Form W 2 Wage and Tax Statement

What is the Form W-2 Wage and Tax Statement

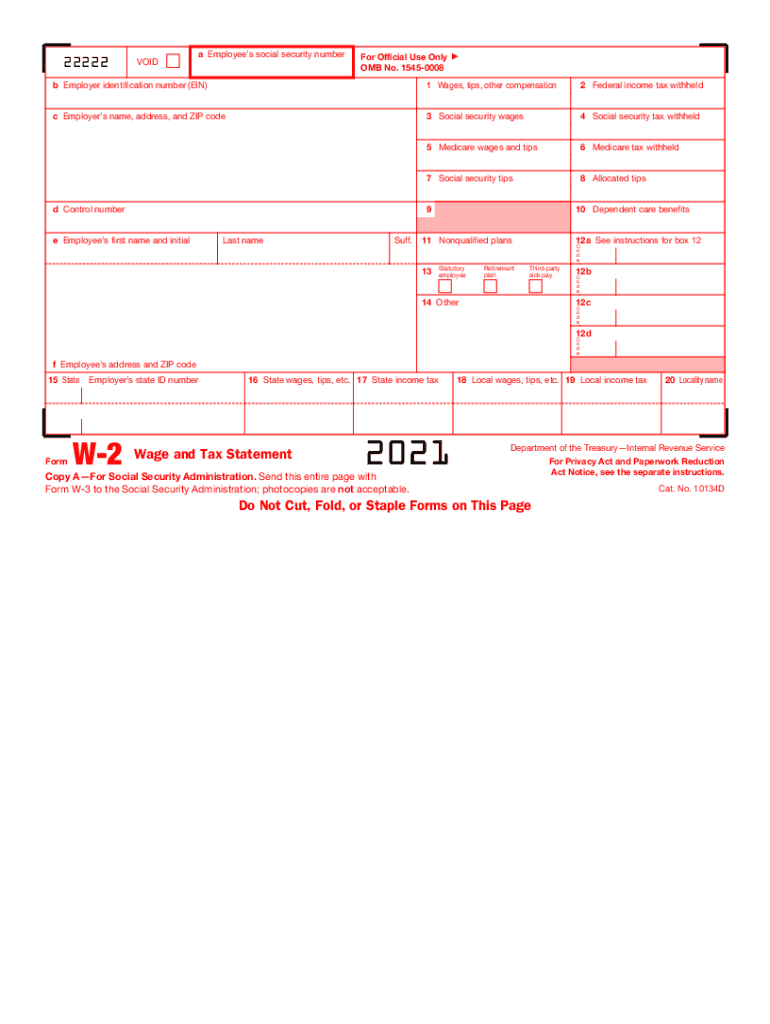

The Form W-2, also known as the Wage and Tax Statement, is a crucial document used in the United States for tax reporting. Employers are required to issue this form to employees, detailing the wages earned and the taxes withheld during the calendar year. It serves as a summary of an employee's earnings and the amount of federal, state, and other taxes withheld from their paycheck.

This form is essential for employees when filing their annual tax returns, as it provides the necessary information to report income accurately to the Internal Revenue Service (IRS). The W-2 form includes various boxes that indicate different types of income and deductions, making it a comprehensive record of an employee's earnings for the year.

Steps to Complete the Form W-2 Wage and Tax Statement

Completing the Form W-2 requires careful attention to detail to ensure accuracy. Here are the key steps involved:

- Gather necessary information: Collect all relevant employee data, including Social Security numbers, addresses, and wage information.

- Fill in employer details: Enter the employer's name, address, and Employer Identification Number (EIN) in the designated fields.

- Input employee information: Provide the employee's name, address, and Social Security number accurately.

- Report wages and taxes: Fill in the appropriate boxes with the total wages paid, Social Security wages, Medicare wages, and the amounts withheld for federal, state, and local taxes.

- Distribute copies: Provide copies of the completed W-2 to the employee and submit the necessary copies to the IRS and state tax agencies.

Legal Use of the Form W-2 Wage and Tax Statement

The legal use of the Form W-2 is governed by federal and state tax laws. Employers are required to issue this form to employees by January 31 of each year, ensuring that employees have sufficient time to file their tax returns. The W-2 form must be completed accurately, as any discrepancies can lead to penalties for both the employer and the employee.

Employees must report the information from their W-2 forms when filing their tax returns. Failure to report income as indicated on the W-2 can result in audits or penalties from the IRS. Therefore, it is essential for both employers and employees to understand the legal implications of the W-2 form.

Key Elements of the Form W-2 Wage and Tax Statement

The Form W-2 includes several key elements that provide essential information for tax reporting:

- Employee's information: Name, address, and Social Security number.

- Employer's information: Name, address, and Employer Identification Number (EIN).

- Wage details: Total wages, tips, and other compensation.

- Tax withholdings: Amounts withheld for federal income tax, Social Security tax, and Medicare tax.

- State and local tax information: Additional withholdings for state and local taxes, if applicable.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Form W-2 is crucial for compliance. Employers must provide employees with their W-2 forms by January 31 of each year. Additionally, employers must submit copies of the W-2 forms to the IRS by the same date if filing electronically or by mail.

Employees should ensure they receive their W-2 forms on time to file their tax returns accurately and avoid any penalties for late filing. The IRS typically sets the tax filing deadline for individuals on April 15, unless it falls on a weekend or holiday.

Who Issues the Form W-2 Wage and Tax Statement

The Form W-2 is issued by employers to their employees. This includes all businesses, non-profits, and government agencies that pay wages to employees. It is important for employers to ensure that they are compliant with IRS regulations regarding the issuance of W-2 forms, including maintaining accurate records of employee earnings and tax withholdings.

Employers are also responsible for ensuring that the information on the W-2 is correct before distributing it to employees. Any errors must be corrected promptly to avoid complications during tax filing.

Quick guide on how to complete 2021 form w 2 wage and tax statement

Effortlessly prepare Form W 2 Wage And Tax Statement on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct template and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents rapidly without any hold-ups. Handle Form W 2 Wage And Tax Statement on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric procedure today.

How to modify and electronically sign Form W 2 Wage And Tax Statement with ease

- Obtain Form W 2 Wage And Tax Statement and click on Get Form to commence.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review all information and click on the Done button to save your changes.

- Choose your preferred method to send your form—whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form W 2 Wage And Tax Statement and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2021 form w 2 wage and tax statement

The way to create an electronic signature for a PDF online

The way to create an electronic signature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The best way to make an eSignature right from your smartphone

The best way to create an eSignature for a PDF on iOS

The best way to make an eSignature for a PDF on Android

People also ask

-

What is a W2 form?

A W2 form is a crucial tax document that employers in the United States must provide to their employees. It reports the employee's annual wages and the amount of taxes withheld from their paychecks. Understanding how to properly fill out and sign your W2 is essential for filing your taxes accurately.

-

How can airSlate SignNow help with W2 forms?

airSlate SignNow simplifies the process of signing and sending W2 forms electronically. Our platform provides a secure and efficient way to manage your W2 documents, ensuring that they are signed and returned promptly. This helps streamline tax season for both employers and employees.

-

Is there a cost associated with using airSlate SignNow for W2 documents?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our cost-effective solution allows you to manage your W2 forms and other document types without breaking the bank. With our plans, you get access to features that save you time and reduce paperwork hassles.

-

What features does airSlate SignNow offer for managing W2 forms?

With airSlate SignNow, you can easily create, send, and track W2 forms. Key features include electronic signatures, customizable templates, and real-time notifications. These tools empower businesses to handle their W2 documents more efficiently and ensure compliance with regulations.

-

Can airSlate SignNow integrate with other software for managing W2 forms?

Yes, airSlate SignNow seamlessly integrates with various software applications, making it easy to manage your W2 documents. Integration with payroll, accounting, and HR systems ensures that your W2 forms are accurately filled out and filed on time. This saves your business valuable time and effort.

-

What are the benefits of using airSlate SignNow for W2 documents?

Using airSlate SignNow for your W2 documents offers numerous benefits, including faster processing, reduced paper usage, and enhanced security. Our platform ensures that your sensitive data is protected through encryption and secure storage. This makes it a reliable choice for businesses handling W2 forms.

-

How secure is airSlate SignNow for signing W2 forms?

airSlate SignNow employs industry-leading security measures to protect your W2 forms. Our platform uses advanced encryption technology and complies with privacy regulations. This ensures that your data remains confidential and secure throughout the signing process.

Get more for Form W 2 Wage And Tax Statement

Find out other Form W 2 Wage And Tax Statement

- How To Sign Washington Mechanic's Lien

- Help Me With Sign Washington Mechanic's Lien

- Sign Arizona Notice of Rescission Safe

- Sign Hawaii Notice of Rescission Later

- Sign Missouri Demand Note Online

- How To Sign New York Notice to Stop Credit Charge

- How Do I Sign North Dakota Notice to Stop Credit Charge

- How To Sign Oklahoma Notice of Rescission

- How To Sign Maine Share Donation Agreement

- Sign Maine Share Donation Agreement Simple

- Sign New Jersey Share Donation Agreement Simple

- How To Sign Arkansas Collateral Debenture

- Sign Arizona Bill of Lading Simple

- Sign Oklahoma Bill of Lading Easy

- Can I Sign Massachusetts Credit Memo

- How Can I Sign Nevada Agreement to Extend Debt Payment

- Sign South Dakota Consumer Credit Application Computer

- Sign Tennessee Agreement to Extend Debt Payment Free

- Sign Kentucky Outsourcing Services Contract Simple

- Sign Oklahoma Outsourcing Services Contract Fast