Form 901 Business Personal Property Rendition 2021

What is the Form 901 Business Personal Property Rendition

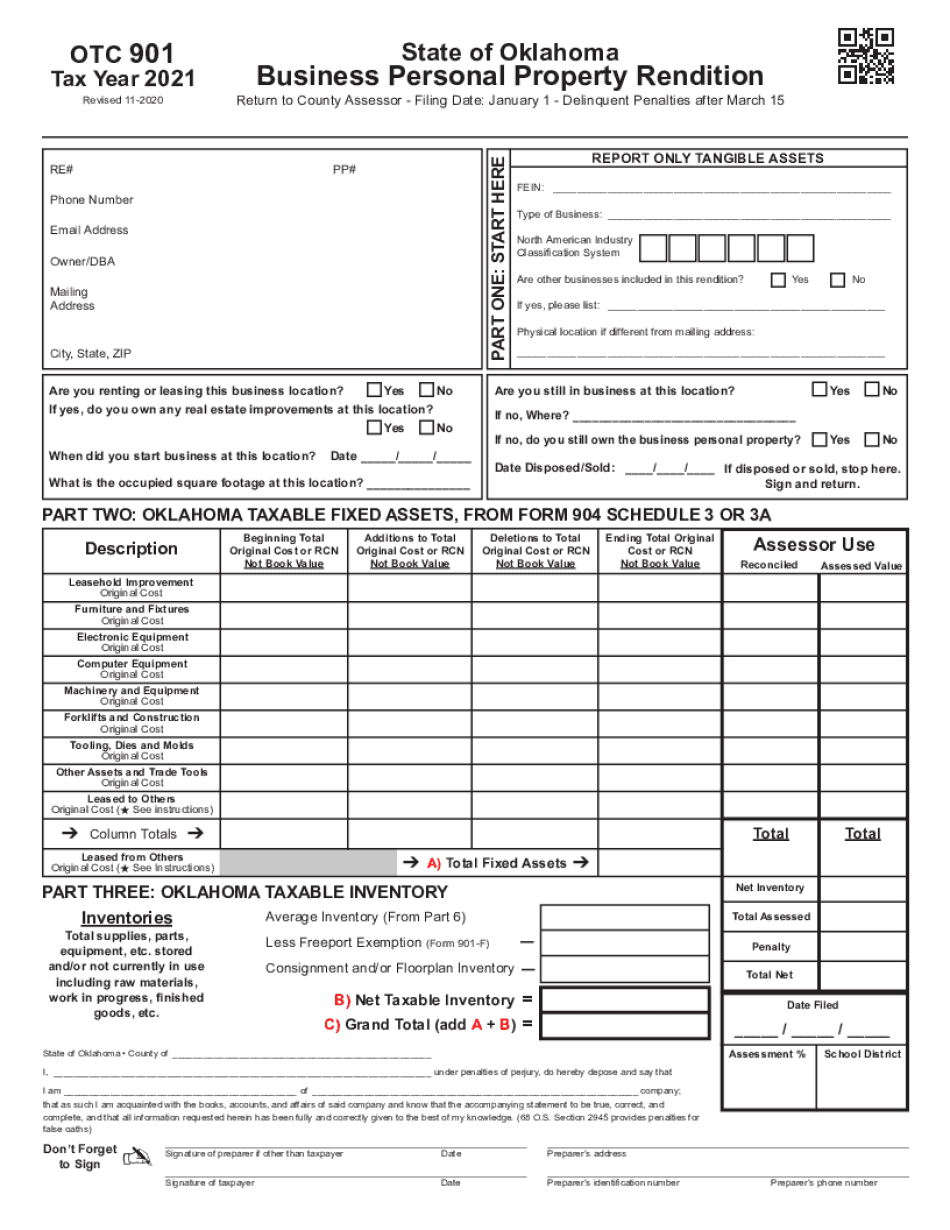

The Form 901, also known as the Oklahoma Business Personal Property Rendition, is a crucial document used by businesses in Oklahoma to report their personal property for tax purposes. This form is designed to provide the Oklahoma Tax Commission with detailed information about the personal property owned or used by a business within the state. Accurate completion of the Form 901 is essential for ensuring proper assessment and taxation of business assets, which may include equipment, machinery, furniture, and other tangible property.

How to use the Form 901 Business Personal Property Rendition

Using the Form 901 involves several straightforward steps. First, businesses must gather information about all personal property owned or used during the tax year. This includes details such as the type of property, its location, and its estimated value. Once all necessary information is compiled, businesses can fill out the form accurately. It is important to ensure that all entries are complete and correct to avoid any issues with tax assessments. After completing the form, businesses should submit it to the appropriate local county assessor's office.

Steps to complete the Form 901 Business Personal Property Rendition

Completing the Form 901 requires careful attention to detail. Here are the steps to follow:

- Gather all relevant information about your business personal property, including purchase dates, values, and locations.

- Obtain the Form 901 from the Oklahoma Tax Commission or your local county assessor's office.

- Fill in the required fields, ensuring that all information is accurate and up-to-date.

- Review the completed form for any errors or omissions.

- Submit the form by the designated deadline to your county assessor's office, either online, by mail, or in person.

Legal use of the Form 901 Business Personal Property Rendition

The Form 901 is legally binding and must be completed in accordance with Oklahoma state laws regarding property taxation. Accurate reporting of business personal property is essential to comply with tax obligations and avoid penalties. The information provided on the form is used by local assessors to determine the fair market value of the property, which in turn affects the property tax owed by the business. Ensuring compliance with the legal requirements associated with the Form 901 is critical for maintaining good standing with tax authorities.

Filing Deadlines / Important Dates

Timely submission of the Form 901 is crucial to avoid penalties. The filing deadline for the Form 901 typically falls on March 15 of each year. Businesses should be aware of this date and plan accordingly to ensure that their forms are submitted on time. It is advisable to check for any updates or changes to deadlines that may occur due to specific circumstances or legislation.

Penalties for Non-Compliance

Failure to file the Form 901 or submitting inaccurate information can result in significant penalties. Businesses may face fines, increased tax assessments, or additional scrutiny from tax authorities. It is important to understand that non-compliance can lead to legal ramifications and financial burdens. Therefore, ensuring that the Form 901 is completed accurately and submitted on time is essential for all businesses operating in Oklahoma.

Quick guide on how to complete 2021 form 901 business personal property rendition

Access Form 901 Business Personal Property Rendition effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal sustainable alternative to conventional printed and signed papers, allowing you to obtain the correct form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents rapidly without delays. Manage Form 901 Business Personal Property Rendition on any platform with airSlate SignNow Android or iOS applications and streamline any document-centric process today.

The easiest way to modify and eSign Form 901 Business Personal Property Rendition seamlessly

- Locate Form 901 Business Personal Property Rendition and click Get Form to begin.

- Use the features we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the information and press the Done button to save your alterations.

- Choose how you wish to send your form—via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 901 Business Personal Property Rendition to maintain excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 form 901 business personal property rendition

Create this form in 5 minutes!

How to create an eSignature for the 2021 form 901 business personal property rendition

The way to make an eSignature for a PDF document in the online mode

The way to make an eSignature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

How to make an electronic signature right from your mobile device

The way to make an eSignature for a PDF document on iOS devices

How to make an electronic signature for a PDF on Android devices

People also ask

-

What is form 901 and why is it important?

Form 901 is a vital document used in various business and legal processes. It serves as a comprehensive way to collect necessary information from clients or stakeholders. Understanding form 901 is crucial for ensuring compliance and facilitating smooth operations within organizations.

-

How can airSlate SignNow help with filling out form 901?

airSlate SignNow allows users to easily fill out form 901 electronically, saving time and reducing errors. The platform provides a user-friendly interface for completing the form, adding signatures, and sending it securely. This seamless process ensures that your form 901 is submitted accurately and efficiently.

-

Are there any costs associated with using airSlate SignNow for form 901?

airSlate SignNow offers a variety of pricing plans tailored to meet different business needs. Whether you're a solo entrepreneur or part of a larger team, you can select a plan that best suits your requirements for managing form 901. The platform's cost-effective solution is designed to enhance productivity without breaking the bank.

-

What features does airSlate SignNow offer for managing form 901?

airSlate SignNow provides robust features for handling form 901, including document editing, eSigning, and document tracking. These features ensure that you can customize your form 901 as needed and monitor its status throughout the signing process. With these tools, managing form 901 becomes streamlined and efficient.

-

Can I integrate airSlate SignNow with other applications for form 901?

Yes, airSlate SignNow offers seamless integrations with popular business applications, allowing you to enhance your workflow for form 901. Whether you're using CRM systems, project management tools, or other software, you can easily connect airSlate SignNow to manage your forms more effectively. This flexibility makes it easier to incorporate form 901 into your existing processes.

-

What benefits do businesses gain from using airSlate SignNow for form 901?

By utilizing airSlate SignNow for form 901, businesses gain increased efficiency and accuracy in their document management processes. The platform reduces paperwork and manual errors while accelerating the document approval timeline. Consequently, users can focus on their core operations rather than getting bogged down in administrative tasks.

-

Is it easy to send a completed form 901 using airSlate SignNow?

Absolutely! Sending a completed form 901 through airSlate SignNow is straightforward. After filling out and signing the document, you can easily send it to the relevant parties with just a few clicks, ensuring a quick and secure delivery process.

Get more for Form 901 Business Personal Property Rendition

Find out other Form 901 Business Personal Property Rendition

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template