Oklahoma Govcontentdam2023 Form 901 Business Personal Property Rendition Oklahoma 2023-2026

What is the Oklahoma Form 901 Business Personal Property Rendition?

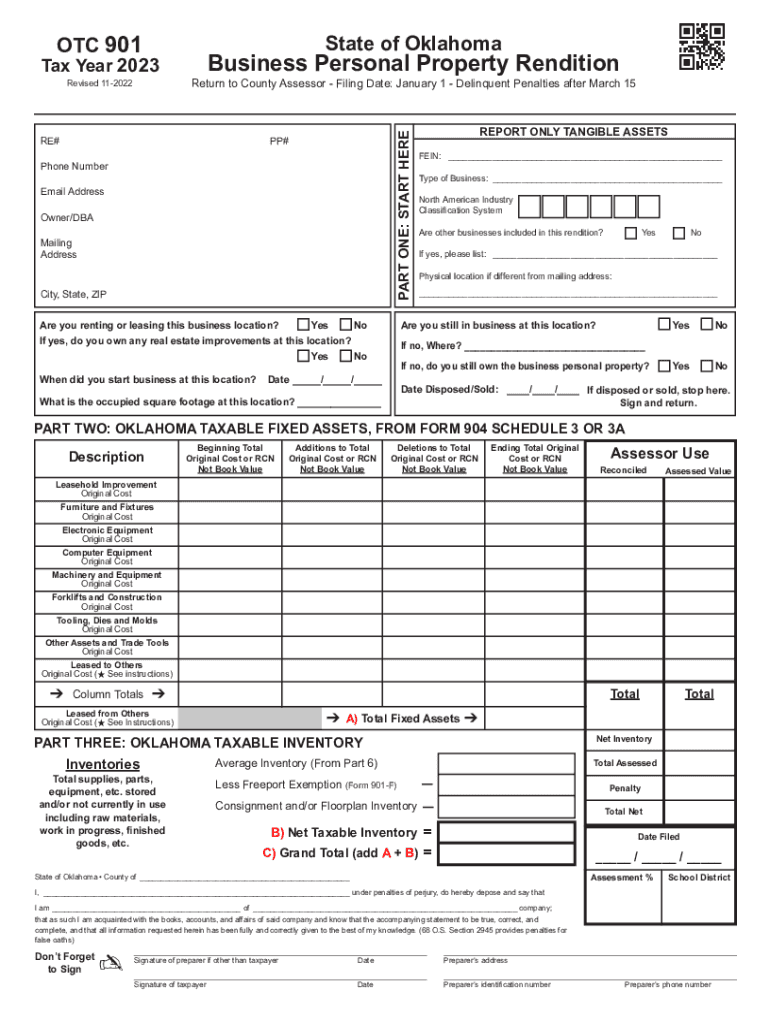

The Oklahoma Form 901, also known as the Business Personal Property Rendition, is a document required by the Oklahoma Tax Commission for businesses to report their personal property for tax purposes. This form is essential for accurately assessing the value of a business's personal property, which includes items such as machinery, equipment, furniture, and fixtures. By submitting this form, businesses ensure they comply with state tax regulations and contribute to local tax revenues.

How to Use the Oklahoma Form 901 Business Personal Property Rendition

To effectively use the Oklahoma Form 901, businesses must gather all necessary information regarding their personal property. This includes details about the type of property, its location, and its estimated value. Once the information is compiled, it can be entered into the form. Businesses can fill out the form electronically using digital tools, which streamline the process and enhance accuracy. After completing the form, it must be submitted to the appropriate local county assessor's office.

Steps to Complete the Oklahoma Form 901 Business Personal Property Rendition

Completing the Oklahoma Form 901 involves several key steps:

- Gather necessary documentation and details about all personal property owned by the business.

- Access the Oklahoma Form 901, which can be found on the Oklahoma Tax Commission website or through local county offices.

- Fill in the required fields, ensuring accuracy in reporting the type and value of each item.

- Review the completed form for any errors or omissions.

- Submit the form electronically or via mail to the local county assessor’s office by the designated deadline.

Legal Use of the Oklahoma Form 901 Business Personal Property Rendition

The Oklahoma Form 901 is legally binding, and its accurate completion is crucial for compliance with state tax laws. The information provided on this form is used by local governments to assess property taxes. Failure to submit the form or providing inaccurate information can lead to penalties and fines. Therefore, it is essential for businesses to understand the legal implications of their submissions and to ensure that all information is truthful and complete.

Filing Deadlines for the Oklahoma Form 901 Business Personal Property Rendition

Businesses must be aware of the filing deadlines associated with the Oklahoma Form 901. Typically, the form is due on or before March 15 of each year. Timely submission is critical to avoid late penalties. If a business fails to file by the deadline, they may incur additional fees or face penalties that could impact their overall tax liability.

Penalties for Non-Compliance with the Oklahoma Form 901

Non-compliance with the Oklahoma Form 901 can result in significant penalties. If a business fails to submit the form by the deadline, they may face a penalty of up to ten percent of the assessed value of the property. Additionally, inaccurate reporting can lead to further scrutiny from tax authorities and potential fines. It is vital for businesses to prioritize the accurate and timely completion of this form to avoid such consequences.

Quick guide on how to complete oklahomagovcontentdam2023 form 901 business personal property rendition oklahoma

Effortlessly prepare Oklahoma govcontentdam2023 Form 901 Business Personal Property Rendition Oklahoma on any device

Digital document management has gained traction among companies and individuals. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, as you can locate the right template and securely keep it online. airSlate SignNow equips you with all the resources necessary to swiftly create, modify, and eSign your documents without any delays. Manage Oklahoma govcontentdam2023 Form 901 Business Personal Property Rendition Oklahoma on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Oklahoma govcontentdam2023 Form 901 Business Personal Property Rendition Oklahoma effortlessly

- Obtain Oklahoma govcontentdam2023 Form 901 Business Personal Property Rendition Oklahoma and click Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or conceal sensitive data with specialized tools provided by airSlate SignNow.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal authority as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow satisfies your document management requirements in just a few clicks from any device you choose. Alter and eSign Oklahoma govcontentdam2023 Form 901 Business Personal Property Rendition Oklahoma while ensuring exceptional communication at any point in your form preparation procedure with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct oklahomagovcontentdam2023 form 901 business personal property rendition oklahoma

Create this form in 5 minutes!

People also ask

-

What is Oklahoma 901 2021 and how does it relate to airSlate SignNow?

Oklahoma 901 2021 refers to specific regulations and amendments that impact eSigning practices in the state. With airSlate SignNow, you can ensure your document processes comply with Oklahoma 901 2021 by utilizing compliant digital signatures. Our platform simplifies the eSigning process while adhering to local laws and regulations.

-

How much does airSlate SignNow cost for users in relation to Oklahoma 901 2021?

airSlate SignNow offers several pricing plans suitable for businesses in Oklahoma, ensuring compliance with Oklahoma 901 2021. Our competitive pricing allows you to choose a plan that fits your needs and budget while taking advantage of our secure eSigning features. Explore our website for detailed pricing information tailored to your business needs.

-

What features does airSlate SignNow offer to assist with Oklahoma 901 2021 compliance?

AirSlate SignNow includes features such as legally binding eSignatures and automated workflows that comply with Oklahoma 901 2021. These features help streamline your document processes while ensuring that you meet all local legal requirements. Our user-friendly interface makes it easy to manage and send documents securely.

-

Are there any benefits of using airSlate SignNow for businesses in Oklahoma in light of the 901 2021 regulations?

Yes, using airSlate SignNow can greatly benefit businesses in Oklahoma with compliance to 901 2021 regulations. Our platform enhances operational efficiency, reduces turnaround times, and ensures legal conformity for your eSigned documents. Additionally, our secure technology protects sensitive information throughout the signing process.

-

Can I integrate airSlate SignNow with other applications while being compliant with Oklahoma 901 2021?

Absolutely! airSlate SignNow supports numerous integrations with popular applications which can help streamline your workflow while complying with Oklahoma 901 2021. Whether it’s CRM systems or document management tools, our seamless integrations enhance productivity while upholding necessary compliance standards.

-

Is airSlate SignNow user-friendly for those unfamiliar with Oklahoma 901 2021 regulations?

Yes, airSlate SignNow is designed to be highly user-friendly, making it accessible to anyone, regardless of their familiarity with Oklahoma 901 2021 regulations. Our platform provides intuitive navigation and resources that clarify legal requirements related to eSigning. You can quickly get up to speed and start signing documents securely.

-

What support does airSlate SignNow provide to help with Oklahoma 901 2021 inquiries?

Our customer support team is always available to help with any inquiries you may have regarding Oklahoma 901 2021. We offer comprehensive resources, including FAQs, tutorial videos, and direct assistance from our staff to ensure you fully understand compliance. With airSlate SignNow, you’re never alone in navigating eSigning requirements.

Get more for Oklahoma govcontentdam2023 Form 901 Business Personal Property Rendition Oklahoma

- Financing form ucc

- Mississippi ucc1 financing statement addendum mississippi form

- Mississippi ucc3 financing statement mississippi form

- Ucc3 financing statement amendment form

- Legal last will and testament form for single person with no children mississippi

- Legal last will and testament form for a single person with minor children mississippi

- Legal last will and testament form for single person with adult and minor children mississippi

- Legal last will and testament form for single person with adult children mississippi

Find out other Oklahoma govcontentdam2023 Form 901 Business Personal Property Rendition Oklahoma

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure