Real and Personal Property Statements Michigan 2023

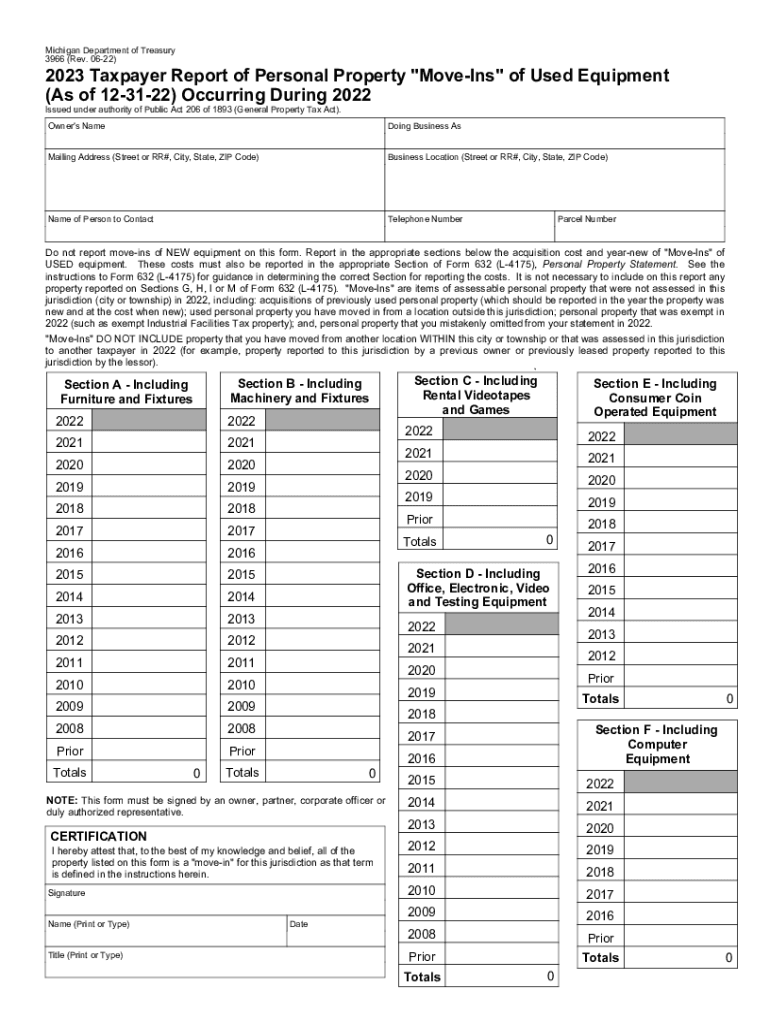

What is the Michigan 3966 Form?

The Michigan 3966 form, also known as the Michigan Property Move form, is a crucial document used for reporting changes in property ownership or occupancy. This form is specifically designed for taxpayers to declare personal property that has been moved or transferred. It is essential for maintaining accurate property records and ensuring compliance with state tax regulations. The form captures details about the property, including its location, type, and the reason for the move, which is vital for local assessors and tax authorities.

Steps to Complete the Michigan 3966 Form

Completing the Michigan 3966 form involves several straightforward steps:

- Gather Required Information: Collect details about the property, including its address, type, and the date of the move.

- Fill Out the Form: Accurately complete all sections of the form, ensuring that all information is correct and up-to-date.

- Review for Accuracy: Double-check the completed form for any errors or omissions before submission.

- Submit the Form: Choose your preferred submission method, whether online, by mail, or in person, to ensure it reaches the appropriate local tax authority.

Legal Use of the Michigan 3966 Form

The Michigan 3966 form serves a legal purpose in documenting property changes. It is recognized by state authorities and is essential for ensuring that property records are accurate and up-to-date. Proper completion and submission of this form help prevent potential disputes regarding property ownership and tax liabilities. Compliance with the legal requirements associated with the form is necessary to avoid penalties and ensure that property taxes are assessed correctly.

Required Documents for the Michigan 3966 Form

When preparing to submit the Michigan 3966 form, certain documents may be required to support your claim. These may include:

- Proof of ownership, such as a deed or title.

- Documentation of the property's previous location, if applicable.

- Any relevant correspondence from local tax authorities regarding property assessments.

Having these documents ready can facilitate a smoother submission process and help clarify any questions that may arise during the review of your form.

Form Submission Methods for the Michigan 3966 Form

The Michigan 3966 form can be submitted through various methods to accommodate different preferences. Options include:

- Online Submission: Many local tax authorities offer online platforms for submitting the form electronically, providing a quick and efficient option.

- Mail Submission: You can print the completed form and send it via postal mail to the appropriate local tax office.

- In-Person Submission: Alternatively, you can deliver the form directly to the local tax office, allowing for immediate confirmation of receipt.

Penalties for Non-Compliance with the Michigan 3966 Form

Failure to submit the Michigan 3966 form on time or providing inaccurate information can lead to penalties. These may include:

- Fines imposed by local tax authorities.

- Potential increases in property tax assessments due to unreported changes.

- Legal consequences if disputes arise regarding property ownership or tax liabilities.

Understanding the importance of timely and accurate submission can help taxpayers avoid these complications and ensure compliance with state regulations.

Quick guide on how to complete real and personal property statements michigan

Complete Real And Personal Property Statements Michigan effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly option to conventional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Real And Personal Property Statements Michigan on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest method to edit and eSign Real And Personal Property Statements Michigan with ease

- Obtain Real And Personal Property Statements Michigan and click on Get Form to begin.

- Use the tools at your disposal to fill out your document.

- Emphasize important sections of the documents or conceal sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you'd like to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from your preferred device. Modify and eSign Real And Personal Property Statements Michigan and ensure excellent communication throughout every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct real and personal property statements michigan

Create this form in 5 minutes!

People also ask

-

What is the Michigan 3966 form and why is it important?

The Michigan 3966 form is a critical document used for various business and legal purposes in Michigan. It serves as an official record and can be essential for compliance, making it important for businesses to manage it properly through a reliable eSign solution like airSlate SignNow.

-

How can airSlate SignNow help with the Michigan 3966 form?

airSlate SignNow simplifies the process of sending and signing the Michigan 3966 form. Our platform allows you to prepare, send, and eSign documents securely, ensuring that your forms are both compliant and efficiently processed.

-

Is there a cost associated with using airSlate SignNow for the Michigan 3966 form?

Yes, airSlate SignNow offers various pricing plans tailored to meet your business needs. We provide cost-effective solutions that allow you to manage the Michigan 3966 form efficiently while keeping your budget in mind.

-

Can I integrate airSlate SignNow with other software for easier management of the Michigan 3966 form?

Absolutely! airSlate SignNow integrates seamlessly with a variety of applications, which enables you to streamline the process of handling the Michigan 3966 form alongside your existing workflows. This integration enhances productivity and ensures a smooth document management experience.

-

What features does airSlate SignNow offer for managing the Michigan 3966 form?

airSlate SignNow offers features like customizable templates, secure eSignature options, and tracking for the Michigan 3966 form. These features ensure that your document management is not only efficient but also secure and compliant with legal requirements.

-

How secure is the airSlate SignNow platform when handling the Michigan 3966 form?

Security is a top priority at airSlate SignNow. We implement advanced encryption protocols and feature rigorous access controls to ensure that your Michigan 3966 form and other sensitive documents are protected from unauthorized access.

-

Can I access the Michigan 3966 form on mobile devices through airSlate SignNow?

Yes, airSlate SignNow is designed to be mobile-friendly, allowing you to access and eSign the Michigan 3966 form from your smartphone or tablet. This flexibility ensures that you can manage your documents on the go, enhancing your efficiency.

Get more for Real And Personal Property Statements Michigan

- Satisfaction release or cancellation of mortgage by corporation north dakota form

- Satisfaction release or cancellation of mortgage by individual north dakota form

- Partial release of property from mortgage for corporation north dakota form

- Partial release of property from mortgage by individual holder north dakota form

- Warranty deed for husband and wife converting property from tenants in common to joint tenancy north dakota form

- Warranty deed for parents to child with reservation of life estate north dakota form

- Warranty deed for separate or joint property to joint tenancy north dakota form

- Warranty deed to separate property of one spouse to both spouses as joint tenants north dakota form

Find out other Real And Personal Property Statements Michigan

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile