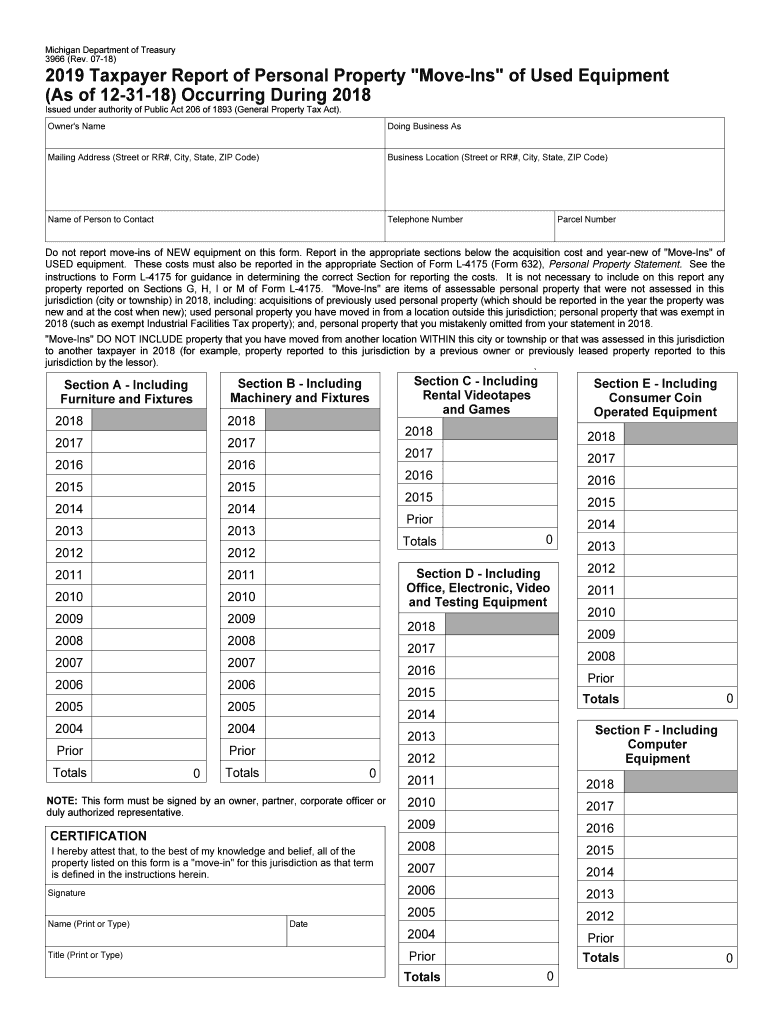

Michigan State Tax Commission Form 3966 2019

What is the Michigan State Tax Commission Form 3966

The Michigan State Tax Commission Form 3966, commonly referred to as the MI Form 3966, is an essential document used primarily for property tax exemption purposes in Michigan. This form allows eligible property owners to apply for specific tax exemptions, such as the Principal Residence Exemption (PRE), which can significantly reduce their property tax burden. Understanding the purpose and requirements of this form is crucial for homeowners seeking to take advantage of available tax benefits.

How to use the Michigan State Tax Commission Form 3966

Using the Michigan State Tax Commission Form 3966 involves several steps to ensure proper completion and submission. First, gather all necessary information, including property details and personal identification. Next, accurately fill out the form, ensuring that all required sections are completed. Once the form is filled out, it must be submitted to the appropriate local tax assessing office. It is important to retain a copy of the submitted form for your records, as it may be needed for future reference or verification.

Steps to complete the Michigan State Tax Commission Form 3966

Completing the MI Form 3966 requires careful attention to detail. Follow these steps for successful completion:

- Begin by downloading the form from the Michigan State Tax Commission website or obtaining a physical copy from your local tax office.

- Fill in your name, address, and other identifying information accurately.

- Provide details about the property for which you are applying for the exemption, including the property address and parcel number.

- Indicate the type of exemption you are applying for, ensuring you meet the eligibility criteria.

- Review the completed form for accuracy and completeness before submission.

Legal use of the Michigan State Tax Commission Form 3966

The legal use of the Michigan State Tax Commission Form 3966 is governed by state laws and regulations regarding property tax exemptions. To be considered valid, the form must be completed accurately and submitted within the specified deadlines. Additionally, the information provided must be truthful and verifiable, as any discrepancies may lead to penalties or denial of the exemption. Understanding these legal implications is vital for ensuring compliance and protecting your rights as a property owner.

Key elements of the Michigan State Tax Commission Form 3966

The MI Form 3966 contains several key elements that are essential for its proper use. These include:

- Applicant Information: Personal details of the property owner, including name and contact information.

- Property Information: Specific details about the property, such as address and parcel number.

- Exemption Type: A section where the applicant indicates the type of exemption being requested.

- Signature: A signature line for the applicant to affirm the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the Michigan State Tax Commission Form 3966 are critical for ensuring that property owners receive their exemptions. Typically, the form must be submitted by June 1st of the tax year in which the exemption is sought. However, specific deadlines may vary based on local regulations, so it is advisable to check with your local tax assessor's office for any updates or changes to these dates. Missing the deadline can result in the loss of potential tax savings.

Quick guide on how to complete 3966 taxpayer report of personal property state of michigan

Prepare Michigan State Tax Commission Form 3966 effortlessly on any device

Online document administration has become increasingly favored by organizations and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Michigan State Tax Commission Form 3966 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to alter and eSign Michigan State Tax Commission Form 3966 with ease

- Locate Michigan State Tax Commission Form 3966 and then click Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Craft your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all the information and then click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choosing. Modify and eSign Michigan State Tax Commission Form 3966 and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 3966 taxpayer report of personal property state of michigan

Create this form in 5 minutes!

How to create an eSignature for the 3966 taxpayer report of personal property state of michigan

How to make an electronic signature for your 3966 Taxpayer Report Of Personal Property State Of Michigan in the online mode

How to create an electronic signature for the 3966 Taxpayer Report Of Personal Property State Of Michigan in Chrome

How to make an electronic signature for putting it on the 3966 Taxpayer Report Of Personal Property State Of Michigan in Gmail

How to generate an electronic signature for the 3966 Taxpayer Report Of Personal Property State Of Michigan right from your smartphone

How to make an eSignature for the 3966 Taxpayer Report Of Personal Property State Of Michigan on iOS devices

How to generate an eSignature for the 3966 Taxpayer Report Of Personal Property State Of Michigan on Android devices

People also ask

-

What is the 2019 MI Form 3966 and why is it important?

The 2019 MI Form 3966 is a document required by the state of Michigan for various vehicle-related transactions. It is crucial for ensuring compliance with state regulations and can facilitate smooth processing for car sales and transfers.

-

How can airSlate SignNow help with the 2019 MI Form 3966?

With airSlate SignNow, you can easily fill out, send, and eSign the 2019 MI Form 3966. Our platform streamlines the document signing process, making it more efficient and convenient for both you and the recipients.

-

Is airSlate SignNow cost-effective for managing the 2019 MI Form 3966?

Yes, airSlate SignNow offers an affordable solution for managing documents like the 2019 MI Form 3966. Our pricing plans are designed for businesses of all sizes, ensuring you access powerful features without breaking the bank.

-

What features does airSlate SignNow offer for the 2019 MI Form 3966?

airSlate SignNow provides features like customizable templates, real-time collaboration, and secure storage specifically for documents like the 2019 MI Form 3966. These features help simplify the document management process and enhance workflow efficiency.

-

Can airSlate SignNow integrate with other tools for the 2019 MI Form 3966?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications to manage the 2019 MI Form 3966. You can connect with CRM systems, cloud storage solutions, and more, enhancing your document workflow.

-

What are the benefits of using airSlate SignNow for the 2019 MI Form 3966?

Using airSlate SignNow for the 2019 MI Form 3966 provides numerous benefits, including increased efficiency in document signing, reduced turnaround times, and improved compliance with state regulations. Our intuitive interface makes it easy for anyone to use.

-

Is it secure to use airSlate SignNow for the 2019 MI Form 3966?

Yes, security is a top priority at airSlate SignNow. Our platform protects your sensitive information related to the 2019 MI Form 3966 through advanced encryption and authentication measures, ensuring that data remains confidential and secure.

Get more for Michigan State Tax Commission Form 3966

- Guardianship reort travis county tx form

- Sample of information blank

- Nota keterangan form

- Co teaching planning forms

- Council badge renewal form

- Confidential application form redcar and cleveland borough redcar cleveland gov

- Certificate of appreciation vfw vfw form

- Form eia 860 annual electric generator report us energy

Find out other Michigan State Tax Commission Form 3966

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA