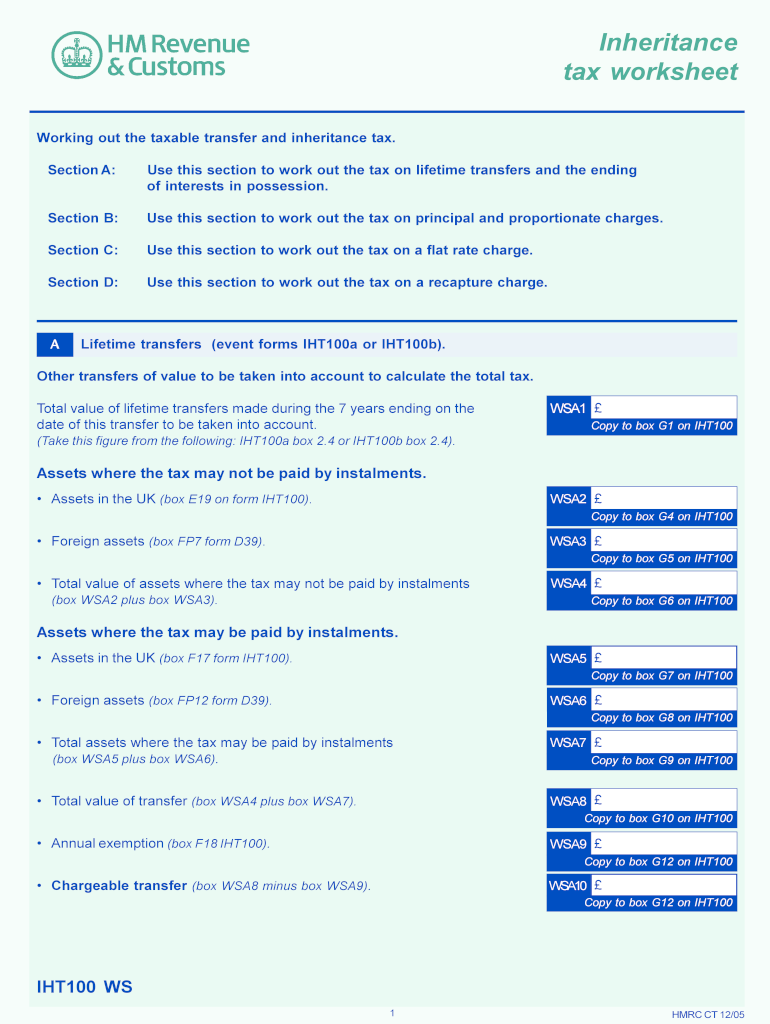

Iht100ws 2005

What is the Iht100ws

The Iht100ws is a form used in the United States for reporting inheritance tax details. It is essential for individuals who are managing the estate of a deceased person. This form helps in calculating the inheritance tax owed based on the value of the estate. The Iht100ws is a crucial document for ensuring compliance with tax regulations and provides a clear outline of the assets and liabilities involved in the estate.

How to use the Iht100ws

Using the Iht100ws involves several steps to ensure accurate reporting of the estate's value. First, gather all necessary documentation regarding the deceased's assets, debts, and other financial obligations. Next, fill out the form with detailed information about each asset, including real estate, bank accounts, and personal property. Ensure that all valuations are current and reflect the fair market value. Once completed, the form must be submitted to the appropriate tax authority for processing.

Steps to complete the Iht100ws

Completing the Iht100ws requires careful attention to detail. Follow these steps:

- Collect all relevant financial documents, including bank statements, property deeds, and investment records.

- List all assets and their corresponding values accurately.

- Document any debts or liabilities that may offset the total value of the estate.

- Fill out the Iht100ws form, ensuring all sections are completed with accurate information.

- Review the form for completeness and accuracy before submission.

Legal use of the Iht100ws

The Iht100ws holds legal significance in the estate settlement process. It is recognized by tax authorities as a formal declaration of the estate's value and is used to assess any inheritance tax owed. To ensure its legal validity, the form must be filled out correctly and submitted within the designated time frame. Failure to comply with legal requirements may result in penalties or complications in the estate settlement process.

Filing Deadlines / Important Dates

Timely filing of the Iht100ws is crucial to avoid penalties. Generally, the form must be submitted within a specific period following the death of the individual whose estate is being reported. It is essential to check state-specific regulations regarding deadlines, as these can vary. Keeping track of these dates ensures compliance and smooth processing of the inheritance tax obligations.

Required Documents

To successfully complete the Iht100ws, several documents are required. These typically include:

- Death certificate of the deceased.

- List of all assets, including property deeds and bank statements.

- Documentation of any debts or liabilities.

- Previous tax returns, if applicable.

Having these documents ready will facilitate the filling out of the form and help ensure that all necessary information is provided.

Quick guide on how to complete iht100ws

Effortlessly Prepare Iht100ws on Any Device

The management of online documents has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, edit, and eSign your documents without delays. Manage Iht100ws on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Edit and eSign Iht100ws with Ease

- Obtain Iht100ws and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select pertinent sections of your documents or obscure sensitive information with specialized tools that airSlate SignNow provides for that purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form: via email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Iht100ws and ensure superb communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct iht100ws

Create this form in 5 minutes!

How to create an eSignature for the iht100ws

How to make an electronic signature for your PDF in the online mode

How to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The best way to create an eSignature right from your smart phone

The best way to generate an electronic signature for a PDF on iOS devices

The best way to create an eSignature for a PDF on Android OS

People also ask

-

What is the iht100ws and how does it benefit my business?

The iht100ws is a powerful digital signing solution offered by airSlate SignNow that simplifies document workflows. It enables your business to easily send and eSign documents, streamlining processes and increasing efficiency. By using iht100ws, you can reduce turnaround time for signatures and ensure your documents are legally compliant.

-

What are the key features of the iht100ws?

The iht100ws includes features such as customizable templates, real-time notifications, and secure document storage. Its intuitive interface allows users to generate and manage documents effortlessly. Moreover, the iht100ws integrates seamlessly with various applications, making it a versatile choice for different business needs.

-

How does pricing work for the iht100ws?

airSlate SignNow offers flexible pricing plans for the iht100ws, catering to businesses of all sizes. You can choose from monthly or annual subscription options that best fit your budget. Additionally, airSlate SignNow provides a free trial, allowing you to explore the features of iht100ws before committing.

-

Can I integrate iht100ws with other software?

Yes, the iht100ws easily integrates with a variety of third-party applications, such as CRM systems, document management tools, and cloud storage services. This integration capability enhances workflow efficiency and improves collaboration across your organization. You can connect tools like Salesforce or Google Drive without any hassle.

-

Is the iht100ws secure for sensitive documents?

Absolutely! The iht100ws is designed with security at its core, ensuring that your sensitive documents remain protected. It uses advanced encryption standards and complies with legal regulations, providing peace of mind for users. With the iht100ws, you can confidently manage confidential documents without compromising security.

-

What types of documents can be signed using iht100ws?

The iht100ws supports a wide range of document formats, including PDFs, Word documents, and images. Whether you're signing contracts, agreements, or forms, the iht100ws provides a versatile platform for all your signing needs. This flexibility helps businesses streamline their documentation processes efficiently.

-

How can iht100ws improve my business workflows?

By implementing iht100ws, you can signNowly enhance your business workflows by reducing manual processes related to document signing. Automating these tasks allows your team to focus on core activities rather than administrative overhead. The result is a more productive environment where documents are handled swiftly and efficiently.

Get more for Iht100ws

Find out other Iht100ws

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure