Zenith Bank Loan Form

What is the Zenith Bank Loan

The Zenith Bank Loan is a financial product designed to assist individuals and businesses in obtaining necessary funding for various purposes. This loan can be utilized for personal needs, such as home improvements or education, as well as for business-related expenses, including equipment purchases or operational costs. The loan is structured to provide flexible repayment options and competitive interest rates, making it an attractive choice for borrowers.

How to Obtain the Zenith Bank Loan

Obtaining a Zenith Bank Loan involves several straightforward steps. First, potential borrowers should assess their financial needs and determine the type of loan that best suits them. Next, they need to gather necessary documentation, which typically includes proof of income, identification, and any relevant financial statements. After preparing the documentation, applicants can initiate the loan application process through the bank's official website or by visiting a local branch.

Steps to Complete the Zenith Bank Loan Application

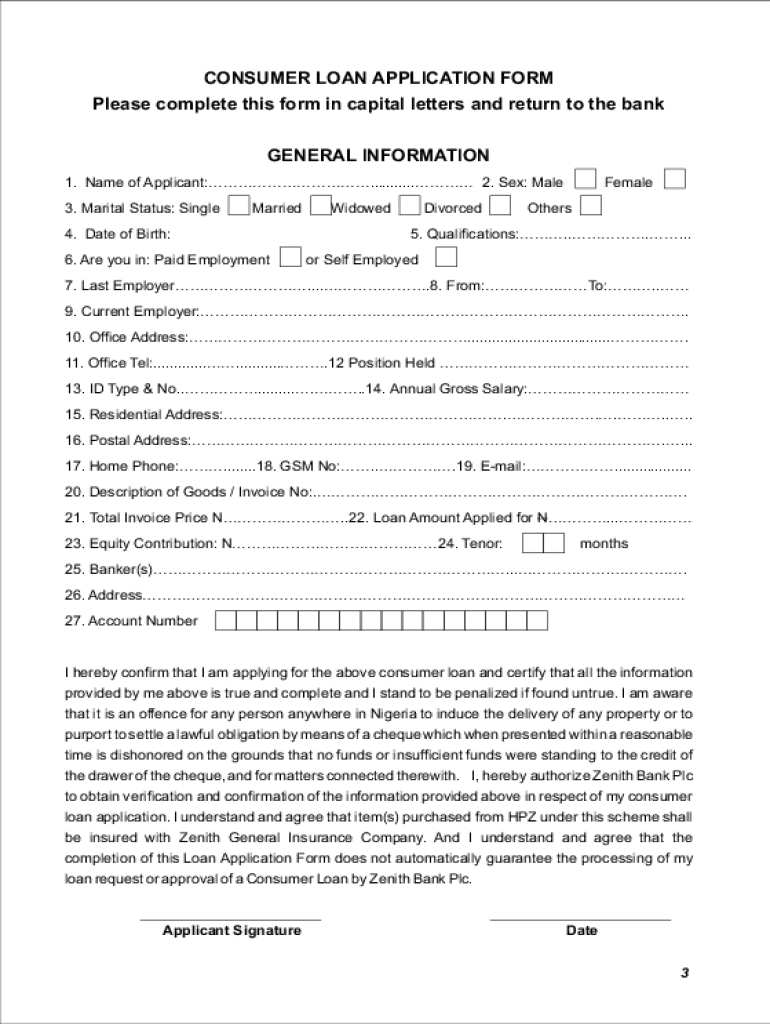

The application process for a Zenith Bank Loan can be completed in a few key steps:

- Gather Documentation: Collect all required documents, such as income verification and identification.

- Fill Out the Application: Complete the loan application form, ensuring all information is accurate.

- Submit the Application: Send the completed application, along with the gathered documents, to Zenith Bank.

- Await Approval: The bank will review the application and notify the applicant of the decision.

Legal Use of the Zenith Bank Loan

To ensure the legal use of the Zenith Bank Loan, borrowers must adhere to all terms and conditions outlined in the loan agreement. This includes using the funds for the specified purposes and making timely repayments. Additionally, borrowers should be aware of their rights and responsibilities under U.S. lending laws, which protect consumers from unfair practices.

Required Documents

When applying for a Zenith Bank Loan, applicants must provide several key documents to facilitate the approval process. Commonly required documents include:

- Proof of identity (e.g., driver's license, passport)

- Proof of income (e.g., pay stubs, tax returns)

- Bank statements

- Business financial statements (for business loans)

Eligibility Criteria

Eligibility for a Zenith Bank Loan typically depends on several factors, including credit history, income level, and the purpose of the loan. Applicants should have a stable source of income and a satisfactory credit score to increase their chances of approval. Additionally, specific loans may have unique criteria based on their intended use, such as business loans requiring a business plan.

Quick guide on how to complete zenith bank loan

Complete Zenith Bank Loan with ease on any device

Online document management has become increasingly favored by businesses and individuals alike. It presents an excellent eco-friendly option compared to traditional printed and signed documents, as you can access the necessary forms and securely store them online. airSlate SignNow provides you with all the resources you need to create, edit, and eSign your documents swiftly without any delays. Manage Zenith Bank Loan on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and eSign Zenith Bank Loan effortlessly

- Locate Zenith Bank Loan and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools tailored for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Put an end to lost or misplaced files, cumbersome form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Zenith Bank Loan and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the zenith bank loan

How to generate an electronic signature for your PDF document online

How to generate an electronic signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature straight from your smart phone

How to make an electronic signature for a PDF document on iOS

The best way to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is the zenith loan application process?

The zenith loan application process is designed to be straightforward and user-friendly. Start by filling out the online form with your personal and financial information, then submit the required documents digitally. Our platform uses secure eSignature technology to streamline the signing process, ensuring you can easily complete your application from anywhere.

-

What are the key features of the zenith loan application?

The zenith loan application offers several key features including a fully digital submission process, real-time status tracking, and seamless integration with popular financial tools. Additionally, its eSigning capabilities allow for a quick turnaround, making it easier to get your loan approved swiftly. Enhanced security measures ensure that your sensitive information is always protected.

-

How much does the zenith loan application cost?

The zenith loan application is available at a competitive price point, aiming to provide value for businesses of all sizes. Specific pricing may vary depending on the features you choose and your transaction volume. We recommend visiting our pricing page for detailed information and to determine the best plan that suits your needs.

-

Can I integrate the zenith loan application with other software?

Yes, the zenith loan application is designed for seamless integration with various popular software and tools. This includes accounting software, CRM systems, and document management platforms. Such integrations ensure that your workflows remain efficient and data can be transferred effortlessly between systems.

-

What benefits does the zenith loan application provide for businesses?

Utilizing the zenith loan application provides numerous benefits, including reduced paperwork, faster approval times, and improved tracking capabilities. By using our platform, businesses can enhance productivity and customer satisfaction, making the loan application process smoother and more efficient. Additionally, the cost-effective nature of our solution helps businesses save money.

-

Is the zenith loan application secure?

Absolutely, security is our top priority when it comes to the zenith loan application. We implement advanced encryption protocols and adhere to industry standards to ensure that all data is transmitted and stored securely. Our platform also offers audit trails to monitor document access and changes for added peace of mind.

-

How long does it take to complete a zenith loan application?

The time it takes to complete a zenith loan application largely depends on the completeness of the information provided. Generally, users can finish the application and eSign documents within minutes. However, verification and approval times will vary based on lender processing speeds once the application is submitted.

Get more for Zenith Bank Loan

Find out other Zenith Bank Loan

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template