About Form 8915 F, Qualified Disaster Retirement Plan Distributions and 2022

About Form 8915 F: Qualified Disaster Retirement Plan Distributions

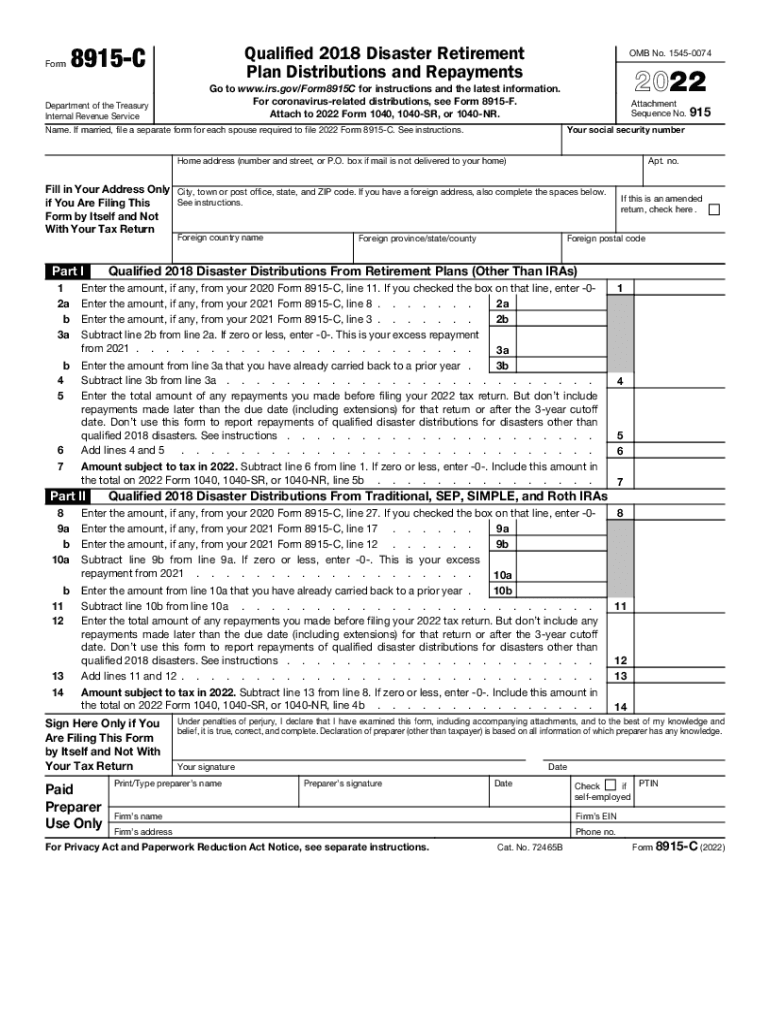

Form 8915 F is a tax form used by individuals to report distributions from retirement plans that are qualified disaster distributions. This form is particularly relevant for taxpayers who have experienced a qualified disaster as defined by the IRS. It allows individuals to take advantage of tax relief provisions that permit them to withdraw funds from their retirement accounts without incurring the usual penalties. The form is essential for ensuring compliance with IRS regulations while potentially reducing the tax burden associated with these distributions.

How to Use Form 8915 F for Qualified Disaster Distributions

To effectively use Form 8915 F, individuals must first determine if their distribution qualifies under the IRS guidelines. This includes confirming that the distribution was made due to a federally declared disaster. Once eligibility is established, taxpayers can fill out the form by providing necessary details about the distribution, including the amount withdrawn and the type of retirement plan involved. It is crucial to follow the instructions carefully to ensure accurate reporting and compliance with tax laws.

Steps to Complete Form 8915 F

Completing Form 8915 F involves several key steps:

- Gather necessary information, including your retirement plan details and the amount of the distribution.

- Indicate the reason for the distribution, ensuring it aligns with the IRS definition of a qualified disaster.

- Fill out the form, ensuring all sections are completed accurately, including personal information and tax identification numbers.

- Review the form for any errors or omissions before submission.

- Submit the completed form with your tax return or as instructed by the IRS.

IRS Guidelines for Form 8915 F

The IRS provides specific guidelines regarding the use of Form 8915 F. These guidelines outline eligibility criteria, reporting requirements, and deadlines for submission. Taxpayers must ensure that they are aware of the latest IRS updates regarding qualified disaster distributions, as these can affect the completion and submission of the form. Staying informed about IRS guidelines helps in avoiding penalties and ensuring that all distributions are reported correctly.

Filing Deadlines for Form 8915 F

Filing deadlines for Form 8915 F typically align with the annual tax return deadlines. For most taxpayers, this means the form should be submitted by April 15 of the following year, unless an extension has been granted. It is important to keep track of any changes in deadlines, especially in the context of disaster relief, as the IRS may adjust timelines based on specific circumstances related to disasters.

Eligibility Criteria for Using Form 8915 F

To be eligible to use Form 8915 F, individuals must meet certain criteria set forth by the IRS. This includes having taken a distribution from a qualified retirement plan due to a federally declared disaster. Additionally, the taxpayer must be able to demonstrate that the distribution was necessary for their financial recovery following the disaster. Understanding these eligibility criteria is essential for ensuring that the form is used correctly and that taxpayers can benefit from the associated tax relief.

Quick guide on how to complete about form 8915 f qualified disaster retirement plan distributions and

Effortlessly Complete About Form 8915 F, Qualified Disaster Retirement Plan Distributions And on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and safely store it online. airSlate SignNow supplies all the necessary tools to create, modify, and eSign your documents swiftly and without delays. Manage About Form 8915 F, Qualified Disaster Retirement Plan Distributions And on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The Easiest Way to Modify and eSign About Form 8915 F, Qualified Disaster Retirement Plan Distributions And Smoothly

- Find About Form 8915 F, Qualified Disaster Retirement Plan Distributions And and click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Select important sections of your documents or hide sensitive information with features that airSlate SignNow provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Alter and eSign About Form 8915 F, Qualified Disaster Retirement Plan Distributions And to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 8915 f qualified disaster retirement plan distributions and

Create this form in 5 minutes!

People also ask

-

What is form 8915 f and why is it important?

Form 8915 f is a tax form used to report distributions from retirement plans and to claim any special tax treatment for them. Understanding how to complete form 8915 f is crucial for ensuring compliance with IRS regulations. Properly filling out this form can also help you maximize your potential tax benefits.

-

How can airSlate SignNow assist with completing form 8915 f?

airSlate SignNow provides an intuitive electronic signature platform that makes it easy to fill out and send form 8915 f securely. With its user-friendly interface, you can quickly complete the form and share it with your tax professional or relevant parties. This streamlines the process and ensures you meet all submission deadlines.

-

Is there a cost associated with using airSlate SignNow for form 8915 f?

Yes, airSlate SignNow offers various pricing plans that cater to businesses of all sizes, making it a cost-effective choice for handling form 8915 f. The pricing is flexible and based on the features you choose, ensuring you only pay for what you need. A free trial is often available for new users to explore the features.

-

What features does airSlate SignNow offer for handling form 8915 f?

airSlate SignNow includes essential features such as eSignatures, document templates, and real-time tracking, which are particularly beneficial for managing form 8915 f. Users can easily customize forms, set signing order, and ensure secure sharing with required stakeholders. This increases efficiency and accuracy in your documentation process.

-

Can I integrate airSlate SignNow with other tools for form 8915 f?

Absolutely! airSlate SignNow seamlessly integrates with various applications, enhancing your capability to manage form 8915 f efficiently. You can connect it with popular tools like Google Drive and Microsoft Office, ensuring a smooth workflow and easy access to your documents within your existing systems.

-

What are the benefits of using airSlate SignNow for form 8915 f?

Using airSlate SignNow for form 8915 f offers signNow benefits such as improved accuracy and enhanced security for your documents. The platform allows for quick electronic signatures, eliminating the need for paper-based processes. This saves time and reduces overhead costs while maintaining compliance with tax regulations.

-

How does airSlate SignNow ensure the security of form 8915 f data?

airSlate SignNow employs industry-leading security protocols, including encryption and secure access, to ensure that all data related to form 8915 f is protected. Compliance with legal standards like HIPAA and GDPR gives users peace of mind regarding their sensitive information. Regular audits further help maintain a secure environment.

Get more for About Form 8915 F, Qualified Disaster Retirement Plan Distributions And

- Ny purchase form

- Home inspection checklist form 497321113

- Sellers information for appraiser provided to buyer new york

- Subcontractors agreement new york form

- Option to purchase addendum to residential lease lease or rent to own new york form

- New york prenuptial premarital agreement with financial statements new york form

- Ny financial form

- Or a major accident with a zipcar form

Find out other About Form 8915 F, Qualified Disaster Retirement Plan Distributions And

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word