Payroll Tax Forms 2024-2026

Understanding the Net Profit Tax Return

The net profit tax return is a crucial document for businesses operating in the United States. It is used to report the net income earned by a business, which is essential for determining the tax liability. This form is particularly important for various business entities, including sole proprietorships, partnerships, and corporations. Each state may have its specific requirements, so understanding the nuances of the net profit tax return is vital for compliance.

Steps to Complete the Net Profit Tax Return

Completing the net profit tax return involves several key steps:

- Gather Financial Records: Collect all relevant financial documents, including income statements, balance sheets, and expense reports.

- Calculate Net Profit: Determine your net profit by subtracting total expenses from total revenue.

- Fill Out the Form: Enter the calculated net profit and other required information into the appropriate sections of the form.

- Review for Accuracy: Double-check all entries to ensure accuracy and completeness before submission.

- Submit the Form: Decide on the submission method, whether online, by mail, or in person.

Filing Deadlines and Important Dates

Filing deadlines for the net profit tax return can vary based on the business structure and state regulations. Generally, businesses must file their returns by the fifteenth day of the fourth month following the end of their fiscal year. For example, if your fiscal year aligns with the calendar year, the deadline would typically be April 15. It is essential to be aware of any state-specific deadlines to avoid penalties.

Required Documents for Filing

When preparing to file the net profit tax return, certain documents are necessary to ensure a smooth process. These may include:

- Income statements detailing revenue earned

- Expense reports outlining business costs

- Previous tax returns for reference

- Any applicable state-specific forms

Having these documents ready will facilitate accurate reporting and compliance with tax obligations.

Penalties for Non-Compliance

Failing to file the net profit tax return on time can result in significant penalties. Businesses may incur late fees, interest on unpaid taxes, and potential legal consequences. Understanding the importance of timely filing can help avoid these issues and ensure that the business remains in good standing with tax authorities.

Digital vs. Paper Version of the Form

Businesses have the option to submit the net profit tax return either digitally or via paper forms. Digital submissions are often faster and more efficient, allowing for immediate confirmation of receipt. Paper submissions may take longer to process and can be subject to mailing delays. Choosing the appropriate method depends on the business's preferences and the specific requirements of the state.

State-Specific Rules for the Net Profit Tax Return

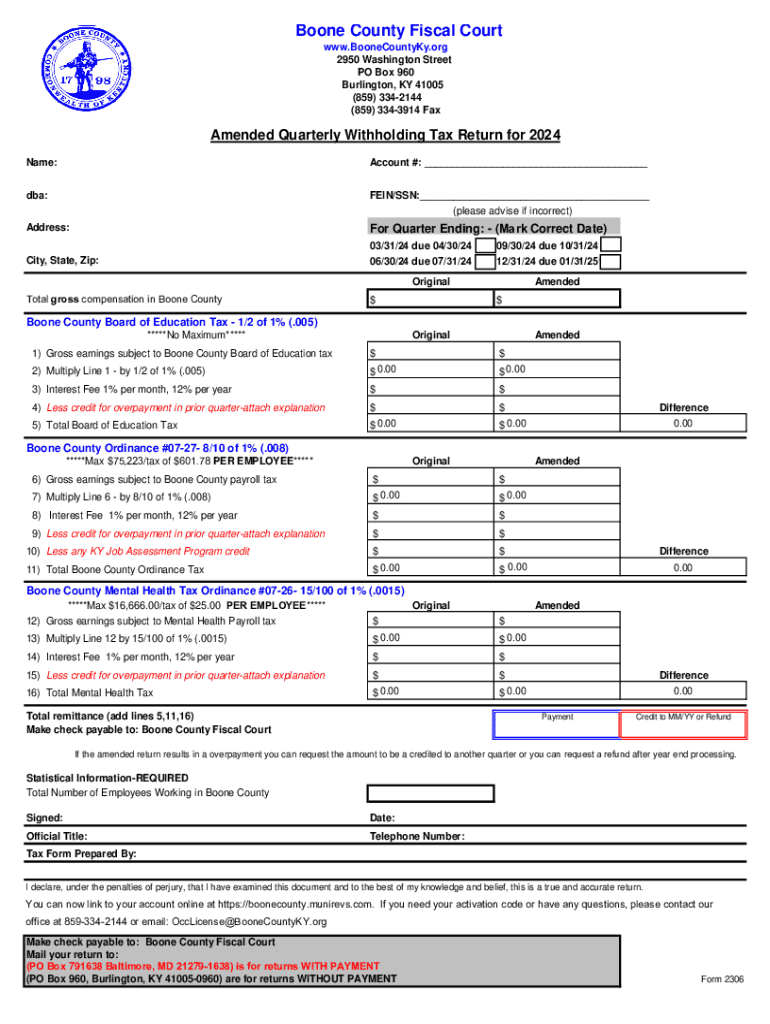

Each state has its regulations regarding the net profit tax return, which can affect how businesses report their income and pay taxes. For instance, Kentucky has specific forms, such as the Kentucky Form Net Profit, which must be used by businesses operating within the state. Understanding these state-specific rules is essential for compliance and to avoid unnecessary penalties.

Create this form in 5 minutes or less

Find and fill out the correct payroll tax forms

Create this form in 5 minutes!

How to create an eSignature for the payroll tax forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a net profit tax return?

A net profit tax return is a financial document that businesses file to report their net income after deducting allowable expenses. This return is essential for determining the amount of tax owed to the government. Understanding how to accurately prepare a net profit tax return can help businesses minimize their tax liabilities.

-

How can airSlate SignNow help with my net profit tax return?

airSlate SignNow streamlines the process of preparing and submitting your net profit tax return by allowing you to easily eSign and send necessary documents. Our platform ensures that all your tax-related documents are securely stored and easily accessible. This efficiency can save you time and reduce the stress associated with tax season.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers features such as document templates, secure eSigning, and real-time collaboration, which are crucial for managing your net profit tax return. These tools help ensure that all stakeholders can review and approve documents quickly. Additionally, our platform provides audit trails for compliance and record-keeping.

-

Is airSlate SignNow cost-effective for small businesses handling net profit tax returns?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses managing their net profit tax returns. Our pricing plans are flexible and cater to various business sizes, ensuring that you only pay for what you need. This affordability allows small businesses to access professional-grade document management without breaking the bank.

-

Can I integrate airSlate SignNow with my accounting software for net profit tax returns?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, making it easier to manage your net profit tax return. This integration allows for automatic data transfer, reducing the risk of errors and saving you time. You can focus on your business while we handle the paperwork.

-

What are the benefits of using airSlate SignNow for my net profit tax return?

Using airSlate SignNow for your net profit tax return offers numerous benefits, including enhanced efficiency, improved accuracy, and secure document handling. Our platform simplifies the eSigning process, ensuring that your documents are signed and submitted promptly. This can lead to faster processing times and peace of mind during tax season.

-

How secure is airSlate SignNow for handling sensitive tax documents?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure cloud storage to protect your sensitive tax documents, including your net profit tax return. Our compliance with industry standards ensures that your data remains confidential and secure throughout the entire process.

Get more for Payroll Tax Forms

Find out other Payroll Tax Forms

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors