businesses and individuals in Rhode Island to report and reconcile their sales and use tax obligations for the year. This form is essential for ensuring compliance with state tax laws and helps taxpayers accurately calculate their tax liabilities. The T 204R form captures various types of sales and use tax data, allowing users to report any discrepancies and make necessary adjustments.

Steps to Complete the RI Form T 204R Annual

Completing the RI Form T 204R Annual involves several key steps:

- Gather Necessary Information: Collect all relevant sales and use tax records, including invoices, receipts, and previous tax filings.

- Fill Out the Form: Enter your business information, total sales, and any exempt sales. Be sure to include any use tax owed on purchases made without sales tax.

- Calculate Tax Liability: Use the provided calculations to determine your total tax liability for the year.

- Review for Accuracy: Double-check all entries for accuracy and completeness to avoid errors that could lead to penalties.

- Sign and Date the Form: Ensure that the form is signed and dated by the appropriate individual.

Legal Use of the RI Form T 204R Annual

The RI Form T 204R Annual is legally binding when completed accurately and submitted in accordance with Rhode Island state tax laws. It is crucial to ensure that all information provided is truthful and complete, as inaccuracies can result in penalties or audits. The form must be filed by the designated deadline to maintain compliance and avoid additional fees.

Filing Deadlines / Important Dates

Filing deadlines for the RI Form T 204R Annual are typically set by the Rhode Island Division of Taxation. Generally, the form is due on or before the last day of the month following the end of the tax year. It is important to stay informed about any changes to deadlines, as late submissions may incur penalties.

Required Documents

To successfully complete the RI Form T 204R Annual, taxpayers should have the following documents ready:

- Sales records and receipts

- Previous tax returns

- Exemption certificates for any exempt sales

- Records of purchases subject to use tax

Form Submission Methods

The RI Form T 204R Annual can be submitted in various ways to ensure convenience for taxpayers. Options include:

- Online Submission: Many taxpayers prefer to file electronically through the Rhode Island Division of Taxation's online platform.

- Mail: The completed form can be printed and mailed to the appropriate tax office.

- In-Person: Taxpayers may also choose to submit the form in person at designated tax offices.

Quick guide on how to complete account identification number

Complete Ri Form T 204r Annual effortlessly on any gadget

Online document management has become increasingly popular among businesses and individuals. It offers a seamless eco-friendly option to traditional printed and signed documents, allowing you to access the necessary forms and securely retain them online. airSlate SignNow provides all the resources you need to create, modify, and eSign your files swiftly without delays. Handle Ri Form T 204r Annual on any device with airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

The easiest way to edit and eSign Ri Form T 204r Annual without hassle

- Obtain Ri Form T 204r Annual and click on Get Form to begin.

- Utilize the tools we provide to finalize your form.

- Emphasize key sections of the documents or conceal sensitive information with tools specially designed by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document versions. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and eSign Ri Form T 204r Annual and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct account identification number

Create this form in 5 minutes!

How to create an eSignature for the account identification number

How to make an electronic signature for the Account Identification Number in the online mode

How to generate an eSignature for your Account Identification Number in Google Chrome

How to create an eSignature for putting it on the Account Identification Number in Gmail

How to generate an eSignature for the Account Identification Number from your smartphone

How to make an eSignature for the Account Identification Number on iOS devices

How to make an eSignature for the Account Identification Number on Android devices

People also ask

-

What is the t 204r annual form?

The t 204r annual form is a tax document used for reporting specific information on annual income and deductions for businesses. It’s essential for businesses to accurately complete the t 204r annual form to ensure compliance with tax regulations. Understanding this form can help streamline your financial reporting processes.

-

How can airSlate SignNow help with the t 204r annual form?

airSlate SignNow provides an easy-to-use platform that simplifies the preparation and submission of the t 204r annual form. With electronic signatures and document templates, you can efficiently manage and send your forms while maintaining legal compliance. This saves time and reduces the hassle of traditional paperwork.

-

Is airSlate SignNow affordable for small businesses needing the t 204r annual form?

Yes, airSlate SignNow offers a cost-effective solution that is ideal for small businesses managing the t 204r annual form. With flexible pricing plans, you can choose a subscription that fits your budget and needs. This helps ensure you can focus on your business without overspending on document management solutions.

-

What features does airSlate SignNow offer for managing the t 204r annual form?

airSlate SignNow includes features such as customizable templates, bulk sending, and real-time tracking to help you manage the t 204r annual form effectively. These features enhance collaboration and make it easier to gather required signatures and approvals. Additionally, secure cloud storage ensures that your documents are safely stored.

-

Can I integrate airSlate SignNow with other software for my t 204r annual form?

Absolutely! airSlate SignNow offers integrations with popular software systems, allowing you to streamline your workflow for the t 204r annual form. Whether you're using CRM software or accounting tools, integration ensures a seamless experience and saves you time by reducing data entry tasks.

-

How secure is airSlate SignNow for sending the t 204r annual form?

airSlate SignNow prioritizes security, employing encryption and compliance measures when sending the t 204r annual form. This ensures that your sensitive information remains confidential and protected against unauthorized access. With industry-standard security practices, you can trust airSlate SignNow for your document management needs.

-

How do I get started with airSlate SignNow for my t 204r annual form?

Getting started with airSlate SignNow is simple! You can sign up for a free trial or choose a subscription plan that meets your needs. Once registered, you can begin creating or uploading your t 204r annual form and start using the platform's features to efficiently manage your documents.

Get more for Ri Form T 204r Annual

Find out other Ri Form T 204r Annual

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free