Arizona Form 140

What is the Arizona Form 140

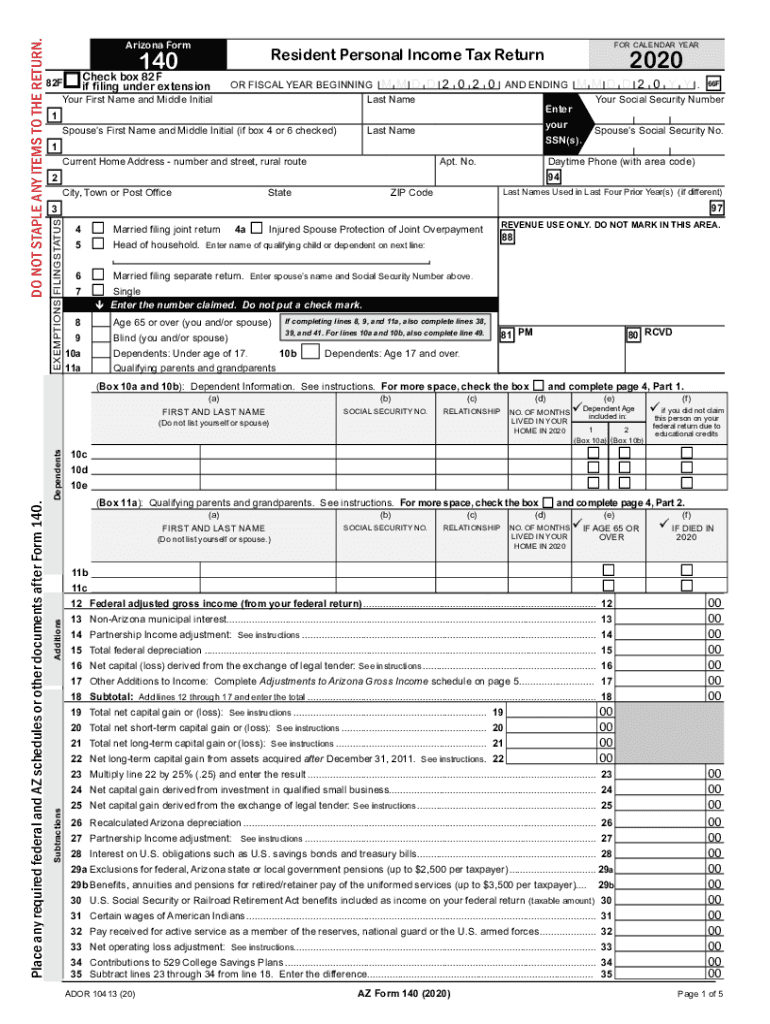

The Arizona Form 140 is the state's primary individual income tax return form. It is designed for residents of Arizona to report their income, claim deductions, and calculate their tax liability for the year. This form is essential for individuals who earn income in Arizona and need to fulfill their tax obligations. The 2020 Arizona Form 140 includes sections for reporting various types of income, such as wages, interest, and dividends. It also allows taxpayers to claim credits and deductions specific to Arizona, which can significantly impact their overall tax liability.

How to complete the Arizona Form 140

Completing the Arizona Form 140 involves several key steps to ensure accuracy and compliance with state tax laws. First, gather all necessary documents, including W-2 forms, 1099s, and any other income statements. Next, fill out the form by providing personal information, including your name, address, and Social Security number. Report your total income, then proceed to calculate your deductions and credits. Be sure to double-check your entries for accuracy. After completing the form, sign and date it before submitting it to the Arizona Department of Revenue.

Filing Deadlines / Important Dates

For the 2020 tax year, the deadline to file the Arizona Form 140 is typically April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial for taxpayers to be aware of these dates to avoid penalties and interest on late filings. Additionally, if you anticipate needing more time, you can file for an extension, but you must still pay any taxes owed by the original deadline to avoid penalties.

Required Documents

When preparing to file the Arizona Form 140, certain documents are essential for accurate reporting. These include:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any deductions or credits you plan to claim

- Proof of health insurance coverage, if applicable

- Any other relevant financial documents

Having these documents on hand will streamline the process of completing your tax return and help ensure that you claim all eligible deductions and credits.

Legal use of the Arizona Form 140

The Arizona Form 140 is legally recognized as a valid document for filing state income taxes. To ensure its legal standing, it must be completed accurately and submitted by the designated deadline. The form must also be signed by the taxpayer or an authorized representative. Utilizing electronic filing methods through secure platforms can enhance the legal validity of your submission, as these methods often provide additional security features and compliance with eSignature regulations.

How to obtain the Arizona Form 140

The Arizona Form 140 can be obtained through various means. It is available for download on the Arizona Department of Revenue's official website, where taxpayers can access the most current version of the form. Additionally, physical copies may be available at local libraries, post offices, and tax assistance centers. For those who prefer digital solutions, many tax preparation software programs also include the Arizona Form 140, allowing for seamless completion and submission.

Quick guide on how to complete arizona form 140

Complete Arizona Form 140 seamlessly on any device

Managing documents online has gained signNow traction among businesses and individuals alike. It offers an excellent eco-friendly substitute to conventional printed and signed papers, allowing you to locate the necessary form and securely archive it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without interruptions. Handle Arizona Form 140 on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to alter and eSign Arizona Form 140 effortlessly

- Locate Arizona Form 140 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive details with tools designed by airSlate SignNow specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Verify the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or mislaid documents, tedious form searching, or errors that require new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Alter and eSign Arizona Form 140 to guarantee exceptional communication throughout the form preparation workflow using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the arizona form 140

The way to create an electronic signature for your PDF document in the online mode

The way to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature right from your mobile device

The best way to create an electronic signature for a PDF document on iOS devices

The way to make an electronic signature for a PDF on Android devices

People also ask

-

What is the 2020 AZ form and why is it important?

The 2020 AZ form is a crucial document for Arizona taxpayers to accurately report their income and determine their state tax obligations. Completing this form correctly ensures compliance with state tax laws and helps avoid potential penalties. Utilizing airSlate SignNow makes it easy to eSign and send your 2020 AZ form securely.

-

How can airSlate SignNow help me with my 2020 AZ form?

airSlate SignNow allows users to fill out, sign, and send their 2020 AZ form electronically, streamlining the filing process. With its intuitive interface, you can easily add signatures, initials, and other required information directly on the form. This not only saves time but ensures that your documents are handled securely.

-

Is there a cost associated with using airSlate SignNow for the 2020 AZ form?

Yes, airSlate SignNow offers various pricing plans to meet different business needs. The plans are designed to be cost-effective and provide excellent value for features like unlimited eSignatures and document storage. You can choose the plan that best fits your budget and requirements for managing the 2020 AZ form.

-

What features does airSlate SignNow offer for completing the 2020 AZ form?

airSlate SignNow provides a range of features such as customizable templates, document sharing, and real-time tracking that enhance the eSigning experience for your 2020 AZ form. Its user-friendly interface allows you to collaborate easily with others, ensuring that all required fields are completed correctly before submission.

-

Can I integrate airSlate SignNow with other applications for handling my 2020 AZ form?

Absolutely! airSlate SignNow offers integrations with various applications such as Google Drive, Dropbox, and more. This allows you to upload and store your 2020 AZ form seamlessly across your preferred platforms, enhancing productivity and organization.

-

How secure is my information when using airSlate SignNow for the 2020 AZ form?

Your security is a top priority at airSlate SignNow. The platform employs industry-standard encryption and compliance measures to protect all your sensitive information, including the details of your 2020 AZ form. You can confidently eSign and share documents knowing your data is safe.

-

Does airSlate SignNow provide customer support for issues related to the 2020 AZ form?

Yes, airSlate SignNow provides robust customer support to assist users with any issues regarding the 2020 AZ form or other services. Their support team is available to help you through every step, ensuring you can effectively use the platform for all your eSigning needs.

Get more for Arizona Form 140

Find out other Arizona Form 140

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later