Form 590 Withholding Exemption Certificate 2021

What is the Form 590 Withholding Exemption Certificate

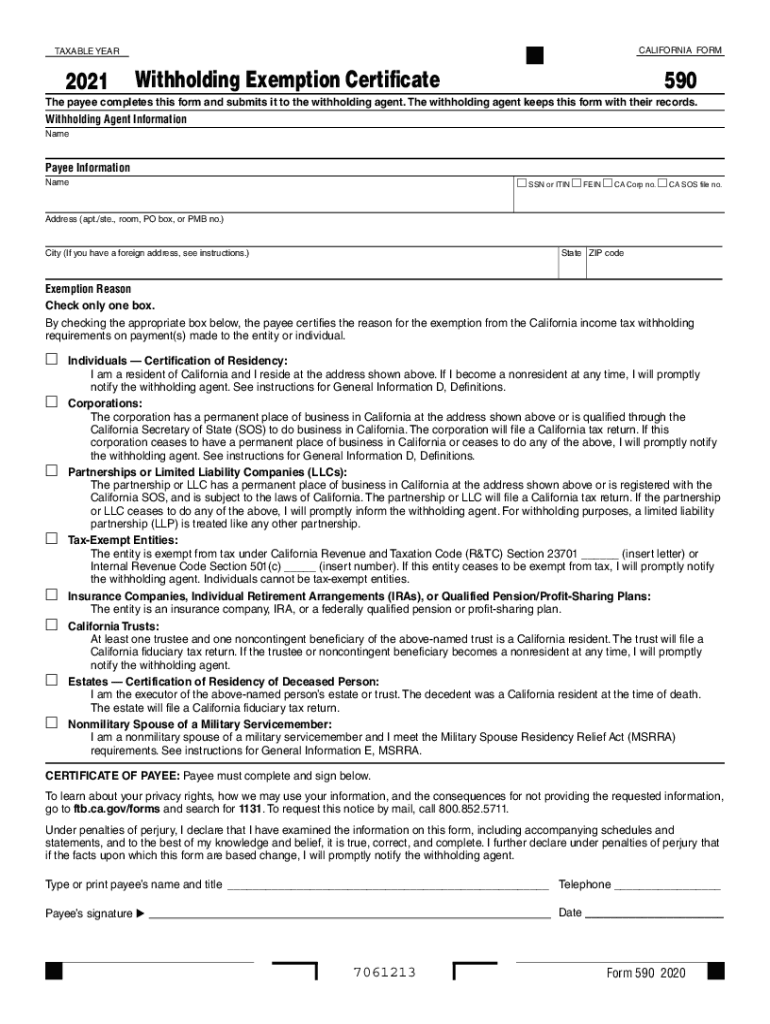

The Form 590 Withholding Exemption Certificate is a crucial document used in California to claim exemption from state income tax withholding. This form is primarily utilized by individuals who meet specific criteria, allowing them to avoid unnecessary tax deductions from their income. By submitting this form, taxpayers can ensure that their earnings are not subject to withholding, provided they qualify based on their income or other relevant factors.

How to use the Form 590 Withholding Exemption Certificate

To effectively use the Form 590, individuals must first determine their eligibility for exemption. This involves reviewing the criteria outlined by the California Franchise Tax Board (FTB). Once eligibility is confirmed, the taxpayer can complete the form by filling in personal information, including name, address, and Social Security number. After completing the form, it should be submitted to the payer, such as an employer or financial institution, to ensure that withholding is adjusted accordingly.

Steps to complete the Form 590 Withholding Exemption Certificate

Completing the Form 590 involves several straightforward steps:

- Download the Form 590 from the California Franchise Tax Board's website.

- Fill in your personal details, including your name, address, and Social Security number.

- Indicate your eligibility for exemption by checking the appropriate boxes.

- Sign and date the form to certify the information provided is accurate.

- Submit the completed form to your employer or the relevant payer.

Key elements of the Form 590 Withholding Exemption Certificate

Several key elements are essential to understand when dealing with the Form 590. These include:

- Personal Information: Accurate details about the taxpayer are necessary for identification.

- Eligibility Criteria: Clear guidelines on who qualifies for exemption must be followed.

- Signature: A valid signature is required to validate the form.

- Submission Instructions: Understanding where and how to submit the form is crucial for compliance.

Legal use of the Form 590 Withholding Exemption Certificate

The legal use of the Form 590 is governed by California tax laws. Taxpayers must ensure that they meet the criteria for exemption to avoid penalties. Submitting this form without proper eligibility can lead to legal repercussions, including fines or back taxes owed. It is advisable to keep a copy of the submitted form for personal records and future reference.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the Form 590 can result in significant penalties. If a taxpayer incorrectly claims exemption or fails to submit the form when required, they may face withholding of taxes from their income. Additionally, the California Franchise Tax Board may impose fines or require repayment of withheld amounts, along with interest. Understanding these penalties emphasizes the importance of accurate and timely submission of the form.

Quick guide on how to complete 2021 form 590 withholding exemption certificate

Prepare Form 590 Withholding Exemption Certificate effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the necessary template and securely store it online. airSlate SignNow provides you with all the resources you require to create, modify, and electronically sign your documents quickly and efficiently. Manage Form 590 Withholding Exemption Certificate on any device using airSlate SignNow's Android or iOS applications and streamline any document-driven process today.

The easiest way to modify and electronically sign Form 590 Withholding Exemption Certificate with ease

- Find Form 590 Withholding Exemption Certificate and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with specialized tools that airSlate SignNow provides for that purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Decide how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form 590 Withholding Exemption Certificate and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 form 590 withholding exemption certificate

Create this form in 5 minutes!

How to create an eSignature for the 2021 form 590 withholding exemption certificate

The way to generate an electronic signature for your PDF in the online mode

The way to generate an electronic signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature from your smart phone

The best way to make an electronic signature for a PDF on iOS devices

How to create an electronic signature for a PDF file on Android OS

People also ask

-

What are CA state withholding forms?

CA state withholding forms are documents used by employers to report and withhold state income tax from employee wages in California. These forms help ensure compliance with California tax regulations and provide necessary information to both employees and the state. Using airSlate SignNow, you can easily create, send, and eSign these forms efficiently.

-

How can airSlate SignNow help with CA state withholding forms?

airSlate SignNow offers a simple platform for businesses to manage CA state withholding forms. With features like easy document creation, eSignatures, and secure storage, it streamlines the process of handling these forms. This not only saves time but also enhances accuracy and compliance.

-

Are there any costs associated with using airSlate SignNow for CA state withholding forms?

While airSlate SignNow offers various subscription plans, the costs can vary depending on the features and volume of use. Many users find the pricing affordable given the time saved and increased efficiency in managing CA state withholding forms. You can choose a plan that best fits your business needs and budget.

-

Can I integrate airSlate SignNow with other software for CA state withholding forms?

Yes, airSlate SignNow integrates seamlessly with various software applications, allowing you to streamline your workflow for CA state withholding forms. Whether you use accounting software or HR management systems, you can easily connect and automate processes, ensuring a smoother experience.

-

What features does airSlate SignNow offer for managing CA state withholding forms?

airSlate SignNow provides several features tailored for managing CA state withholding forms, including document templates, eSigning capabilities, and automated workflows. These features make it easy for businesses to create and distribute these forms efficiently. Additionally, built-in compliance checks help ensure that you meet all state regulations.

-

How does airSlate SignNow enhance the security of CA state withholding forms?

Security is a top priority with airSlate SignNow, which employs advanced encryption and secure storage for CA state withholding forms. This ensures that all sensitive information is protected and accessible only to authorized users. Compliance with data protection regulations further enhances the security of your documents.

-

Can I track the status of my CA state withholding forms with airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your CA state withholding forms in real-time. You can see when documents are sent, viewed, and signed, providing you with complete visibility into the signing process. This feature helps keep your business organized and informed.

Get more for Form 590 Withholding Exemption Certificate

Find out other Form 590 Withholding Exemption Certificate

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile