Form 8379 Rev December Injured Spouse Claim and Allocation

What is the Form 8379 Injured Spouse Claim and Allocation

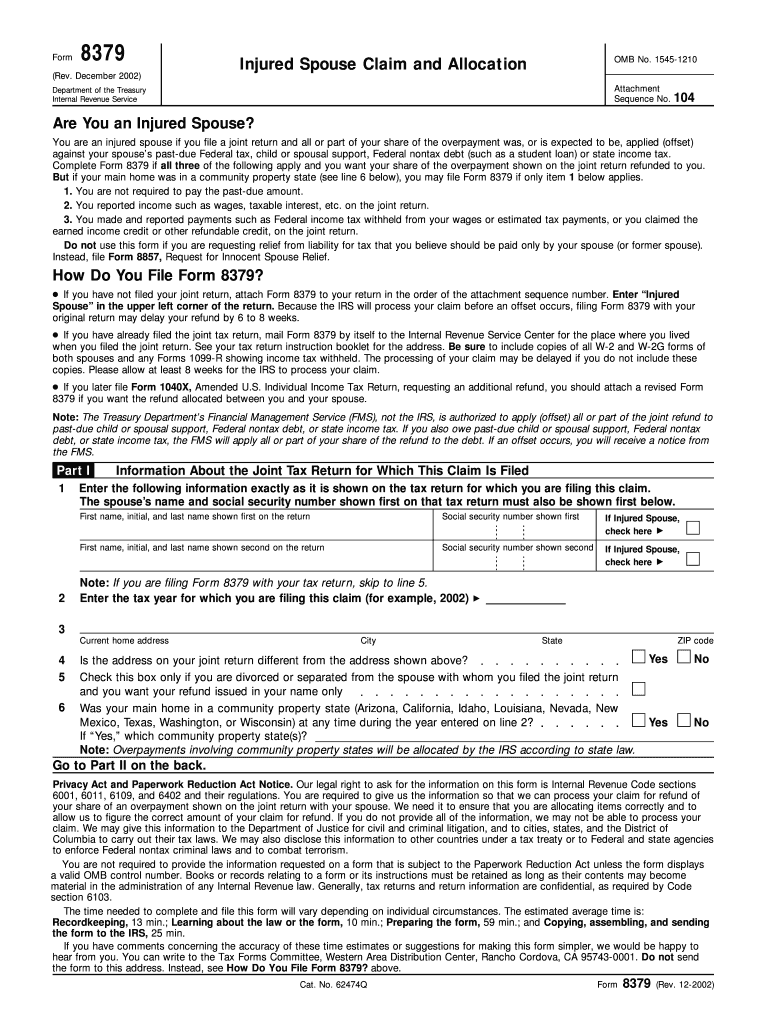

The Form 8379, also known as the injured spouse form, is a document used by individuals to request their share of a joint tax refund that may be withheld due to their spouse's debts. This form allows the injured spouse to claim their portion of the refund, ensuring that they receive the funds they are entitled to, despite their partner's financial obligations. It is essential for those who have filed jointly and are facing potential offsets due to their spouse's tax liabilities, student loans, or other debts.

How to Use the Form 8379 Injured Spouse Claim and Allocation

To effectively use the Form 8379, you should first determine your eligibility as an injured spouse. This involves filing the form alongside your joint tax return or submitting it separately after filing. When completing the form, provide accurate information about your income, tax withheld, and any applicable debts. Ensure that you include all necessary documentation to support your claim, such as copies of your tax returns and any notices received regarding offsets. Once completed, submit the form to the IRS, either electronically or by mail, following the specific guidelines provided for your situation.

Steps to Complete the Form 8379 Injured Spouse Claim and Allocation

Completing the Form 8379 involves several key steps:

- Gather Information: Collect your tax documents, including your joint tax return and any notices from the IRS regarding offsets.

- Fill Out the Form: Provide your personal information, including your name, Social Security number, and details about your income and tax withheld.

- Indicate Your Claim: Clearly state your claim for the refund and provide any necessary explanations regarding your spouse's debts.

- Review Your Submission: Double-check all entries for accuracy and completeness to avoid delays in processing.

- Submit the Form: Send the completed form to the IRS either electronically with your tax return or by mailing it separately, as appropriate.

Eligibility Criteria for the Form 8379 Injured Spouse Claim and Allocation

To qualify for filing the Form 8379, you must meet specific criteria. You should have filed a joint tax return with your spouse, and you must not be legally responsible for the debts that are causing the offset. Additionally, you should have reported income that was subject to withholding, and your share of the refund must be greater than the amount of the offset. Understanding these eligibility requirements is crucial to ensure that your claim is valid and can be processed by the IRS.

Form Submission Methods for the Injured Spouse Claim and Allocation

The Form 8379 can be submitted through various methods, depending on your filing situation. If you are filing your tax return electronically, you can include the injured spouse form with your submission. Alternatively, if you have already filed your return and need to submit the form separately, you can mail it directly to the IRS. It is important to follow the specific instructions provided by the IRS for the submission method you choose to ensure timely processing of your claim.

IRS Guidelines for the Form 8379 Injured Spouse Claim and Allocation

The IRS provides specific guidelines for completing and submitting the Form 8379. These guidelines include instructions on how to fill out the form accurately, what documentation to include, and the timelines for submission. It is essential to adhere to these guidelines to avoid delays or rejections. The IRS also outlines the process for reviewing claims and the expected timeframe for receiving your refund once the form is submitted.

Quick guide on how to complete form 8379 rev december 2002 injured spouse claim and allocation

Prepare Form 8379 Rev December Injured Spouse Claim And Allocation effortlessly on any device

Online document management has gained prominence with businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can discover the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly and without delays. Manage Form 8379 Rev December Injured Spouse Claim And Allocation on any platform with airSlate SignNow Android or iOS applications and enhance any document-centered process today.

How to modify and eSign Form 8379 Rev December Injured Spouse Claim And Allocation with ease

- Obtain Form 8379 Rev December Injured Spouse Claim And Allocation and click Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight essential sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Select how you wish to submit your form, via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Modify and eSign Form 8379 Rev December Injured Spouse Claim And Allocation and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

When and how are the assignments for IGNOU CHR to be submitted for the December 2018 TEE? How and when to fill out the examination form? Where do I look for the datasheet?

First download the assignments from IGNOU - The People's University website and write them with A4 size paper then submitted it in your study center.check the above website you will find a link that TEE from fill up for dec 2018 after got the link you will fill your tee from online.Remember while filling your TEE you should put tick mark on the box like this;Are you submitted assignments: yes[ ] No[ ]

-

Will the NEET 2018 give admission in paramedical courses and Ayush courses too? If yes, how do you fill out the form to claim a seat if scored well?

wait for notifications.

Create this form in 5 minutes!

How to create an eSignature for the form 8379 rev december 2002 injured spouse claim and allocation

How to make an electronic signature for your Form 8379 Rev December 2002 Injured Spouse Claim And Allocation in the online mode

How to make an electronic signature for the Form 8379 Rev December 2002 Injured Spouse Claim And Allocation in Google Chrome

How to generate an electronic signature for putting it on the Form 8379 Rev December 2002 Injured Spouse Claim And Allocation in Gmail

How to create an electronic signature for the Form 8379 Rev December 2002 Injured Spouse Claim And Allocation from your mobile device

How to generate an eSignature for the Form 8379 Rev December 2002 Injured Spouse Claim And Allocation on iOS

How to make an electronic signature for the Form 8379 Rev December 2002 Injured Spouse Claim And Allocation on Android OS

People also ask

-

What is the Form 8379 Rev December Injured Spouse Claim And Allocation?

The Form 8379 Rev December Injured Spouse Claim And Allocation is a tax form used by married couples to request the allocation of a tax refund when one spouse has outstanding debts. By submitting this form, the injured spouse can protect their portion of the refund from being used to pay the other spouse's obligations. This form is essential for ensuring that each spouse receives their rightful share of the tax refund.

-

How can airSlate SignNow help with filing Form 8379 Rev December Injured Spouse Claim And Allocation?

airSlate SignNow streamlines the process of filing the Form 8379 Rev December Injured Spouse Claim And Allocation by allowing users to easily fill out, sign, and send the document electronically. Our platform is user-friendly, ensuring that you can complete your claim quickly and efficiently. Plus, with our secure eSignature feature, you can be confident that your submission is safe.

-

What are the pricing options for airSlate SignNow when filing Form 8379 Rev December Injured Spouse Claim And Allocation?

airSlate SignNow offers various pricing plans to accommodate different needs, starting with a free trial that allows you to explore our features. Our plans are competitively priced and provide excellent value, ensuring that you can file your Form 8379 Rev December Injured Spouse Claim And Allocation without breaking the bank. Choose a plan that best fits your requirements and budget!

-

Can I integrate airSlate SignNow with other tax software for filing Form 8379 Rev December Injured Spouse Claim And Allocation?

Yes, airSlate SignNow seamlessly integrates with popular tax software and applications, making it easier for you to manage your tax documents, including the Form 8379 Rev December Injured Spouse Claim And Allocation. This integration allows you to import data directly, reducing errors and saving time during the filing process.

-

What features does airSlate SignNow offer for completing Form 8379 Rev December Injured Spouse Claim And Allocation?

airSlate SignNow provides a range of features for completing the Form 8379 Rev December Injured Spouse Claim And Allocation, including customizable templates, real-time collaboration, and secure eSigning. These tools ensure that you can fill out the form accurately and efficiently, making the entire process hassle-free.

-

Is airSlate SignNow secure for handling Form 8379 Rev December Injured Spouse Claim And Allocation?

Absolutely! airSlate SignNow prioritizes your privacy and security. Our platform uses advanced encryption and complies with industry standards to protect your sensitive information, including your Form 8379 Rev December Injured Spouse Claim And Allocation. You can trust us to keep your data safe.

-

What are the benefits of using airSlate SignNow for my Form 8379 Rev December Injured Spouse Claim And Allocation?

Using airSlate SignNow for your Form 8379 Rev December Injured Spouse Claim And Allocation offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced accuracy. Our digital solution saves you time and effort, allowing you to focus on more important tasks while ensuring your claim is filed correctly.

Get more for Form 8379 Rev December Injured Spouse Claim And Allocation

Find out other Form 8379 Rev December Injured Spouse Claim And Allocation

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile