Fin 405 Form

What is the Fin 405?

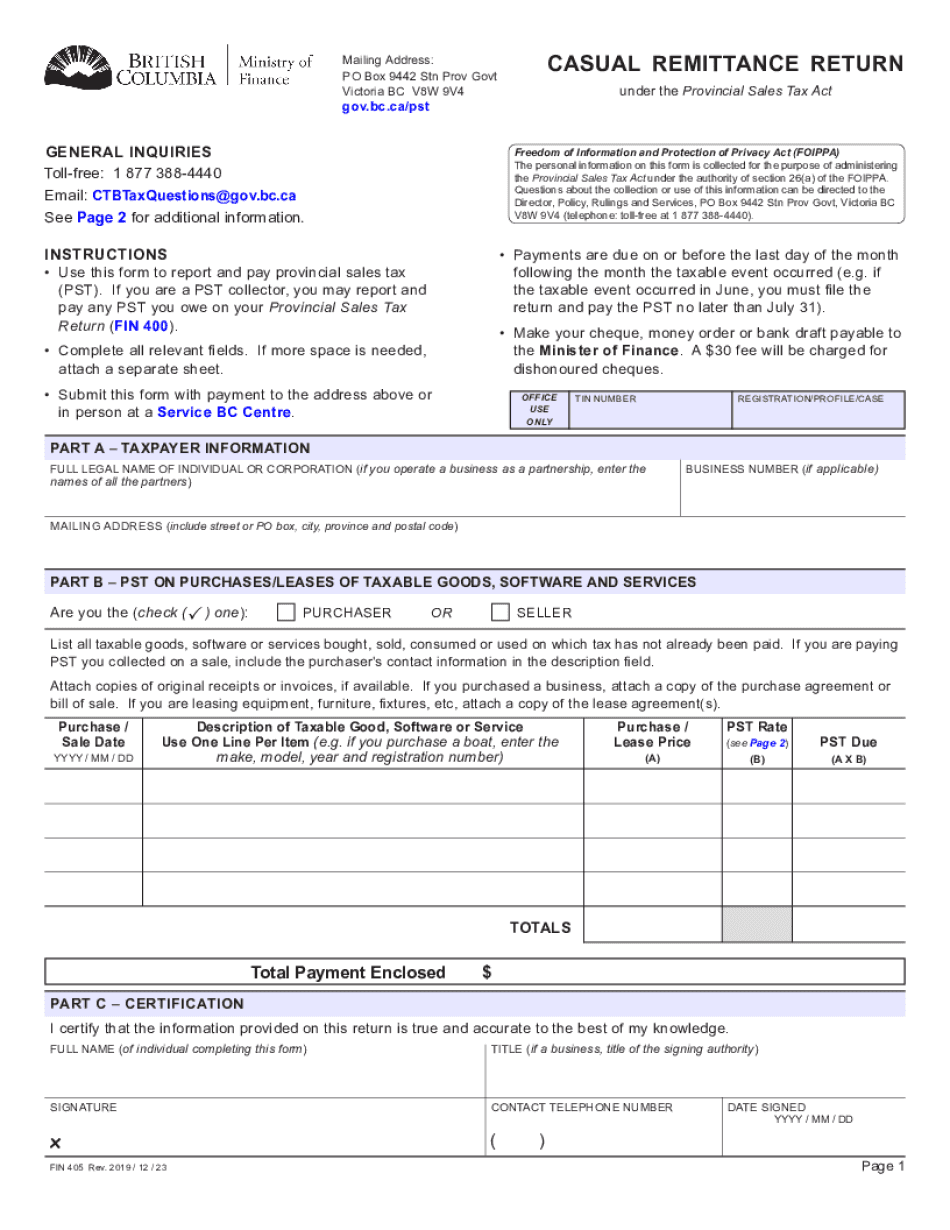

The Fin 405 is a form used for casual remittance, primarily designed to facilitate the reporting of certain financial transactions. This form is essential for individuals and businesses that need to document and report specific payments made to the Internal Revenue Service (IRS). It serves as a tool for ensuring compliance with federal tax regulations, providing a clear record of remittances for both the payer and the IRS.

How to use the Fin 405

Using the Fin 405 involves a straightforward process that ensures accurate reporting of casual remittances. First, gather all necessary information regarding the payment, including the amount, date, and purpose. Next, fill out the form with the required details, ensuring that all information is accurate and complete. Once the form is filled out, it can be submitted electronically or via mail, depending on your preference and the specific requirements of the IRS.

Steps to complete the Fin 405

Completing the Fin 405 requires careful attention to detail. Follow these steps for a smooth process:

- Gather all relevant financial information, including payment amounts and dates.

- Access the Fin 405 form, either through a digital platform or by downloading it.

- Fill in the required fields, ensuring accuracy in all entries.

- Review the completed form for any errors or omissions.

- Submit the form according to the chosen method, either electronically or by mail.

Legal use of the Fin 405

The Fin 405 is legally recognized for reporting casual remittances, provided it is completed and submitted in accordance with IRS guidelines. It is important to adhere to the legal stipulations surrounding the use of this form, as improper use may lead to penalties or complications with tax obligations. Ensuring compliance with the relevant laws helps protect both the payer and the recipient in any financial transaction.

Filing Deadlines / Important Dates

Filing deadlines for the Fin 405 are critical to avoid penalties. Typically, the form must be submitted by specific dates set by the IRS, which may vary depending on the type of transaction being reported. It is advisable to keep track of these deadlines and plan submissions accordingly to ensure timely compliance with tax regulations.

Required Documents

When preparing to complete the Fin 405, certain documents are necessary to provide the required information accurately. These may include:

- Payment receipts or records.

- Tax identification numbers for both the payer and recipient.

- Any prior correspondence with the IRS related to the transaction.

Having these documents on hand will streamline the completion process and enhance the accuracy of the information provided.

Quick guide on how to complete fin 405 492756783

Effortlessly prepare Fin 405 on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to access the correct form and store it securely online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Handle Fin 405 on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The simplest way to modify and eSign Fin 405 with ease

- Find Fin 405 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal value as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, text message (SMS), an invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tiring form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from your preferred device. Modify and eSign Fin 405 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fin 405 492756783

The way to create an eSignature for a PDF document online

The way to create an eSignature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

How to make an electronic signature straight from your smart phone

The best way to generate an eSignature for a PDF document on iOS

How to make an electronic signature for a PDF document on Android OS

People also ask

-

What is form fin remittance and how does it work with airSlate SignNow?

Form fin remittance is a process that allows businesses to manage their financial transactions efficiently. With airSlate SignNow, users can easily create, send, and eSign form fin remittance documents, ensuring secure and streamlined operations. The platform simplifies this process, making it accessible and user-friendly for companies of all sizes.

-

How does airSlate SignNow handle form fin remittance documents securely?

Security is paramount when dealing with form fin remittance documents. airSlate SignNow employs advanced encryption standards and secure cloud storage to protect sensitive data. Additionally, the platform complies with key regulations to ensure that all form fin remittance activities are conducted securely and legally.

-

Are there any costs associated with using airSlate SignNow for form fin remittance?

Yes, airSlate SignNow offers a variety of pricing plans to cater to different business needs regarding form fin remittance. By choosing the right plan, organizations can access features tailored to optimize their financial document workflows. Users can benefit from a cost-effective solution that aligns with their budget and requirements.

-

What features does airSlate SignNow offer for managing form fin remittance?

airSlate SignNow provides several features to facilitate form fin remittance management, including customizable templates, automated workflows, and tracking functionalities. These features help businesses streamline their processes and reduce time spent on paperwork. The intuitive interface makes it easy for users to navigate and manage their documents effectively.

-

Can I integrate airSlate SignNow with other applications for form fin remittance?

Absolutely! airSlate SignNow supports integration with a wide range of applications, enhancing your form fin remittance process. This includes popular CRM, accounting, and productivity software, helping businesses create a seamless workflow. Integrating these tools allows for more efficient operations and better tracking of financial documents.

-

What are the benefits of using airSlate SignNow for form fin remittance?

Using airSlate SignNow for form fin remittance offers numerous benefits, including time savings, improved accuracy, and enhanced security. With an easy-to-use interface and automated processes, companies can signNowly reduce the burden of manual paperwork. Additionally, the platform enables faster turnaround times for approvals and transactions, leading to efficient business practices.

-

Is airSlate SignNow suitable for large businesses handling form fin remittance?

Yes, airSlate SignNow is designed to cater to businesses of all sizes, including large enterprises dealing with form fin remittance. The platform's scalability ensures that it can handle high volumes of documents without compromising performance. Features such as advanced analytics and user permission settings make it an ideal choice for larger organizations.

Get more for Fin 405

Find out other Fin 405

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement