PTAX 300 Application for Non Homestead St Clair 2020-2026

What is the PTAX 300 Application for Non-Homestead St. Clair?

The PTAX 300 Application for Non-Homestead is a form used in St. Clair County, Illinois, to apply for a property tax exemption for properties that do not qualify as homesteads. This application is essential for property owners who wish to reduce their tax burden on non-residential properties, such as commercial buildings or vacant land. Understanding the purpose of this application helps ensure that property owners can take advantage of available exemptions and potentially lower their property tax assessments.

Steps to Complete the PTAX 300 Application for Non-Homestead St. Clair

Completing the PTAX 300 Application involves several key steps:

- Gather Required Information: Collect all necessary documentation, including property details, ownership information, and any supporting evidence for the exemption.

- Fill Out the Application: Carefully complete the PTAX 300 form, ensuring all sections are accurately filled in. Pay attention to details to avoid delays.

- Review the Application: Double-check all entries for accuracy and completeness. This step is crucial to prevent rejection due to minor errors.

- Submit the Application: Send the completed application to the appropriate county office, either by mail or in person, as per the submission guidelines.

Eligibility Criteria for the PTAX 300 Application for Non-Homestead St. Clair

To qualify for the PTAX 300 Application, property owners must meet specific eligibility criteria. Generally, the property must be classified as non-homestead, meaning it is not the owner's primary residence. Additionally, the property should be used for commercial purposes, vacant land, or other non-residential activities. It is important to review any additional criteria set by the St. Clair County Assessor's Office to ensure compliance and eligibility for the exemption.

Required Documents for the PTAX 300 Application for Non-Homestead St. Clair

When submitting the PTAX 300 Application, property owners must include various supporting documents to substantiate their claims. These may include:

- Proof of Ownership: Documents such as a deed or title that confirm ownership of the property.

- Property Description: A detailed description of the property, including its location and current use.

- Financial Information: Any relevant financial statements or documents that demonstrate the property's non-homestead status.

Form Submission Methods for the PTAX 300 Application for Non-Homestead St. Clair

The PTAX 300 Application can be submitted through several methods, depending on the preferences of the property owner. These methods include:

- By Mail: Send the completed application and supporting documents to the St. Clair County Assessor's Office via postal service.

- In-Person: Deliver the application directly to the Assessor's Office during business hours for immediate processing.

Penalties for Non-Compliance with the PTAX 300 Application for Non-Homestead St. Clair

Failure to comply with the requirements of the PTAX 300 Application can result in penalties. Property owners may face increased tax assessments, loss of exemption eligibility, or potential fines. It is crucial to adhere to all deadlines and submission guidelines to avoid these consequences and ensure that the application is processed smoothly.

Quick guide on how to complete ptax 300 application for non homestead st clair

Effortlessly prepare PTAX 300 Application For Non homestead St Clair on any device

Managing documents online has gained popularity among organizations and individuals alike. It offers a superb eco-friendly substitute for conventional printed and signed files, allowing you to obtain the correct form and securely store it in the cloud. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage PTAX 300 Application For Non homestead St Clair on any platform with airSlate SignNow’s Android or iOS applications and enhance any document-centric task today.

The easiest way to edit and eSign PTAX 300 Application For Non homestead St Clair effortlessly

- Locate PTAX 300 Application For Non homestead St Clair and click on Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which only takes seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate issues with lost or misplaced documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign PTAX 300 Application For Non homestead St Clair while ensuring clear communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ptax 300 application for non homestead st clair

Create this form in 5 minutes!

How to create an eSignature for the ptax 300 application for non homestead st clair

The way to generate an electronic signature for your PDF document online

The way to generate an electronic signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

How to create an electronic signature straight from your smart phone

The best way to make an electronic signature for a PDF document on iOS

How to create an electronic signature for a PDF document on Android OS

People also ask

-

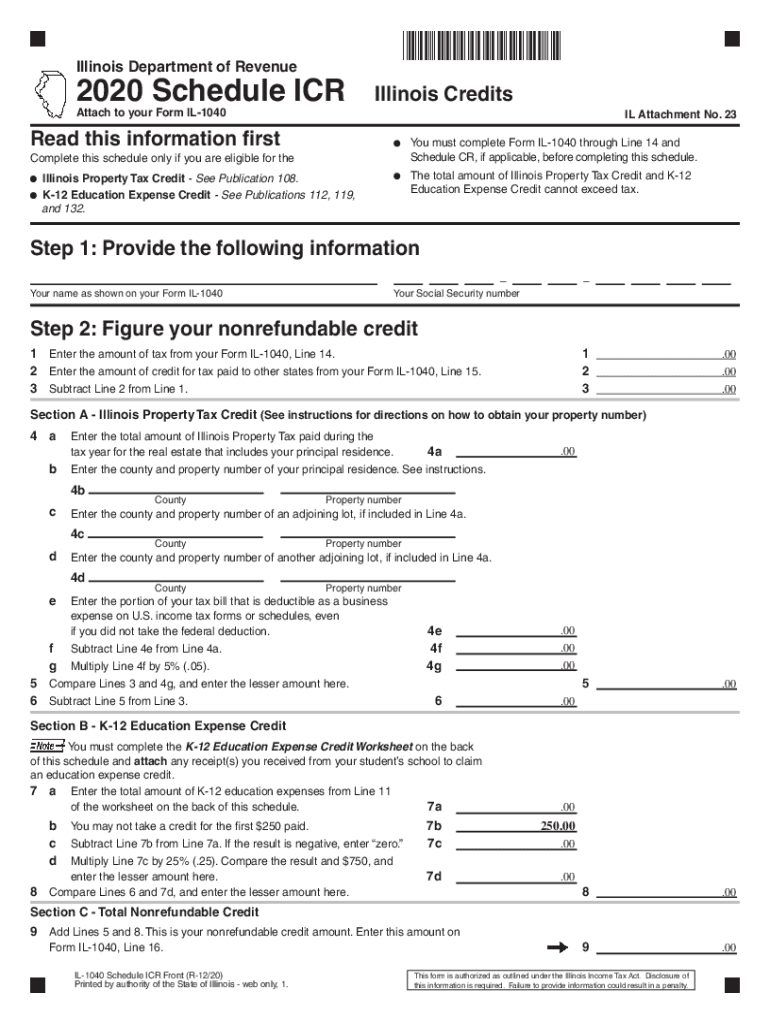

What is the 2017 Illinois Schedule ICR form?

The 2017 Illinois Schedule ICR form is a tax form used by individuals and businesses in Illinois to report income and calculate their estimated tax liabilities. It is essential for ensuring compliance with state tax regulations, which can impact your financial standing. Understanding this form helps in accurate tax filing and avoiding penalties.

-

Where can I find the 2017 Illinois Schedule ICR form?

You can obtain the 2017 Illinois Schedule ICR form from the Illinois Department of Revenue's official website. This site provides downloadable forms and necessary resources to assist in completing your tax documentation. Utilizing airSlate SignNow can streamline your process of signing and submitting the form electronically.

-

How can airSlate SignNow help with the 2017 Illinois Schedule ICR form?

airSlate SignNow allows users to send and eSign the 2017 Illinois Schedule ICR form conveniently and securely online. This tool eliminates the need for printing and mailing paper copies, helping save time and resources. Moreover, you can track the status of your document, ensuring timely submission.

-

Is there a cost associated with using airSlate SignNow for the 2017 Illinois Schedule ICR form?

Yes, airSlate SignNow offers various pricing plans tailored to suit different business needs. The cost is designed to be cost-effective, especially when considering the time saved in document management. Check out our pricing page to find a plan that works for your requirements.

-

What features does airSlate SignNow offer for managing the 2017 Illinois Schedule ICR form?

airSlate SignNow provides a range of features including document templates, customizable workflows, and cloud storage integration to manage your 2017 Illinois Schedule ICR form effectively. Additionally, electronic signature capabilities ensure a faster turnaround time for approvals. This enhances productivity and ensures compliance with necessary regulations.

-

Can airSlate SignNow integrate with other software for managing the 2017 Illinois Schedule ICR form?

Yes, airSlate SignNow offers integrations with various software applications commonly used for tax management and document processing. This allows for seamless data transfer and enhances overall workflow efficiency when dealing with the 2017 Illinois Schedule ICR form. Explore our integrations page for more details.

-

What are the benefits of eSigning the 2017 Illinois Schedule ICR form with airSlate SignNow?

eSigning the 2017 Illinois Schedule ICR form with airSlate SignNow ensures a secure and legally binding signature process. It also provides a quicker turnaround, reducing the waiting time associated with traditional signatures. These benefits signNowly enhance the efficiency of your document workflows.

Get more for PTAX 300 Application For Non homestead St Clair

Find out other PTAX 300 Application For Non homestead St Clair

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word