Wi Beneficiary Form

What is the Wisconsin Beneficiary?

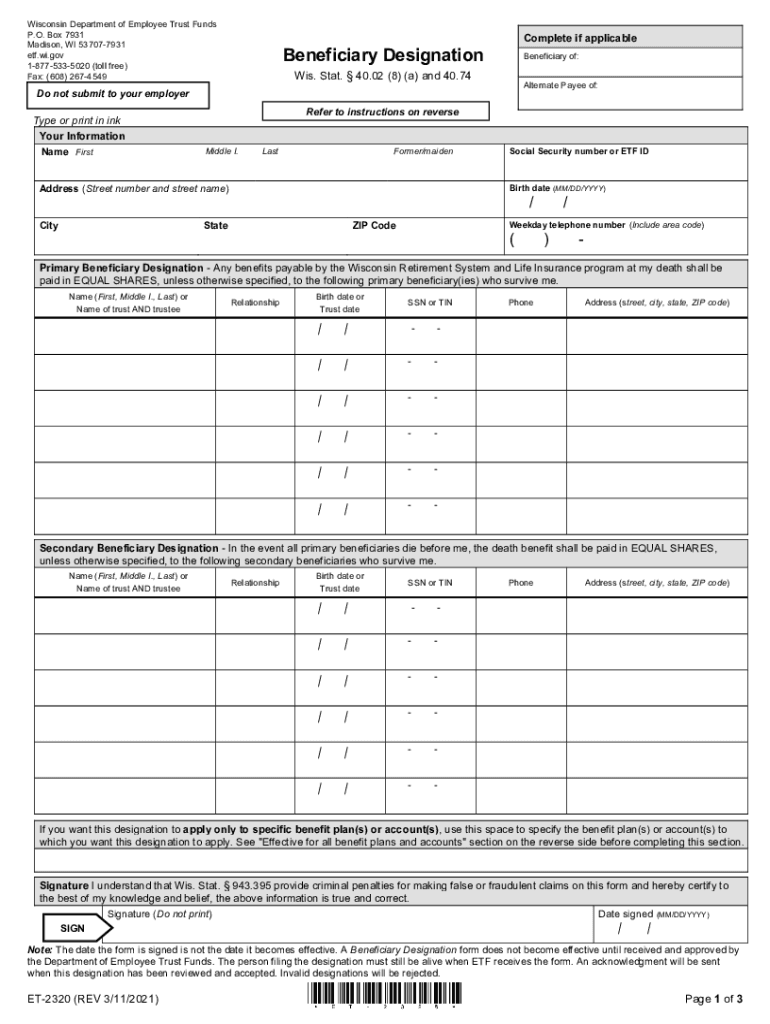

The Wisconsin beneficiary designation is a crucial element in estate planning, particularly for individuals involved with the Wisconsin Retirement System (WRS). This designation allows a member to specify who will receive their benefits upon their passing. It is essential for ensuring that the member's assets are distributed according to their wishes. The beneficiary can be a person, such as a spouse or child, or an entity, such as a trust or charity. Understanding the implications of this designation is vital for effective estate management.

Steps to Complete the Wisconsin Beneficiary Form

Completing the Wisconsin beneficiary form, specifically the ET 2320, involves several straightforward steps. First, gather all necessary personal information, including your Social Security number and details about your beneficiaries. Next, accurately fill out the form, ensuring that all fields are completed to avoid delays. Afterward, review the form for accuracy and completeness. Finally, submit the form according to the provided instructions, which may include online submission, mailing it to the appropriate office, or delivering it in person.

Legal Use of the Wisconsin Beneficiary Designation

The legal use of the Wisconsin beneficiary designation is governed by state laws that ensure the proper execution and recognition of the form. This designation is legally binding when completed correctly, meaning it must comply with specific state regulations. It is important to understand that simply filling out the form does not guarantee its acceptance; it must meet all legal requirements, including proper signatures and notarization if necessary. Consulting with a legal professional can help clarify these requirements and ensure compliance.

Required Documents for the Wisconsin Beneficiary Form

When filling out the Wisconsin beneficiary form, certain documents are typically required to support the application. These may include identification documents, such as a driver's license or Social Security card, to verify the identity of the member and the beneficiaries. Additionally, any legal documents that establish the relationship between the member and the beneficiaries, such as marriage certificates or birth certificates, may also be necessary. Having these documents ready can streamline the process and reduce the likelihood of errors.

Who Issues the Wisconsin Beneficiary Form?

The Wisconsin beneficiary form, specifically the ET 2320, is issued by the Wisconsin Department of Employee Trust Funds (ETF). This department oversees the administration of the Wisconsin Retirement System and provides the necessary forms and guidance for members looking to designate beneficiaries. It is advisable to visit the ETF's official resources for the most current version of the form and any updates regarding submission procedures or requirements.

Eligibility Criteria for Designating a Beneficiary

Eligibility to designate a beneficiary on the Wisconsin beneficiary form is generally limited to members of the Wisconsin Retirement System. Members must be in good standing and have the legal capacity to make such designations. Additionally, beneficiaries must be individuals or entities recognized under Wisconsin law. It is essential for members to review their eligibility and ensure that their chosen beneficiaries meet all necessary criteria to avoid complications in the future.

Form Submission Methods for the Wisconsin Beneficiary Form

The submission methods for the Wisconsin beneficiary form include online submission, mailing the completed form to the appropriate department, or delivering it in person. Online submission is often the most efficient method, allowing for quick processing. If mailing the form, it is advisable to use a secure method to ensure it reaches the destination safely. In-person submissions can provide immediate confirmation of receipt, which may be beneficial for members who prefer direct interaction.

Quick guide on how to complete wi beneficiary

Complete Wi Beneficiary effortlessly on any gadget

Digital document management has become favored by businesses and individuals alike. It offers a superb eco-friendly alternative to traditional printed and signed papers, as you can locate the right template and securely save it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents swiftly without interruptions. Handle Wi Beneficiary on any gadget with airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to modify and eSign Wi Beneficiary with ease

- Obtain Wi Beneficiary and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tiring form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Wi Beneficiary and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wi beneficiary

The best way to generate an electronic signature for a PDF document online

The best way to generate an electronic signature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

How to make an electronic signature right from your smart phone

The way to make an eSignature for a PDF document on iOS

How to make an electronic signature for a PDF on Android OS

People also ask

-

What is the ET 2320 form and how does it relate to airSlate SignNow?

The ET 2320 form is a vital document for businesses that need to manage their electronic signatures securely. With airSlate SignNow, you can easily eSign and send the ET 2320 form, ensuring compliance and efficiency in your business processes.

-

How much does airSlate SignNow cost for handling ET 2320 forms?

airSlate SignNow offers flexible pricing plans designed to accommodate various business needs. You can choose the plan that fits your requirements for managing ET 2320 forms, ensuring a cost-effective solution for your electronic signing needs.

-

What features does airSlate SignNow provide for the ET 2320 form?

With airSlate SignNow, you can enjoy features such as customizable templates, audit trails, and secure storage for your ET 2320 forms. These tools streamline the signing process and enhance your document management efficiency.

-

Can I integrate airSlate SignNow with other software for processing ET 2320 forms?

Yes, airSlate SignNow offers integrations with popular business applications, allowing you to seamlessly process ET 2320 forms alongside your existing workflows. This enhances productivity by eliminating the need for manual data entry and document handling.

-

What are the benefits of using airSlate SignNow for the ET 2320 form?

Using airSlate SignNow for the ET 2320 form brings signNow benefits, including faster turnaround times and improved document security. It reduces the time spent on paperwork, allowing your team to focus on more critical tasks.

-

Is airSlate SignNow secure for signing the ET 2320 form?

Absolutely! airSlate SignNow employs advanced security measures, including encryption and authentication, to ensure that your ET 2320 form is signed and stored securely. You can trust that your sensitive data is protected while using our eSigning solution.

-

How can I track the status of my ET 2320 forms in airSlate SignNow?

airSlate SignNow provides real-time tracking capabilities for your ET 2320 forms. You can easily monitor the signing progress, receive notifications when documents are viewed or signed, ensuring full visibility throughout the process.

Get more for Wi Beneficiary

- Lambunao scandal form

- Form 34 rto gujarat

- 8 ball pool vip points hack form

- Ritz carlton hotel in usa document and i d card form

- California meal break waiver form pdf 12073681

- Eraeft enrollment form aetna

- Wells fargo certification of trustee form

- Tc 69c notice of change for a tax account cloudfront net form

Find out other Wi Beneficiary

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free