Otc 901 Form 2018

What is the Otc 901 Form

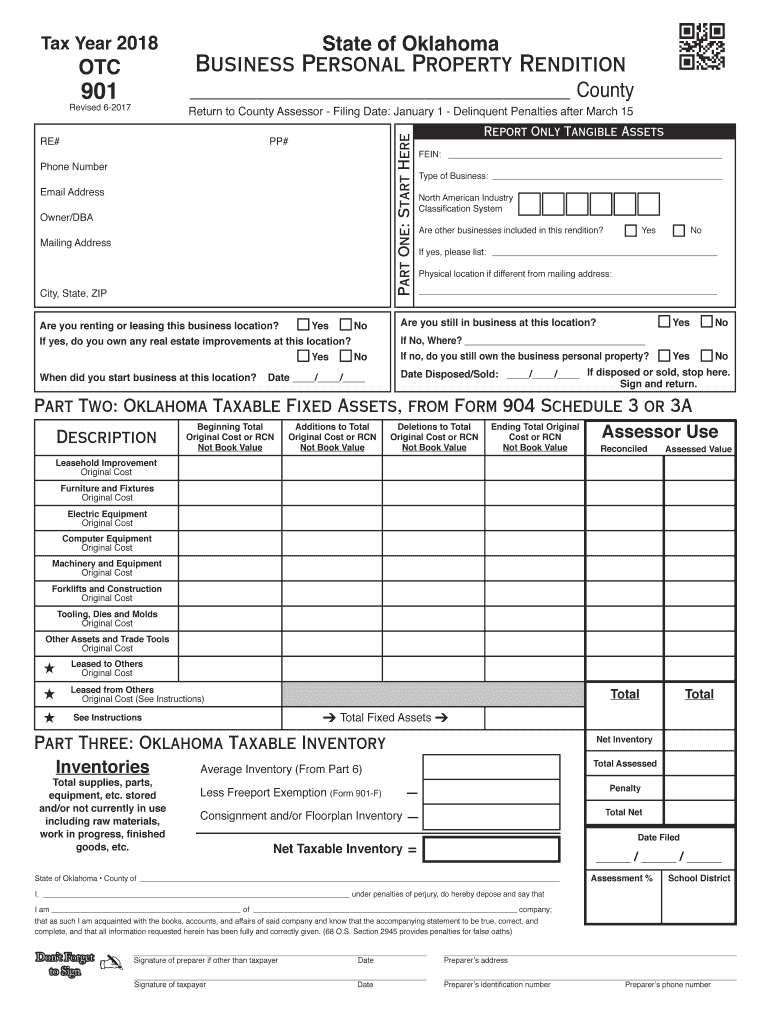

The Otc 901 Form is a tax-related document utilized by individuals and businesses in the United States to report specific financial information to the Internal Revenue Service (IRS). This form is essential for ensuring compliance with federal tax regulations, allowing taxpayers to accurately report their income and deductions. Understanding the purpose and requirements of the Otc 901 Form is crucial for effective tax management and avoiding potential penalties.

How to Use the Otc 901 Form

Using the Otc 901 Form involves several key steps. First, gather all necessary financial documents, including income statements and receipts for deductions. Next, carefully fill out the form, ensuring that all information is accurate and complete. After completing the form, it is important to review it for any errors before submission. Depending on your preference, you can submit the Otc 901 Form electronically or by mail, adhering to the specific guidelines set by the IRS.

Steps to Complete the Otc 901 Form

Completing the Otc 901 Form requires attention to detail. Follow these steps for a smooth process:

- Collect all relevant financial documentation.

- Access the Otc 901 Form from an authorized source.

- Fill in your personal and financial information accurately.

- Double-check all entries for correctness.

- Sign and date the form as required.

- Submit the form through your chosen method, ensuring you meet any deadlines.

Legal Use of the Otc 901 Form

The legal use of the Otc 901 Form is governed by IRS regulations. It is important to ensure that the form is filled out correctly and submitted on time to avoid legal repercussions. Failure to comply with the requirements can lead to penalties, including fines or additional scrutiny from the IRS. Understanding the legal implications of using the Otc 901 Form helps taxpayers maintain compliance and protect their financial interests.

Key Elements of the Otc 901 Form

Key elements of the Otc 901 Form include personal identification details, income reporting sections, and deduction claims. Each section must be filled out accurately to reflect the taxpayer's financial situation. Additionally, it is crucial to include any necessary attachments or supporting documents as required by the IRS. Familiarity with these elements ensures that the form is completed correctly and efficiently.

Filing Deadlines / Important Dates

Filing deadlines for the Otc 901 Form are critical for compliance. Typically, the form must be submitted by a specific date each year, coinciding with the overall tax filing deadline. It is essential for taxpayers to be aware of these dates to avoid late fees or penalties. Keeping a calendar of important tax-related dates can help ensure timely submission of the Otc 901 Form.

Form Submission Methods (Online / Mail / In-Person)

The Otc 901 Form can be submitted through various methods, including online, by mail, or in person. Online submission is often the fastest and most efficient option, allowing for immediate processing. Mailing the form requires careful attention to postal timelines to ensure it is sent before the deadline. In-person submission may be necessary in certain situations, providing an opportunity to address any questions or concerns directly with IRS representatives.

Quick guide on how to complete otc 901 2018 form

Your assistance manual on how to prepare your Otc 901 Form

If you’re curious about how to fill out and submit your Otc 901 Form, here are a few concise guidelines to simplify your tax filing experience.

To begin, you simply need to set up your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an exceptionally user-friendly and powerful document solution that enables you to modify, generate, and finalize your income tax forms effortlessly. Utilizing its editor, you can alternate between text, check boxes, and eSignatures and return to modify information as necessary. Enhance your tax management with advanced PDF editing, eSigning, and easy sharing.

Follow the steps below to complete your Otc 901 Form in just a few minutes:

- Create your account and start editing PDFs within moments.

- Explore our directory to find any IRS tax form; browse through various versions and schedules.

- Click Get form to access your Otc 901 Form in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Utilize the Sign Tool to insert your legally-binding eSignature (if necessary).

- Examine your document and correct any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Be aware that paper filing may increase return errors and delay refunds. Furthermore, before e-filing your taxes, check the IRS website for filing regulations specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct otc 901 2018 form

FAQs

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

-

How do I fill out the CAT 2018 application form?

The procedure for filling up the CAT Application form is very simple. I’ll try to explain it to you in simple words.I have provided a link below for CAT registration.See, first you have to register, then fill in details in the application form, upload images, pay the registration fee and finally submit the form.Now, to register online, you have to enter details such as your name, date of birth, email id, mobile number and choose your country. You must and must enter your own personal email id and mobile number, as you will receive latest updates on CAT exam through email and SMS only.Submit the registration details, after which an OTP will be sent to the registered email id and mobile number.Once the registration part is over, you will get the Login credentials.Next, you need to fill in your personal details, academic details, work experience details, etc.Upload scanned images of your photograph, and signature as per the specifications.Pay the registration fee, which is Rs. 950 for SC/ST/PWD category candidates and Rs. 1900 for all other categories by online mode (Credit Card/ Debit Card/ Net Banking).Final step - Submit the form and do not forget to take the print out of the application form. if not print out then atleast save it somewhere.CAT 2018 Registration (Started): Date, Fees, CAT 2018 Online Application iimcat.ac.in

-

How do I fill out the NTSE form 2017- 2018 Jharkhand online?

You cannot gove NTSE online or at your own level you have to belong to a school which is conducting ntse. Then download the form online from the page of ntse, fill it and submit it to your school along with fee. If your school is not conducting ntse, sorry to say but you cannot give ntse. It can only be given through, no institutions are allowed to conduct thos exam.

-

How do I fill out the NEET application form for 2018?

For the academic session of 2018-2019, NEET 2018 will be conducted on 6th May 2018.The application form for the same had been released on 8th February 2018.Steps to Fill NEET 2018 Application Form:Registration: Register yourself on the official website before filling the application form.Filling Up The Form: Fill up the application form by providing personal information (like name, father’s name, address, etc.), academic details.Uploading The Images: Upload the scanned images of their photograph, signature and right-hand index finger impression.Payment of The Application Fees: Pay the application fees for NEET 2018 in both online and offline mode. You can pay through credit/debit card/net banking or through e-challan.For details, visit this site: NEET 2018 Application Form Released - Apply Now!

-

How do I fill out the JEE Main 2018 application form?

How to fill application form for JEE main 2018?Following is the Step By Step procedure for filling of Application Form.Before filling the form you must check the eligibility criteria for application.First of all, go to the official website of CBSE Joint Entrance Exam Main 2018. After that, click on the "Apply for JEE Main 2018" link.Then there will be some important guidelines on the page. Applicants must read those guidelines carefully before going further.In the next step, click on "Proceed to Apply Online" link.After that, fill all the asked details from you for authentication purpose and click Submit.Application Form is now visible to you.Fill all your personal and academic information.Then, Verify Your Full Details before you submit the application form.After that, the applicants have to Upload Scanned Images of their passport sized photograph and their signature.Then, click Browse and select the images which you have scanned for uploading.After Uploading the scanned images of your their passport sized photograph and their signature.At last, pay the application fee either through online transaction or offline mode according to your convenience.After submitting the fee payment, again go to the login page and enter your allotted Application Number and Password.Then, Print Acknowledgement Page.Besides this, the candidates must keep this hard copy of the application confirmation receipt safe for future reference.

Create this form in 5 minutes!

How to create an eSignature for the otc 901 2018 form

How to generate an electronic signature for the Otc 901 2018 Form in the online mode

How to generate an electronic signature for your Otc 901 2018 Form in Chrome

How to create an eSignature for signing the Otc 901 2018 Form in Gmail

How to make an electronic signature for the Otc 901 2018 Form right from your smart phone

How to create an eSignature for the Otc 901 2018 Form on iOS devices

How to create an electronic signature for the Otc 901 2018 Form on Android OS

People also ask

-

What is the OTC 901 Form and why is it important?

The OTC 901 Form is a critical document used for various transactions in the healthcare industry. It helps streamline processes related to over-the-counter medications and ensures compliance with regulations. Using the OTC 901 Form can simplify your documentation needs and enhance efficiency.

-

How can airSlate SignNow help with the OTC 901 Form?

airSlate SignNow offers an easy-to-use platform for sending and eSigning the OTC 901 Form. With our solution, you can quickly prepare, share, and sign this essential document, ensuring that all parties can access it seamlessly. This not only saves time but also improves accuracy in your transactions.

-

Is there a cost associated with using the OTC 901 Form through airSlate SignNow?

Yes, while the OTC 901 Form itself is a standard form, airSlate SignNow provides a cost-effective solution for managing your document workflows. Our pricing plans are designed to suit businesses of all sizes, offering flexibility and scalability as your needs grow. You'll find that investing in our service enhances your productivity and lowers overall operational costs.

-

What features does airSlate SignNow provide for the OTC 901 Form?

airSlate SignNow includes several features specifically beneficial for the OTC 901 Form, such as customizable templates, secure eSigning, and real-time tracking. These features ensure that you can manage your forms efficiently while maintaining compliance and security. Additionally, our platform allows for easy integration with other tools you may already be using.

-

Can I integrate airSlate SignNow with other software for managing the OTC 901 Form?

Absolutely! airSlate SignNow offers seamless integrations with various software solutions to help you manage the OTC 901 Form more effectively. Whether you use CRM, ERP, or other document management systems, our platform can enhance your workflow by connecting with your existing tools.

-

What are the benefits of using airSlate SignNow for the OTC 901 Form?

Using airSlate SignNow for the OTC 901 Form provides numerous benefits, including reduced turnaround times, improved document accuracy, and enhanced security. Our platform simplifies the signing process, allowing you to focus on your core business activities. Furthermore, it ensures compliance with industry regulations, giving you peace of mind.

-

How secure is the OTC 901 Form when using airSlate SignNow?

Security is a top priority at airSlate SignNow. When using our platform for the OTC 901 Form, all documents are encrypted, and we adhere to strict compliance regulations to protect your data. This means you can confidently manage sensitive information without worrying about unauthorized access.

Get more for Otc 901 Form

Find out other Otc 901 Form

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe