Iht423 2018

What is the IHT423?

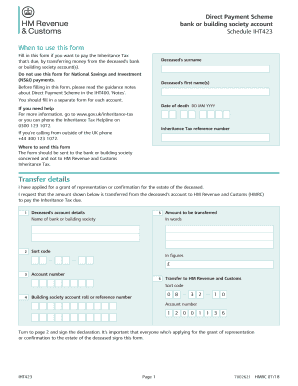

The IHT423 form is an essential document used in the United Kingdom for reporting inheritance tax. It is specifically designed for individuals who are applying for the Inheritance Tax Direct Payment Scheme. This form helps to determine the amount of inheritance tax owed when a person passes away, ensuring that the estate is settled according to legal requirements. The IHT423 form must be completed accurately to avoid delays in processing and potential penalties.

How to obtain the IHT423

To obtain the IHT423 form, individuals can visit the official HM Revenue and Customs (HMRC) website, where the form is available for download. The form can also be requested by contacting HMRC directly via phone or mail. It is important to ensure that you have the most current version of the form, as updates may occur periodically. The IHT423 form download is typically straightforward, allowing users to access the document easily for completion.

Steps to complete the IHT423

Completing the IHT423 form involves several key steps:

- Gather necessary information: Collect details about the deceased's estate, including assets, liabilities, and any gifts made before death.

- Fill out the form: Accurately enter all required information in the appropriate sections of the IHT423 form.

- Review your entries: Double-check all information for accuracy to prevent errors that could lead to complications.

- Sign and date the form: Ensure that the form is signed by the appropriate parties, as required by law.

- Submit the form: Send the completed IHT423 form to HMRC either online or by mail, following their submission guidelines.

Legal use of the IHT423

The IHT423 form is legally binding when completed and submitted according to HMRC regulations. It is crucial to comply with all legal requirements to ensure that the inheritance tax obligations are met. Using a reliable electronic signature solution can enhance the legal validity of the document. The form must be filled out truthfully, as false information can lead to penalties or legal repercussions.

Required Documents

When completing the IHT423 form, several documents may be required to support the information provided. These documents typically include:

- Death certificate of the deceased

- Details of the deceased's estate, including property deeds and bank statements

- Records of any gifts made within seven years prior to death

- Valuations of assets, such as real estate and investments

Having these documents readily available can facilitate a smoother completion process for the IHT423 form.

Form Submission Methods

The IHT423 form can be submitted through various methods, providing flexibility for users. These methods include:

- Online submission: Users can fill out and submit the form electronically through the HMRC online services.

- Mail: The completed form can be printed and sent to HMRC by post.

- In-person: In some cases, individuals may choose to deliver the form directly to HMRC offices, although this method is less common.

Choosing the appropriate submission method depends on personal preference and the urgency of the matter.

Quick guide on how to complete iht423

Effortlessly Prepare Iht423 on Any Device

Digital document management has become increasingly favored by both businesses and individuals. It offers a sustainable alternative to traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Handle Iht423 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Modify and eSign Iht423 with Ease

- Find Iht423 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, painstaking form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Iht423 to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct iht423

Create this form in 5 minutes!

How to create an eSignature for the iht423

How to make an electronic signature for your PDF online

How to make an electronic signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The best way to create an eSignature right from your smartphone

The best way to generate an electronic signature for a PDF on iOS

The best way to create an eSignature for a PDF on Android

People also ask

-

What is the iht423 form UK and how is it used?

The iht423 form UK is a crucial document used for reporting assets and liabilities for inheritance tax purposes. This form helps in calculating the tax due on an estate. Proper completion of the iht423 form UK ensures compliance with HMRC regulations and can expedite the processing of estate assets.

-

How can airSlate SignNow help with the iht423 form UK?

airSlate SignNow streamlines the process of completing and signing the iht423 form UK through its user-friendly software. With eSignature capabilities, users can seamlessly send the form for signatures, ensuring security and compliance. This enhances document management while reducing the time needed to finalize inheritance tax submissions.

-

Is there a cost associated with using airSlate SignNow for the iht423 form UK?

Yes, there is a subscription fee for using airSlate SignNow, which provides access to a range of features for managing documents, including the iht423 form UK. However, considering the time saved and the efficiency gained, many users find it a cost-effective solution for their document needs.

-

What features does airSlate SignNow offer for managing the iht423 form UK?

airSlate SignNow provides features such as customizable templates, workflow automation, and secure eSignature capabilities for the iht423 form UK. These tools make it easy to manage the document throughout its lifecycle, from creation to signature collection, ensuring a streamlined process.

-

Can I integrate airSlate SignNow with other applications while working on the iht423 form UK?

Absolutely! airSlate SignNow offers integrations with various applications, enhancing your ability to manage the iht423 form UK effectively. This seamless connection with tools like CRM systems and file storage services allows users to synchronize their workflows and improve efficiency.

-

What are the benefits of using airSlate SignNow for the iht423 form UK?

Using airSlate SignNow for the iht423 form UK offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The ability to sign documents electronically also speeds up the process of submitting tax forms to HMRC, minimizing potential delays in estate settlements.

-

How secure is airSlate SignNow when handling the iht423 form UK?

airSlate SignNow prioritizes security, implementing top-notch encryption and compliance with data protection regulations. When handling sensitive documents like the iht423 form UK, users can trust that their information is secure and that signatures are legally binding.

Get more for Iht423

- Lesson 7 homework practice divide fractions answer key form

- 6 3 skills practice elimination using addition and subtraction answer key form

- Caq certificate number form

- Requesting letter for address proof from company pdf form

- Dieses antragsformular ist unentgeltlich

- Ds 1648 form

- Local government records destruction notice fillable form

- Heart failure weight log pdf form

Find out other Iht423

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA