Form 706 Rev October Fill in Capable United States Estate and Generation Skipping Transfer Tax Return

What is the US Form 706?

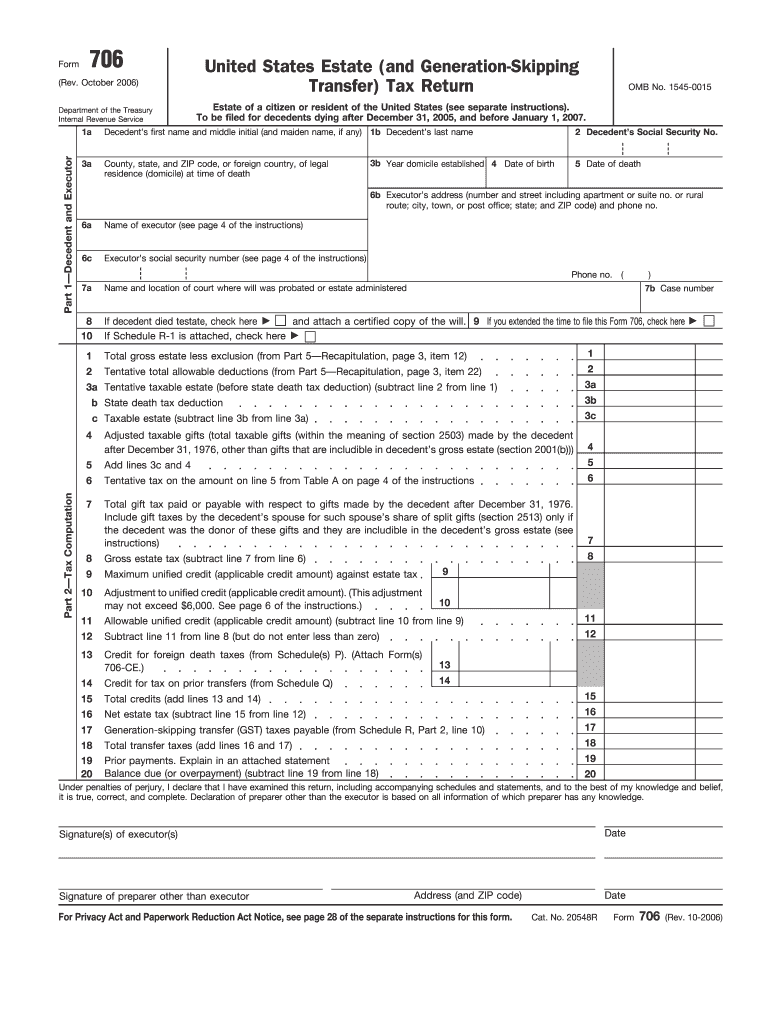

The US Form 706, officially known as the United States Estate (and Generation-Skipping Transfer) Tax Return, is a crucial document used to report the estate tax liability of a deceased individual. This form is required when the gross estate exceeds a certain threshold, which is adjusted periodically by the IRS. The form encompasses various aspects of the estate, including property, financial accounts, and other assets, and is essential for calculating any taxes owed to the federal government. Understanding the purpose and requirements of this form is vital for executors and administrators managing an estate.

Steps to Complete the US Form 706

Completing the US Form 706 involves several key steps to ensure accuracy and compliance with IRS regulations. First, gather all necessary documentation related to the deceased’s assets, liabilities, and deductions. Next, fill out the form by providing detailed information about the estate, including the value of assets and any applicable deductions. It is important to review the instructions carefully to ensure all sections are completed correctly. Once the form is filled out, it should be signed and dated by the executor before submission to the IRS.

Legal Use of the US Form 706

The legal use of the US Form 706 is governed by federal tax laws. This form must be filed to report the estate tax and is legally binding once submitted. It is essential that the executor or administrator of the estate understands the legal implications of the information provided on the form. Inaccuracies or omissions can lead to penalties or additional taxes owed. Therefore, it is advisable to consult with a tax professional or attorney specializing in estate planning to ensure compliance with all legal requirements.

Filing Deadlines for the US Form 706

The filing deadline for the US Form 706 is typically nine months after the date of the decedent's death. However, extensions may be available under certain circumstances. It is crucial to adhere to this timeline to avoid penalties and interest on any taxes owed. Executors should be aware of these deadlines and plan accordingly to ensure timely submission of the form.

How to Obtain the US Form 706

The US Form 706 can be obtained directly from the IRS website or through various tax preparation software that includes estate tax filing capabilities. Additionally, physical copies may be available at local IRS offices. It is important to ensure that the most current version of the form is used, as updates may occur that affect how the form should be completed.

Key Elements of the US Form 706

The US Form 706 includes several key elements that must be accurately reported. These elements consist of the decedent's information, a detailed inventory of the estate's assets, liabilities, and deductions, as well as calculations to determine the taxable estate. Understanding these components is essential for properly completing the form and ensuring that all necessary information is included for the IRS review.

Quick guide on how to complete form 706 rev october 2006 fill in capable united states estate and generation skipping transfer tax return

Prepare Form 706 Rev October Fill In Capable United States Estate and Generation Skipping Transfer Tax Return seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Form 706 Rev October Fill In Capable United States Estate and Generation Skipping Transfer Tax Return on any device with airSlate SignNow’s Android or iOS applications and enhance any document-based process today.

How to modify and eSign Form 706 Rev October Fill In Capable United States Estate and Generation Skipping Transfer Tax Return with ease

- Obtain Form 706 Rev October Fill In Capable United States Estate and Generation Skipping Transfer Tax Return and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow.

- Craft your eSignature using the Sign feature, which takes mere seconds and carries the same legal value as a traditional handwritten signature.

- Review the details and then click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your PC.

Say goodbye to lost or misplaced documents, cumbersome form navigation, and errors requiring new document prints. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Alter and eSign Form 706 Rev October Fill In Capable United States Estate and Generation Skipping Transfer Tax Return and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 706 rev october 2006 fill in capable united states estate and generation skipping transfer tax return

How to make an eSignature for the Form 706 Rev October 2006 Fill In Capable United States Estate And Generation Skipping Transfer Tax Return online

How to create an eSignature for the Form 706 Rev October 2006 Fill In Capable United States Estate And Generation Skipping Transfer Tax Return in Chrome

How to generate an electronic signature for putting it on the Form 706 Rev October 2006 Fill In Capable United States Estate And Generation Skipping Transfer Tax Return in Gmail

How to create an eSignature for the Form 706 Rev October 2006 Fill In Capable United States Estate And Generation Skipping Transfer Tax Return straight from your smart phone

How to make an eSignature for the Form 706 Rev October 2006 Fill In Capable United States Estate And Generation Skipping Transfer Tax Return on iOS

How to generate an electronic signature for the Form 706 Rev October 2006 Fill In Capable United States Estate And Generation Skipping Transfer Tax Return on Android devices

People also ask

-

What is the Form 706 Rev October Fill In Capable United States Estate and Generation Skipping Transfer Tax Return?

The Form 706 Rev October Fill In Capable United States Estate and Generation Skipping Transfer Tax Return is a federal form used to report the estate tax and generation skipping transfer tax. This form is crucial for estates that exceed the exempt amount, ensuring compliance with IRS regulations. Utilizing airSlate SignNow simplifies the process of completing and submitting this form by providing easy-to-use eSignature solutions.

-

How can airSlate SignNow help with completing the Form 706 Rev October Fill In Capable United States Estate and Generation Skipping Transfer Tax Return?

airSlate SignNow offers a user-friendly platform that allows you to fill in the Form 706 Rev October Fill In Capable United States Estate and Generation Skipping Transfer Tax Return digitally. With our intuitive interface, you can easily input necessary information, save your progress, and seamlessly eSign the document for submission. This streamlines the often complex process of tax return preparation.

-

Is there a cost associated with using airSlate SignNow for the Form 706 Rev October Fill In Capable United States Estate and Generation Skipping Transfer Tax Return?

Yes, airSlate SignNow offers competitive pricing plans that cater to different user needs when completing the Form 706 Rev October Fill In Capable United States Estate and Generation Skipping Transfer Tax Return. Our plans include a variety of features that enhance your document management experience, ensuring you get the best value for your investment. You can start with a free trial to explore our capabilities.

-

What features does airSlate SignNow provide for the Form 706 Rev October Fill In Capable United States Estate and Generation Skipping Transfer Tax Return?

airSlate SignNow provides several features to assist with the Form 706 Rev October Fill In Capable United States Estate and Generation Skipping Transfer Tax Return, including customizable templates, secure eSigning, and collaborative tools. These features ensure that you can efficiently manage and finalize your estate documents while maintaining compliance with legal requirements.

-

Can I integrate airSlate SignNow with other software for managing the Form 706 Rev October Fill In Capable United States Estate and Generation Skipping Transfer Tax Return?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, enhancing your workflow for the Form 706 Rev October Fill In Capable United States Estate and Generation Skipping Transfer Tax Return. You can connect with platforms like Google Drive, Salesforce, and more, allowing for a more streamlined process in managing your documents.

-

Is the airSlate SignNow platform secure for handling the Form 706 Rev October Fill In Capable United States Estate and Generation Skipping Transfer Tax Return?

Yes, security is a top priority for airSlate SignNow. Our platform employs advanced encryption and compliance measures to protect your data while you work on the Form 706 Rev October Fill In Capable United States Estate and Generation Skipping Transfer Tax Return. You can confidently eSign and share sensitive documents knowing they are secure.

-

What are the benefits of using airSlate SignNow for estate tax document management?

Using airSlate SignNow for estate tax document management, including the Form 706 Rev October Fill In Capable United States Estate and Generation Skipping Transfer Tax Return, offers numerous benefits. These include increased efficiency, reduced paperwork, and enhanced accuracy in document completion. Additionally, our platform provides a cost-effective solution that simplifies the entire process.

Get more for Form 706 Rev October Fill In Capable United States Estate and Generation Skipping Transfer Tax Return

- Minardi bakery inc revised 2 08 rcs louis minardi age fifty andrews form

- Download employment application here arnel form

- Fancy sushi job aplication pdf form

- Employment and support allowance medical report form

- Starbucks employemnt application fillable form

- Catholic community service ccs juneau form

- Nurse practitioner skills checklist form

- Ohs form 005 safe work method statement swms

Find out other Form 706 Rev October Fill In Capable United States Estate and Generation Skipping Transfer Tax Return

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will