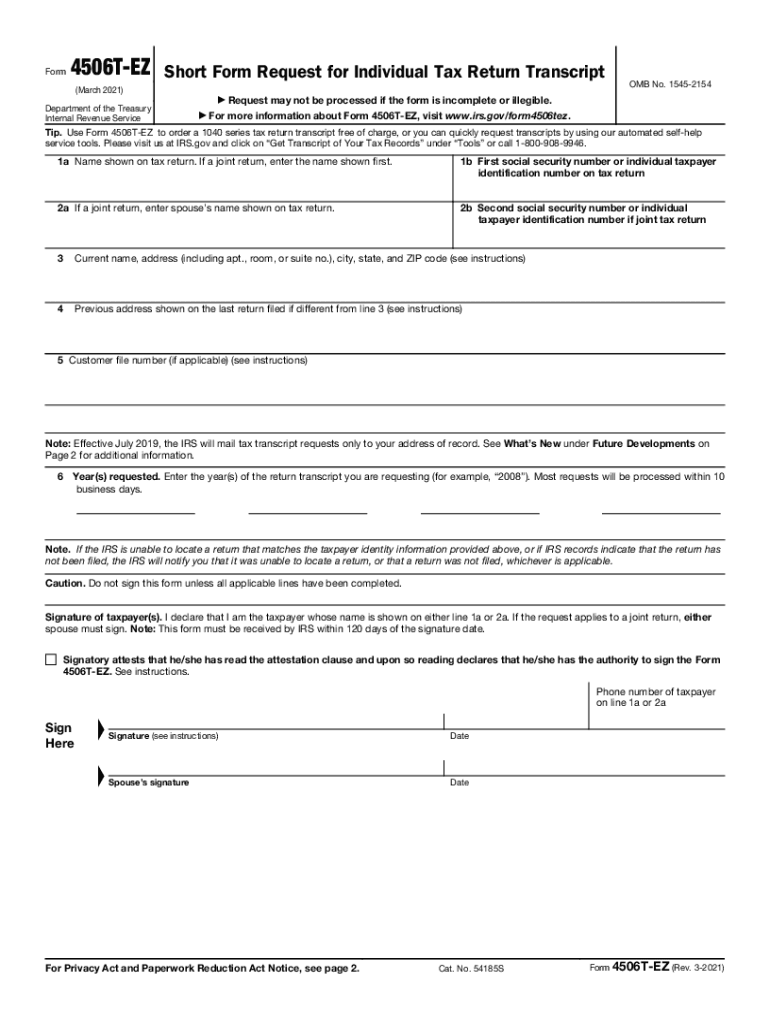

About Form 4506 T EZ, Short Form Request for Individual Tax

Understanding the 1040NR Transcript Form

The 1040NR transcript form is essential for non-resident aliens in the United States who need to request a transcript of their tax return information. This form provides a summary of the tax return filed with the IRS, including details on income, deductions, and credits. It is particularly useful for individuals who may need to verify their income for various purposes, such as applying for loans or other financial assistance.

Steps to Complete the 1040NR Transcript Form

Filling out the 1040NR transcript form requires careful attention to detail. Here are the steps to complete it:

- Obtain the form from the IRS website or through your tax professional.

- Fill in your personal information, including your name, address, and Social Security number or Individual Taxpayer Identification Number (ITIN).

- Indicate the tax year for which you are requesting the transcript.

- Specify the type of transcript you need, such as a tax return transcript or a record of account.

- Sign and date the form before submitting it to ensure its validity.

Legal Use of the 1040NR Transcript Form

The 1040NR transcript form serves a legal purpose, allowing individuals to obtain a record of their tax filings. It can be used for various legal and financial situations, such as applying for loans, verifying income for immigration purposes, or resolving disputes with the IRS. Ensuring that the form is completed accurately and submitted correctly is crucial for its acceptance in legal matters.

IRS Guidelines for the 1040NR Transcript Form

The IRS provides specific guidelines regarding the use and submission of the 1040NR transcript form. It is important to adhere to these guidelines to avoid delays or issues with your request. The IRS typically processes transcript requests within ten business days. Additionally, individuals should be aware of any identification requirements, such as providing a valid form of ID when submitting the request.

Form Submission Methods

The 1040NR transcript form can be submitted through various methods to accommodate different preferences. Individuals can choose to submit their requests online through the IRS website, by mail, or in person at designated IRS offices. Each method has its own processing times and requirements, so it is advisable to select the one that best fits your needs.

Required Documents for the 1040NR Transcript Form

When completing the 1040NR transcript form, certain documents may be required to support your request. This includes a valid form of identification, such as a driver's license or passport, and any relevant tax documents from the year you are requesting. Having these documents ready can streamline the process and ensure that your request is processed efficiently.

Quick guide on how to complete about form 4506 t ez short form request for individual tax

Effortlessly Prepare About Form 4506 T EZ, Short Form Request For Individual Tax on Any Device

Digital document management has gained traction among businesses and individuals. It offers a perfect eco-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to swiftly create, modify, and eSign your documents without delays. Manage About Form 4506 T EZ, Short Form Request For Individual Tax on any device using airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to Adjust and eSign About Form 4506 T EZ, Short Form Request For Individual Tax with Ease

- Locate About Form 4506 T EZ, Short Form Request For Individual Tax and click Get Form to commence.

- Utilize the available tools to complete your document.

- Highlight pertinent sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all details and click on the Done button to save your modifications.

- Choose your preferred method for sharing your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any selected device. Edit and eSign About Form 4506 T EZ, Short Form Request For Individual Tax and ensure outstanding communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the about form 4506 t ez short form request for individual tax

How to make an eSignature for a PDF file online

How to make an eSignature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

How to create an eSignature straight from your mobile device

The best way to make an eSignature for a PDF file on iOS

How to create an eSignature for a PDF document on Android devices

People also ask

-

What is the 1040nr transcript form and who needs it?

The 1040nr transcript form is a record of an individual's non-resident tax return, used primarily by international students or non-residents in the U.S. It provides essential information for tax filings and financial applications. Understanding this form is critical for anyone needing accurate tax documentation.

-

How does airSlate SignNow assist with the 1040nr transcript form?

airSlate SignNow helps streamline the process of completing and signing the 1040nr transcript form. With our user-friendly interface, you can easily upload, manage, and eSign the necessary documents online. This efficiency saves you time and minimizes the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the 1040nr transcript form?

Yes, airSlate SignNow offers various pricing plans to ensure that businesses of all sizes can effectively use our platform. Our plans are cost-effective and tailored to meet diverse needs, ensuring you get the best value for managing your 1040nr transcript form.

-

What features does airSlate SignNow provide for handling the 1040nr transcript form?

airSlate SignNow includes robust features such as eSigning, document templates, and secure cloud storage. These tools enhance your experience when managing the 1040nr transcript form, ensuring that your documents are both easily accessible and securely stored.

-

Can I integrate airSlate SignNow with other applications for my 1040nr transcript form?

Absolutely! airSlate SignNow offers seamless integrations with various business tools, allowing you to manage your 1040nr transcript form alongside your existing systems. This helps enhance productivity and ensures you can access everything from one central platform.

-

What are the benefits of using airSlate SignNow for the 1040nr transcript form?

Using airSlate SignNow for your 1040nr transcript form provides numerous benefits, including time savings, ease of use, and enhanced security. Our platform simplifies the eSigning process, allowing for faster turnaround times and helping you stay compliant with tax regulations.

-

Is airSlate SignNow secure for submitting the 1040nr transcript form?

Yes, security is a top priority at airSlate SignNow. We implement industry-standard encryption and security protocols to protect your sensitive information when submitting the 1040nr transcript form. You can trust that your data is safe with us.

Get more for About Form 4506 T EZ, Short Form Request For Individual Tax

Find out other About Form 4506 T EZ, Short Form Request For Individual Tax

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now