Missouri 1120 Form

What is the Missouri 1120?

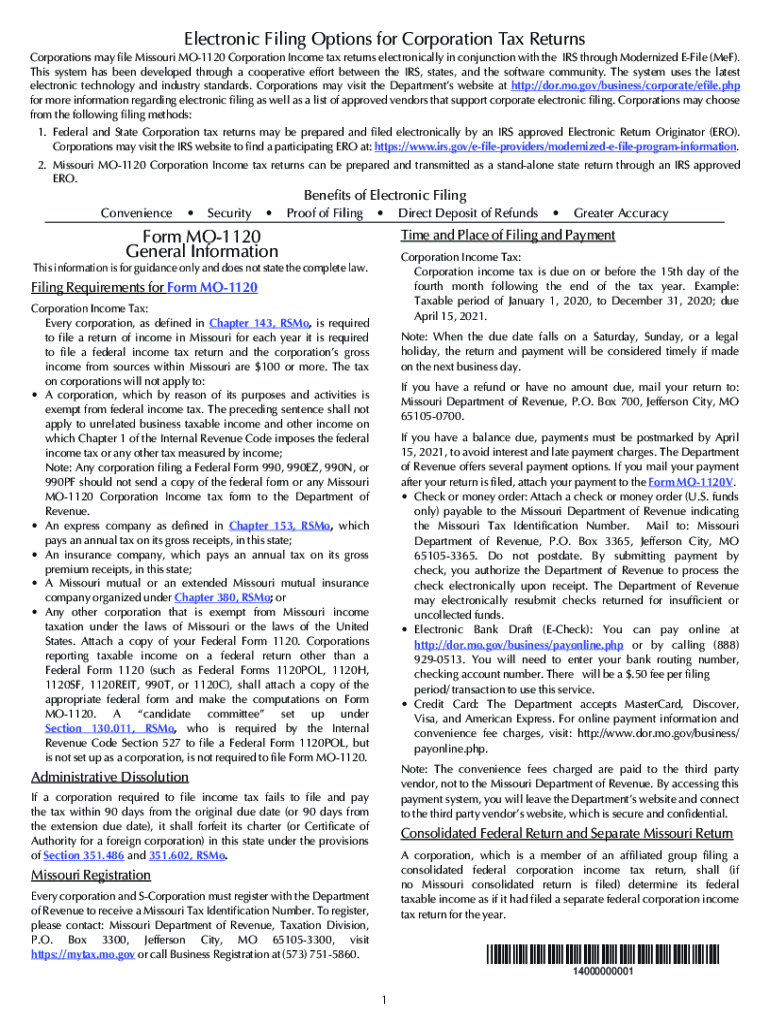

The Missouri 1120 is a corporate income tax return form used by corporations operating in the state of Missouri. This form is essential for reporting income, deductions, and credits to determine the corporation's tax liability. It is specifically designed for C corporations, which are taxed separately from their owners. Understanding the Missouri 1120 is crucial for businesses to ensure compliance with state tax laws and to accurately report their financial activities.

Steps to Complete the Missouri 1120

Completing the Missouri 1120 involves several key steps to ensure accuracy and compliance. Here are the main steps:

- Gather necessary financial documents, including income statements, balance sheets, and prior tax returns.

- Begin filling out the form by entering the corporation's identifying information, such as the name, address, and federal employer identification number (EIN).

- Report total income, including gross receipts and other income sources, on the appropriate lines of the form.

- Deduct allowable expenses, including cost of goods sold, operating expenses, and any applicable tax credits.

- Calculate the taxable income and the corresponding tax liability based on Missouri tax rates.

- Review the completed form for accuracy and ensure all required signatures are in place.

Legal Use of the Missouri 1120

The Missouri 1120 must be filed in accordance with state tax laws to be considered legally valid. It serves as an official record of a corporation's income and tax obligations. To ensure legal compliance, corporations must adhere to the filing deadlines and provide accurate information. The form must also be signed by an authorized officer of the corporation, which can be done electronically using secure eSignature solutions. This adds an additional layer of authenticity and compliance with legal standards.

Filing Deadlines / Important Dates

Corporations must be aware of the filing deadlines for the Missouri 1120 to avoid penalties. Typically, the form is due on the fifteenth day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the deadline is April 15. Extensions may be available, but they require timely submission of an extension request. It is advisable to mark these important dates on the calendar to ensure timely compliance.

Required Documents

To complete the Missouri 1120 accurately, certain documents are required. These include:

- Financial statements, including income statements and balance sheets.

- Prior year tax returns for reference.

- Documentation for any deductions or credits being claimed.

- Records of any estimated tax payments made throughout the year.

Having these documents ready will streamline the completion of the form and help ensure accuracy in reporting.

Who Issues the Form

The Missouri 1120 is issued by the Missouri Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among businesses operating within Missouri. The department provides guidelines and resources to assist corporations in understanding their tax obligations and completing the form accurately.

Quick guide on how to complete missouri 1120

Complete Missouri 1120 effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents rapidly without any delays. Manage Missouri 1120 on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to modify and eSign Missouri 1120 seamlessly

- Obtain Missouri 1120 and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method of sharing your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form navigation, or errors requiring the printing of new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you choose. Modify and eSign Missouri 1120 and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the missouri 1120

The way to create an eSignature for a PDF file in the online mode

The way to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature straight from your smartphone

The best way to generate an eSignature for a PDF file on iOS devices

How to make an electronic signature for a PDF document on Android

People also ask

-

What are the Missouri MO 1120 instructions for filing taxes?

The Missouri MO 1120 instructions provide guidance for corporations to complete their tax returns. It's essential to follow these instructions carefully to ensure compliance and avoid penalties. You can find detailed information in the official documentation provided by the Missouri Department of Revenue.

-

How does airSlate SignNow simplify the process of managing Missouri MO 1120 instructions?

airSlate SignNow streamlines the document signing process, allowing businesses to handle Missouri MO 1120 instructions digitally. This means you can easily fill out, sign, and send your tax documents without the need for printing or mailing. The platform ensures a secure and efficient way to manage your tax paperwork.

-

Are there any costs associated with using airSlate SignNow for Missouri MO 1120 instructions?

Yes, airSlate SignNow offers various pricing plans tailored for different business needs. The cost depends on the features you choose, but the platform is designed to be cost-effective, helping you save time and resources while managing your Missouri MO 1120 instructions. Consider starting with a free trial to explore the features.

-

What features does airSlate SignNow offer for handling Missouri MO 1120 instructions?

airSlate SignNow provides features like document templates, eSigning capabilities, and secure storage to make managing Missouri MO 1120 instructions easier. These tools help ensure that your tax documents are completed accurately and stored securely. Additionally, you can collaborate with team members in real-time.

-

Can airSlate SignNow integrate with other software for managing Missouri MO 1120 instructions?

Yes, airSlate SignNow integrates seamlessly with various software applications such as CRM and accounting tools. These integrations help streamline workflow processes and ensure that your Missouri MO 1120 instructions are aligned with your existing systems, enhancing overall productivity.

-

How does eSigning with airSlate SignNow benefit businesses managing Missouri MO 1120 instructions?

eSigning with airSlate SignNow offers convenience and speed for businesses managing Missouri MO 1120 instructions. It allows you to sign documents electronically, reducing delays caused by traditional signing methods. This efficiency helps you meet tax deadlines and ensures that your submissions are processed on time.

-

Is airSlate SignNow user-friendly for individuals new to Missouri MO 1120 instructions?

Absolutely! airSlate SignNow is designed with user experience in mind, making it accessible for anyone, including those unfamiliar with Missouri MO 1120 instructions. The intuitive interface guides you through each step, ensuring that you can complete your documents with ease and confidence.

Get more for Missouri 1120

- Can public pass asia brewery road form

- Us custom letterhead form

- Form 1709 ssa

- Jomec ethical approval form cardiff university redirect cf ac

- Form number nhjb2685fs

- Virtual classroom observation form

- Residential data input form bmymetrotexcomb

- Fillable online residential lease property data input form

Find out other Missouri 1120

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple