5076 Small Business Property Tax State of Michigan 2021

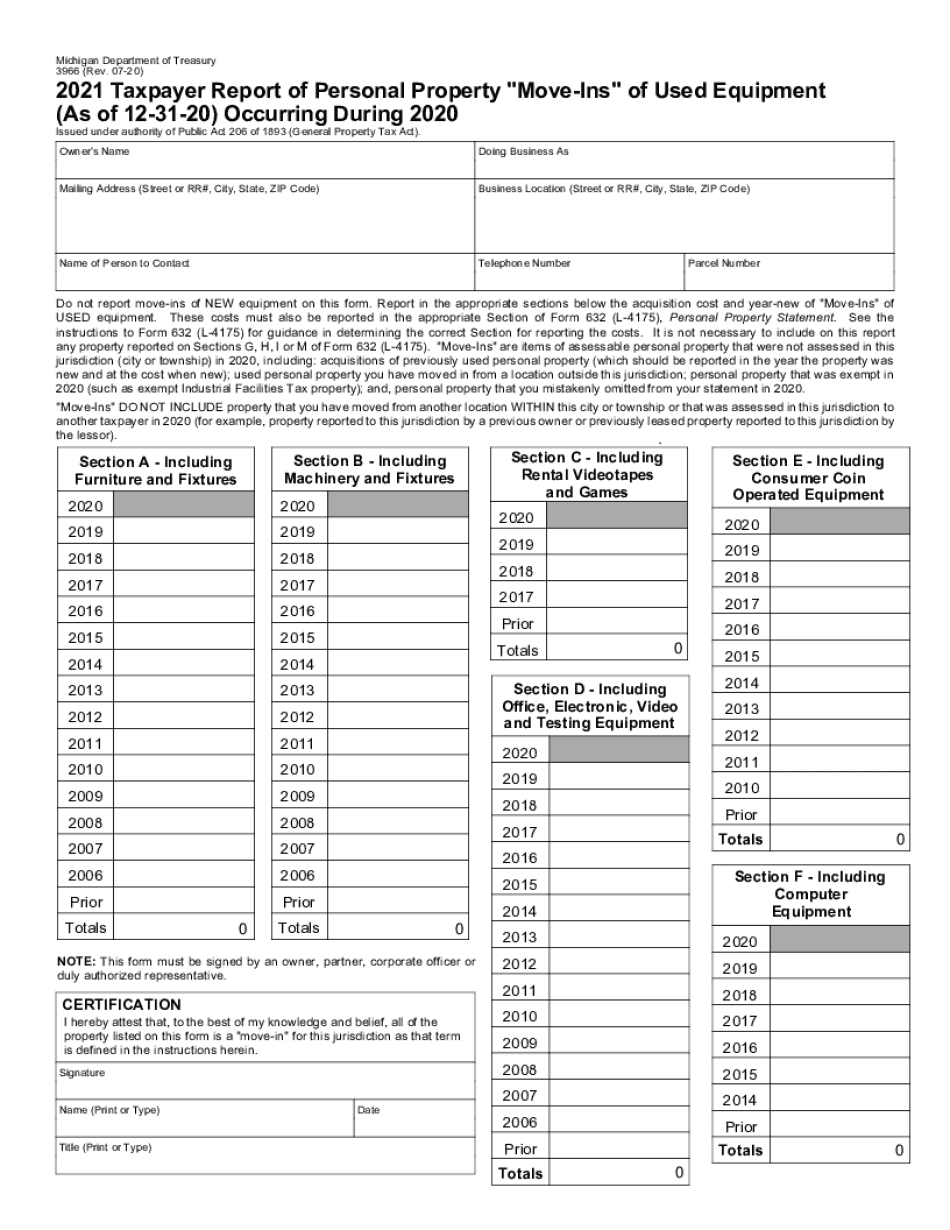

What is the 3966 taxpayer form?

The 3966 taxpayer form is a document used in Michigan for reporting personal property, specifically related to small businesses. This form is essential for taxpayers who own equipment or property that may be subject to taxation. The information provided on the 3966 form helps local governments assess the value of personal property for tax purposes, ensuring compliance with state regulations.

Steps to complete the 3966 taxpayer form

Completing the 3966 taxpayer form involves several key steps:

- Gather necessary information: Collect details about your business, including the type of property you own and its estimated value.

- Fill out the form: Enter your business information accurately, ensuring that all required fields are completed.

- Review for accuracy: Double-check all entries to minimize errors that could lead to penalties or delays.

- Submit the form: File the completed form either online or through traditional mail, depending on your preference and local guidelines.

Filing deadlines for the 3966 taxpayer form

It is crucial to be aware of the filing deadlines for the 3966 taxpayer form to avoid penalties. Typically, the form must be submitted by February first of the tax year. Late submissions may incur fines or interest on unpaid taxes, so timely filing is essential for compliance.

Required documents for the 3966 taxpayer form

When completing the 3966 taxpayer form, you may need to provide supporting documentation. This can include:

- Proof of ownership for the property being reported.

- Previous tax returns that may relate to the property.

- Any relevant financial statements that detail the property's value.

Having these documents ready can facilitate a smoother filing process.

Legal use of the 3966 taxpayer form

The 3966 taxpayer form must be used in accordance with Michigan state laws governing personal property taxation. This includes accurately reporting all relevant property and adhering to the guidelines set forth by local tax authorities. Failure to comply with these regulations may result in legal repercussions, including fines or audits.

Who issues the 3966 taxpayer form?

The 3966 taxpayer form is issued by the Michigan Department of Treasury. This state agency oversees the administration of tax laws and ensures that all forms are up-to-date with current regulations. Taxpayers can access the form through the official state website or local tax offices.

Quick guide on how to complete 5076 small business property tax state of michigan

Effortlessly prepare 5076 Small Business Property Tax State Of Michigan on any device

Online document management has become popular among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly without delays. Manage 5076 Small Business Property Tax State Of Michigan on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign 5076 Small Business Property Tax State Of Michigan with ease

- Obtain 5076 Small Business Property Tax State Of Michigan and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Generate your electronic signature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose your preferred method of delivering your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Modify and electronically sign 5076 Small Business Property Tax State Of Michigan to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 5076 small business property tax state of michigan

Create this form in 5 minutes!

How to create an eSignature for the 5076 small business property tax state of michigan

The way to make an electronic signature for your PDF document in the online mode

The way to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

How to make an eSignature from your mobile device

The way to generate an electronic signature for a PDF document on iOS devices

How to make an eSignature for a PDF file on Android devices

People also ask

-

What is the 3966 ins document eSigning feature offered by airSlate SignNow?

The 3966 ins feature allows users to electronically sign documents securely and efficiently. With airSlate SignNow, businesses can streamline their signing process, ensuring that agreements are executed promptly without the hassle of traditional paperwork.

-

How much does airSlate SignNow cost for using the 3966 ins service?

AirSlate SignNow offers competitive pricing for its 3966 ins eSigning services, accommodating various budgets. Pricing plans are designed to fit organizations of all sizes, making it a cost-effective solution for your document signing needs.

-

What are the main benefits of using airSlate SignNow for 3966 ins documents?

Using airSlate SignNow for 3966 ins documents provides multiple benefits, including faster turnaround times, enhanced security, and the convenience of a fully digital process. This efficiency helps businesses focus more on their core operations while ensuring compliance and reducing errors.

-

Can I integrate airSlate SignNow with other tools for processing 3966 ins documents?

Yes, airSlate SignNow seamlessly integrates with various applications, enhancing your workflow for 3966 ins documents. This includes CRM systems, cloud storage solutions, and productivity tools, allowing you to manage your document signing process more effectively.

-

Is there a mobile app for managing 3966 ins eSignatures?

Absolutely! airSlate SignNow offers a mobile app that allows users to manage 3966 ins eSignatures on the go. This app enables you to send, sign, and track documents from your smartphone or tablet, providing flexibility and convenience for busy professionals.

-

How secure is the eSigning process for 3966 ins documents on airSlate SignNow?

The eSigning process for 3966 ins documents on airSlate SignNow is highly secure, employing advanced encryption and compliance with industry standards. This ensures that your sensitive information remains protected during the entire signing process, giving you peace of mind.

-

What types of documents can I send for eSigning using the 3966 ins feature?

With the 3966 ins feature, you can send various types of documents for eSigning, including contracts, agreements, and forms. This flexibility makes airSlate SignNow an ideal choice for businesses looking to simplify their document management process.

Get more for 5076 Small Business Property Tax State Of Michigan

Find out other 5076 Small Business Property Tax State Of Michigan

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF