Form 590 Withholding Exemption Certificate 2023-2026

What is the Form 590 Withholding Exemption Certificate

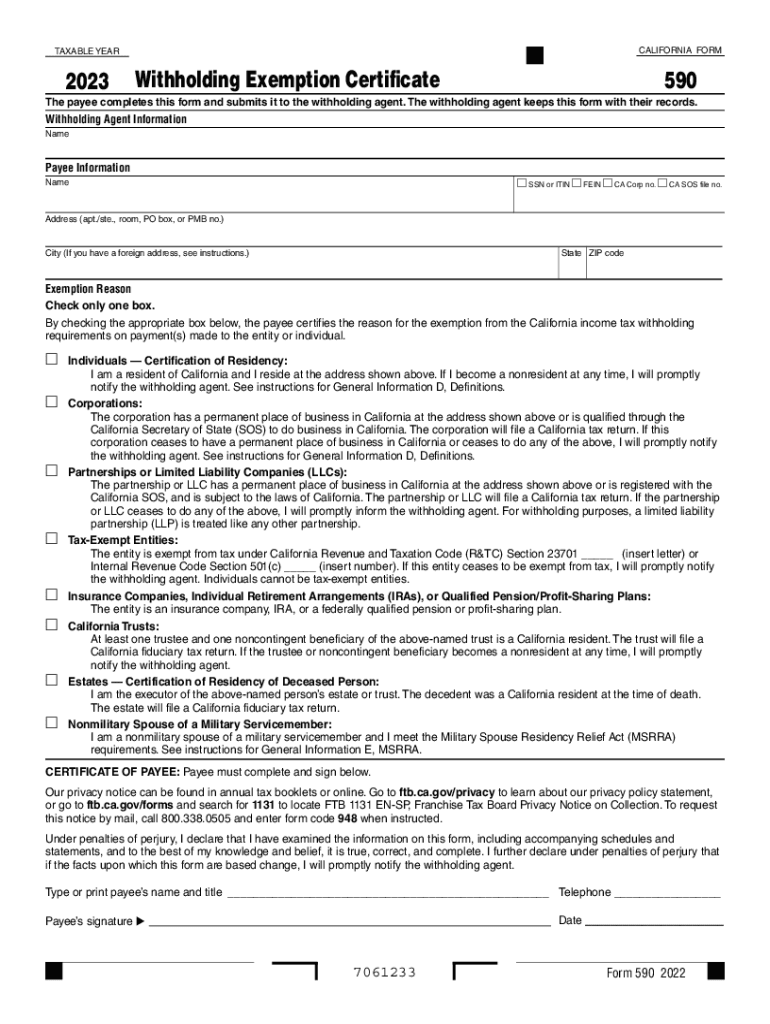

The Form 590 is a Withholding Exemption Certificate used in California to claim an exemption from state income tax withholding. This form is primarily utilized by individuals who are not subject to withholding due to specific eligibility criteria. It is essential for those receiving payments such as rents, royalties, or other income types that may be subject to withholding. By submitting this form, taxpayers can ensure that the correct amount of tax is withheld or none at all, depending on their circumstances.

How to use the Form 590 Withholding Exemption Certificate

To use the Form 590, individuals must first determine their eligibility for exemption. This involves reviewing the criteria outlined by the California Franchise Tax Board. Once eligibility is confirmed, the taxpayer should complete the form accurately, providing necessary personal information and details about the income for which they seek exemption. After filling out the form, it should be submitted to the payer or withholding agent, who will then adjust the withholding accordingly. It is advisable to keep a copy for personal records.

Steps to complete the Form 590 Withholding Exemption Certificate

Completing the Form 590 involves several straightforward steps:

- Download the Form 590 from the California Franchise Tax Board website.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Indicate the type of income you are receiving and the reason for claiming the exemption.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form to the appropriate payer or withholding agent.

Legal use of the Form 590 Withholding Exemption Certificate

The legal use of the Form 590 is governed by California tax laws. It is crucial that the form is filled out truthfully and submitted only by those who meet the exemption criteria. Misuse of the form can lead to penalties, including fines or additional tax liabilities. Therefore, understanding the legal implications and ensuring compliance with state regulations is vital for all users of the Form 590.

Eligibility Criteria

To qualify for the exemption claimed on the Form 590, individuals must meet specific eligibility criteria. Generally, these include being a non-resident, having income that is not subject to withholding, or being exempt due to other applicable tax laws. It is important for taxpayers to review the guidelines provided by the California Franchise Tax Board to confirm their eligibility before submitting the form.

Filing Deadlines / Important Dates

Filing deadlines for the Form 590 are critical to ensure compliance and avoid penalties. Typically, the form should be submitted before the first payment is made to the taxpayer for which the exemption is claimed. It is advisable to check the California Franchise Tax Board’s official calendar for any specific dates related to tax withholding and exemptions to ensure timely submission.

Quick guide on how to complete 2023 form 590 withholding exemption certificate

Complete Form 590 Withholding Exemption Certificate effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents swiftly without complications. Manage Form 590 Withholding Exemption Certificate on any device using airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and eSign Form 590 Withholding Exemption Certificate with ease

- Find Form 590 Withholding Exemption Certificate and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or conceal sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Edit and eSign Form 590 Withholding Exemption Certificate and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2023 form 590 withholding exemption certificate

Create this form in 5 minutes!

How to create an eSignature for the 2023 form 590 withholding exemption certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow, and how does it relate to the term '590'?

airSlate SignNow is a powerful eSignature software solution that simplifies document signing processes for businesses. The term '590' refers to our feature set that enhances user experience and workflow efficiency. By utilizing airSlate SignNow, businesses can streamline their document management and eSigning needs effectively.

-

How much does airSlate SignNow cost, particularly under the '590' pricing model?

The pricing for airSlate SignNow under the '590' model is designed to be cost-effective, making it accessible for businesses of all sizes. Our plans vary based on the features included and the number of users, ensuring that you can find a solution that fits your budget while still getting the most out of your investment.

-

What features are included in airSlate SignNow's '590' package?

The '590' package includes a comprehensive set of features designed for efficient document handling, such as customizable templates, automated workflows, and advanced security options. These features empower users to create, send, and sign documents seamlessly, ultimately improving overall productivity.

-

Can airSlate SignNow integrate with other tools I use, particularly in the context of '590'?

Yes, airSlate SignNow offers robust integrations with various business applications to enhance its '590' capabilities. You can easily connect it with popular tools like Salesforce, Google Drive, and Microsoft Office, ensuring a smooth workflow across your existing platforms.

-

What are the benefits of using airSlate SignNow for eSigning documents?

Utilizing airSlate SignNow for eSigning, particularly under the '590' framework, offers numerous benefits including increased efficiency, reduced turnaround time, and enhanced security measures. This solution eliminates the need for physical signatures, allowing businesses to manage documents seamlessly from anywhere.

-

How does airSlate SignNow ensure the security of documents signed through the '590' process?

airSlate SignNow takes document security seriously by incorporating advanced encryption and authentication features within the '590' process. This ensures that all electronically signed documents are protected against unauthorized access, guaranteeing compliance with industry standards.

-

Is there a mobile app for airSlate SignNow that aligns with the '590' functionalities?

Absolutely! airSlate SignNow offers a mobile app that provides the full range of '590' functionalities, enabling users to manage documents and collect eSignatures on-the-go. This feature is particularly valuable for businesses with mobile workforces that require flexibility and convenience in document management.

Get more for Form 590 Withholding Exemption Certificate

- Acets eye gaze technology screening checklist set bc setbc form

- Mise a jour decodeur digisat form

- Ministry of health and family welfare notification iriakerala form

- Phuthuma nathi shares application forms

- Theory of mind task battery pdf form

- Pattadar passbook download form

- Dc6 111a request for visiting privileges revised 3223 form

- Residential tenancy agreement form 1aa renting a home in wa

Find out other Form 590 Withholding Exemption Certificate

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe