Direct Payment Schemes for Inheritance Tax IHT423 Use This Form to Pay the Inheritance Tax Due, by Transferring Money from the D 2020-2026

Understanding the Direct Payment Scheme for Inheritance Tax IHT423

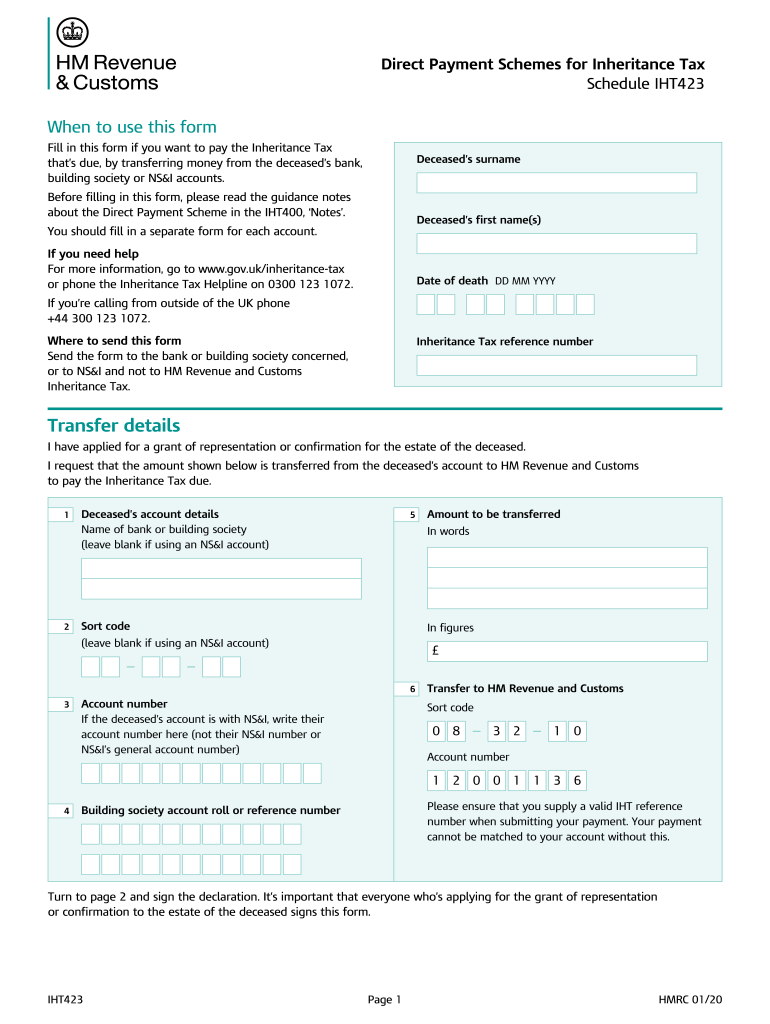

The IHT423 form is essential for settling inheritance tax obligations by transferring funds from the deceased's bank, building society, or National Savings and Investments accounts. This scheme allows executors or personal representatives to pay the tax directly from these accounts, simplifying the process during a challenging time. It is crucial to understand that this form is specifically designed for those handling estates where inheritance tax is due, ensuring a streamlined method for fulfilling tax responsibilities.

Steps to Complete the IHT423 Form

Completing the IHT423 form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information regarding the deceased’s financial accounts, including account numbers and the institutions holding these accounts. Next, accurately fill out the form, providing details about the deceased, the estate, and the specific amounts to be transferred. It is important to double-check all entries for correctness before submission. Finally, submit the form to the appropriate tax authority and retain copies for your records.

Legal Use of the IHT423 Form

The IHT423 form serves a legal purpose in the context of inheritance tax. By using this form, executors can ensure that the payments made from the deceased's accounts are recognized by tax authorities. Compliance with the legal requirements surrounding the form is essential, as improper use could lead to penalties or delays in processing the estate. Understanding the legal implications of the IHT423 form helps ensure that all actions taken are within the framework of the law.

Required Documents for the IHT423 Process

When preparing to submit the IHT423 form, certain documents are required to support the application. These include the death certificate of the deceased, proof of identity for the executor or personal representative, and documentation of the deceased's financial accounts. Having these documents ready will facilitate a smoother submission process and help avoid potential delays in payment processing.

Who Issues the IHT423 Form?

The IHT423 form is issued by the Internal Revenue Service (IRS) as part of the inheritance tax payment process. It is important to obtain the most current version of the form to ensure compliance with any updates or changes in tax regulations. Executors should verify that they are using the correct form to avoid complications during submission.

Filing Deadlines for the IHT423 Form

Filing deadlines for the IHT423 form are critical to ensure timely payment of inheritance tax. Typically, the form must be submitted within a specific time frame following the death of the individual. Executors should be aware of these deadlines to avoid penalties or interest charges on unpaid taxes. Keeping track of these dates is essential for effective estate management.

Eligibility Criteria for Using the IHT423 Form

To utilize the IHT423 form, certain eligibility criteria must be met. Primarily, the form is intended for estates where inheritance tax is due, and the executor must have the legal authority to act on behalf of the deceased's estate. Understanding these criteria is vital for ensuring that the correct procedures are followed and that the form is applicable to the specific circumstances of the estate.

Quick guide on how to complete direct payment schemes for inheritance tax iht423 use this form to pay the inheritance tax due by transferring money from the

Prepare Direct Payment Schemes For Inheritance Tax IHT423 Use This Form To Pay The Inheritance Tax Due, By Transferring Money From The D effortlessly on any gadget

Managing documents online has gained popularity among organizations and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools essential for swiftly creating, editing, and electronically signing your documents without delays. Handle Direct Payment Schemes For Inheritance Tax IHT423 Use This Form To Pay The Inheritance Tax Due, By Transferring Money From The D on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest method to alter and electronically sign Direct Payment Schemes For Inheritance Tax IHT423 Use This Form To Pay The Inheritance Tax Due, By Transferring Money From The D with ease

- Obtain Direct Payment Schemes For Inheritance Tax IHT423 Use This Form To Pay The Inheritance Tax Due, By Transferring Money From The D and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or redact sensitive details with tools that airSlate SignNow provides for that specific purpose.

- Create your electronic signature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Verify all the details and click the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form navigation, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Adjust and electronically sign Direct Payment Schemes For Inheritance Tax IHT423 Use This Form To Pay The Inheritance Tax Due, By Transferring Money From The D to ensure exceptional communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct direct payment schemes for inheritance tax iht423 use this form to pay the inheritance tax due by transferring money from the

Create this form in 5 minutes!

How to create an eSignature for the direct payment schemes for inheritance tax iht423 use this form to pay the inheritance tax due by transferring money from the

The best way to make an eSignature for your PDF file online

The best way to make an eSignature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The best way to generate an electronic signature from your mobile device

How to make an electronic signature for a PDF file on iOS

The best way to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is the IHT scheme form and how does it work?

The IHT scheme form is a specific document designed to facilitate the declaration of Inheritance Tax liabilities to HM Revenue and Customs. By using airSlate SignNow’s platform, users can easily fill out, sign, and send their IHT scheme form securely, ensuring compliance and a smooth submission process.

-

How much does it cost to use the airSlate SignNow for the IHT scheme form?

airSlate SignNow offers a variety of pricing plans tailored to different business needs, starting from a budget-friendly option suitable for occasional users. Each plan gives you access to seamless eSigning capabilities for documents like the IHT scheme form without incurring hidden fees.

-

What features does airSlate SignNow offer for the IHT scheme form?

With airSlate SignNow, you can access features such as customizable templates, automated workflows, and mobile signing, specifically designed to streamline filling out the IHT scheme form. These tools make it easier to manage the document creation and signing process efficiently.

-

Why should I use airSlate SignNow for my IHT scheme form?

Using airSlate SignNow for your IHT scheme form simplifies the eSigning process, making it faster and more secure. It enhances productivity by reducing paperwork time and ensures that your forms are compliant with legal standards.

-

Can I integrate airSlate SignNow with other tools for handling the IHT scheme form?

Yes, airSlate SignNow easily integrates with various business applications, allowing for a seamless workflow when handling the IHT scheme form. Whether you use CRM systems or cloud storage solutions, our platform connects to help you manage documents efficiently.

-

Is my data safe when using airSlate SignNow for the IHT scheme form?

Absolutely! airSlate SignNow employs advanced security measures, including encryption and two-factor authentication, to ensure that your data is safe when working with the IHT scheme form. We prioritize user privacy and regulatory compliance to safeguard your information.

-

Can multiple users collaborate on the IHT scheme form with airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate on the IHT scheme form, making it easier to gather necessary signatures and information. This feature fosters teamwork and accelerates the completion process for critical documents.

Get more for Direct Payment Schemes For Inheritance Tax IHT423 Use This Form To Pay The Inheritance Tax Due, By Transferring Money From The D

Find out other Direct Payment Schemes For Inheritance Tax IHT423 Use This Form To Pay The Inheritance Tax Due, By Transferring Money From The D

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer