Form 2018

What is the Form

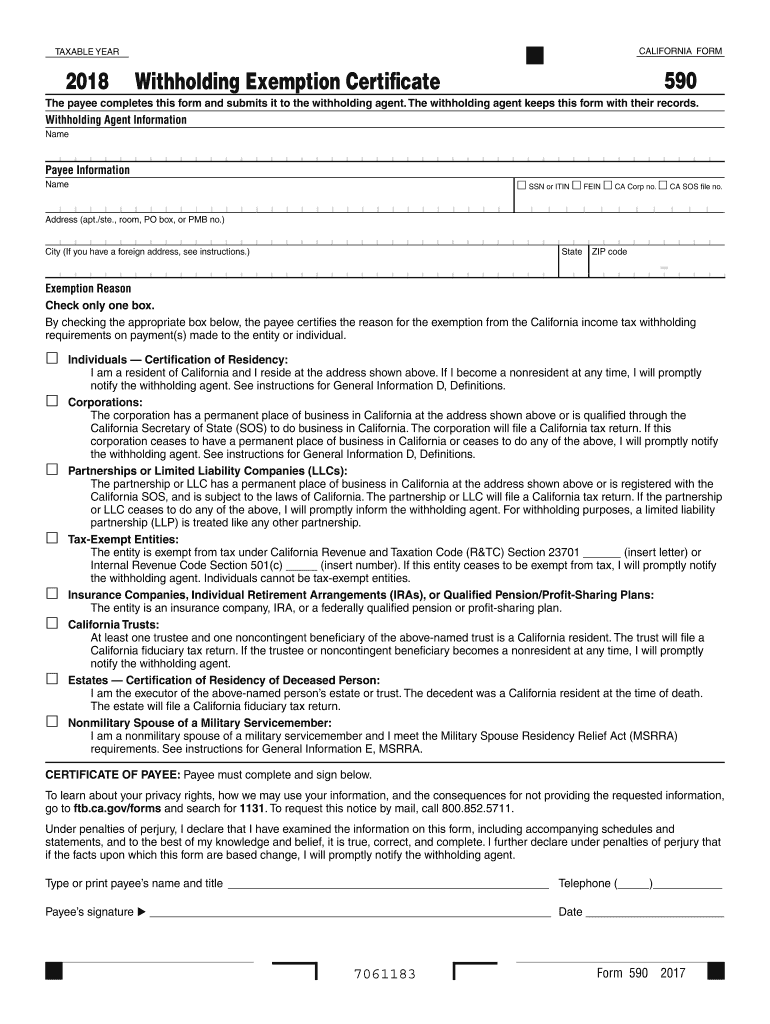

The form is an official document used for various purposes, including tax reporting, legal agreements, and applications. It serves as a structured way to collect and present information required by governmental or organizational entities. Understanding the specific type of form you are dealing with is crucial, as each form has its own requirements and guidelines. For instance, tax forms often have specific instructions related to income reporting, deductions, and credits.

How to use the Form

Using the form involves several steps, starting with obtaining the correct version. After acquiring the form, carefully read the instructions provided. Each section typically contains fields where you must enter relevant information. It is important to ensure that all required fields are completed accurately to avoid delays or issues during processing. Once filled out, the form may need to be signed, either electronically or by hand, depending on its nature.

Steps to complete the Form

Completing the form involves a systematic approach to ensure accuracy and compliance. Here are the steps to follow:

- Obtain the correct version of the form from a reliable source.

- Read the instructions thoroughly to understand the requirements.

- Gather any necessary documents or information needed to fill out the form.

- Fill in the required fields, ensuring accuracy and legibility.

- Review the completed form for any errors or omissions.

- Sign the form as required, using an electronic signature if applicable.

- Submit the form through the designated method, whether online, by mail, or in person.

Legal use of the Form

The legal use of the form is essential to ensure its validity. Many forms require specific signatures and dates to be considered legally binding. It is important to familiarize yourself with the legal implications of the form you are using, including any state-specific regulations. For example, certain forms may need to be notarized or witnessed to meet legal standards. Always check the requirements to ensure compliance.

Filing Deadlines / Important Dates

Filing deadlines are crucial when it comes to submitting forms, especially for tax-related documents. Missing a deadline can result in penalties or delays in processing. Each form typically has a specific due date, which can vary based on the type of form and the jurisdiction. It is advisable to mark these dates on your calendar and prepare your form well in advance to avoid last-minute issues.

Form Submission Methods (Online / Mail / In-Person)

Forms can generally be submitted through various methods, including online, by mail, or in person. Online submission is often the most efficient and secure option, allowing for quicker processing. When submitting by mail, ensure that you use the correct address and consider using a trackable mailing service. In-person submissions may be required for certain forms, especially those that need to be notarized or witnessed. Always check the specific submission guidelines for the form you are using.

IRS Guidelines

When dealing with tax forms, adhering to IRS guidelines is essential. The IRS provides detailed instructions for each form, outlining how to fill it out, what information is required, and how to submit it. These guidelines also include information on eligibility, deductions, and credits that may apply. Staying informed about IRS updates and changes can help ensure compliance and optimize your tax filing process.

Quick guide on how to complete form 2018 101755176

Your assistance manual on how to prepare your Form

If you are wondering how to fill out and submit your Form, here are some concise guidelines to simplify the tax processing experience.

To begin, all you need to do is create your airSlate SignNow account to change how you handle documents online. airSlate SignNow is a highly user-friendly and powerful document management tool that allows you to modify, generate, and finalize your tax documents with ease. Utilizing its editor, you can alternate between text, checkboxes, and electronic signatures, and return to adjust answers whenever necessary. Streamline your tax administration with advanced PDF editing, eSigning, and straightforward sharing.

Follow these instructions to finish your Form in a few minutes:

- Create your account and start processing PDFs within minutes.

- Utilize our catalog to find any IRS tax form; explore various versions and schedules.

- Click Obtain form to access your Form in our editor.

- Complete the necessary fillable fields with your details (text, numbers, checkmarks).

- Use the Signature Tool to include your binding electronic signature (if required).

- Examine your document and correct any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Keep in mind that submitting on paper can lead to return errors and delay refunds. Certainly, before e-filing your taxes, verify the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct form 2018 101755176

FAQs

-

While filling out the JEE main application form 2018, I filled out the wrong school name, can it be changed? How?

HiYou can edit your JEE Main 2018 application form only if you haven’t paid registration fee. You have to login to your account and enter details-Then click on view application form on the left side.Now click on Edit Application formNow after signNowing to this page you can edit your application form.Hope this will help you.Thanks !!

-

What is the process to fill out the CISF recruitment 2018 application form?

Central Industrial Security Force (CISF) Job Notification:Central Industrial Security Force (CISF) invited applications for the 519 posts of Assistant Sub-Inspector post. The eligible candidates can apply to the post through the prescribed format on or before 15 December 2018.Important Date:Last date of receipt of application by the Unit Commanders: 12 December 2018Last date of receipt of application by respective Zonal DIsG: 22 December 2018Written examination: 24 February 2019

-

How do I fill out forms for an MS at US universities for semesters starting in August - September 2018?

Go to the websites of respective universities.In that go under apply tab and see the dates available for application. Every single information is there about everything you will need.

-

How do I fill out the JEE Main 2018 application form?

How to fill application form for JEE main 2018?Following is the Step By Step procedure for filling of Application Form.Before filling the form you must check the eligibility criteria for application.First of all, go to the official website of CBSE Joint Entrance Exam Main 2018. After that, click on the "Apply for JEE Main 2018" link.Then there will be some important guidelines on the page. Applicants must read those guidelines carefully before going further.In the next step, click on "Proceed to Apply Online" link.After that, fill all the asked details from you for authentication purpose and click Submit.Application Form is now visible to you.Fill all your personal and academic information.Then, Verify Your Full Details before you submit the application form.After that, the applicants have to Upload Scanned Images of their passport sized photograph and their signature.Then, click Browse and select the images which you have scanned for uploading.After Uploading the scanned images of your their passport sized photograph and their signature.At last, pay the application fee either through online transaction or offline mode according to your convenience.After submitting the fee payment, again go to the login page and enter your allotted Application Number and Password.Then, Print Acknowledgement Page.Besides this, the candidates must keep this hard copy of the application confirmation receipt safe for future reference.

-

How can I fill out the NEET form 2018 for the state of domicile for the 15% quota, as I am from Haryana and 12th from Delhi. Which domicile do I fill?

You may fill the form from Delhi so that you are getting 15% AIQ, Delhi 85% state quota and due to your Haryana Domicile you are getting 85% Haryana state quota. G S Walia 9717856115, 8851972958

-

How do I fill out the NEET application form for 2018?

For the academic session of 2018-2019, NEET 2018 will be conducted on 6th May 2018.The application form for the same had been released on 8th February 2018.Steps to Fill NEET 2018 Application Form:Registration: Register yourself on the official website before filling the application form.Filling Up The Form: Fill up the application form by providing personal information (like name, father’s name, address, etc.), academic details.Uploading The Images: Upload the scanned images of their photograph, signature and right-hand index finger impression.Payment of The Application Fees: Pay the application fees for NEET 2018 in both online and offline mode. You can pay through credit/debit card/net banking or through e-challan.For details, visit this site: NEET 2018 Application Form Released - Apply Now!

Create this form in 5 minutes!

How to create an eSignature for the form 2018 101755176

How to generate an electronic signature for the Form 2018 101755176 online

How to create an electronic signature for your Form 2018 101755176 in Google Chrome

How to make an electronic signature for putting it on the Form 2018 101755176 in Gmail

How to generate an eSignature for the Form 2018 101755176 right from your mobile device

How to make an electronic signature for the Form 2018 101755176 on iOS

How to create an electronic signature for the Form 2018 101755176 on Android OS

People also ask

-

What is an airSlate SignNow Form?

An airSlate SignNow Form is an electronic document that allows users to create, send, and eSign important paperwork with ease. With our intuitive interface, businesses can streamline their processes while ensuring that all necessary information is accurately captured and securely stored.

-

How much does it cost to use airSlate SignNow for forms?

Pricing for airSlate SignNow varies based on the features and services your business needs. We offer flexible plans that cater to different team sizes and payment preferences, ensuring you only pay for the forms and functionalities that matter most to your organization.

-

Can I customize my forms in airSlate SignNow?

Absolutely! AirSlate SignNow provides a robust form builder that lets you personalize your forms to match your brand. You can easily add your logo, adjust design elements, and configure fields to suit your specific requirements, making the form experience unique to your business.

-

What are the main benefits of using airSlate SignNow Forms?

Using airSlate SignNow Forms offers numerous benefits, including increased efficiency, enhanced security, and improved compliance. By digitizing your forms, you reduce the time spent on manual paperwork and minimize the risk of errors, allowing your team to focus on more critical tasks.

-

Does airSlate SignNow integrate with other tools?

Yes, airSlate SignNow boasts seamless integrations with various popular applications such as Google Drive, Salesforce, and Zapier. This connectivity allows you to automate workflows and centralize your form management, enhancing productivity across your organization's tech stack.

-

How do I create a form in airSlate SignNow?

Creating a form in airSlate SignNow is simple and can be done in just a few steps. Start by using our user-friendly form builder to add fields and customize the layout, then save your form and share it with your recipients via email or a direct link for easy access.

-

Is airSlate SignNow secure for handling sensitive forms?

Yes, airSlate SignNow employs advanced encryption and security measures to protect your data while handling sensitive forms. We adhere to industry standards for information protection, ensuring that your documents and personal details remain confidential and secure.

Get more for Form

- Respiratory protection hazard assessment sonicdrillingcom form

- U s dod form dod opnav 4790 66

- Afp retirement and separation benefits system form

- Pdffiller coupon code form

- Raffle financial statement form

- Apartment management contract template form

- Apartment roommate contract template form

- Financ contract template form

Find out other Form

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement