Online Homestead Exemption Application Form

What is the Online Homestead Exemption Application

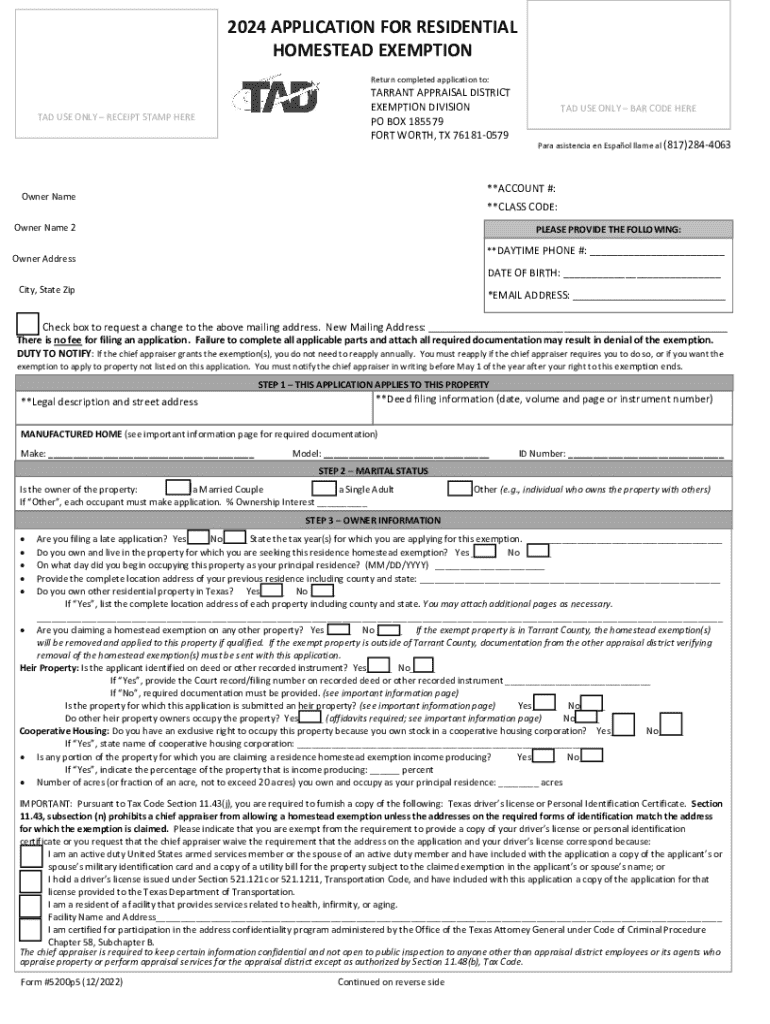

The Online Homestead Exemption Application is a digital form that allows homeowners to apply for a homestead exemption, which can provide tax relief on their primary residence. This exemption reduces the taxable value of the property, potentially lowering the amount of property taxes owed. The application process is designed to be accessible, enabling users to complete and submit their forms electronically, streamlining the overall experience.

Steps to complete the Online Homestead Exemption Application

Completing the Online Homestead Exemption Application involves several straightforward steps:

- Gather necessary documentation, such as proof of identity and ownership of the property.

- Access the online application portal provided by your local appraisal district.

- Fill out the required fields in the application form, ensuring all information is accurate and complete.

- Review the application for any errors or missing information before submission.

- Submit the application electronically and save a copy for your records.

Eligibility Criteria

To qualify for the homestead exemption, applicants must meet specific eligibility criteria, which may vary by state. Generally, the following conditions apply:

- The property must be the applicant's primary residence.

- The applicant must be the owner of the property as of January first of the tax year.

- In some cases, applicants may need to provide proof of residency, such as a driver's license or utility bill.

Required Documents

When applying for the homestead exemption, certain documents are typically required to verify eligibility. Commonly needed documents include:

- Proof of identity, such as a government-issued ID.

- Proof of ownership, like a property deed or tax statement.

- Documentation supporting residency, such as a recent utility bill or lease agreement.

Form Submission Methods

The Online Homestead Exemption Application can be submitted through various methods, depending on the local appraisal district's guidelines. Common submission methods include:

- Online submission via the designated application portal.

- Mailing a printed version of the application to the appraisal district office.

- In-person submission at the local appraisal district office.

Key elements of the Online Homestead Exemption Application

Understanding the key elements of the Online Homestead Exemption Application is essential for a successful submission. Important components typically include:

- Property information, including address and parcel number.

- Owner information, such as name and contact details.

- Eligibility declarations, confirming the applicant's status as the primary resident.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the online homestead exemption application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 5200 homestead exemption?

The 5200 homestead exemption is a property tax exemption that reduces the taxable value of your home, providing signNow savings for homeowners. This exemption is designed to help residents maintain affordable housing costs. By applying for the 5200 homestead exemption, you can lower your property tax bill and keep more money in your pocket.

-

How can airSlate SignNow help with the 5200 homestead exemption application process?

airSlate SignNow streamlines the application process for the 5200 homestead exemption by allowing you to easily fill out and eSign necessary documents online. This eliminates the need for printing, scanning, or mailing paperwork, making the process faster and more efficient. With our user-friendly platform, you can ensure that your application is submitted accurately and on time.

-

What are the benefits of the 5200 homestead exemption?

The primary benefit of the 5200 homestead exemption is the reduction in property taxes, which can lead to substantial savings each year. Additionally, this exemption can provide financial relief for low-income homeowners and help stabilize housing costs. By taking advantage of the 5200 homestead exemption, you can enhance your financial well-being and invest in other areas of your life.

-

Is there a cost associated with applying for the 5200 homestead exemption?

Applying for the 5200 homestead exemption is typically free, but some local jurisdictions may charge a nominal fee for processing. Using airSlate SignNow, you can complete your application without incurring additional costs related to printing or mailing. Our platform is designed to be cost-effective, ensuring you can focus on maximizing your savings.

-

What documents do I need to apply for the 5200 homestead exemption?

To apply for the 5200 homestead exemption, you generally need proof of residency, such as a driver's license or utility bill, and documentation of your property's ownership. airSlate SignNow allows you to upload and eSign these documents securely, ensuring that your application is complete and compliant with local requirements. This simplifies the process and helps you avoid delays.

-

Can I track the status of my 5200 homestead exemption application?

Yes, many local tax offices provide a way to track the status of your 5200 homestead exemption application online. By using airSlate SignNow, you can keep a digital record of your submitted documents and any correspondence related to your application. This transparency helps you stay informed and prepared for any follow-up actions needed.

-

How does airSlate SignNow ensure the security of my 5200 homestead exemption documents?

airSlate SignNow prioritizes the security of your documents with advanced encryption and secure cloud storage. When you submit your 5200 homestead exemption application through our platform, you can trust that your personal information is protected. Our commitment to security means you can focus on completing your application without worrying about data bsignNowes.

Get more for Online Homestead Exemption Application

Find out other Online Homestead Exemption Application

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now

- eSign Pennsylvania Mutual non-disclosure agreement Now

- Help Me With eSign Utah Non disclosure agreement sample

- How Can I eSign Minnesota Partnership agreements

- eSign Pennsylvania Property management lease agreement Secure

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now