Form 8824 Fill in Version Like Kind Exchanges

What is the Form 8824?

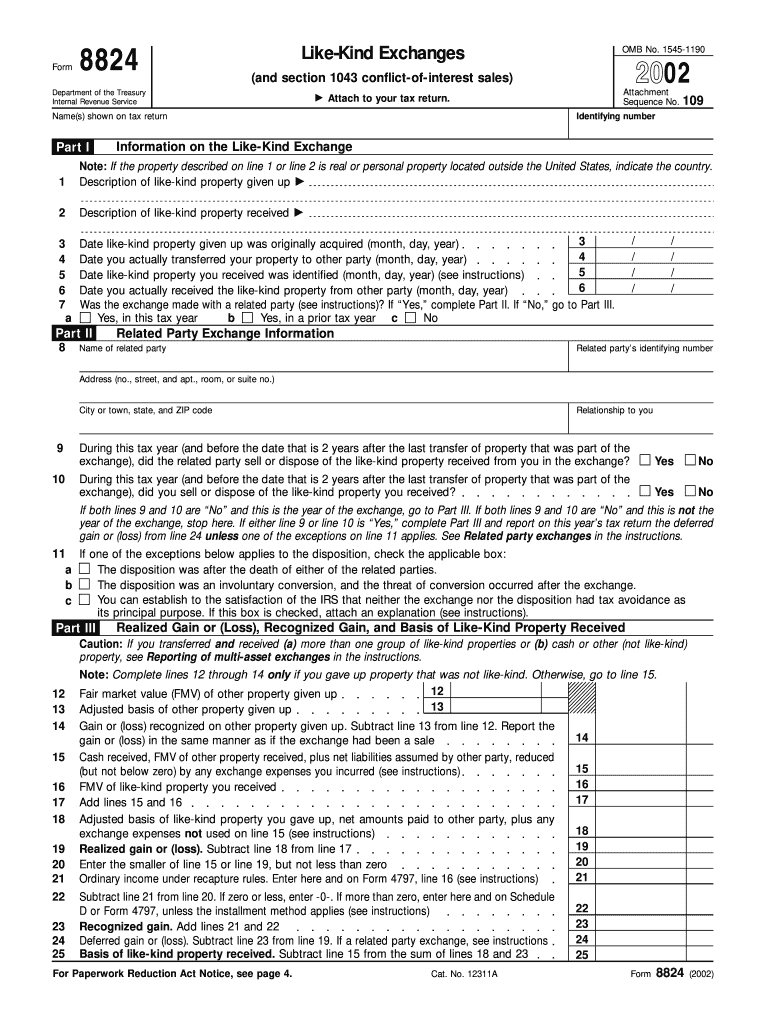

The Form 8824, also known as the Like-Kind Exchange Worksheet, is a tax form used by U.S. taxpayers to report the exchange of property held for productive use in a trade or business or for investment. This form is essential for documenting transactions that qualify for tax deferral under Section 1031 of the Internal Revenue Code. By utilizing this form, taxpayers can defer capital gains taxes on the exchange of like-kind properties, which can be beneficial for investment strategies and asset management.

Steps to Complete the Form 8824

Completing the Form 8824 involves several key steps to ensure accuracy and compliance with IRS regulations. Here are the main steps:

- Gather necessary documentation, including details about the properties exchanged and any related financial information.

- Fill out the identification section with the names and addresses of the parties involved in the exchange.

- Provide a description of the relinquished and acquired properties, including their fair market values.

- Detail the dates of the exchange and any related transactions.

- Calculate any gain or loss from the exchange and determine the amount of deferred gain.

- Review the completed form for accuracy before submission.

IRS Guidelines for Form 8824

The IRS provides specific guidelines for completing and submitting the Form 8824. Taxpayers must adhere to these guidelines to ensure compliance and avoid penalties. Key points include:

- Ensure that the properties exchanged are of like kind, which generally means they are of the same nature or character.

- Complete the form in accordance with the instructions provided by the IRS, which outline how to report various types of exchanges.

- Submit the form with your tax return for the year in which the exchange took place.

Examples of Using the Form 8824

Understanding practical examples of how to use the Form 8824 can clarify its application. For instance, if a taxpayer exchanges a rental property for another rental property, they would report this exchange using the form. Another example could involve a business owner exchanging commercial real estate for another commercial property, allowing them to defer taxes on any gains realized from the transaction. Each example highlights the importance of documenting the details of the exchange accurately.

Required Documents for Form 8824

To complete the Form 8824 accurately, several documents are typically required. These may include:

- Closing statements for both the relinquished and acquired properties.

- Appraisals or documentation supporting the fair market value of the properties.

- Records of any mortgages or liens associated with the properties involved in the exchange.

- Any agreements or contracts related to the exchange.

Filing Deadlines for Form 8824

Filing deadlines for the Form 8824 align with the standard tax return deadlines. Typically, the form must be filed with your annual tax return, which is due on April fifteenth of the following year. If you require an extension, ensure that the Form 8824 is included with your extended return submission. It is crucial to adhere to these deadlines to avoid potential penalties and interest on unpaid taxes.

Quick guide on how to complete 2002 form 8824 fill in version like kind exchanges

Finish Form 8824 Fill in Version Like Kind Exchanges seamlessly across all devices

Managing documents online has become increasingly favored by organizations and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed files, allowing you to find the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents promptly without any holdups. Handle Form 8824 Fill in Version Like Kind Exchanges on any device with airSlate SignNow’s Android or iOS applications and enhance any document-centric process today.

The simplest method to revise and electronically sign Form 8824 Fill in Version Like Kind Exchanges with ease

- Find Form 8824 Fill in Version Like Kind Exchanges and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you would like to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiring form searches, or mistakes that necessitate printing new document copies. airSlate SignNow satisfies all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Form 8824 Fill in Version Like Kind Exchanges and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How can I fill out a form to become a pilot in Nepal?

Obtain the forms. Read the forms. Add correct information.

-

What is the procedure to fill out the DU admission form? How many colleges and courses can I fill in?

It's as simple as filling any school admission form but you need to be quite careful while filling for courses ,don't mind you are from which stream in class 12 choose all the courses you feel like choosing,there is no limitations in choosing course and yes you must fill all the courses related to your stream ,additionally there is no choice for filling of college names in the application form .

-

How do I get an admission in ALLEN Satyarth for an achiever? Is there any option available online (like a form to fill out)?

There is no option available at formBut phases are decidingWhich phase are in which building are pre decideBut probably all phases of achiever are start in satyarth.

-

How can I repeat the HSC Maharashtra board 2019? Which kind of form should I have to fill and when?

If you have passed HSC but not satisfied due to less marks and wants to appear again then you can go for HSC improvement exam. Just contact your Institute and fill out form of it and appear exam again.You can also apply online through site https://mahahsscboard.maharashtra.gov.in/ select class improvement and fill the form.

-

Do W9 forms need to be filled out by hand? Can I fill it out in a text editor like Word instead?

No, W9 forms do not need to be filled out by hand. Assuming you have a PDF, there are many PDF editors which allow you to fill in the form on your personal computer and even insert a signature, if you have one.Mac’s Preview app does this on most PDFs. Word might actually do it as well, I simply don’t use Word. Google Docs has the functionality, as well.

Create this form in 5 minutes!

How to create an eSignature for the 2002 form 8824 fill in version like kind exchanges

How to generate an electronic signature for the 2002 Form 8824 Fill In Version Like Kind Exchanges online

How to generate an eSignature for the 2002 Form 8824 Fill In Version Like Kind Exchanges in Google Chrome

How to generate an electronic signature for signing the 2002 Form 8824 Fill In Version Like Kind Exchanges in Gmail

How to create an electronic signature for the 2002 Form 8824 Fill In Version Like Kind Exchanges straight from your smartphone

How to make an electronic signature for the 2002 Form 8824 Fill In Version Like Kind Exchanges on iOS devices

How to create an electronic signature for the 2002 Form 8824 Fill In Version Like Kind Exchanges on Android devices

People also ask

-

What is the Form 8824 Fill in Version Like Kind Exchanges?

The Form 8824 Fill in Version Like Kind Exchanges is a specific IRS form used to report like-kind exchanges of property. This form helps taxpayers defer capital gains taxes when exchanging similar types of property. Understanding how to properly fill it out is crucial for compliance and maximizing tax benefits.

-

How can airSlate SignNow help with the Form 8824 Fill in Version Like Kind Exchanges?

airSlate SignNow offers an intuitive platform that allows users to easily fill out and eSign the Form 8824 Fill in Version Like Kind Exchanges. Our solution simplifies the document management process, ensuring that your forms are completed accurately and efficiently, saving you time and effort.

-

Is there a cost associated with using airSlate SignNow for Form 8824 Fill in Version Like Kind Exchanges?

Yes, airSlate SignNow provides various pricing plans to suit different business needs. Each plan includes features that facilitate the completion and eSigning of documents, including the Form 8824 Fill in Version Like Kind Exchanges. Explore our pricing page to find the best option for your requirements.

-

What features does airSlate SignNow offer for completing the Form 8824 Fill in Version Like Kind Exchanges?

With airSlate SignNow, you gain access to features like customizable templates, document sharing, and real-time collaboration tools. Our platform also provides automated reminders and notifications, ensuring that you stay on track when completing the Form 8824 Fill in Version Like Kind Exchanges.

-

Can I access the Form 8824 Fill in Version Like Kind Exchanges on mobile devices using airSlate SignNow?

Absolutely! airSlate SignNow is designed to be mobile-friendly, allowing you to access and complete the Form 8824 Fill in Version Like Kind Exchanges from your smartphone or tablet. This flexibility ensures that you can manage your documents on the go, making it convenient for busy professionals.

-

Does airSlate SignNow integrate with other software for Form 8824 Fill in Version Like Kind Exchanges?

Yes, airSlate SignNow integrates seamlessly with various applications, including cloud storage services and business tools. This enables you to streamline your workflow when preparing the Form 8824 Fill in Version Like Kind Exchanges and other important documents, enhancing your overall productivity.

-

What are the benefits of using airSlate SignNow for tax documents like Form 8824 Fill in Version Like Kind Exchanges?

Using airSlate SignNow for tax documents like the Form 8824 Fill in Version Like Kind Exchanges offers numerous benefits. It enhances efficiency by automating the signing process, increases accuracy with real-time editing, and ensures compliance with legal standards. This results in a smoother tax filing experience.

Get more for Form 8824 Fill in Version Like Kind Exchanges

- Audition evaluation template form

- Corrective action form verbal written dismissal

- Pbsd 0755 form

- Texas aampm university drop or withdraw appeal form

- Internal transfer form emory university collegecouncil emorycampuslife

- Announcement form

- Texas southern university transcripts form

- Miramar high school transcripts form

Find out other Form 8824 Fill in Version Like Kind Exchanges

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free

- Can I Electronic signature Vermont Bulk Sale Agreement

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy