This is NOT a Tax Bill DO NOT Send Money or Check 2023

What is the This Is NOT A Tax Bill DO NOT Send Money Or Check

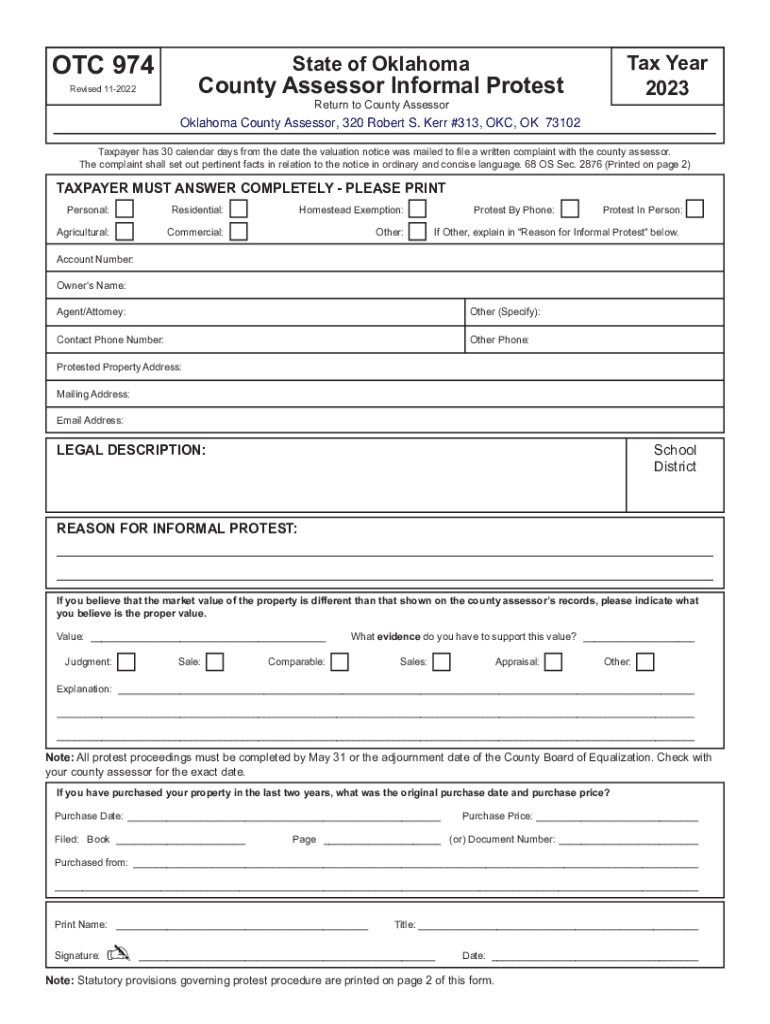

The document labeled "This Is NOT A Tax Bill DO NOT Send Money Or Check" serves as a notification rather than an official tax bill. It typically outlines information regarding a taxpayer's account status or an assessment that does not require immediate payment. Understanding this document is crucial for taxpayers to avoid confusion about their financial obligations.

This notification may include details about pending assessments, changes in tax law, or updates regarding previously filed returns. It is essential to recognize that no payment is required when receiving this document, as it is intended to inform rather than demand action.

How to use the This Is NOT A Tax Bill DO NOT Send Money Or Check

Next, read through the content to understand any actions you may need to take. If the document mentions any discrepancies or requests for additional information, make note of these items. However, remember that no immediate payment is necessary, as this document is not a bill.

Key elements of the This Is NOT A Tax Bill DO NOT Send Money Or Check

Several key elements are typically present in the "This Is NOT A Tax Bill DO NOT Send Money Or Check." These may include:

- Taxpayer Information: Your name, address, and taxpayer identification number.

- Account Status: Current standing of your tax account, including any pending assessments.

- Important Dates: Deadlines for any required responses or actions.

- Contact Information: Details on how to reach the issuing agency for questions or clarifications.

Understanding these elements can help you navigate your tax obligations more effectively.

Legal use of the This Is NOT A Tax Bill DO NOT Send Money Or Check

The legal use of the "This Is NOT A Tax Bill DO NOT Send Money Or Check" document lies in its role as a formal notification from a tax authority. It is essential for taxpayers to recognize that this document is not a request for payment and should not be treated as such.

Instead, it serves to inform taxpayers about their account status and any necessary actions they may need to take. Misinterpreting this document as a bill could lead to unnecessary payments or stress. Taxpayers should retain this document for their records, as it may be relevant for future correspondence or audits.

Filing Deadlines / Important Dates

While the "This Is NOT A Tax Bill DO NOT Send Money Or Check" does not require immediate action, it may include important dates related to your tax account. These dates can encompass deadlines for filing tax returns, responding to inquiries from tax authorities, or submitting additional documentation.

It is advisable to keep track of these deadlines to ensure compliance with tax regulations. Missing a deadline could result in penalties or interest on any outstanding balances. Always refer to the document for specific dates that may affect your tax situation.

Examples of using the This Is NOT A Tax Bill DO NOT Send Money Or Check

Examples of scenarios where you might receive the "This Is NOT A Tax Bill DO NOT Send Money Or Check" include:

- Tax Assessment Notification: If there has been a change in your tax assessment, this document may inform you of the new amount without requiring payment.

- Account Review: You might receive this document during a routine review of your tax account, indicating no outstanding balance.

- Pending Documentation: If additional information is required for your tax return, this document may notify you of that need without requesting payment.

Recognizing these examples can help you understand the context in which this document is issued and how to respond appropriately.

Create this form in 5 minutes or less

Find and fill out the correct this is not a tax bill do not send money or check

Create this form in 5 minutes!

How to create an eSignature for the this is not a tax bill do not send money or check

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What does 'This Is NOT A Tax Bill DO NOT Send Money Or Check' mean?

The phrase 'This Is NOT A Tax Bill DO NOT Send Money Or Check' is a warning to ensure that recipients do not mistakenly treat the document as a tax obligation. It is crucial to understand that this document is not a bill and does not require any payment. Always verify the source before taking any action.

-

How can airSlate SignNow help with document management?

airSlate SignNow provides a streamlined platform for sending and eSigning documents, making it easier to manage your paperwork. With features like templates and automated workflows, you can efficiently handle documents without confusion. Remember, if you receive a document marked 'This Is NOT A Tax Bill DO NOT Send Money Or Check,' it’s essential to use our platform to clarify its purpose.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to suit different business needs, ensuring you get the best value for your investment. Each plan includes features that enhance document management and eSigning capabilities. It's important to note that regardless of the plan, you will never receive a document labeled 'This Is NOT A Tax Bill DO NOT Send Money Or Check' as a legitimate charge.

-

What features does airSlate SignNow offer?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure eSigning. These tools are designed to simplify the document workflow process for businesses of all sizes. You can rest assured that any document you handle will be clearly marked, avoiding confusion like 'This Is NOT A Tax Bill DO NOT Send Money Or Check.'

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow offers integrations with various applications, enhancing your workflow and productivity. You can connect it with CRM systems, cloud storage, and other tools to streamline your document processes. This ensures that you can manage all your documents effectively, without encountering misleading notices like 'This Is NOT A Tax Bill DO NOT Send Money Or Check.'

-

What benefits does airSlate SignNow provide for businesses?

airSlate SignNow empowers businesses by providing a cost-effective solution for document management and eSigning. It helps reduce turnaround times and improve efficiency, allowing teams to focus on what matters most. By using our platform, you can avoid the pitfalls of misinterpreting documents, such as those marked 'This Is NOT A Tax Bill DO NOT Send Money Or Check.'

-

Is airSlate SignNow secure for sensitive documents?

Absolutely, airSlate SignNow prioritizes security and compliance, ensuring that your sensitive documents are protected. We utilize encryption and secure storage to safeguard your information. This means you can confidently manage documents without worrying about misleading labels like 'This Is NOT A Tax Bill DO NOT Send Money Or Check.'

Get more for This Is NOT A Tax Bill DO NOT Send Money Or Check

Find out other This Is NOT A Tax Bill DO NOT Send Money Or Check

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract

- eSignature Missouri Business Insurance Quotation Form Mobile

- eSignature Iowa Car Insurance Quotation Form Online

- eSignature Missouri Car Insurance Quotation Form Online

- eSignature New Jersey Car Insurance Quotation Form Now

- eSignature Hawaii Life-Insurance Quote Form Easy

- How To eSignature Delaware Certeficate of Insurance Request

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking