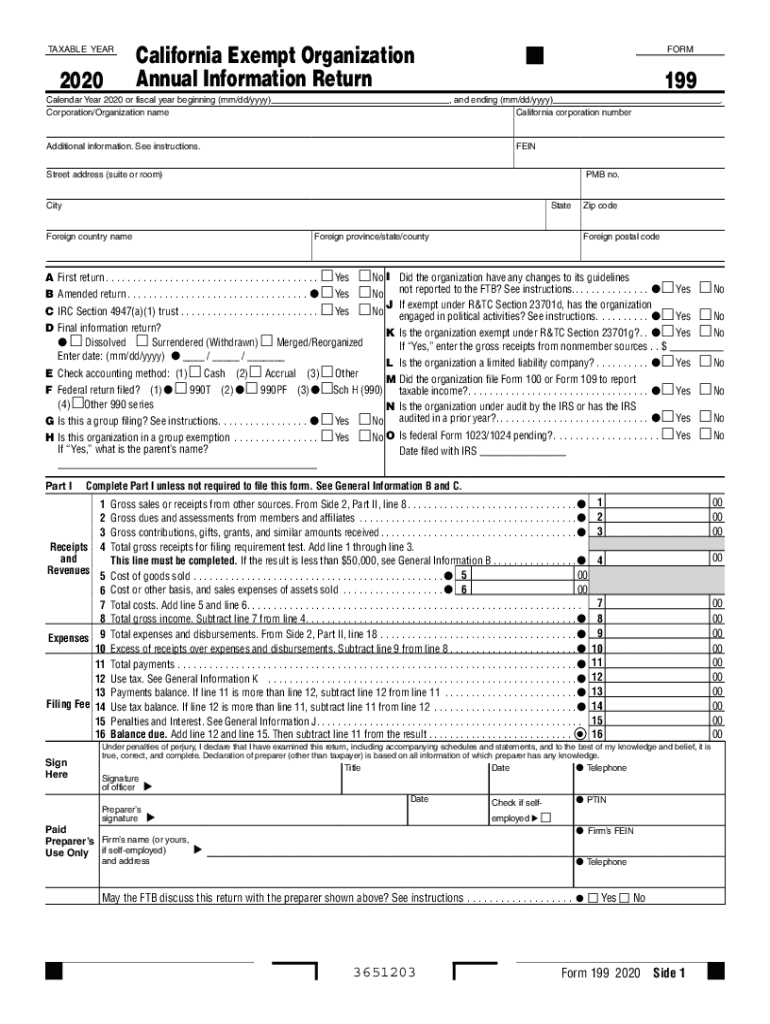

Tax Rates Form

What are the Tax Rates for California 2020?

The tax rates for California in 2020 vary depending on the income level and filing status of the taxpayer. California has a progressive income tax system, which means that individuals with higher incomes pay a higher percentage in taxes. The rates range from one percent to thirteen point three percent, with the lowest rate applying to income up to eight thousand dollars for single filers and up to sixteen thousand dollars for married couples filing jointly. The highest rate applies to income over one million dollars.

How to Use the Tax Rates for California 2020

To effectively use the tax rates for California 2020, taxpayers should first determine their filing status: single, married filing jointly, married filing separately, or head of household. Next, they should calculate their total taxable income, which includes wages, interest, dividends, and other sources of income. Once the taxable income is established, taxpayers can apply the appropriate tax rate based on their income bracket to estimate their state tax liability. Utilizing tax software or consulting with a tax professional can help ensure accuracy in these calculations.

Steps to Complete the Tax Rates Calculation

Completing the tax rates calculation involves several clear steps:

- Determine your filing status.

- Calculate your total income from all sources.

- Subtract any deductions and exemptions to find your taxable income.

- Refer to the California 2020 tax rate schedule to identify your applicable tax bracket.

- Multiply your taxable income by the corresponding tax rate for your bracket.

- Add any additional taxes, such as self-employment tax, if applicable.

Legal Use of the Tax Rates

The legal use of the tax rates in California 2020 is governed by state tax laws and regulations. Taxpayers must adhere to the guidelines set forth by the California Franchise Tax Board. Accurate reporting of income and adherence to the tax rates is essential to avoid penalties. Taxpayers should ensure they are using the correct rates for their specific income levels and filing statuses to remain compliant with state tax laws.

Filing Deadlines for California 2020

For the tax year 2020, the standard deadline for filing California state tax returns was April 15, 2021. However, taxpayers could request an extension, which typically allowed for an additional six months to file. It is important to note that while an extension provides more time to file, any taxes owed were still due by the original deadline to avoid interest and penalties.

Required Documents for Filing California 2020 Taxes

When preparing to file California 2020 taxes, taxpayers should gather several important documents, including:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Records of any other income sources.

- Documentation for deductions, such as mortgage interest statements or medical expenses.

- Previous year's tax return for reference.

Penalties for Non-Compliance with California Tax Rates

Failure to comply with California tax laws and accurately report income using the correct tax rates can result in various penalties. These may include fines, interest on unpaid taxes, and potential legal action. The California Franchise Tax Board enforces these penalties, and taxpayers are encouraged to address any discrepancies or issues promptly to mitigate consequences.

Quick guide on how to complete 2020 tax rates

Complete Tax Rates effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed papers, enabling you to access the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without interruptions. Handle Tax Rates on any gadget using the airSlate SignNow Android or iOS applications and streamline any document-oriented workflow today.

How to adjust and electronically sign Tax Rates with ease

- Obtain Tax Rates and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and electronically sign Tax Rates to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2020 tax rates

The way to create an eSignature for a PDF online

The way to create an eSignature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The way to make an electronic signature from your smartphone

The best way to generate an eSignature for a PDF on iOS

The way to make an electronic signature for a PDF file on Android

People also ask

-

What is airSlate SignNow's role in managing tax 2020 documents?

airSlate SignNow provides an efficient platform for businesses to manage tax 2020 documents by allowing users to easily send, sign, and store important files securely. This streamlines the tax preparation process and helps ensure compliance with legal requirements. With airSlate SignNow, users can reduce the time spent on paperwork and focus more on financial strategies.

-

How does airSlate SignNow pricing work for handling tax 2020 paperwork?

airSlate SignNow offers a range of pricing plans to suit different business needs, making it an affordable choice for managing tax 2020 paperwork. Each plan comes with features tailored to help users efficiently eSign and manage their documents, without hidden fees. This transparency in pricing allows businesses to choose the best option based on their volume of tax documents.

-

What features does airSlate SignNow offer that simplify tax 2020 document management?

airSlate SignNow is equipped with features such as template creation, bulk sending, and real-time tracking, which signNowly simplify tax 2020 document management. These functionalities allow users to prepare and distribute tax documents quickly, ensuring that all signatures and approvals are collected efficiently. This reduces overall processing time and increases productivity.

-

Is airSlate SignNow secure for sending sensitive tax 2020 information?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that all sensitive tax 2020 information is protected. The platform employs robust encryption and follows industry standards to guard against unauthorized access. This level of security allows businesses to confidently send and store their tax documents without worry.

-

Can airSlate SignNow be integrated with accounting software for tax 2020 preparation?

Yes, airSlate SignNow seamlessly integrates with various accounting software solutions, making it easier to manage tax 2020 preparation. By connecting with these tools, users can streamline their processes and ensure that all tax documents are organized and easily accessible. This integration enhances the overall efficiency of tax management.

-

What are the benefits of using airSlate SignNow for tax 2020 eSigning?

Using airSlate SignNow for tax 2020 eSigning offers numerous benefits, including time savings and improved workflow. The ease of sending and receiving signed documents allows businesses to finalize their tax-related paperwork faster, reducing the stress associated with tax deadlines. Additionally, users can access their documents from anywhere, enhancing flexibility.

-

How can airSlate SignNow help in tracking tax 2020 document statuses?

airSlate SignNow provides features that allow users to track the status of their tax 2020 documents in real time. This tracking capability keeps businesses informed about which documents have been signed and which are still pending. This transparency helps teams manage their workload and ensures that all tax documents are processed on time.

Get more for Tax Rates

Find out other Tax Rates

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word