Form 8915 F Rev January 2023-2026

What is the Form 8915 F Rev January

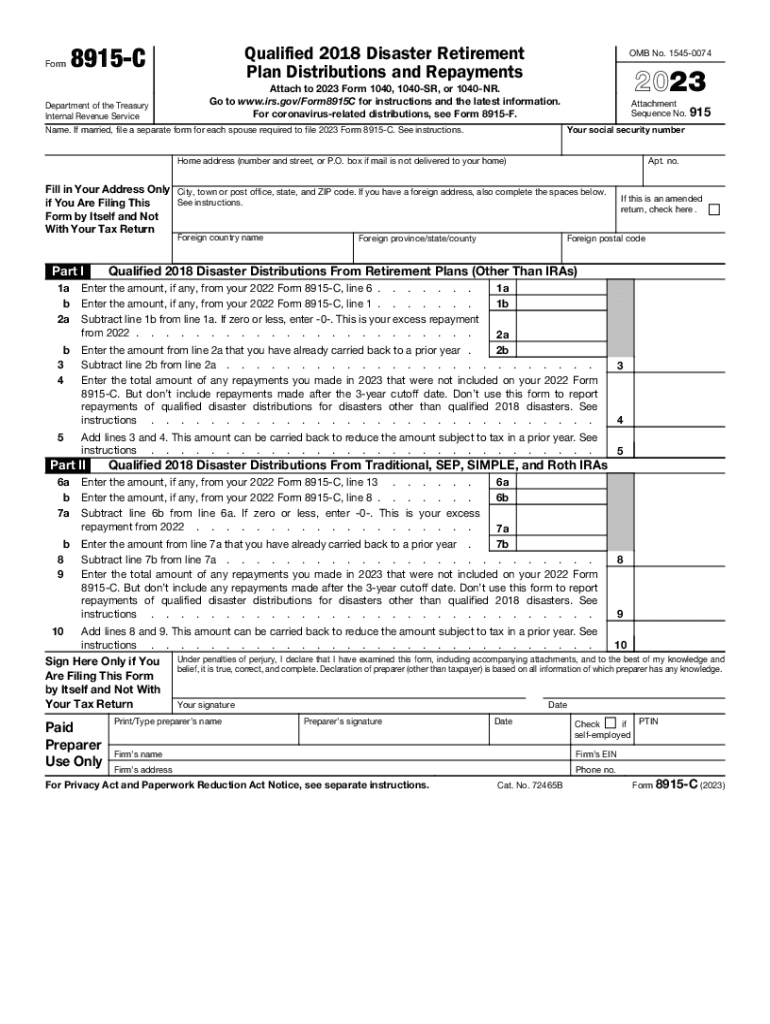

The Form 8915 F is a tax form used by individuals to report distributions from retirement plans that qualify for a special tax treatment under the Internal Revenue Code. This form is specifically designed for those who have taken distributions from their retirement accounts due to the COVID-19 pandemic. The IRS introduced this form to help taxpayers accurately report these distributions and calculate any taxes owed on them.

How to use the Form 8915 F Rev January

To use the Form 8915 F, taxpayers must first determine if they are eligible to report distributions from their retirement accounts. Once eligibility is confirmed, the form must be filled out with accurate information regarding the amount of the distribution, the type of retirement account, and any amounts that may qualify for tax relief. The completed form is then submitted with the taxpayer's annual income tax return.

Steps to complete the Form 8915 F Rev January

Completing the Form 8915 F involves several key steps:

- Gather necessary documentation, including details of the retirement account and the distribution amount.

- Enter personal information, such as name, address, and Social Security number at the top of the form.

- Report the total distribution amount in the appropriate section of the form.

- Calculate any amounts that may be eligible for tax relief, following the IRS guidelines.

- Review the form for accuracy before submission.

Filing Deadlines / Important Dates

Taxpayers must be aware of specific deadlines when submitting the Form 8915 F. Generally, the form should be filed along with the annual tax return, which is typically due on April 15 of each year. However, if additional time is needed, taxpayers can file for an extension, but they must still pay any taxes owed by the original deadline to avoid penalties.

Eligibility Criteria

To be eligible to use the Form 8915 F, taxpayers must have taken a distribution from a qualified retirement plan due to the COVID-19 pandemic. This includes distributions from 401(k) plans, IRAs, and other retirement accounts. The distribution must meet specific criteria set by the IRS to qualify for the favorable tax treatment outlined in the form.

IRS Guidelines

The IRS provides comprehensive guidelines on how to complete and file the Form 8915 F. These guidelines include detailed instructions on eligibility, reporting requirements, and how to calculate any tax relief associated with the distributions. It is essential for taxpayers to refer to the latest IRS publications and updates to ensure compliance and accuracy in their filings.

Required Documents

When completing the Form 8915 F, taxpayers should have several documents on hand to ensure accurate reporting. These documents may include:

- Form 1099-R, which reports distributions from retirement plans.

- Documentation of the reason for the distribution, such as proof of financial hardship related to COVID-19.

- Any previous tax returns that may provide context for the current year’s filing.

Quick guide on how to complete form 8915 f rev january

Complete Form 8915 F Rev January smoothly on any device

Online document management has gained signNow traction among businesses and individuals. It offers an excellent environmentally-friendly substitute to conventional printed and signed documents, allowing you to obtain the necessary form and securely preserve it online. airSlate SignNow equips you with all the resources required to create, alter, and eSign your documents quickly and effortlessly. Manage Form 8915 F Rev January on any platform using the airSlate SignNow applications for Android or iOS and streamline any document-related tasks today.

How to modify and eSign Form 8915 F Rev January with ease

- Locate Form 8915 F Rev January and click on Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Emphasize key sections of your documents or redact sensitive information with tools that airSlate SignNow provides for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you prefer to send your form—via email, text message (SMS), an invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors requiring new document prints. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign Form 8915 F Rev January to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8915 f rev january

Create this form in 5 minutes!

How to create an eSignature for the form 8915 f rev january

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8915 f and who needs it?

Form 8915 f is a tax form used by individuals to report disaster-related distributions from retirement plans. If you have received a distribution related to a federally declared disaster area, you will need to fill out form 8915 f to ensure proper tax handling.

-

How can airSlate SignNow help me with form 8915 f?

airSlate SignNow provides a seamless platform to eSign your form 8915 f quickly and securely. Our solution simplifies the signing process, allowing you to collect signatures effortlessly while ensuring your documents meet all necessary compliance requirements.

-

Is airSlate SignNow cost-effective for eSigning form 8915 f?

Yes, airSlate SignNow offers competitive pricing plans that make it a cost-effective solution for eSigning your form 8915 f. Our tiered pricing allows you to choose the best option based on your business's needs, ensuring you only pay for the features you use.

-

Can I integrate airSlate SignNow with other applications to manage form 8915 f?

Absolutely! airSlate SignNow integrates with various applications, making it easier to manage form 8915 f alongside your other business tools. Whether you use CRM software or document management systems, our integrations streamline your workflow.

-

What features does airSlate SignNow offer for handling form 8915 f?

airSlate SignNow offers a range of features for handling form 8915 f, including customizable templates, team collaboration, and advanced security protocols. These features enhance your document workflow, making it easier to complete forms efficiently.

-

Is there a free trial available for airSlate SignNow when using form 8915 f?

Yes, airSlate SignNow provides a free trial so you can explore all features before committing, including the eSigning of form 8915 f. This allows you to evaluate how our platform can meet your document management needs without any financial commitment.

-

What is the process for eSigning form 8915 f with airSlate SignNow?

To eSign form 8915 f with airSlate SignNow, simply upload your document to our platform, add the necessary signers, and send it for signature. The process is quick, and you can track the status to ensure timely completion.

Get more for Form 8915 F Rev January

- Mississippi valley state university transcript request form

- Candidate placement agreement form

- Residence permit application for the spouse of a finnish citizen form

- Indemnity form horse dynamics for a child

- Florida wic form 28259800

- I e shaffer local 102 form

- Fatca hsbc form

- Event vendor agreement template form

Find out other Form 8915 F Rev January

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed