8915 C Form 2020

What is the 8915 C Form

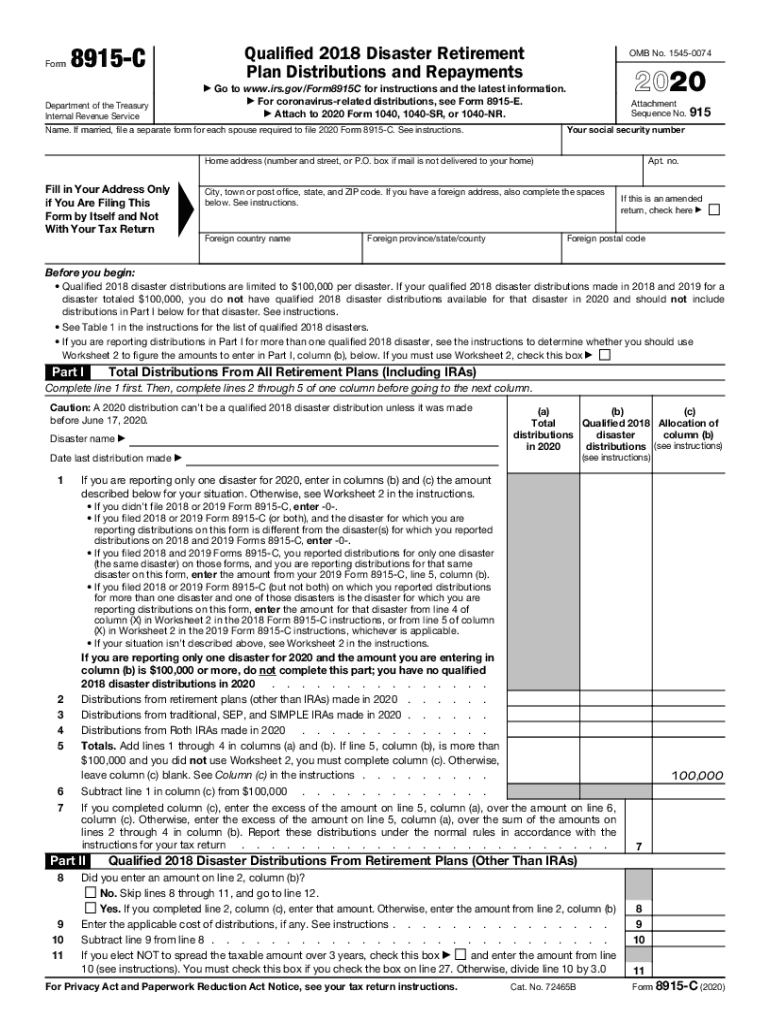

The 8915 C Form, officially known as the 2020 IRS Form 8915 C, is utilized by taxpayers to report repayments of qualified disaster distributions. This form is particularly relevant for individuals who have taken distributions from retirement plans due to federally declared disasters. It helps taxpayers calculate the amount of repayment for such distributions and ensures compliance with IRS regulations. The form is essential for accurately reporting these transactions on your tax return.

How to use the 8915 C Form

Using the 8915 C Form involves several steps to ensure accurate reporting of disaster-related distributions. Taxpayers should first gather relevant information regarding their distributions, including the amounts withdrawn and the dates of the distributions. Next, complete the form by entering the required details, such as the total amount of distributions and repayments. It's crucial to follow the instructions provided with the form to ensure all information is accurately reported. This will help in determining the correct tax implications and any potential refunds.

Steps to complete the 8915 C Form

Completing the 8915 C Form requires careful attention to detail. Here are the steps to follow:

- Gather all necessary documents related to your qualified disaster distributions.

- Begin filling out the form by entering your personal information at the top.

- Report the total amount of distributions received in the appropriate section.

- Detail any repayments made towards those distributions.

- Calculate the taxable amount, if applicable, and ensure all entries are accurate.

- Review the completed form for any errors before submission.

Legal use of the 8915 C Form

The legal use of the 8915 C Form is crucial for ensuring compliance with IRS regulations regarding disaster distributions. The form must be filled out correctly to avoid penalties or issues with tax filings. By using this form, taxpayers can demonstrate their adherence to the rules governing disaster-related withdrawals and repayments. It is important to keep copies of the completed form and any supporting documentation in case of future inquiries from the IRS.

Filing Deadlines / Important Dates

Understanding filing deadlines for the 8915 C Form is essential for compliance. Typically, the form must be submitted along with your annual tax return. For most taxpayers, this means filing by April 15 of the following year. However, extensions may apply if you file for an extension on your tax return. It is important to stay informed about any changes in deadlines, especially in the context of disaster relief, as the IRS may announce special provisions or extended deadlines in response to specific events.

Eligibility Criteria

To utilize the 8915 C Form, taxpayers must meet specific eligibility criteria. Primarily, the form is intended for individuals who have taken distributions from retirement accounts due to federally declared disasters. Eligibility also includes having made repayments towards those distributions within the designated timeframe set by the IRS. Taxpayers should ensure they meet these criteria to accurately complete the form and avoid any compliance issues.

Quick guide on how to complete 8915 c form

Complete 8915 C Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents promptly without delays. Manage 8915 C Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

The easiest way to modify and eSign 8915 C Form without hassle

- Obtain 8915 C Form and then click Get Form to initiate the process.

- Use the tools provided to fill out your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal significance as a traditional handwritten signature.

- Review the information and then click on the Done button to finalize your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign 8915 C Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 8915 c form

Create this form in 5 minutes!

How to create an eSignature for the 8915 c form

The way to generate an electronic signature for your PDF online

The way to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

How to create an electronic signature from your smartphone

The best way to make an electronic signature for a PDF on iOS

How to create an electronic signature for a PDF file on Android

People also ask

-

What is the 8915 c retirement form and why is it important?

The 8915 c retirement form is essential for individuals who need to report distributions from retirement plans and how they choose to pay taxes on them. Understanding this form can help you navigate tax obligations effectively, especially during your 8915 c retirement planning.

-

How does airSlate SignNow simplify the signing process for the 8915 c retirement form?

airSlate SignNow offers a seamless eSigning experience that simplifies the process of signing the 8915 c retirement form. With an intuitive interface, you can quickly send out your form for electronic signature, saving time and ensuring accuracy.

-

What features does airSlate SignNow provide for 8915 c retirement document management?

airSlate SignNow includes features like template management, real-time tracking, and secure storage, all crucial for managing your 8915 c retirement documents. These features ensure that you can efficiently handle your retirement-related documentation without any hassle.

-

Is there a free trial available for airSlate SignNow to manage my 8915 c retirement documents?

Yes, airSlate SignNow offers a free trial that allows you to explore its features for managing your 8915 c retirement documents. This trial helps you assess the platform's benefits before making any financial commitment.

-

Can I integrate airSlate SignNow with other software for my 8915 c retirement needs?

Absolutely! airSlate SignNow integrates seamlessly with various applications, making it easy to manage documents related to your 8915 c retirement. Whether you are using a CRM or document management system, you can enhance your workflow with these integrations.

-

What are the pricing plans for using airSlate SignNow for the 8915 c retirement process?

airSlate SignNow offers flexible pricing plans that cater to different business sizes and needs for handling 8915 c retirement documents. You can choose a plan that provides the features you need without overspending.

-

How secure is airSlate SignNow for processing 8915 c retirement documents?

Security is a top priority for airSlate SignNow, especially with sensitive documents like the 8915 c retirement form. The platform employs industry-standard encryption and strict compliance with data protection regulations to ensure your information remains safe.

Get more for 8915 C Form

Find out other 8915 C Form

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast

- Sign Indiana Legal Cease And Desist Letter Easy

- Can I Sign Kansas Legal LLC Operating Agreement

- Sign Kansas Legal Cease And Desist Letter Now

- Sign Pennsylvania Insurance Business Plan Template Safe

- Sign Pennsylvania Insurance Contract Safe

- How Do I Sign Louisiana Legal Cease And Desist Letter

- How Can I Sign Kentucky Legal Quitclaim Deed

- Sign Kentucky Legal Cease And Desist Letter Fast

- Sign Maryland Legal Quitclaim Deed Now

- Can I Sign Maine Legal NDA

- How To Sign Maine Legal Warranty Deed

- Sign Maine Legal Last Will And Testament Fast

- How To Sign Maine Legal Quitclaim Deed

- Sign Mississippi Legal Business Plan Template Easy

- How Do I Sign Minnesota Legal Residential Lease Agreement

- Sign South Carolina Insurance Lease Agreement Template Computer