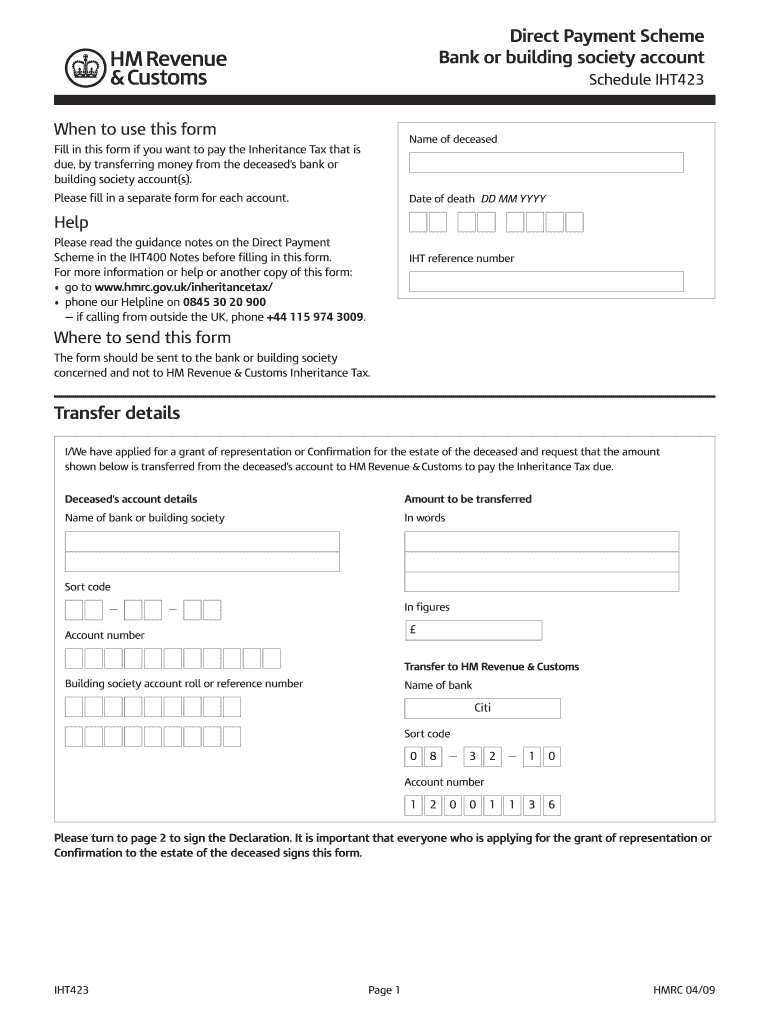

Iht423 Form 2009

What is the IHT423 Form

The IHT423 form, also known as the Inheritance Tax Account form, is a crucial document used in the United States for reporting the value of an estate and calculating the inheritance tax owed. This form is typically required when an individual passes away, and their estate exceeds a certain threshold. It provides a detailed account of the deceased's assets, liabilities, and any exemptions that may apply, ensuring compliance with federal tax regulations.

How to Use the IHT423 Form

Using the IHT423 form involves several steps to ensure accurate completion. First, gather all necessary financial documents related to the deceased's estate, including bank statements, property deeds, and investment records. Next, accurately fill out the form, detailing the value of assets and any debts owed. It is essential to double-check the information for accuracy, as errors can lead to delays or penalties. After completing the form, it should be submitted to the appropriate tax authority along with any required supporting documents.

Steps to Complete the IHT423 Form

Completing the IHT423 form requires careful attention to detail. Begin by entering the deceased's personal information, including their full name, date of birth, and date of death. Next, list all assets, such as real estate, bank accounts, and personal property, along with their estimated values. Include any debts or liabilities that may offset the estate's value. Finally, review the completed form for accuracy and clarity before submission. Consider consulting a tax professional if you have questions about specific entries or calculations.

Legal Use of the IHT423 Form

The IHT423 form is legally binding when completed and submitted in accordance with U.S. tax laws. It serves as an official declaration of the estate's value and the inheritance tax owed. Proper use of this form ensures compliance with legal obligations and can help prevent potential disputes among heirs or beneficiaries. It is important to retain copies of the submitted form and any correspondence with tax authorities for future reference.

Required Documents

When completing the IHT423 form, several supporting documents are required to substantiate the information provided. These may include:

- Death certificate

- Property deeds

- Bank statements

- Investment account statements

- Documents related to debts or liabilities

Having these documents readily available will facilitate the completion of the form and ensure accurate reporting of the estate's value.

Form Submission Methods

The IHT423 form can be submitted through various methods, depending on the requirements of the local tax authority. Common submission methods include:

- Online submission through the tax authority's website

- Mailing a physical copy to the appropriate office

- In-person submission at designated tax offices

Each method may have specific guidelines and deadlines, so it is important to verify the preferred submission method in your jurisdiction.

Quick guide on how to complete iht423 form

Prepare Iht423 Form effortlessly on any device

Virtual document management has become widely embraced by companies and individuals alike. It offers a fantastic eco-friendly substitute for conventional printed and signed materials, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and electronically sign your documents promptly without delays. Handle Iht423 Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign Iht423 Form with ease

- Find Iht423 Form and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choice. Modify and electronically sign Iht423 Form and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct iht423 form

Create this form in 5 minutes!

How to create an eSignature for the iht423 form

The best way to generate an eSignature for a PDF document online

The best way to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The way to create an eSignature from your smart phone

How to create an eSignature for a PDF document on iOS

The way to create an eSignature for a PDF file on Android OS

People also ask

-

What is the iht423 form and how does it work with airSlate SignNow?

The iht423 form is a document used for reporting gifts and estates to HM Revenue and Customs. With airSlate SignNow, you can easily fill out, send, and eSign the iht423 form securely and efficiently, ensuring compliance and accuracy in your submissions.

-

What are the key features of airSlate SignNow for completing the iht423 form?

AirSlate SignNow offers intuitive features such as template management, real-time collaboration, and customizable workflows specifically for the iht423 form. These features help streamline the completion process, reducing errors and saving time.

-

Is there a cost associated with using airSlate SignNow for the iht423 form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our plans provide great value for resources when handling the iht423 form, ensuring an affordable solution for eSigning and document management.

-

Can I integrate airSlate SignNow with other applications for managing the iht423 form?

Absolutely! AirSlate SignNow can be seamlessly integrated with various applications, allowing you to manage the iht423 form alongside other tools. Integrations with CRM systems, cloud storage, and productivity apps enhance efficiency and data flow.

-

How does airSlate SignNow improve the process of submitting the iht423 form?

AirSlate SignNow simplifies the submission of the iht423 form by providing a user-friendly interface, secure electronic signatures, and tracking capabilities. This ensures that your submissions are timely and organized, minimizing the risk of errors.

-

What are the benefits of using airSlate SignNow for the iht423 form compared to traditional methods?

Using airSlate SignNow for the iht423 form offers numerous benefits, including speed, security, and ease of use. Unlike traditional methods, eSigning and sending documents electronically greatly reduce paperwork, enhance security measures, and provide faster processing times.

-

Can I use airSlate SignNow on mobile devices for the iht423 form?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to complete and eSign the iht423 form on the go. This mobile accessibility ensures that you can manage important documents anytime, anywhere, without delay.

Get more for Iht423 Form

- Toyota claim form

- Teacher goal form

- Application central point school district 6 district6 form

- Employee personal details form

- How to use the pennsylvania will to live form suggestions and nrlc

- Nsa official youth roster national softball association form

- Money count deposit form club eastlake middle school elm sweetwaterschools

- What mandated reporters need to know about form

Find out other Iht423 Form

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT