Irs 8915 C 2019

What is the IRS 8915 C?

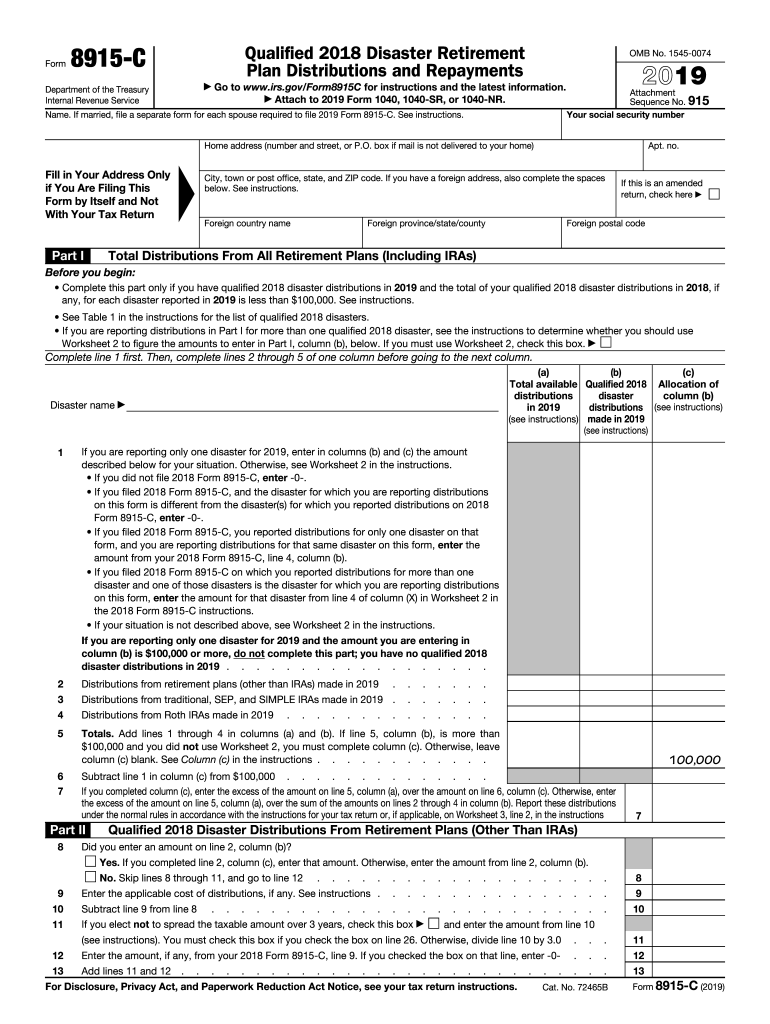

The IRS 8915 C form is used to report distributions from retirement plans that qualify for repayment under the Coronavirus Aid, Relief, and Economic Security (CARES) Act. This form allows taxpayers to spread the income tax on these distributions over three years, providing financial relief during challenging times. It is essential for individuals who took a distribution from eligible retirement accounts due to the COVID-19 pandemic to understand how to properly complete and submit this form.

How to Obtain the IRS 8915 C

To obtain the IRS 8915 C form, taxpayers can visit the official IRS website, where the form is available for download. It can also be found in tax preparation software that supports IRS forms. Additionally, taxpayers may request a physical copy from tax professionals or local IRS offices. Ensuring you have the most current version of the form is crucial for accurate reporting.

Steps to Complete the IRS 8915 C

Completing the IRS 8915 C involves several key steps:

- Gather necessary information, including the amount of the distribution and the date it was taken.

- Fill out the form by providing personal information, such as your name, Social Security number, and details about the distribution.

- Indicate the amount you are repaying, if applicable, and calculate the taxable income for the year.

- Review the completed form for accuracy before submission.

Legal Use of the IRS 8915 C

The IRS 8915 C form is legally recognized as a valid method for reporting distributions from retirement accounts. To ensure compliance, taxpayers must adhere to IRS guidelines regarding eligibility and repayment terms. Using a reliable electronic signature platform can enhance the legal validity of the completed form, ensuring that it meets all necessary requirements for submission.

Filing Deadlines / Important Dates

Taxpayers should be aware of the filing deadlines associated with the IRS 8915 C. Typically, the form must be submitted along with your annual tax return by the usual tax filing deadline, which is usually April 15. It is important to stay informed about any extensions or changes to deadlines, especially during tax season, to avoid penalties.

Eligibility Criteria

Eligibility for using the IRS 8915 C form primarily revolves around having taken a distribution from an eligible retirement plan due to the impact of COVID-19. Taxpayers must meet specific criteria set forth by the IRS, including the amount of the distribution and the reason for taking it. Understanding these criteria is essential for proper form completion and to ensure that the taxpayer benefits from the available tax relief options.

Quick guide on how to complete irs 8915 c

Complete Irs 8915 C effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly and efficiently. Administer Irs 8915 C on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

The easiest way to modify and eSign Irs 8915 C seamlessly

- Obtain Irs 8915 C and then click Get Form to begin.

- Utilize the tools we offer to submit your document.

- Emphasize key parts of the documents or redact sensitive information with tools specifically provided by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing additional document copies. airSlate SignNow addresses your document management needs in a few clicks from your chosen device. Modify and eSign Irs 8915 C and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs 8915 c

Create this form in 5 minutes!

How to create an eSignature for the irs 8915 c

The best way to make an eSignature for a PDF online

The best way to make an eSignature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

How to generate an eSignature straight from your smartphone

How to make an eSignature for a PDF on iOS

How to generate an eSignature for a PDF document on Android

People also ask

-

What is the Form 8915 C and why is it important?

The Form 8915 C is a tax form used to report repayments of COVID-19-related distributions from retirement plans. Understanding its importance is crucial for accurate tax reporting and compliance. Using the form correctly can help you avoid penalties and ensure that your tax obligations are met in a timely manner.

-

How can airSlate SignNow help with my Form 8915 C submissions?

airSlate SignNow allows you to easily create, fill out, and eSign documents, including the Form 8915 C. Our platform streamlines the submission process and ensures that all necessary signatures are obtained promptly. This efficiency saves time and enhances the accuracy of your tax reporting.

-

Is there a cost associated with using airSlate SignNow for Form 8915 C?

Yes, airSlate SignNow offers a cost-effective solution with various pricing plans to fit your business needs. The plans are designed to accommodate different user requirements, ensuring that you can efficiently manage your Form 8915 C submissions without breaking the bank. Explore our pricing page to find the plan that suits you best.

-

What features does airSlate SignNow offer for handling the Form 8915 C?

With airSlate SignNow, you can take advantage of features like customizable templates, document tracking, and automated reminders. These tools help ensure your Form 8915 C is completed accurately and submitted on time. Additionally, our user-friendly interface makes the entire process simple and efficient.

-

Can I integrate airSlate SignNow with other software for Form 8915 C processing?

Absolutely! airSlate SignNow offers robust integrations with popular software such as CRMs and accounting platforms. This allows you to easily manage and submit your Form 8915 C alongside other important documents and data, streamlining your workflow across different applications.

-

What benefits does airSlate SignNow provide for businesses filing Form 8915 C?

By using airSlate SignNow for filing your Form 8915 C, businesses can increase efficiency and reduce errors. Our platform ensures secure and compliant handling of your documents, while also facilitating quick signatures. This translates to faster submissions and peace of mind when it comes to managing tax responsibilities.

-

Is airSlate SignNow secure for sensitive documents like Form 8915 C?

Yes, airSlate SignNow prioritizes the security of your documents. We utilize industry-standard encryption and compliance protocols to protect sensitive information when handling Form 8915 C and other documents. This commitment to security helps to ensure that your data is safe throughout the signing process.

Get more for Irs 8915 C

- Section 8 rta packet form

- Old gold formation of elements answer key

- Rf12 form download

- English file beginner tests form

- Interior design project proposal form

- Pre enrollment grant application nyc gov nyc form

- De 351gc 101 order appointing guardian ad litem probate form

- Disc 015 request for statement of witnesses and evidencefor limited civil cases under 35000 judicial council forms

Find out other Irs 8915 C

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document

- How Do I eSign Indiana Car Dealer Document

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form