Colorado Tax Form Dr 0204

What is the Colorado Tax Form DR 0204

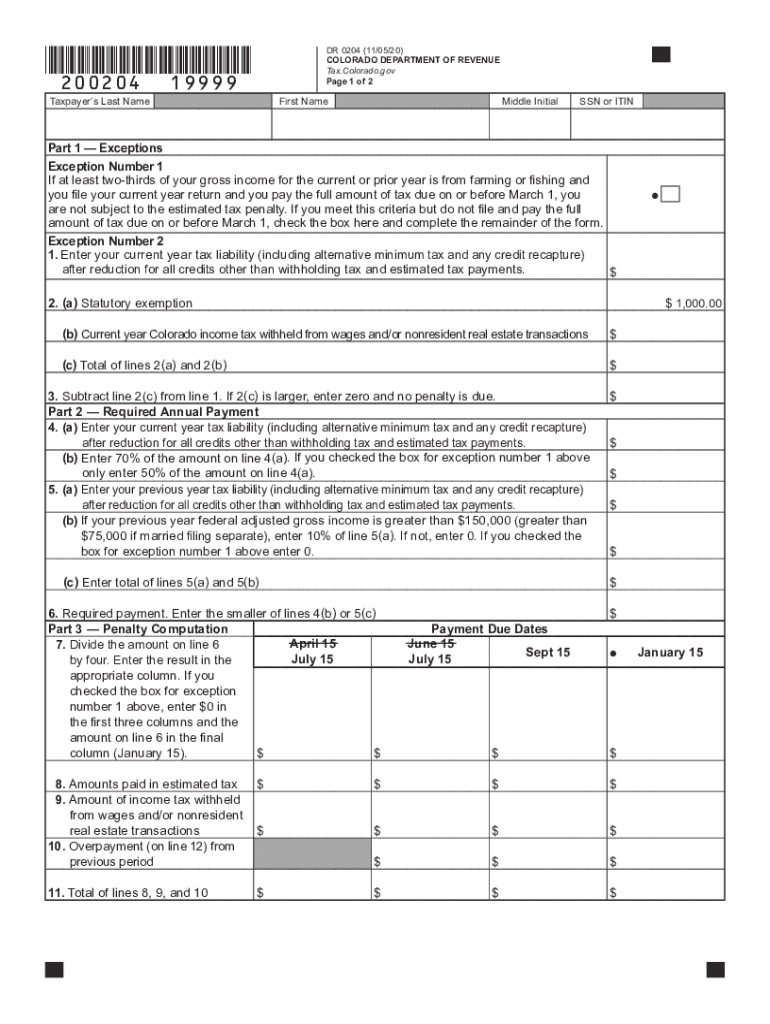

The Colorado Tax Form DR 0204 is specifically designed for individuals and businesses to report estimated tax payments. This form is crucial for taxpayers who expect to owe tax of $1,000 or more when filing their annual return. It allows for the calculation of estimated tax payments to be made throughout the year, ensuring compliance with state tax obligations.

How to use the Colorado Tax Form DR 0204

To effectively use the DR 0204 form, taxpayers should first gather relevant financial information, including income, deductions, and credits. This data will help in accurately estimating the tax liability. The form requires taxpayers to input their expected income and calculate the estimated tax due for the year. Once completed, the form can be submitted along with the estimated payments to the Colorado Department of Revenue.

Steps to complete the Colorado Tax Form DR 0204

Completing the DR 0204 involves several key steps:

- Gather necessary documents, including prior year tax returns and income statements.

- Fill in personal information, including your name, address, and Social Security number.

- Estimate your total income for the year, considering all sources of income.

- Calculate your estimated tax liability using the provided tax rates and tables.

- Determine the amount of estimated tax payments you need to make for the year.

- Review the completed form for accuracy before submission.

Legal use of the Colorado Tax Form DR 0204

The DR 0204 form is legally recognized by the Colorado Department of Revenue for the purpose of reporting estimated tax payments. To ensure its legality, taxpayers must comply with all relevant state tax laws and regulations. Properly completing and submitting this form helps avoid penalties and ensures that taxpayers meet their financial obligations to the state.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the DR 0204 form. Estimated tax payments are typically due on the 15th of April, June, September, and January of the following year. Missing these deadlines can result in penalties and interest charges, making timely submission crucial for compliance.

Penalties for Non-Compliance

Failure to file the DR 0204 form or to make the required estimated tax payments can lead to significant penalties. The Colorado Department of Revenue may impose fines based on the amount owed and the duration of the non-compliance. Understanding these penalties can help motivate timely and accurate filing.

Quick guide on how to complete colorado 2020 tax form dr 0204

Complete Colorado Tax Form Dr 0204 effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documentation, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents quickly without delays. Handle Colorado Tax Form Dr 0204 on any platform using airSlate SignNow applications for Android or iOS and streamline your document-related tasks today.

How to modify and electronically sign Colorado Tax Form Dr 0204 with ease

- Locate Colorado Tax Form Dr 0204 and click Get Form to initiate the process.

- Use the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign function, which takes only seconds and holds the same legal standing as a conventional wet ink signature.

- Review the details and hit the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or an invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets all of your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Colorado Tax Form Dr 0204 to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the colorado 2020 tax form dr 0204

The way to create an electronic signature for your PDF in the online mode

The way to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The way to make an eSignature straight from your smart phone

The best way to create an electronic signature for a PDF on iOS devices

The way to make an eSignature for a PDF document on Android OS

People also ask

-

What is dr 0204 colorado, and how does it relate to airSlate SignNow?

dr 0204 colorado refers to a specific regulation or standard that may influence document management in Colorado. airSlate SignNow helps businesses comply with such regulations by providing a secure platform for e-signatures and document workflows, ensuring that all electronic transactions meet local legal standards.

-

How much does airSlate SignNow cost for users in dr 0204 colorado?

The pricing for airSlate SignNow varies based on the plan you choose, starting from a budget-friendly option to more comprehensive packages. Users in dr 0204 colorado can take advantage of scalable pricing that grows with their business needs, allowing for flexible usage models without breaking the bank.

-

What features does airSlate SignNow offer for businesses in dr 0204 colorado?

airSlate SignNow includes features such as electronic signatures, document templates, real-time collaboration, and advanced security measures. These functionalities are tailored to meet the requirements of businesses operating under dr 0204 colorado, helping streamline their document processes and improve efficiency.

-

How can airSlate SignNow benefit my business under dr 0204 colorado?

Leveraging airSlate SignNow can greatly benefit businesses under dr 0204 colorado by enhancing workflow efficiency, reducing turnaround times, and ensuring all documents are legally binding. Additionally, its user-friendly interface makes it easy for teams to adopt, ultimately leading to increased productivity.

-

Is airSlate SignNow compliant with dr 0204 colorado regulations?

Yes, airSlate SignNow is designed to comply with key regulations, including those associated with dr 0204 colorado. Our platform implements industry-leading security protocols and legal compliance measures to ensure that your documents are handled safely and in accordance with local laws.

-

What integrations does airSlate SignNow offer for users in dr 0204 colorado?

airSlate SignNow offers various integrations with popular business tools such as CRM systems, Google Drive, and Microsoft Office. This seamless integration provides users in dr 0204 colorado the ability to manage their documents efficiently without having to disrupt their existing workflows.

-

Can I try airSlate SignNow before committing under dr 0204 colorado?

Absolutely! airSlate SignNow provides a free trial that allows businesses in dr 0204 colorado to explore its features and benefits before making a commitment. This trial period is a great opportunity to evaluate the platform and see how it fits your organization’s needs.

Get more for Colorado Tax Form Dr 0204

- Pnp flowchart form

- Dividing fractions worksheet form

- Mountain hardwear returns form

- Are we similar answer key form

- Model m 110l microfluidizer processor user manual form

- Pickleball tournament registration form martinsburg berkeley mbcparks rec

- Scholarship bapplicationb chitina native corporation form

- Motorcycle show flyer and registration form milpitaschamber

Find out other Colorado Tax Form Dr 0204

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement