Form 590 Withholding Exemption Certificate , Form 590 Withholding Exemption Certificate 2020

What is the Form 590 Withholding Exemption Certificate?

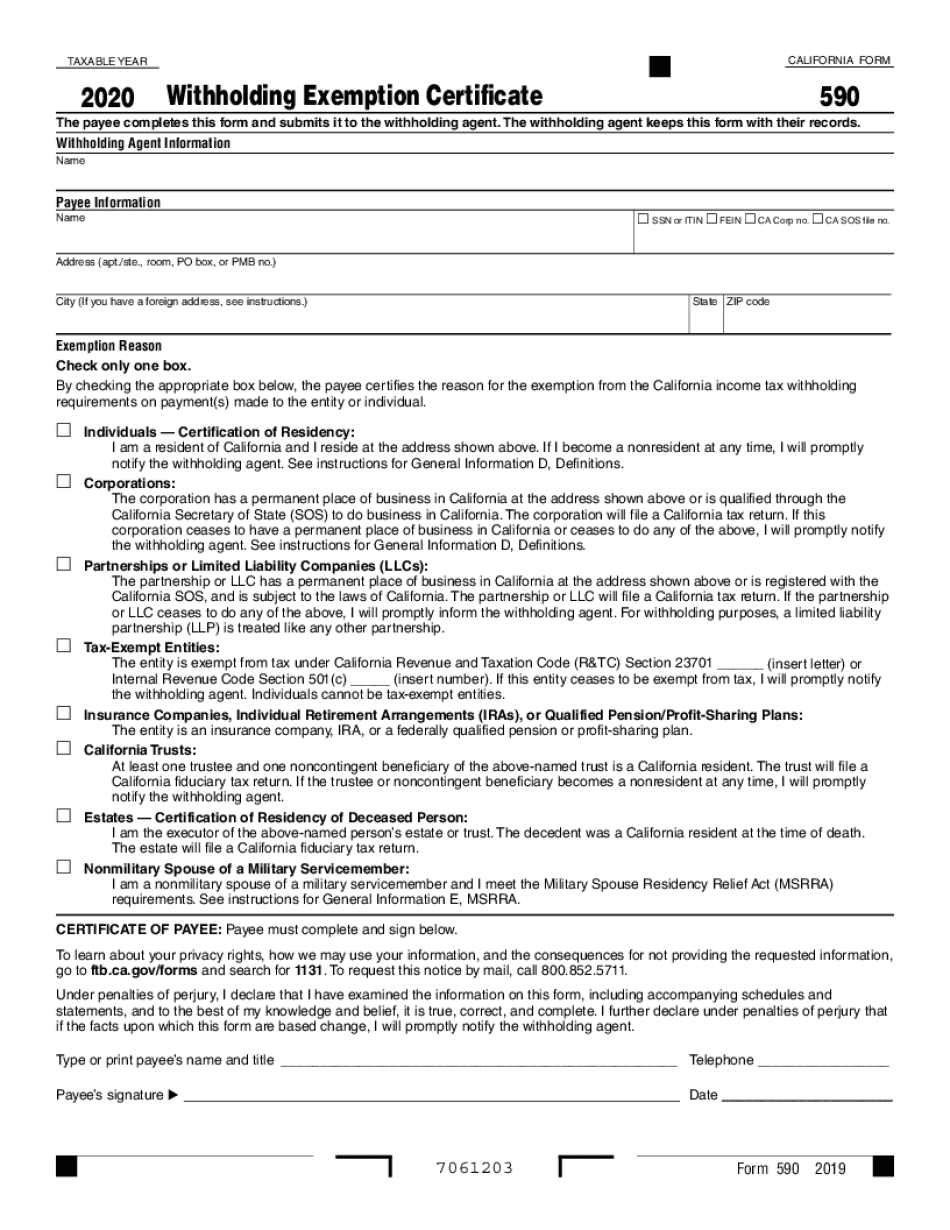

The Form 590 Withholding Exemption Certificate is a crucial document used in the United States, specifically for California tax purposes. It allows individuals and businesses to claim exemption from withholding on certain types of income. This form is particularly relevant for those who are not subject to California state income tax withholding, such as certain non-residents or exempt organizations. By submitting this form, taxpayers can avoid unnecessary withholding, ensuring that they receive the full amount of their earnings without premature deductions for taxes.

Steps to Complete the Form 590 Withholding Exemption Certificate

Completing the Form 590 requires careful attention to detail to ensure accuracy and compliance with state regulations. Here are the key steps involved:

- Begin by entering your personal information, including your name, address, and taxpayer identification number.

- Indicate the type of income for which you are claiming exemption, such as rental income or dividends.

- Provide any necessary documentation that supports your claim for exemption, such as proof of residency or tax-exempt status.

- Review the form for completeness and accuracy before signing and dating it.

- Submit the completed form to the appropriate withholding agent, typically the payer of the income.

Legal Use of the Form 590 Withholding Exemption Certificate

The Form 590 is legally binding when completed correctly and submitted to the appropriate parties. It is essential to understand the legal implications of this form, as it serves as a declaration of your exemption status. Misuse or false claims can lead to penalties, including fines or additional tax liabilities. Therefore, it is advisable to ensure that all information provided is truthful and accurate, aligning with the requirements set forth by the California Franchise Tax Board.

Eligibility Criteria for the Form 590 Withholding Exemption Certificate

To qualify for the Form 590 Withholding Exemption Certificate, certain eligibility criteria must be met. These may include:

- Being a non-resident of California who is receiving income from California sources.

- Having a valid reason for claiming exemption, such as being an exempt organization or meeting specific income thresholds.

- Providing supporting documentation that verifies your eligibility for exemption.

It is important to review these criteria carefully to ensure compliance and avoid potential issues with tax withholding.

How to Obtain the Form 590 Withholding Exemption Certificate

The Form 590 can be easily obtained through the California Franchise Tax Board's official website. Additionally, it may be available at various tax preparation offices or through tax software that includes California forms. When obtaining the form, ensure that you are using the most current version to comply with the latest tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Form 590 vary depending on the type of income and the specific circumstances of the taxpayer. Generally, it is advisable to submit the form before the income is paid to ensure that the exemption is applied correctly. Key dates to remember include:

- January 31: Deadline for submitting the form for income paid in the previous calendar year.

- Ongoing: Submit the form as soon as you become eligible to claim the exemption.

Staying informed about these deadlines is essential to avoid unnecessary withholding and potential penalties.

Quick guide on how to complete 2020 form 590 withholding exemption certificate 2020 form 590 withholding exemption certificate

Complete Form 590 Withholding Exemption Certificate , Form 590 Withholding Exemption Certificate effortlessly on any device

Digital document management has become increasingly favored by companies and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and eSign your documents swiftly without delays. Manage Form 590 Withholding Exemption Certificate , Form 590 Withholding Exemption Certificate on any platform using airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

The easiest way to modify and eSign Form 590 Withholding Exemption Certificate , Form 590 Withholding Exemption Certificate with ease

- Find Form 590 Withholding Exemption Certificate , Form 590 Withholding Exemption Certificate and click Get Form to begin.

- Utilize the tools we offer to finish your document.

- Mark important sections of the documents or redact sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature with the Sign feature, which takes moments and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Form 590 Withholding Exemption Certificate , Form 590 Withholding Exemption Certificate to ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 590 withholding exemption certificate 2020 form 590 withholding exemption certificate

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 590 withholding exemption certificate 2020 form 590 withholding exemption certificate

The way to generate an electronic signature for your PDF document in the online mode

The way to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your mobile device

The best way to make an electronic signature for a PDF document on iOS devices

The best way to create an electronic signature for a PDF document on Android devices

People also ask

-

What is the 590 form 2019 and why do I need it?

The 590 form 2019 is an important tax document used to exempt certain paycheck allocations from withholding in California. This form is essential for qualifying certain individuals to ensure they do not have unnecessary income tax withheld. If you're self-employed or receiving non-qualified distributions, filling out the 590 form 2019 is crucial for managing your tax obligations.

-

How can airSlate SignNow help me with the 590 form 2019?

airSlate SignNow provides a seamless solution for electronically signing and sending the 590 form 2019. With its user-friendly interface, you can quickly upload your document, obtain necessary signatures, and store everything securely. This streamlines your documentation process and ensures compliance with tax requirements.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including individual plans and team options. Each plan provides access to e-signature tools, document management, and templates specifically for forms like the 590 form 2019. Choosing the right plan will enhance your document workflow without breaking your budget.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow can be easily integrated with popular software solutions such as Google Drive, Salesforce, and more. These integrations allow you to streamline your workflow, making it easier to manage documents like the 590 form 2019 within your existing systems. This simplifies tracking and ensures all your paperwork is accessible from a single platform.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes a wide range of features for efficient document management, including customizable templates, real-time tracking, and secure cloud storage. These tools are particularly useful for handling specific forms like the 590 form 2019, ensuring that you can manage your documents with ease. Additionally, you can set reminders for deadlines related to these important forms.

-

Is it secure to e-sign the 590 form 2019 with airSlate SignNow?

Absolutely! airSlate SignNow employs top-notch security measures to protect your data and documents. With features like SSL encryption and two-factor authentication, you can confidently e-sign the 590 form 2019, knowing your information is safe. Compliance with industry standards adds an extra layer of security to your signing process.

-

What are the benefits of using airSlate SignNow for the 590 form 2019?

Using airSlate SignNow for the 590 form 2019 offers numerous benefits, including time savings and increased efficiency in document processing. The platform eliminates the hassles of traditional paperwork and allows for quick collaboration with others who need to sign. You'll also benefit from improved compliance and the ability to track the status of your documents easily.

Get more for Form 590 Withholding Exemption Certificate , Form 590 Withholding Exemption Certificate

- Bylaws of lorelei corporation form

- Escrow agreement document form

- Revolving loan agreement template form

- Term loan agreement form

- Plan of reorganization between franklin gold fund and franklin gold and precious metals fund form

- Convertible agreement form

- Registration rights agreement form

- Contribution agreement form

Find out other Form 590 Withholding Exemption Certificate , Form 590 Withholding Exemption Certificate

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease