Iht100ws Form 2020-2026

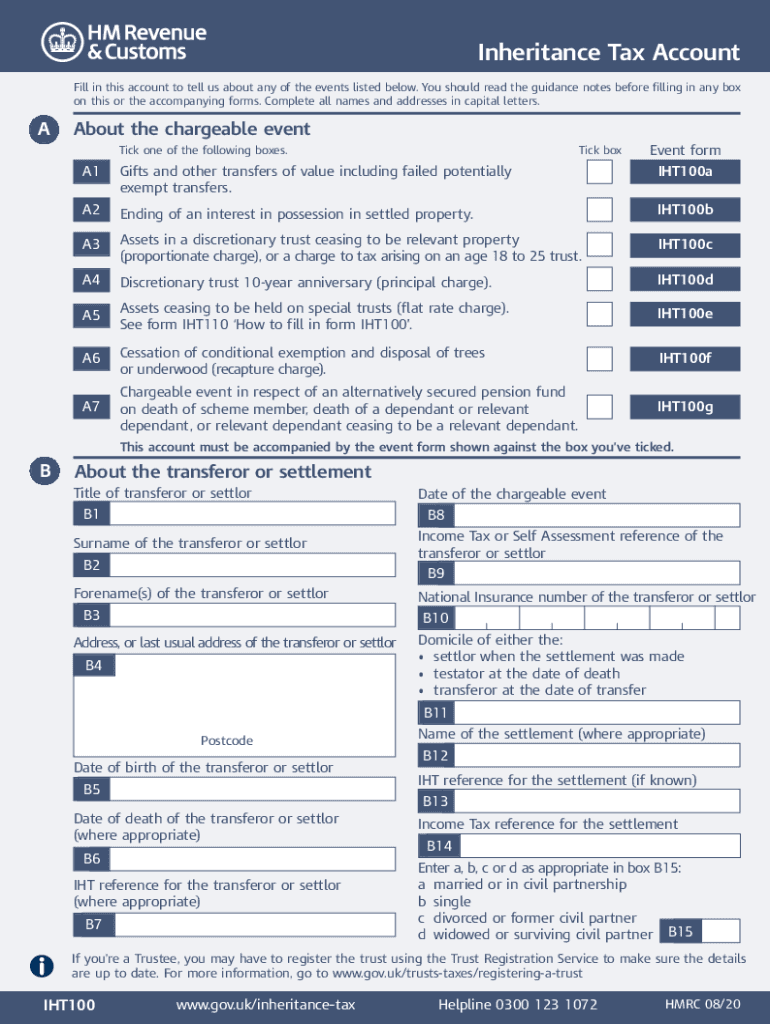

What is the Iht100ws Form

The Iht100ws form, also known as the inheritance tax worksheet, is a crucial document used in the United States for calculating the inheritance tax owed on an estate. This form helps individuals and executors determine the value of the estate and the applicable tax liabilities. It is essential for ensuring compliance with federal and state tax regulations.

How to use the Iht100ws Form

Using the Iht100ws form involves several steps. First, gather all necessary information about the deceased's assets, liabilities, and beneficiaries. Next, fill out the form by entering the required details, such as property values and debts. It's important to ensure accuracy, as errors can lead to delays or penalties. Once completed, the form can be submitted to the appropriate tax authority as part of the estate settlement process.

Steps to complete the Iht100ws Form

Completing the Iht100ws form requires a systematic approach:

- Collect all relevant financial documents, including bank statements, property deeds, and insurance policies.

- List all assets and their estimated values, ensuring to include real estate, investments, and personal property.

- Document any outstanding debts or liabilities that may affect the estate's value.

- Fill in the form accurately, double-checking all entries for correctness.

- Consult with a tax professional if needed to ensure compliance with all regulations.

Key elements of the Iht100ws Form

The Iht100ws form includes several key elements that must be addressed:

- Asset valuation: Accurate assessment of all estate assets is critical.

- Liabilities: All debts must be listed to determine the net value of the estate.

- Beneficiary information: Details about who will inherit the estate must be included.

- Tax calculations: The form should include calculations for any taxes owed based on the estate's value.

Legal use of the Iht100ws Form

The Iht100ws form is legally binding when filled out correctly and submitted to the appropriate authorities. It must comply with federal and state laws regarding inheritance tax. Ensuring that the form is completed accurately is essential to avoid legal complications or disputes among beneficiaries. The use of electronic signatures can also enhance the legal validity of the document when submitted digitally.

Form Submission Methods (Online / Mail / In-Person)

The Iht100ws form can be submitted through various methods depending on the jurisdiction:

- Online: Many states offer online submission options for tax forms, allowing for quicker processing.

- Mail: The form can be printed and sent via postal service to the designated tax authority.

- In-Person: Some individuals may choose to submit the form in person at local tax offices for immediate confirmation.

Quick guide on how to complete iht100ws form

Effortlessly prepare Iht100ws Form on any device

The management of online documents has gained immense popularity among companies and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the necessary form and securely save it online. airSlate SignNow provides all the features required to create, amend, and eSign your documents quickly without any hold-ups. Manage Iht100ws Form seamlessly across any platform with the airSlate SignNow apps for Android or iOS, and enhance any document-related workflow today.

The simplest way to edit and eSign Iht100ws Form with ease

- Obtain Iht100ws Form and then click Get Form to begin.

- Utilize the features we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specially designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Iht100ws Form and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct iht100ws form

Create this form in 5 minutes!

How to create an eSignature for the iht100ws form

The way to generate an electronic signature for your PDF file in the online mode

The way to generate an electronic signature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your smartphone

The best way to make an electronic signature for a PDF file on iOS devices

The best way to create an electronic signature for a PDF document on Android

People also ask

-

What is an inheritance tax worksheet?

An inheritance tax worksheet is a tool used to calculate the taxes owed on an estate after someone passes away. It helps ensure that all taxable items are accounted for, making the estate settlement process smoother. Using an inheritance tax worksheet can simplify tax obligations and provide clarity on the total amount due.

-

How can airSlate SignNow help with my inheritance tax worksheet?

airSlate SignNow allows you to easily create, manage, and eSign your inheritance tax worksheet online. Our platform streamlines document handling, ensuring you can collaborate with family members and tax professionals without hassle. With electronic signatures, you can finalize your tax worksheet quickly and securely.

-

Is the inheritance tax worksheet provided by airSlate SignNow customizable?

Yes, you can customize the inheritance tax worksheet using airSlate SignNow's user-friendly interface. Tailor it to fit your specific needs and circumstances regarding your estate. This customization ensures that all relevant information is accurately captured, enhancing the document's effectiveness.

-

Are there any fees associated with using the inheritance tax worksheet on airSlate SignNow?

airSlate SignNow offers a cost-effective solution for managing your inheritance tax worksheet, with various pricing plans suitable for different needs. You can choose a subscription that best fits your requirements. The value you receive with our service includes secure document handling and fast processing times.

-

What features does airSlate SignNow offer for completing my inheritance tax worksheet?

airSlate SignNow provides features such as templates for an inheritance tax worksheet, eSignature capabilities, and document management tools. These features ensure you can efficiently complete and sign your worksheet, track changes, and collaborate with others. This streamlining helps to ensure compliance and accuracy in tax reporting.

-

Can I integrate airSlate SignNow with other applications for my inheritance tax worksheet?

Yes, airSlate SignNow supports integrations with various popular applications to assist you with your inheritance tax worksheet. This allows you to import data and collaborate more effectively with your team and advisors. Our platform facilitates seamless integration with tools you already use, increasing productivity.

-

What are the benefits of using airSlate SignNow for my inheritance tax worksheet?

Using airSlate SignNow for your inheritance tax worksheet streamlines document creation, ensures secure eSigning, and simplifies the entire process. This efficiency reduces the time spent on tax documentation, allowing you to focus on other important matters. Additionally, the platform enhances collaboration, making it easier to work with family members and advisors.

Get more for Iht100ws Form

- Leather inspection report form

- Genius challenge water cycle answers form

- Dr2504 100497256 form

- New jersey assignment of tidelands license form

- Flagger workbook form

- Licensing and accreditation department form

- Rewrite the sentence with the correct capitalization form

- Exhibit b claim form sc superior court e filing

Find out other Iht100ws Form

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online