Printable California Form 5870 a Tax on Accumulation Distribution of Trusts

Understanding the California Form 5870 A Tax on Accumulation Distribution of Trusts

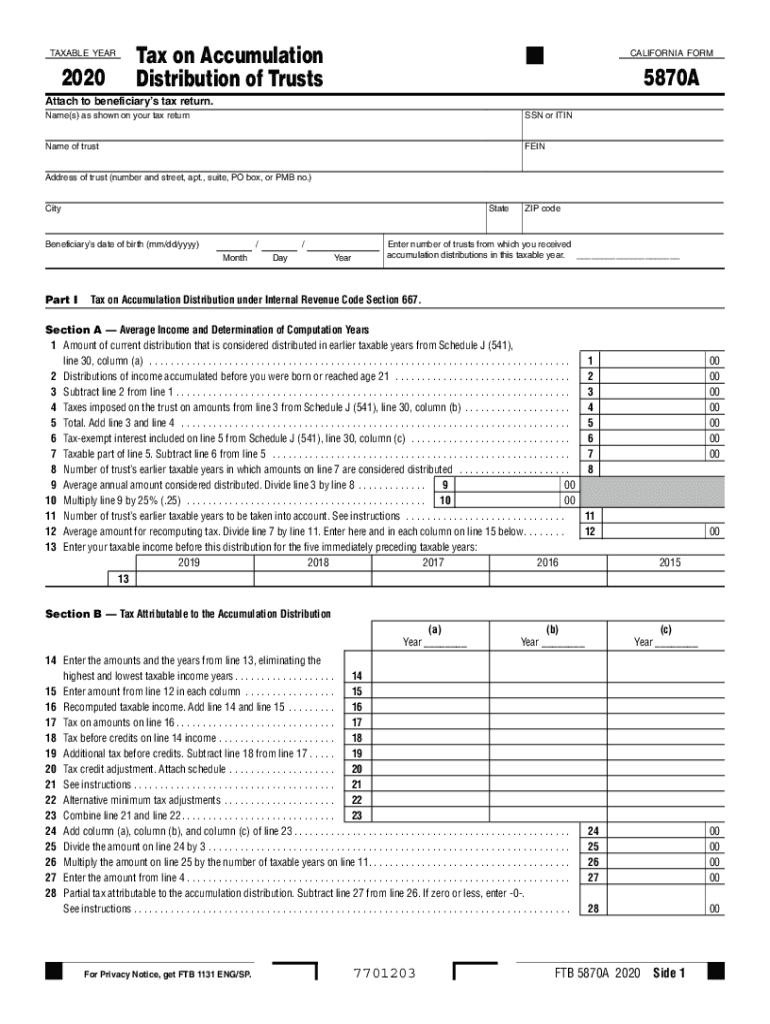

The California Form 5870 A is specifically designed for reporting taxes on accumulation distributions from trusts. This form is essential for beneficiaries who receive distributions from a trust that has accumulated income instead of distributing it annually. The tax implications can be significant, as they affect both the trust and the beneficiaries, making it crucial to understand how this form operates within California's tax framework.

Steps to Complete the California Form 5870 A

Filling out the California Form 5870 A requires careful attention to detail. Here are the steps to ensure accurate completion:

- Gather necessary information about the trust, including its name, address, and taxpayer identification number.

- Identify the beneficiaries and their respective shares of the accumulated distributions.

- Calculate the total amount of accumulated distributions that are subject to tax.

- Complete each section of the form accurately, ensuring all figures are correctly entered.

- Review the completed form for any errors or omissions before submission.

Legal Use of the California Form 5870 A

Using the California Form 5870 A is legally mandated for specific tax situations involving trusts. This form must be filed to comply with California tax laws when distributions from a trust are accumulated rather than distributed. Failure to file can result in penalties and interest on unpaid taxes, emphasizing the importance of timely and accurate submission.

Filing Deadlines for the California Form 5870 A

It is crucial to be aware of the filing deadlines associated with the California Form 5870 A. Typically, the form must be submitted by the due date of the trust's tax return. This date may vary depending on the type of trust and its fiscal year. Keeping track of these deadlines helps avoid penalties and ensures compliance with state tax regulations.

Obtaining the California Form 5870 A

The California Form 5870 A can be obtained through the California Franchise Tax Board's official website. It is available in printable format, allowing users to fill it out by hand or digitally. Ensuring you have the most current version of the form is essential for compliance and accuracy in reporting.

Examples of Using the California Form 5870 A

There are various scenarios in which the California Form 5870 A is applicable. For instance, if a trust has accumulated income over several years and decides to distribute a portion of that income to beneficiaries, the form must be filed to report the tax implications of those distributions. Understanding these examples can clarify when and how to use the form effectively.

Quick guide on how to complete printable 2020 california form 5870 a tax on accumulation distribution of trusts

Effortlessly Prepare Printable California Form 5870 A Tax On Accumulation Distribution Of Trusts on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can obtain the correct template and securely store it online. airSlate SignNow provides all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Printable California Form 5870 A Tax On Accumulation Distribution Of Trusts on any device with the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

How to Modify and eSign Printable California Form 5870 A Tax On Accumulation Distribution Of Trusts with Ease

- Obtain Printable California Form 5870 A Tax On Accumulation Distribution Of Trusts and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Printable California Form 5870 A Tax On Accumulation Distribution Of Trusts to ensure exceptional communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the printable 2020 california form 5870 a tax on accumulation distribution of trusts

The best way to create an eSignature for a PDF document in the online mode

The best way to create an eSignature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

The way to generate an electronic signature straight from your mobile device

The way to generate an eSignature for a PDF document on iOS devices

The way to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is Form 5870 and how can it be used with airSlate SignNow?

Form 5870 is a essential document that businesses often need to complete for tax purposes. With airSlate SignNow, you can easily access this form, fill it out, and eSign it, ensuring a smooth and efficient process for your business needs.

-

Is there a cost associated with using Form 5870 in airSlate SignNow?

Using airSlate SignNow to manage Form 5870 is part of our comprehensive pricing plans. We offer cost-effective solutions that make it easy for businesses of any size to send, sign, and store their documents securely, including Form 5870.

-

What features does airSlate SignNow offer for Form 5870?

airSlate SignNow offers a variety of features specifically designed for managing Form 5870. These include easy document templates, eSignature capabilities, and customizable workflows, enabling users to streamline their document handling efficiently.

-

Can I integrate airSlate SignNow with other applications for Form 5870 management?

Yes, airSlate SignNow seamlessly integrates with various applications, allowing you to export and manage Form 5870 alongside your existing tools. This integration enhances productivity and ensures you can access your documents wherever you work.

-

What are the benefits of using airSlate SignNow for Form 5870 documents?

Using airSlate SignNow for Form 5870 offers numerous benefits, including improved efficiency, reduced paper usage, and enhanced security for your sensitive information. Additionally, our platform allows for easy tracking and management of your document workflows.

-

Is airSlate SignNow secure for signing Form 5870?

Absolutely! airSlate SignNow employs industry-standard security measures to ensure that all documents, including Form 5870, are protected. With features like encryption and secure storage, your sensitive information remains safe from unauthorized access.

-

How can I get started with using Form 5870 in airSlate SignNow?

Getting started with Form 5870 in airSlate SignNow is simple. Just sign up for an account, access the templates section, and locate Form 5870 to begin filling it out right away. Our user-friendly interface makes the process intuitive and quick.

Get more for Printable California Form 5870 A Tax On Accumulation Distribution Of Trusts

- Nsw advance care directive comprehensive form

- Bawa claim form

- Hamtramck building department form

- Washington state tax exempt form

- Housing transfer application form

- Shriners referral form

- Dr 0145 colorado tax information authorization or power of attorney

- Rtf 3 state of nj division of taxation claim for refund nj gov form

Find out other Printable California Form 5870 A Tax On Accumulation Distribution Of Trusts

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate