Additional Filing Requirements Economic Injury Disaster Loan and Military Reservist Economic Injury Disaster Loan Form

What is the Additional Filing Requirements for Economic Injury Disaster Loan?

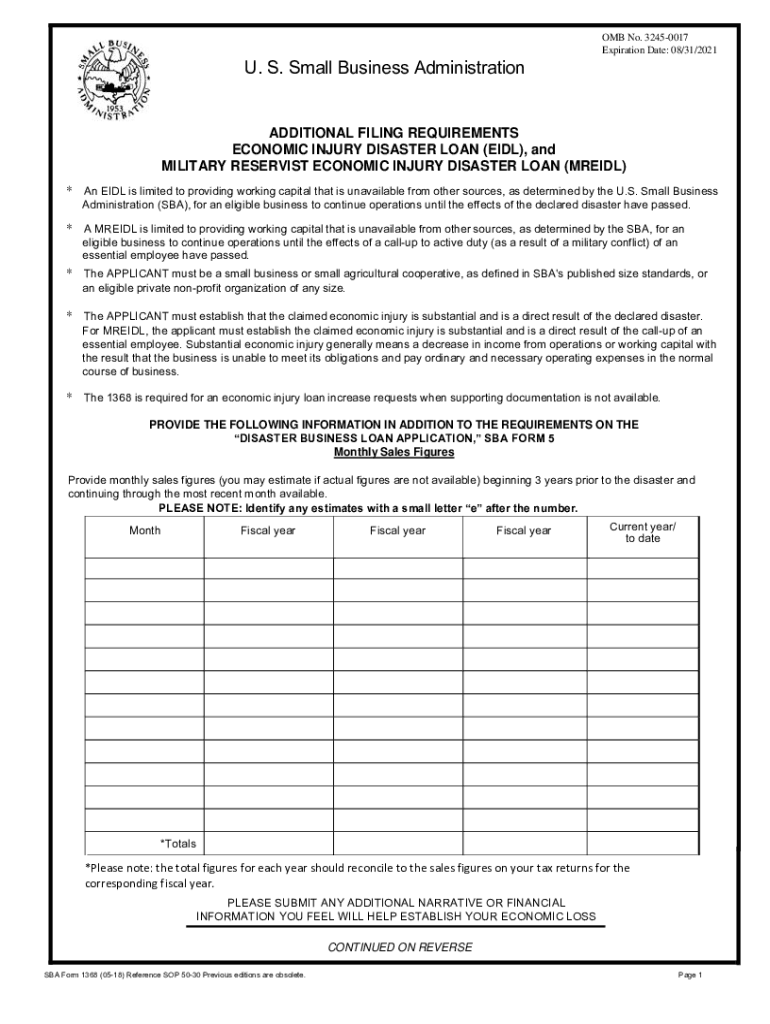

The Additional Filing Requirements for the Economic Injury Disaster Loan (EIDL) are specific documents and information that applicants must provide to demonstrate their eligibility for the program. This loan is designed to assist businesses that have suffered substantial economic loss due to disasters, including the COVID-19 pandemic. The requirements may include financial statements, tax returns, and detailed descriptions of the economic impact on the business. Understanding these requirements is crucial for a successful application process.

Steps to Complete the Additional Filing Requirements for Economic Injury Disaster Loan

Completing the Additional Filing Requirements for the Economic Injury Disaster Loan involves several key steps:

- Gather necessary documentation, including financial statements and tax returns.

- Provide a clear narrative explaining the economic impact of the disaster on your business.

- Fill out the required forms accurately, ensuring all information is current and complete.

- Review your application for any missing information or errors.

- Submit the application through the designated method, whether online or via mail.

Following these steps carefully can enhance the chances of approval for the EIDL.

Eligibility Criteria for Economic Injury Disaster Loan

To qualify for the Economic Injury Disaster Loan, applicants must meet specific eligibility criteria. Generally, the business must be located in a declared disaster area and have suffered substantial economic injury as a result of the disaster. Eligible businesses include small businesses, cooperatives, and certain private non-profit organizations. Additionally, the business must be able to demonstrate its ability to repay the loan. Understanding these criteria is essential before applying.

Required Documents for Economic Injury Disaster Loan

When applying for the Economic Injury Disaster Loan, applicants must submit various documents to support their application. Commonly required documents include:

- Personal and business tax returns for the last three years.

- Financial statements, including balance sheets and profit and loss statements.

- Business licenses and permits.

- Details of any other funding received related to the disaster.

- Statements regarding the number of employees and business structure.

Providing complete and accurate documentation is vital for a smooth review process.

Application Process & Approval Time for Economic Injury Disaster Loan

The application process for the Economic Injury Disaster Loan involves several stages. Initially, applicants must fill out the EIDL application form, providing all necessary information and documentation. Once submitted, the application will be reviewed by the Small Business Administration (SBA). Approval times can vary based on the volume of applications and the completeness of the submitted information. Typically, applicants can expect a response within a few weeks, but delays may occur during peak periods.

Legal Use of the Additional Filing Requirements for Economic Injury Disaster Loan

The legal use of the Additional Filing Requirements for the Economic Injury Disaster Loan is governed by federal regulations established by the SBA. These requirements ensure that applicants provide truthful and accurate information regarding their business and the economic impact of the disaster. Misrepresentation or failure to comply with these requirements can result in penalties, including denial of the loan or legal action. Therefore, understanding and adhering to these legal stipulations is crucial for applicants.

Quick guide on how to complete additional filing requirements economic injury disaster loan and military reservist economic injury disaster loan

Prepare Additional Filing Requirements Economic Injury Disaster Loan And Military Reservist Economic Injury Disaster Loan effortlessly on any gadget

Digital document administration has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Additional Filing Requirements Economic Injury Disaster Loan And Military Reservist Economic Injury Disaster Loan on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to alter and eSign Additional Filing Requirements Economic Injury Disaster Loan And Military Reservist Economic Injury Disaster Loan with ease

- Find Additional Filing Requirements Economic Injury Disaster Loan And Military Reservist Economic Injury Disaster Loan and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal authenticity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you would like to submit your form, via email, text message (SMS), invitation link, or download it to your computer.

Put an end to missing or lost documents, tedious form searching, or errors requiring new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any gadget you prefer. Modify and eSign Additional Filing Requirements Economic Injury Disaster Loan And Military Reservist Economic Injury Disaster Loan and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the additional filing requirements economic injury disaster loan and military reservist economic injury disaster loan

The best way to generate an eSignature for a PDF document online

The best way to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The way to create an eSignature from your smart phone

How to create an eSignature for a PDF document on iOS

The way to create an eSignature for a PDF file on Android OS

People also ask

-

What is the SBA Form 1368 and why is it important?

The SBA Form 1368 is a key document required for businesses seeking financial assistance from the Small Business Administration. It helps provide a clear understanding of the monthly operating costs, which is essential for loan applications. Using airSlate SignNow can expedite the signing process of your SBA Form 1368, making it easier to submit applications swiftly.

-

How does airSlate SignNow help with filling out the SBA Form 1368?

airSlate SignNow offers an intuitive platform that allows you to easily upload and fill out the SBA Form 1368 electronically. With its user-friendly interface, you can quickly complete the form and ensure that all necessary information is accurately captured. This can save you time and minimize errors in your application.

-

Can I track the status of my SBA Form 1368 once sent through airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking capabilities for any document sent, including the SBA Form 1368. You will receive notifications as the document is viewed and signed, allowing you to stay informed on the progress of your application. This transparency helps streamline communication with your recipients.

-

Is there an integration available for managing the SBA Form 1368 with airSlate SignNow?

airSlate SignNow seamlessly integrates with various platforms, including CRM and document management systems, making it easier to manage your SBA Form 1368. By integrating with your existing tools, you can automate workflows and ensure that all necessary documents are in sync. This enhances your overall efficiency in handling loan applications.

-

What are the pricing options for using airSlate SignNow for the SBA Form 1368?

airSlate SignNow offers several pricing plans designed to accommodate businesses of all sizes, making it cost-effective for managing documents like the SBA Form 1368. Choose from a monthly or annual subscription that fits your budget and needs. Each plan provides access to essential features that streamline the signing process.

-

Are there any security features when using airSlate SignNow for my SBA Form 1368?

Absolutely! airSlate SignNow prioritizes the security of your documents, including the SBA Form 1368. The platform utilizes encryption, secure access controls, and compliance with industry standards to protect sensitive information, giving you peace of mind while you manage your applications.

-

Can I customize the SBA Form 1368 through airSlate SignNow?

Yes, airSlate SignNow allows for customization of the SBA Form 1368, enabling you to add fields, company branding, and specific instructions. This way, you can tailor the document to meet your unique business requirements. Customization improves clarity and ensures that recipients understand their signing obligations.

Get more for Additional Filing Requirements Economic Injury Disaster Loan And Military Reservist Economic Injury Disaster Loan

Find out other Additional Filing Requirements Economic Injury Disaster Loan And Military Reservist Economic Injury Disaster Loan

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document