BIR 2316 Form 2018-2022

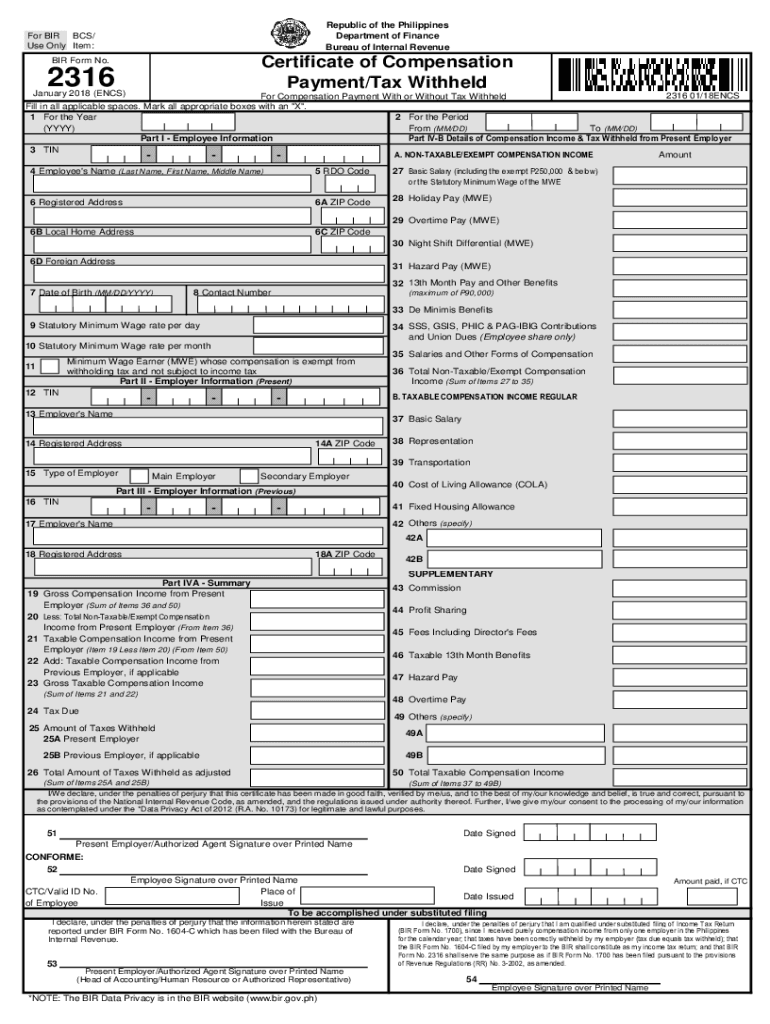

Understanding the 2316 Form

The 2316 form, also known as the Certificate of Compensation Payment Tax Withheld, is a crucial document for employees in the United States. It serves as a summary of the total compensation received by an employee during the year, along with the taxes withheld by the employer. This form is essential for tax filing purposes, as it provides the necessary information for individuals to accurately report their income and tax obligations. Understanding the details included in the 2316 form can help employees ensure they are compliant with federal tax regulations.

Steps to Complete the 2316 Form

Completing the 2316 form involves several key steps to ensure accuracy and compliance. First, gather all necessary personal and employment information, including your name, Social Security number, and employer details. Next, input your total compensation for the year, ensuring that you include all forms of income, such as bonuses and overtime. Then, record the total amount of taxes withheld from your paychecks throughout the year. Finally, review the completed form for any errors before submitting it to the appropriate tax authority.

Legal Use of the 2316 Form

The 2316 form is legally recognized as an official document for tax reporting in the United States. It must be completed accurately to comply with IRS regulations. Employers are required to provide this form to their employees, ensuring that all compensation and tax withholding information is transparent. Failure to provide or accurately complete the 2316 form can lead to penalties for both the employer and the employee, making it essential to understand its legal implications.

Filing Deadlines and Important Dates

Filing deadlines for the 2316 form are critical for compliance with tax regulations. Typically, employers must provide this form to employees by January 31 of the following year. Employees should ensure they receive their 2316 form in a timely manner to prepare their tax returns accurately. Additionally, the IRS has specific deadlines for submitting tax returns, which can vary based on individual circumstances, such as whether a taxpayer is self-employed or has other income sources.

Required Documents for the 2316 Form

To complete the 2316 form, certain documents are necessary. These include your previous year’s tax return, W-2 forms, and any other documentation related to income received throughout the year. Having these documents on hand will help ensure that the information entered on the 2316 form is accurate and complete. It is important to keep all records organized, as they may be needed for future reference or in the event of an audit.

Penalties for Non-Compliance

Non-compliance with the requirements related to the 2316 form can result in significant penalties. Employees who fail to report their income accurately may face fines or audits from the IRS. Employers who do not provide the 2316 form to their employees or fail to submit it on time may also incur penalties. Understanding these consequences emphasizes the importance of completing and submitting the 2316 form correctly and on time.

Quick guide on how to complete 1707 january 2018 encs for bir use only republic of the

Easily create Get and Sign BIR 2316 Form 2018-2022 on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right forms and securely store them online. airSlate SignNow equips you with all the essential tools to create, modify, and electronically sign your documents quickly without delays. Handle Get and Sign BIR 2316 Form 2018-2022 on any platform with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Get and Sign BIR 2316 Form 2018-2022 effortlessly

- Find Get and Sign BIR 2316 Form 2018-2022 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method of sharing your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Get and Sign BIR 2316 Form 2018-2022 to ensure clear communication at every step of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1707 january 2018 encs for bir use only republic of the

The way to make an eSignature for a PDF file online

The way to make an eSignature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The best way to make an eSignature straight from your mobile device

The way to make an eSignature for a PDF file on iOS

The best way to make an eSignature for a PDF document on Android devices

People also ask

-

What is the 2316 form and how is it used?

The 2316 form is a tax document that employers provide to their employees to summarize their total earnings and withholding tax for the year. It serves as a vital record for employees when filing their income tax returns. Understanding its importance ensures employees can accurately report their earnings and taxes.

-

How can airSlate SignNow simplify the process of sending the 2316 form?

With airSlate SignNow, sending the 2316 form becomes effortless. Our platform allows you to easily create, share, and eSign documents securely, ensuring that your employees receive their forms promptly. This streamlined process saves time and reduces the potential for errors.

-

Is there a cost associated with using airSlate SignNow for the 2316 form?

Yes, airSlate SignNow offers various pricing plans to accommodate businesses of all sizes looking to manage documents like the 2316 form efficiently. We provide a cost-effective solution with flexible subscription options, allowing you to choose the plan that best fits your needs and budget.

-

What features does airSlate SignNow offer for managing the 2316 form?

AirSlate SignNow includes features like electronic signatures, customizable templates, and secure document storage, making it an ideal choice for managing the 2316 form. You can also track document status in real-time, ensuring you stay on top of your workflow.

-

How does airSlate SignNow ensure the security of the 2316 form?

Security is a priority at airSlate SignNow. We use encryption and secure access protocols to protect sensitive information on documents like the 2316 form. Additionally, robust user authentication processes help prevent unauthorized access to your documents.

-

Can I integrate airSlate SignNow with other tools for handling the 2316 form?

Absolutely! AirSlate SignNow offers integrations with various third-party applications, enhancing your ability to manage the 2316 form alongside other software tools. This interoperability streamlines your workflow and allows for efficient document handling across platforms.

-

Does airSlate SignNow provide support for users managing the 2316 form?

Yes, airSlate SignNow provides comprehensive support for users handling the 2316 form. Whether you need assistance creating documents or understanding feature functionalities, our dedicated support team is available to help you at every step of the process.

Get more for Get and Sign BIR 2316 Form 2018-2022

Find out other Get and Sign BIR 2316 Form 2018-2022

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed