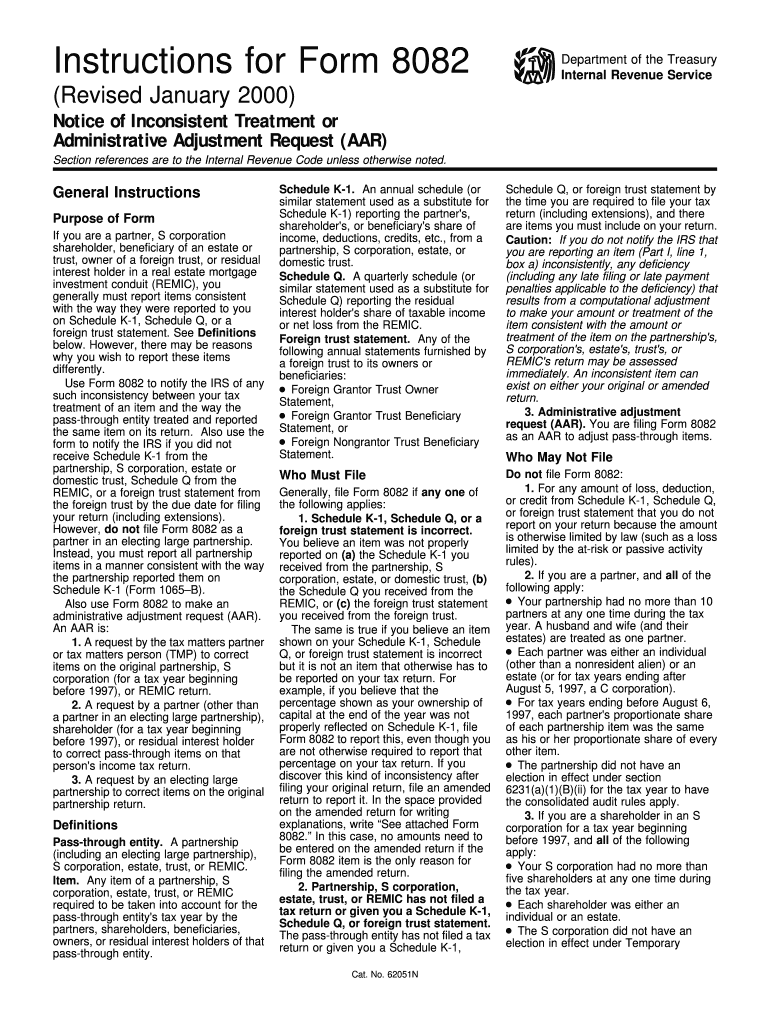

Instructions for Form 8082 Rev January

What are the Instructions for Form 8082?

The Instructions for Form 8082 provide essential guidance for taxpayers who need to report certain tax-related information to the IRS. This form is primarily used to notify the IRS of a partnership's or S corporation's intention to make a tax election or to report a change in the entity's tax status. Understanding these instructions is crucial for ensuring compliance with federal tax regulations and avoiding potential penalties.

Steps to Complete the Instructions for Form 8082

Completing the Instructions for Form 8082 involves several key steps:

- Gather necessary information about the partnership or S corporation, including its tax identification number and details about the election being made.

- Review the specific sections of the instructions that pertain to your situation, as the requirements may vary based on the type of election.

- Carefully fill out the form, ensuring that all required fields are completed accurately.

- Double-check the information for any errors or omissions before submission.

- Submit the completed form to the IRS by the specified deadline, either electronically or via mail, as per the guidelines.

Legal Use of the Instructions for Form 8082

The legal use of the Instructions for Form 8082 is governed by IRS regulations. It is important to ensure that the form is filled out correctly and submitted on time to maintain compliance with tax laws. Failure to adhere to these guidelines may result in penalties or delays in processing the election. Utilizing a reliable eSignature solution can help ensure that the submission of the form is legally binding and secure.

Filing Deadlines / Important Dates

Filing deadlines for Form 8082 can vary based on the specific tax election being made. Generally, the form must be filed within a certain period following the close of the tax year in which the election is intended to take effect. It is essential to consult the IRS guidelines or the specific instructions for Form 8082 to determine the exact deadlines applicable to your situation.

Required Documents

To complete Form 8082, certain documents may be required, including:

- Tax identification number of the partnership or S corporation.

- Details of the election being made, including any relevant agreements or supporting documentation.

- Previous tax returns or forms that may provide context for the current filing.

Having these documents on hand will facilitate a smoother completion process and ensure that all necessary information is provided.

Form Submission Methods

Form 8082 can be submitted to the IRS using various methods, including:

- Online submission through the IRS e-file system, if applicable.

- Mailing the completed form to the appropriate IRS address, as specified in the instructions.

- In-person submission at designated IRS offices, if needed.

Choosing the right submission method can help ensure timely processing of the form.

Quick guide on how to complete instructions for form 8082 rev january 2000

Complete Instructions For Form 8082 Rev January effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the relevant form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and eSign your documents swiftly without delays. Manage Instructions For Form 8082 Rev January on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

How to alter and eSign Instructions For Form 8082 Rev January without difficulty

- Locate Instructions For Form 8082 Rev January and then click Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize essential sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as an ordinary wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select how you wish to deliver your form, via email, SMS, invitation link, or download it to your PC.

Say goodbye to lost or mislaid files, cumbersome form navigation, or errors that require reprinting new document copies. airSlate SignNow manages all your document management requirements in just a few clicks from any device of your preference. Edit and eSign Instructions For Form 8082 Rev January and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

What's the best way to get users to read a set of instructions for filling out a form?

Your question confuses me a bit. What's missing is "WHY are the instructions displayed?" What makes them so important? More to the point, what makes them so important to the user?You say it's a simple form, but also say they must read the instructions before filling it out. If it's simple, what are all the instructions for? I haven't seen the form and already I'm confused.People will do things if they understand (and agree with) the purpose for doing them. If they don't understand the need for the instructions (e.g. because the form appears to be simple), you'll have a hard time getting users to read them (they won't see the need).My suggestion would be to take a step back from the design a bit and look at the form's purpose. If the instructions are to minimize data entry errors, look for ways in your design to do that and eliminate an instruction or two. For example, do real-time validation of things like zip codes, phone numbers, usernames, and anything else your web page can do.If the instructions are to educate the user on some specific process, look at the process to see if it can be made simpler or more obvious such that it doesn't need any explanation.Finally, don't forget user testing--ask some potential (or representative) users what they think works for them.

-

Do we need to fill out different forms for the January and April attempts of the JEE Mains 2019?

Dear studentYes ! There is different notification for each of these two exams , So a separate application for each of these two exam is required.Since it is not compulsory for candidate to appear in both the exam.NTA will prepare for exam and allot the seats as per actual no. of candidate to be appear in examination.Wishing you all the best !God bless !

-

How can I make it easier for users to fill out a form on mobile apps?

I’ll tell you a secret - you can thank me later for this.If you want to make the form-filling experience easy for a user - make sure that you have a great UI to offer.Everything boils down to UI at the end.Axonator is one of the best mobile apps to collect data since it offers powerful features bundled with a simple UI.The problem with most of the mobile form apps is that they are overloaded with features that aren’t really necessary.The same doesn’t hold true for Axonator. It has useful features but it is very unlikely that the user will feel overwhelmed in using them.So, if you are inclined towards having greater form completion rates for your survey or any data collection projects, then Axonator is the way to go.Apart from that, there are other features that make the data collection process faster like offline data collection, rich data capture - audio, video, images, QR code & barcode data capture, live location & time capture, and more!Check all the features here!You will be able to complete more surveys - because productivity will certainly shoot up.Since you aren’t using paper forms, errors will drop signNowly.The cost of the paper & print will be saved - your office expenses will drop dramatically.No repeat work. No data entry. Time & money saved yet again.Analytics will empower you to make strategic decisions and explore new revenue opportunities.The app is dirt-cheap & you don’t any training to use the app. They come in with a smooth UI. Forget using, even creating forms for your apps is easy on the platform. Just drag & drop - and it’s ready for use. Anyone can build an app under hours.

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 8082 rev january 2000

How to generate an eSignature for your Instructions For Form 8082 Rev January 2000 in the online mode

How to create an electronic signature for your Instructions For Form 8082 Rev January 2000 in Google Chrome

How to generate an electronic signature for putting it on the Instructions For Form 8082 Rev January 2000 in Gmail

How to create an electronic signature for the Instructions For Form 8082 Rev January 2000 from your mobile device

How to make an electronic signature for the Instructions For Form 8082 Rev January 2000 on iOS devices

How to make an eSignature for the Instructions For Form 8082 Rev January 2000 on Android

People also ask

-

What are form 8082 instructions?

Form 8082 instructions provide guidance on how to properly complete and submit Form 8082, which is used for informing the IRS of a qualified subchapter S subsidiary (QSub) election. Understanding these instructions is essential to ensure compliance and to avoid potential delays in processing your tax filings.

-

How can airSlate SignNow help with form 8082 instructions?

airSlate SignNow simplifies the document management process, allowing you to easily upload, sign, and send your form 8082 and its instructions electronically. With our user-friendly interface, you can efficiently manage your tax documents without the hassle of paper trails.

-

Is there a cost associated with using airSlate SignNow for form 8082 instructions?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. Our pricing is structured to be cost-effective, providing businesses with the tools to manage form 8082 instructions and other documents while being mindful of their budgets.

-

What features does airSlate SignNow offer for managing form 8082 instructions?

airSlate SignNow provides features such as custom templates, automated workflows, and secure eSignature options specifically designed to streamline the management of form 8082 instructions. These features enhance usability while ensuring adherence to legal requirements.

-

Can I track the status of my form 8082 using airSlate SignNow?

Absolutely! With airSlate SignNow, you can easily track the status of your form 8082 as it moves through the signing process. This feature ensures that you are always informed about your document’s progress, reducing uncertainty.

-

Does airSlate SignNow integrate with other tools for managing form 8082 instructions?

Yes, airSlate SignNow offers seamless integrations with various applications, including CRMs and accounting software. These integrations facilitate the efficient management of form 8082 instructions alongside your other business processes.

-

What are the benefits of using airSlate SignNow for form 8082 instructions?

Using airSlate SignNow for your form 8082 instructions provides several benefits, including enhanced efficiency, improved security for your sensitive tax documents, and the ability to access your documents anytime, anywhere. This all-in-one solution helps streamline your workflow.

Get more for Instructions For Form 8082 Rev January

- Expungement information student affairs penn state university studentaffairs psu

- Parentguardian sign in sign out sheet form

- Psychotherapy case discussion form ranzcp

- Confidential recommendation form endicott college

- Student accident report form

- Wor wic community college transcripts form

- Mgm resorts international mandatory contribution form borgata

- Strobe get form

Find out other Instructions For Form 8082 Rev January

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF